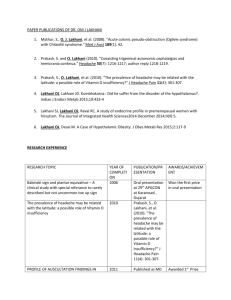

Transfer Pricing by sushil lakhani 26.03.2015

advertisement

Association of Multimodal Transport Operators of India (AMTOI) Income Tax Implications of Cross Border Transactions by Members of AMTOI By Sushil Lakhani 26th March, 2015 Overview o Snapshot of relevant proposals in Finance Bill,2015 o Taxability of foreign shipping company under the I.T Act • • Section 44B vs. 172 Issues under the Act o Overview of TDS u/s 195 on payments to non-residents o Some Specific Issues Under The Act o Taxability of foreign shipping company under Treaty(DTAA) 26/03/2015 • Article 8 - Special Provision • “International Traffic” – Meaning & Issues • “Profits from operations of Ships in International Traffic” – Scope & Issues • “Place of Effective Management” - Issues • International Co-operation/Pool Profits Sushil Lakhani 2 SNAPSHOT OF RELEVANT PROPOSALS IN FINANCE BILL,2015 FM says so… • GST from next year. (Para 96) • DTC shelved. (Para 129) • Reduction in rate of Corporate Tax. (Para 97) • Phasing out of exemptions and incentives. (Para 98) • Legislations for curbing black money. (Para 102) • Mandatory quoting of PAN. (Para 105) • Information of cross border transactions. (Para 105) • Access to information for CBDT & CBEC. (Para 105) • To and fro conveyance allowance. (Para 125) • Rules for foreign dividend (Para 114). 26/03/2015 Sushil Lakhani 4 FM’s Roadmap on Black Money-I (Para 102 to 104) • Comprehensive legislation to curb Black Money • Concealment of Income & Assets • Not eligible for settlement • Penalty @ 300% of tax Prosecution & Rigorous imprisonment upto 10 years • Non-compoundable offence • Return of Income with disclosure • • • Beneficiary of foreign assets to file Return of Income • 26/03/2015 Non compliance liable to RI for 7 years Liable to tax or not Sushil Lakhani 5 Effective Rates Particulars A.Y. 2015-16 A.Y. 2016-17 Domestic Company Income < 1 cr. Income > 1 cr. < 10 cr. Income > 10cr. 30.90% 32.45% 33.99% 30.90% 33.06% 34.61% Foreign Company Income < 1 cr. Income > 1 cr. < 10 cr. Income > 10cr. 41.20% 42.02% 43.26% 41.20% 42.02% 43.26% Individuals/ HUFs/AOP/BOI Income < 1 cr. Income > 1 cr. 30.90% 33.99% 30.90% 34.61% Firms & LA Income < 1 cr. Income > 1 cr. 30.90% 33.99% 30.90% 34.61% MAT Income > 1 cr. < 10 cr. Income > 10cr. 20.01% 20.96% 20.39% 21.34% AMT rates for noncorporates Income > 1 cr. 20.96% 21.34% TDS on royalty & FTS payment to NR Income > 1 cr. < 10 cr. Income > 10cr. 26.27% 27.04% 10.51% 10.82% 26/03/2015 Sushil Lakhani 6 Effective rate of Tax on distribution Particulars A.Y. 2015-16 A.Y. 2016-17 DDT u/s. 115-O 19.99% 20.36% Buyback u/s. 115-QA 22.66% 23.07% Individual or HUF 28.33% 28.84% Any other person 33.99% 34.61% By IDF u/s 115-R Non- Residents 5.67% 5.77% By Securitisation Trusts u/s 115-TA Individual or HU F 28.33% 28.84% Any other person 33.99% 34.61% Tax exempt entities (Mutual funds) Nil Nil By MFs u/s 115-R 26/03/2015 Recipient Sushil Lakhani 7 Wealth Tax s.3, cl. 79, para 113 • Not leviable w.e.f. A.Y. 2016-17 • Information about Wealth Tax to be furnished in ITR • Loss compensated by increase of 2% in SC on Income tax − Gain of Rs. 9000 crore for loss of Rs. 1008 crore. • No increase in SC for FC though wealth tax abolished. 26/03/2015 Sushil Lakhani 8 Residence of a Company s. 6, cl. 4 • Substitution of sub-section (3) w.e.f. 1.04.2016 − Concept of Place Of Effective Management − ‘at any time’ in India for a ‘company’ − In place of ‘Control and Management’ wholly ‘in India’ − POEM to mean; • • • • • • • Place of Key management and commercial decisions For conduct of business of entity as a whole in substance Scope for debate on various aspects of POEM Assistance from DTAA Exposure for Indian and Foreign MNCs. Relevance of place over person Assurance by CBDT 26/03/2015 Sushil Lakhani 9 Domestic Transfer Pricing s.92BA, cl.24, para 115 • W.e.f. 01.04.2016 • Applicabe in the case where value of specified