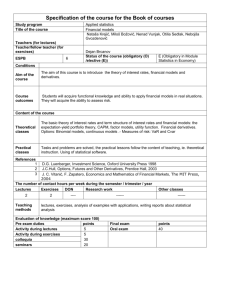

Assessment Summary

advertisement

Unit Code Fin460 Derivatives Securities Unit Coordinator Dr. Ikhlaas Gurrib Department of Finance and Accounting College of Business Administration UNIT OUTLINE Semester 1 2009 INTRODUCTION “…Whales only get harpooned when they come to the surface, and turtles can only move forward when they stick their neck out, but investors face risk no matter what they do.’’’ Charles Jaffe Welcome to Derivatives Securities 460 and the College of Business Administration at PSU. Derivatives FIN460 is an advanced unit in Finance. It covers that branch of finance which deals with in depth structures of financial instruments, pricing and risk management techniques of such tools, and foundations to equip students to pursue financial market careers in derivatives. FIN460 is an important and one of the most challenging unit for those pursuing careers in international finance. It will help you understand the world in which you live, it will enable you to be a rigorous and informed investor in today’s ever challenging economy and it will give you the tools for better informed investment decisions eventually. Good luck with your studies this semester and I sincerely hope that this subject will provide you a rewarding perspective into the world of modern finance. ESSENTIAL ADMINISTRATIVE INFORMATION Unit Title Derivatives Securities Unit Study Package Number Fin 460 Unit Coordinator Dr. Ikhlaas Gurrib Teaching Area Finance Credit Hours 3 Mode(s) of study Internal Co-, Pre- requisites Principles of Finance 301 and Principles of Investment 350 Result Type Grade and Mark Unit Website The website for this unit is: tba Faculty or School Website http://www.psu.edu.sa/cba.html Study Load 2.5 hours per week (normally 2 hours lectures + class activity) Page 2 of 9 UNIT COORDINATOR & PRINCIPAL LECTURER Every unit has a person who is responsible for the overall administration of that unit. This person is the Unit Coordinator. For this unit your Unit Coordinator will also be your Principal Lecturer. This is the staff member that will assist you with your learning in this unit. He will also be responsible for overseeing the marking of assessments and providing feedback in relation to your progress. Their contact details are below: Unit Coordinator: A/Prof Muhammad Ikhlaas Gurrib Email: mgurrib@psu.edu.sa Phone: 01 494 8977 Building: CBA Room: Level 2 CBA E345 Contact Hours: UT 2.30-3.45pm E 240 Consultation Hours Tba In case you need consultation, please come and see me in my office during consultation hours. Unless for urgent matters, it is advisable you email me first at least 24 hours prior to your visit. Page 3 UNIT SYLLABUS LEARNING OUTCOMES On successful completion of this unit you will be able to: 1. Know the terminology of derivative securities. 2. Identify the key characteristics of different types of derivative securities. 3. Explain the main uses of derivative securities. 4. Understand the theoretical foundations for price determination. 5. Understand the limitations of theoretical development in price determination. 6. Understand the market’s application of pricing theory in practice. 7. Understand key issues in risk managing portfolios of derivative securities. 8. Solve problems in derivative security pricing and risk management. LEARNING ACTIVITIES You should attend your scheduled class. Students will receive a DN grade in class when he accumulates 13 absences. Furthermore, each absence results for the loss of half a point on a scale of 100. Pease review your student manual for more information on PSU policies. (http://www.psu.edu.sa/cba/Students_Manual_CBA.pdf) The lectures cover the syllabus material. The lectures will summarise the material covered in the textbook and will focus on the important concepts and understandings of the course. The test and the exam will be based on the material covered in the lectures. The class hours are the only opportunity you will have for regular group discussion of topics covered in the lectures and textbook. Tutorials will provide you with the best guide as to your understanding of the course material. This is why it is essential to attend regularly and be well prepared. This means reading the text, revising your lecture notes and preparing answers to the tutorial questions and problems. As well you should ask your professor to explain any parts of the course that you have not understood or found difficult. You should expect to devote at least 5-7 hours to reading your text/lecture notes and preparing answers to the tutorial discussion questions. Each week you will be asked by your professor to explain an answer to the class, or use the whiteboard to illustrate an answer. In finance, it is important to communicate effectively in writing using finance theory and to engage confidently in interpersonal communication in tutorials. STUDENT FEEDBACK It is highly valuable that students do give their feedback to improve the unit further for future students at PSU. They can directly consult Dr. Ikhlaas Gurrib and make suggestions. These might include ways to improve course outlines, assignments, presentations, web site information, etc. Page 4 LEARNING RESOURCES Learning resources are located on the website: Unit Outline Sample MCQs Finance Articles relevant to course Finance Websites relevant to course TEXT BOOK You will need to purchase the following textbook in order to complete this unit: Robert Kolb and James Overdahl, Futures, Options and Swaps,5th Edition, Blackwell Publishing Recommended Texts: There are many other Principles of Investments texts available from the library. You do not have to purchase the following textbooks but you may like to refer to them. Options, Futures, and Other Derivatives, 7th Edition, Copyright © John C. Hull 2008. Fundamentals of Options and Futures markets, 6th Edition, McGraw Hill, John C. Hull. ASSESSMENT DETAILS Assessment Summary The assessment for this unit consists of the following items. Assessment Tasks Class Work Major 1 Major 2 Assignment Worth Due Unit Learning Outcome Assessed 15% Random 1,2,3,4 10% 