Impacts - Supply Chain Resource Cooperative

advertisement

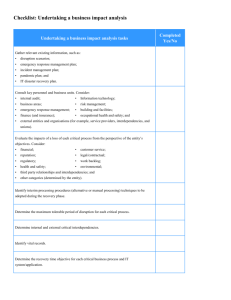

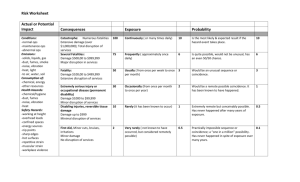

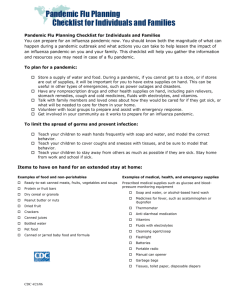

Preparing for the Black Swan Risk Mitigation and Planning for Procurement and the Supply Chain ISM Risk Management August 20, 2012 Rob Handfield, PhD Co-Director, Supply Chain Resource Cooperative Bank of America University Distinguished Professor of SCM 1 Introductions… Rob Handfield, PhD • Bank of America University Distinguished Professor of Supply Chain Management, NC State University • Director, Supply Chain Resource Cooperative – top 3 MBA SCM programs in the US • Adjunct Professor, Manchester Business School Research and consulting supply risk projects with different industries including: • Bank of America • Biogen Idec • Boston Scientific • BP • Cardinal Health • Chevron • ConocoPhillips • Duke Energyr • General Motors • GlaxoSmithKline • Honda • Northrupp Grumman • LyondellBasel • Spectra Energy • Shell Current Partner Companies 3 4 Agenda • The Global Market Picture • Why think about Complex Adaptive Systems? • Issues Facing Industry Executives in this context – Commodity Volatility – Global Footprint and Regulatory Challenges – Supplier Risk – Talent management – Global footprint • Building an Agile Organization 5 Global Economic Woes Foreseeable for Some Time to Com Unemployment stuck at 8-9%, contagion in Europe, home values below market, banks are mired in regulatory firefighting. Uncertainty, low demand, and excess supply has postponed expansion and hiring, job markets recovery will take years. Commodity prices are likely to rise on trend, while the dollar will weaken and housing will remain flat for a number of years Economic recovery estimates have been scaled back to 2013 under a positive scenario Multiple mixed signals emanating from global markets makes forecasting & strategic planning for 2013 and beyond extremely challenging Global Risks are Frequently Generating Supply Chain Disruptions Caterpillar Tornado Oxford MS Tsunami Indian Ocean Fallujah Offensive 2005 SARS Outbreak Sadr City Bombings Hurricane Katrina 2006 Mumbai Attacks Iceland volcano Healthcare H1N1 Outbreak Global Recession 2007 2008 Hurricane Katrina Chinas stimulus package 2009 Surge in Afghanistan 2010 Japanese Earthquake French Strikes Thai Floods 2011 Toyota Accelerator Recalls Business Failures: Bear Stearns, Lehman Brothers, TARP, Global Recession 6 Libyan Crisis 2012 Greek Political Chaos Agenda • “Black Swan” Events • Common Errors in Forecasting and Risk Mgmt • Approaches for Reducing Impact of Unplanned Events • Case Study: Pandemic Scenario Planning Survey Results 7 Global Risk Events Overlap and Impacts Compound Sept 2001 Terrorist Attacks Hurricane Katrina West Coast Ports Lockout SARS/H1N1 Virus Iceland Volcano Conflict in Iraq AFP – Frederic J. Brown Dealing with Risks is the Normal Operating State 8 Why Should Companies Manage Supply Chain Risks Like Other Risks? Shareholder Value Impact Is About the Same Magnitude and Duration for Supply Chain Risk Events and Traditional Crises • Cost of supply chain “glitches” – average of 10.28% decrease in shareholder value at time of announcement, with share price recovery (if firm does recover…) in roughly 60 trading days.1 • Cost of crises – sharp initial decrease of almost 8%, with full share price recovery (if firm does recover…) in roughly 50 trading days. 2 • 69% of CFOs, Treasurers & Risk Managers at Global 1000 companies in North America & Europe view fires/explosions and supply chain disruptions as leading threats to top revenue sources.3 Hendricks and Singhal, “The effect of supply chain glitches on shareholder wealth,” Journal of Operations Management, Vol 21, 2003, pp. 501-522. Supply chain glitches include parts shortages, order changes by customers, production problems, product launch problems, quality problems, engineering changes, weather-related problems, capacity and equipment problems, IT system problems, etc. 1 Knight and Pretty, “The impact of catastrophes on shareholder value,” The Oxford Executive Research Briefings, 22 pages. Crises include Johnson & Johnson Tylenol product tampering, Union Carbide Bhopal gas leak incident, Pan Am Lockerbie plane crash, Occidental Piper Alpha Oil Platform explosion, Exxon Valdez oil spill, Perrier Benzene contamination, etc. 2 3 Green, “Loss/Risk Management Notes: Survey: Executives Rank Fire, Disruptions Top Threats,” Best's Review, Sept. 1, 2004 9 “Black Swan Events” An event with three attributes: 1. An outlier, that lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility. 2. It carries an extreme impact. 3. In spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact making it explainable and predictable. Source: Nassim Taleb, New York Times, April 22, 2007. 