domestic transactions exceeded specified limit • Limit extended to Rs. 20 crore from Rs. 5 crore 26/03/2015 Sushil Lakhani 10 General Anti-Avoidance Rules s.95, cl.25, para 109 • W.e.f 01.04.2016 • Date of Implementation of chapter X-A extended to 01.04.2018 • Investments made up to 31.03.2017 to remain unaffected • 26/03/2015 Assurance by FM Sushil Lakhani 11 Tax on Royalty and FTS s. 115A, cl. 27, para 110 • W.e.f. 01.04.2016 • Income of a non-resident or a foreign company • Royalty or FTS • Other than the one referred to in s. 44DA • Rate of tax reduced from 25% to 10% • Other income at the regular rates. • Was amended by FA, 2013 to increase the rates • Higher rate where no PAN • Beneficial rate under DTAA • No SC & EC • Case of excess over ALP and s. 115A 26/03/2015 Sushil Lakhani 12 Payments to Non Residents s. 195, cl. 48 • Substitution of sub-section (6) w.e.f. 01.06.2015 • Furnishing of information of payment to NR or FC • In prescribed manner and form • • • • Inserted by FA, 2008 for furnishing reports Rule 37BB, Form 15CA/CB Report only where tax was deducted Now payment whether chargeable to tax or not under the Act • Assurance by CBDT • Payments not in nature of income • Fees, gifts, expenses and remittances • Relevance of s.195(7) 26/03/2015 Sushil Lakhani 13 Penalty for violation of s. 195(6) s.277I, cl. 73 • New provision w.e.f. 01.06.2015 • Information relating to payment • the prescribed manner and form • Failure to furnish information liable to penalty • Rs. 1,00,000 • Each or all defaults 26/03/2015 Sushil Lakhani 14 TAXABILITY OF NONRESIDENT SHIPPING/AIRCRAFT COMPANIES UNDER THE INCOME TAX ACT,1961 Taxability of non-resident Shipping/Aircraft Companies Section Section 44B Section 172 Section 44BBA Section 10(15A) Coverage Special provision for computing profits and gains of shipping business in the case of non- residents Occasional Shipping business of nonresidents Special provision for computing profits and gains of the business of operation of aircraft in the case of non-residents Exemption of tax for Indian company engaged in business of operation of aircraft Section 90 – Treaty Override 26/03/2015 Sushil Lakhani 16 Sec. 44B Vs. Sec. 172 Section 44B Section 172 Applicable to non-residents engaged in regular Shipping operations. Overrides sections 28 to 43A of the Act Normal procedures for assessment and payment of taxes applicable 26/03/2015 Applicable to ships owned or chartered by non-residents engaged in occasional shipping business Overrides all other provisions of the Act Specific ( adhoc/provisional?) procedure for levy, assessment and collection of tax is provided. Sushil Lakhani 17 Section 44B Vs. Section 172 (Contd.) Section 44B Section 172 DPR 7.5%. DPR 7.5%. Carriage of passengers, Carriage of passengers, livestock, mail or goods livestock, mail or goods shipped at a port in India. Also shipped at a port in India. covers amount received or receivable in India on account of carriage of passengers etc. shipped at a port outside India Demurrage charges or handling charges or any other amount of similar nature will also be included. 26/03/2015 Demurrage charges or handling charges or any other amount of similar nature will also be included. 18 Sushil Lakhani Other Relevant Provisions – Payment to non-resident shipping company where provisions of Sec. 172 apply – Sec. 194C or Sec. 195 do not apply – Provisions of Sec. 194C and Sec. 195 will also not apply if the payment to be made to an agent of non-resident shipping company where Sec. 172 applies – Whether Circular 723 dated 19-9-1995 is applicable only to payments covered by Sec. 172 or also to payments covered by Sec. 44B? – Orient Goa Pvt. Ltd (2009-TIOL-HC-MUM-IT) Sec. 163: freight forwarders can be treated as agent of non-resident shipping companies (WSA Shipping (143 TTJ 423 & 48 SOT 551)) 26/03/2015 Sushil Lakhani 19 OVERVIEW OF TDS ON PAYMENTS TO NONRESIDENTS (SECTION 195) TDS under section 