20th Nov 15% 27th Dec 1, 2, 3 20% 6th Jan 1, 2, 3, 4 1,2,3 Page 5 Final exam TOTAL 40% Exam Week 1, 2, 3, 4 100% Assessment 1 – Class Work Worth: 15% Due: Collected at random during lectures throughout the semester. Students will be tested at random four times during the semester. These tests will consist of two or three questions which will take approximately 15 minutes of lecture time, at the lecturer’s discretion. Students can refer to notes and texts, etc. but cannot discuss answers with anyone else. Once student answers are collected, the lecturer’s answers will be supplied to provide students with immediate feedback on their progress. Each test is worth 5%, and the student’s best three results will contribute to the assessment for class work. Example 1: Student 1 sat four tests scoring 5, 4, 2, and 3. Therefore, Student 1’s mark for class work is 5+4+3=12 out of a possible 15. Example 2: Student 2 sat three tests scoring 3, 4 and 2. Therefore, Student 2’s mark for class work is 3+4+2=9 out of a possible 15. If students miss a test, for whatever reason, another test will not be rescheduled. Students are expected to attend all lectures. By taking the best three out of the four test results, the lecturer is giving students the flexibility to miss a test through illness etc. It is extremely unlikely that a student would miss two or more tests for valid reasons. Assessment 2 – Major 1 and Major 2 Worth: 25% Major 1 (10%) – Held on 20th Oct Major 2 (15%) – Held on 10th Nov The test will examine material covered in Lectures 1-2-3 (Major 1) and Lectures 2-4-5 (Major 2). The test will consist of 10 multiple choice questions for Major 1, and 3 short answer calculation questions for Major 2. The test will be conducted in normal lecture time. Please obtain your test time from your professor. Sample multiple choice questions can be found on the website. Page 6 Assessment 3 - Assignment (Case Study) Worth: 20% Due: No later than 6th Jan 2010 3pm (Riyadh Time). The assignment would consist of an assignment testing various chapters. Due to the status of the financial crisis nowadays, it is a must for fresh finance professionals like graduates to fully understand that the different scenes between the crisis. This semester’s topic is as follows: “Did deregulated derivatives cause the financial crisis?” Although it’s a take home assignment, just be aware that plagiarism is a form of cheating. The penalty for plagiarism is a mark of zero and possible expulsion from the unit and/or course of study. It will be a group assignment with a maximum of 2 students per group. Assignment Marking Criteria CONTENT (85%) Sound application and explanation of theory Relevance of content: appropriate level of detail Well-reasoned arguments and conclusions Critical analysis and evaluation Structure (clear, logical organization) PROFESSIONAL SKILLS (15%) Correct in-text referencing and list of references Style: fluent, concise, correct English & grammar Professional presentation Assessment 4 – Final Exam Worth: 40% Due: Exam Week – refer to Exam timetable The exam will consist of a multiple choice section and a written question/problem section. The exact format will be provided towards the end of the semester. The exam will cover all the topics in the semester program. Guidelines for Submission: All assignments must be received by 6th Jan 2010. Page 7 Assignment Marking Students should allow a 2 week marking turnaround for written assignments. STUDENTS’ RIGHTS AND RESPONSIBILITIES It is the responsibility of every student to be aware of all relevant legislation, policies and procedures relating to their rights and responsibilities as a student. These include: the Student Charter, the University’s Guiding Ethical Principles, the University’s policy and statements on plagiarism and academic integrity, copyright principles and responsibilities, the University’s policies on appropriate use of software and computer facilities, students’ responsibility to check enrolment, deadlines, appeals, and grievance resolution, student feedback, other policies and procedures electronic communication with students See http://www.psu.edu.sa/ByLaws/RulesRegulations_of_Undergraduate_Study_n_Exam.pdf for comprehensive information on all of the above. ADDITIONAL INFORMATION Telephone Contacts: If you have a query relating to administrative matters such as: requests for deferment of study difficulties with accessing online study materials obtaining assessment results Please contact the College of Business Administration, Student Affairs. Deferrals A deferred assessment is the formal approval by a Board of Examiners for a student to complete an outstanding assessment task for a unit at a later date. Outstanding assessment tasks can include an examination or assignment or other work. Approval for deferred assessment should only be given in circumstances where the specified criteria are met. For further information please see the current PSU Student manual: http://www.psu.edu.sa/cba/Students_Manual_CBA.pdf UNIT STUDY CALENDAR If you have a printed copy of this document, you may like to tear off this final page and keep the Study Calendar handy as you work through the unit. Page 8 Semester 1 2009 WEEK 1. Week starting 3rd Oct MODULE/CHAPTER/TOPIC: 2. Mechanics of Futures Markets 17th Oct 3. Hedging Strategies using Futures 4. 24th Oct 4. Mechanics of options markets 5. 31ST Oct 5. Trading strategies involving options 6. 7th Nov 3. DUE DATE Major 1 8th Nov 1. Revision of key concepts + Theoretical foundations of derivative security pricing. 10th Oct 2. ASSESSMENT Mid Semester Test HAJJ VACATION 19th Nov – 4th Dec -----No Class during Hajj Vacation----7. 5th Dec 6. Global Financial Crisis and risk management 8. 12th Dec 7. European option pricing (BSM) 9. 19th Dec 8. American option pricing (binomial) 10. 26th Dec 9. Options on stock indices and currencies 11. 2nd Jan 10. Greek letters 12. 9th Jan 11. Interest rate derivatives and swaps 13. 16th Jan 12. A look at a live trading system 14. 23th Jan 13. Derivatives Mishaps and Course Review 15. 30th Jan Major 2 Assignment 6th Jan Final Exams Page 9