195 Wide Scope of the section Conditions for application of Section 195 a) “any person” - Includes a person having no taxable income b) “a non-resident” c) 26/03/2015 - Includes NRIs - does not include R but NOR “any sum chargeable to tax (other than Salaries)” Sushil Lakhani 21 TDS under section 195 Any sum chargeable to tax means The moment there is a remittance out of India, it does not trigger Sec 195. The payer is bound to deduct tax only if the sum is chargeable to tax in India read with sec 4, 5 and 9. Obligation to deduct TDS limited to the income portion (GE India Technology Centre (234 CTR 153) (SC)) Impact of Circular 723 dated 19-09-1995 Impact of DTAA & Circular 732 dated 29-12-1995 26/03/2015 Sushil Lakhani 22 TDS under section 195 Section 195 (2) – Application by Payer Section 195 (3) – Application by Payee Section 195(4) – Validity of certificate issued by AO Section 195(6) – CA Certificate for Remittances and providing information 26/03/2015 Sushil Lakhani 23 TDS under section 195 Disallowance u/s. 40(a)(i) or Section 58(1)(a)(ii) Interest u/s. 201(1A) (1% p.m. for late deduction, 1.5% p.m. for late payment) Cannot be levied if recipient has paid full tax (296 ITR 226 (SC) & Finance Bill, 2012) Penalties - (Section 221; Section 271C)(Refer Hindustan Coca Cola (296 ITR 226 (SC)). Finance Bill,2015 proposes penalty of Rupees one lakh for non-filing of information Prosecution - (Section 276 B) 26/03/2015 Sushil Lakhani 24 Some Typical TDS Issues U/S 195 Faced By AMTOI Members: • Payments to a marketing agent abroad for marketing container leasing etc. • Payments to a foreign company towards demurrage at port outside India. • Where Foreign Company does not provide PAN. • Where Foreign Company doesnot provide Tax Residency Certicate. • Any Other???? 26/03/2015 Sushil Lakhani 25 SOME SPECIFIC ISSUES UNDER THE ACT Cross Border Transactions – Some specific Issues Under The Act Whether transport, procurement, custom clearance, sorting, delivery, warehousing and picking up services, provided by a non-resident outside India in respect of export consignments from India under ‘Regional Transportation Services Agreement‘ is “fees for technical services”? Such services were not managerial or technical or consultancy services and do not fall within ambit of section 9(1)(vii) Income from India by means of operations carried on outside India will not fall within scope of section 9(1)(i) (UPS SCS (Asia) Ltd. (18 taxmann.com 302 (Mum)) 26/03/2015 Sushil Lakhani 27 Cross Border Transactions – Specific Issues Under the Act Payment of Demurrage Charges Demurrage charges shall be considered as part of freight Gosalia Shipping (P) Ltd. (113 ITR 307) (SC) Lima Leitao & Co. Ltd. (70 ITR 518) Japan Lines Ltd. (139 Taxman 267 (MAD.) (TDS not applicable in view of CBDT Circular No. 723 (Hasmukh J. Patel (Ahmedabad ITAT) Demurrage for delay at port outside India is not taxable in India 26/03/2015 Sushil Lakhani 28 Specific Issues under the Act Whether Inland Haulage Charges are covered within the scope of Section 44B ? - No [Safe marine Container Lines NV [(2009) 121 TTJ (Mumbai) 50] where it was held that to Classify any item to fall under the term “any other amount of similar nature” it should be of the nature of handling charges or demurrage charges .] - It was held in the same case that they fall under Article 8 as being Ancillary to the main operation 4. Whether Slot Charges are Covered within the Scope of Section 44B and Section 172 ? - Yes (It was held in A.P. Moller Maersk Agency India (P) Limited vs. Deputy Commissioner of Income Tax that slot are in the nature of handling charges or demurrage charges and are covered under above sections ) 3. 26/03/2015 Sushil Lakhani 29 Specific Issues under the Act 5. Whether under section 44B there is no provision to make a deduction for any outgoings ? - No. [NEDLLOYD LINES BV vs. DEPUTY COMMISSIONER OF INCOME TAX ] - It was held that there is no provision in the Act to make deduction for outgoings after determining tax payable at the flat rate . The concept of taxation in this context postulate payment on gross income . The language of the section is clear, and unambiguous 6. Whether Special rebate or Deferred Rebate granted can be allowed as a deduction from aggregate amount of freight received for purpose of Section 44 B ? - NO. [ D.D.G. HENSA VS. COMMISSIONER OF INCOME TAX (78 TAXMAN 174 ) (CAL) (HC) ] - It was held in the above case that it was not a case of the amounts being diverted before forming part of earnings , but a case where some amount was given as a discount after accrual of income. 26/03/2015 Sushil Lakhani 30 Specific Issues under the Act 7. Whether “dead freight” could be covered under section 172 ? - Held No. [ Commissioner of Income Tax vs. Pestonji Bhicajee [ (107 ITR 837) (HC) (GUJ) ] - It was held that “dead Freight’ is payable on account of non carriage of goods and is payable for compensation for the loss of freight . - Therefore such amount is not received for carriage of goods . Thus not covered under this section 8. Whether towing of a ship by another Ship , can be said to be covered under section 172 ? - Held No [ (2012 ) Commissioner of Income Tax vs. Oceanic Shipping Service of M.T. Suhail ( 18 taxmann.com 289 ) (Guj) ( HC) ] - It was held in the above decision that “carrying “ and “tow” have different meanings . Carrying has to mean carrying by a ship abroad a ship whereas towing has to mean to pull something hard . 26/03/2015 Sushil Lakhani 31 Issues under the Act 9. Whether the assessment of Income under section 172 (4) can be treated as assessment of total Income without assessee exercising option u/s 172(7) ? - Held No [ Commissioner of Income – Tax v Taiyo Gyogyo kabushiki kaisha [(2000) 111 taxman 343 (Ker)(HC) ] - It was held in the above case that the provisions of Section 172(2) and 172 (4) are not substitute for assessment on the total income of a non – resident engaged in the shipping business. - It was also held that the collection and recovery of tax under section 172 are of provisional in nature , even where section 172 is applied, the assessing officer is not precluded from resorting to section 44B and making the assessment 26/03/2015 Sushil Lakhani 32 Issues under the Act 10. Whether assessee can claim adjustment of brought forward business loss against profits and gains computed under section 172 /Section 44B ? - - NO Under Section 172 & Yes Under section 44B ….. The non obstante clause in section 172 overrides all other provisions of the Act . Therefore, whether the provisions relating to setoff and carry forward losses and unabsorbed depreciation do not apply in case of an assessee taxable under section 172? (Delhi High court in the case of Emirates Shipping Line, FZE vs. ADIT (2012) ( writ petition No . 9780 of 2009) held that section 172 is a special and specific provision but it does not postulate or mandate that section 147/148 or other provisions like section 154, 263 etc, would not be applicable) As regards Section 44 B , provision relating to set off and carry forward and set off losses apply . However, Set –off of unabsorbed Depreciation cannot be claimed Universal Cargo vs CIT (165 ITR 209) (Cal) Anchor Line Limited (32 ITD 403) (Mum) 26/03/2015 Sushil Lakhani 33 Issues under the Act 11. Whether Circular 723 dated 19-9-1995 is applicable only to payments covered by Sec. 172 or also to payments covered by Sec. 44B? Not applicable to payments covered by section 44B [Orient Goa Pvt. Ltd (2010 ) (185 Taxman 131) Section 172 and Section 44B operate in different areas (CBDT Vs.Chowgule 192 ITR ITR 955) 40 ; CIT Vs. Hongkong Oceans 238 In following held without discussing 44B that circular applied – [DCIT vs. Hasmukh J Patel (2012) (49 SOT 147 )(Ahd.) ] – [Smt. Sudha Devi Saraf (2013)(33 Taxman 500 )(KOL.) 12. Whether interest u/s 234B, 234C leviable to and 244A receivable from foreign shipping companies ? – Yes as per Dept.--Circular 730 dated 14-12-1995 reversed by Circular 9/2001 dated 09-07-2001 – No as per ITAT-- Norasia Lines (Malta) Ltd. (109 TTJ 152) (Cochin) (SB) 26/03/2015 Sushil Lakhani 34 Issues under the Act 13.Whether the Section 172 is and exhaustive Section for Computing total Income of non- resident involved in occasional shipping business ? - Held no [ Czechoslovak Co. vs ITO 81 ITR 162 ] . It was held that section 172 is not exhaustive of the liability of the owner of the ship. He may be taxable under section 5 in respect of profits arising from the use of the ship otherwise than from the carrying of passengers or cargo from Indian ports. 26/03/2015 Sushil Lakhani 35 ISSUES CONNECTED WITH TAXABILITY UNDER TAX TREATIES Article 8 – A snapshot Sub – Articles Coverage Article 8(1) Taxability of profits from operation of ships or aircrafts in international traffic Article 8(2) Taxability of profits from operation of boats engaged in inland waterways transport Article 8(3) Where place of effective management of enterprise is aboard a ship or boat Article 8(4) Joint business / Pooling Arrangement extension of scope of Article 8(1) Article 8B (2) – UN Model Right to tax profits to the Source Country if activities more than casual in nature. Article 8 specific provision for shipping profits – Article 7 does not apply 26/03/2015 Sushil Lakhani 37 Article 8(1) Profits “from” the operation of ships or aircraft in international traffic shall be taxable only in the Contracting State in which the place of effective management of the enterprise is situated [Netherlands, Mauritius, Germany , Cyprus ] o o Variations Art. 8(1) is Residence based [eg. USA, UK, Singapore, Japan etc.] Art. 8(1) provides for both (Residence + POEM) ( eg.Cyprus) o Instead of “profits from” , the words “profits derived from “ eg. Denmark and most other Treaties (AP Moller, Maersk Agency (89 ITD 563) (Mum---narrow meaning- , incorrect view ?? ) Following factors not Relevant: – where the PE is situated. – where the enterprise is Registered. – where the enterprise is Resident. – Ownership of Ship is not important for shipping Operation. o Computation of income – left to Domestic Law 26/03/2015 Sushil Lakhani 38 “International Traffic” – Meaning o International traffic – Article 3(1)(e) – the term "international traffic" means any transport by a ship or aircraft operated by an enterprise that has its place of effective management in a Contracting State, except when the ship or aircraft is operated solely between places in the other Contracting State o Only Coastal Traffic across countries is covered in Article 8(1) o If travel exclusively between two or more points within the other contracting state – Not ‘International Traffic’ - PE principle to apply – taxability under Article7…. 26/03/2015 Sushil Lakhani 39 …“International Traffic” – Meaning o However, if travel between two points in the other contracting state forming part of longer voyage involving place of departure or arrival outside the other contracting state is included in “International Traffic” (Refer Essar Oil Ltd. (5 SOT 669) (Mum)) o Analysis – The number of ports or airports during a voyage or flight immaterial – Not necessary to cross a border after every sailing or take off. If there is no POEM in any of the contracting states then Article 8 will not apply. 26/03/2015 Sushil Lakhani 40 Profits from operation of ship – Scope & Issues OECD Commentary o Profits directly obtained by the enterprise from transportation of passengers or cargo by ships or aircrafts (whether owned, leased or otherwise at the disposal of the enterprise) that it operates in international traffic o The “Profits “ covers profits from activities directly connected with such operations as well as profits from activities which are not directly connected with the operation of the enterprise's ships or aircraft in international traffic as long as they are ancillary to such operation. Profits “derived from” in India-Denmark Treaty held (incorrectly??) to be narrower in scope (AP Moller, Maersk Agency (89 ITD 563) (Mum) – 26/03/2015 Sushil Lakhani 41 Profits from operation of ship… o Ancillary activities - Meaning – Activities not required to be carried for operation of ships but – Make minor contribution relative to operation of ships and are so closely connected that – Cannot be regarded as separate business or source of income (Refer British Airways (80 ITD 90) (Del)) 26/03/2015 Sushil Lakhani 42 o Examples of activities directly connected with or ancillary to the operation of ships or aircrafts: – – – – – Sale of passenger tickets on behalf of other operators transportation of goods by truck – hauling, fishing or dredging activities (lease of fishing trawler) Use, maintenance or rental of containers (also includes container detention charges) Advertising Profits derived from Provision of goods and Services by engineers, ground and equipment –maintenance staff, cargo handlers ,catering staff and customer services personnel where the enterprise provides such goods to ,or performs services for, other enterprises and such activities are directly connected or ancillary to the enterprise’s operation of ships or aircraft in international traffic 26/03/2015 Sushil Lakhani 43 Cross Border Transactions – Specific Issues Payments to non-resident NVOCC: Transportation through ships owned/leased/chartered enterprises : by other Such transportation would be outside scope of Article 8(2) of India-USA Treaty. Thus, not exempt under Article 8. Income will be treated as business profits and would be taxable under Article 7 (Federal Express Corporation (130 TTJ 526) (Mum)) Assessee did not actually transport the cargo, though it entered into Charter Party agreement with its client, but acted as agent and earned commission income. Thus, no exemption under Article 8 of IndiaSingapore Treaty (Thoresen Chartering Singapore (24 SOT 433) (Mum) & J.M Baxi & Co. (42 SOT 333)(Mum)) 26/03/2015 Sushil Lakhani 44 Cross Border Transactions – Specific Issues Payments to non-resident shipping company for the transportation through feeder vessel of other operator Delmas France (121 TTJ 501) (Mum) Shipping company need to establish link between transportation by feeder vessel and mother vessel operated by it. Cie De Navegasao Norsul (124 TTJ 124) (Mum) If link not established then only profits attributable to voyage from midstation to final destination by mother vessel operated by shipping company, would be covered by Article 8. 26/03/2015 Sushil Lakhani 45 Profits from Ancillary Activities… - Code-sharing or slot-chartering arrangement • In the case of Balaji Shipping (UK) Ltd. (25 SOT 325) (Mum), it was held by the court, that such agreement have a close nexus to the main business of the enterprise of the operation of ships. They are ancillary to and complement the operation of ships by the enterprise . • However in the same case it was held that if they are not merely ancillary to the main business of operation of ships but constitute the primary and main activities of the enterprise, it may be a different matter , which was not the circumstances of the present case The High court in the case of Hapag Lloyd AG Vs Add. Director of Income Tax (31 taxmann.com 64) has remanded the matter back to the Tribunal for fresh consideration in the light of descion in the matter of Balaji Shipping UK Ltd. (Supra) .All contention before the Tribunal are left open 26/03/2015 Sushil Lakhani 46 …Profits from operation of ship… Types of Charters Payments o Bareboat Charter (Dry Lease) – Hiring of a ship/aircraft for a stipulated period o o – Possession and control (including the right to appoint the master and crew ) of ship given to the charterer – Purchase of ship or aircraft on installment i.e. Finance Lease (Bareboat Charter-cumdemise – BBCD) – As per OECD Commentary Para 5 Article 7 and not Article 8 applies to profits from leasing a ship or aircraft on a bare boat charter basis except when it is an ancillary activity of an enterprise engaged in the international operation of ships or aircrafts Time Charter (Wet Lease) – Fully equipped ship/aircraft along with crew is provided - Agreement for a definite period – As per OECD Commentary Para 5 ,Profit derived by leasing a ship or aircraft on charter fully equipped ,crewed and supplied must be treated like the profits from the carriage of passengers or cargo. Voyage Charter (Wet Lease) – 26/03/2015 Fully equipped ship along with crew is provided - Agreement for a particular voyage Sushil Lakhani 47 …Profits from operation of ship… Taxability of Charter payments held “royalty” Whether Dry Lease/BBC/BBCD covered under Article 7 or Article 12? Poompuhar Shipping Corporation Ltd [38 Taxmann 150 Madras (2013)] Equipment’ includes ship and Charter fees ( Bare Boat --as also Time Charter !!!!) thereof is ‘Royalty’ o - o Royalty to include use or right to use ship being an equipment (Refer West Asia Maritime Ltd. (111 ITD 155) (Mum)) o CBDT letter dated July 29, 2003 to Ministry of Shipping clarifies: – Ships are industrial equipments. – 26/03/2015 Payments for bareboat charter in the nature of royalty. o India reservations to OECD updates of 2010– India reserves its right to tax profits from leasing ships or aircrafts on a bare charter basis as Royalty o (As per OECD BBC covered by Article 7; Bareboat Charter could be covered by Article 8 if ancillary to main activity) Sushil Lakhani 48 …Profits from operation of ship Taxability of Charter payments Whether Wet Lease/Time-Voyage Charter not covered by Article 8? o OECD Commentary & Klaus Vogel on Double Taxation Conventions o ‘Time Charter’ payment not for ‘carriage’ of goods o – UOI v. Gosalia Shipping (113 ITR 307) (SC) – ONGC v. IAC (29 ITD 422) (Del) – Contrary view in Indian National Ship Owners Association (Bombay HC W.P. No. 400 of 2007 – BCAJ August 2007) – SC in Gosalia Shipping (113 ITR 307) held that time charter is not covered by Sec. 172/Sec. 44B. However, under treaties, as per OECD Commentary, charters fully equipped, crewed and supplied are covered under Article 8. Poompuhar Shipping Corporation Ltd. (108 TTJ 970) (Mum) – o Caribjet Inc (4 SOT 18) (Mum) – 26/03/2015 Considered Time Charter as BBC Held no fundamental distinction between dry leasing and wet leasing Sushil Lakhani 49 Article 8 (4) o o 26/03/2015 Article 8 (4) – Article 8 (1) also applicable to profits from participation in following: – a pool, – joint business or – an international operating agency. Analysis – Terms pool, a joint business or an international operating agency not been defined in the convention. – Cover forms of cooperation like sharing of infrastructure, manpower, maintenance facilities etc. (varying interpretations – refer next slide) – Such profits taxed in participating enterprise – Activity of NVOCC distinct from ‘pool’ or ‘joint business’ – Operations of boats for inland waterways transportations – not covered the Sushil Lakhani state POEM of each 50 Issues – Article 8(4) o Lufthansa German Airlines (83 TTJ 113) (Del) – Profits earned by extending technical facilities to IATP member airlines not taxable in India as same in the nature of profits from participation in a pool – – 26/03/2015 Participation in Pool requires: Reciprocity in the sense of rendering services as well as availing of IATP recognized services/facilities Use of standard agreement forms and levy of charges as per the IATP manual Non-existence of commercial/business providing services to other airlines activities in Distinguished British Airways ( 73 TTJ 519) (Del) Sushil Lakhani 51 Thank you Sushil Lakhani Lakhani & Associates, Chartered Accountants 4th Floor, Bharat House, 104, Mumbai Samachar Marg, Fort, Mumbai-400023 Tel: + 91-22-40693939 (M) : 9821111852 E-mail : sushil@sushillakhani.com