10 Strategies for Managing Commodity Volatility New Sources focusing on new emerging players Pre-qualification investments can open options. New players can offer lower cost opportunities, as evidenced in steel and aluminum Increase visibility of key commodities bottom line impact with ‘rules of thumb’ Understanding how and where commodities impact and ‘time lag’ to bottom line help manage exposure Constant forecasting relying on market experts for insight Ensures proper visibility and data driven sourcing decisions Scenarios for building future options and guiding decisions Which scenario is hard to know but impact of scenarios can be mapped (remember when gold at $1,000 / oz was insane?) Understand when ‘rules of thumb’ break down Detail Red Flags to watch and transition into potential new market scenarios when they appears Rapid Decisions and Rapid Implementation Inactivity is a decision: Procuring infrastructure will need to facilitate implementation 11 The track record on predicting Black Swan events is not good…. October, 2007: “The problems in credit markets have been severe, and while the first phase is now over, we are still waiting to see exactly how the consequences will play out…..At this point, we expect global growth to slow in 2008, but remain at a buoyant pace. - IMF December, 2007: “The economists project, on average, that the economy will grow 2.1% from the fourth quarter of 2007 to the end of 2008, vs. 2.6% in 2007. Only two of the forecasters [out of 54 in total] expect a recession.” - Business Week annual survey of business forecasters. March, 2008: “I have great, great confidence in our capital markets and in our financial institutions. Our financial institutions, banks and investment banks are strong. Our capital markets are resilient. They’re efficient. They’re flexible. - Henry Paulson. US Treasury July 15, 2008: “We can have confidence in the long-term foundation of our economy….I think the system basically is sound. I truly do.” - George W. Bush, President 12 Statistical Regularity ≠ Predictability Sigma (“”) is a measure… SIGMA 1.0 2.0 3.0 4.0 5.0 6.0 DPMO * 691,462 308,538 66,807 6,210 233 3.4 YIELD 30.8538% 69.1462% 93.3193% 99.3790% 99.9767% 99.9997% * EPMO = Events per million opportunities 6 variation 6 = 3.4 events per Million Opportunities 5 4 Unpredictable events 3 2 Variation 1 Expectation • Variation in commuting time by subway can be modeled by bell curve with almost all values falling within 3 std. deviations •BUT – what is the probability of being hit by a coconut under a palm tree while on vacation? (“coconut uncertainty”) •How to forecast an event that is 20 ? 30 ? 13 Source: Mykridakis, Hogarth and Gaba, “Why Forecasts Fail”, MIT Sloan Mgmt Rev., Winter 2010. Six Common Executive Mistakes in Trying to Manage Uncertain Events Instead, focus on: Common Mistakes 1. 2. 3. 4. 5. 6. Thinking you can manage risk by predicting extreme events. Convincing your team that studying the past will help manage risk. Not listening to good advice about what you shouldn’t do. Assuming risk can be measured by standard deviations. Confusing mathematical equivalency with psychological equivalency. Focusing on being lean without considering the importance of redundancy. 1. 2. 3. 4. 5. 6. Gauging how your company will be affected, and how your supply chain partners will be impacted. Recognizing there are no “typical” failures or successes, as global randomness is inherently unstructured in nature. Thinking of risk mgmt in terms of preservation of profits and retention of shareholder value. Avoid underestimating the size of the class of rare events that can impact supply chain. Looking at multiple measures of risk from multiple perspectives, not just the best case scenario which increases risk appetite. Avoiding leverage, and identifying strategic redundancies in the supply chain that are critical in the event of something going wrong. Source: Taleb, Goldstein, and Spitznagel, The Six Mistakes Executives Make in Risk Management, 14 Harvard Business Review, October, 2009. Supply Market Intelligence Enables Supply Chain Risk Mitigation Three key elements of supply chain disruption management • • • Disruption Discovery – What type of detection and intelligence does a firm need to detect disruptions? Disruption Recovery – Once the disruption is discovered, how does a firm effectively recover from a disruption? Supply Chain Redesign – How can a company strategically redesign its supply chain over time to become more resilient and avoid or easily mitigate future disruptions? Disruption Discovery Supply Chain Redesign Disruption Recovery 15 Impact (B) The key is planning, NOT forecasting. The ability to respond is a function of how well your organization has considered and planned for the worst case scenario. Disruption Amplifiers (Globalization and Complexity) Impact of Disruption ($, Customer Account, Market share) Disruption Discovery and Recovery Disruption Discovery and Recovery time (B) Disruption Discovery and Recovery time (A) Excess Resources Impact(A) Visibility Systems Discovery(A) Recovery (A) Discovery(B) 16 Recovery (B) Time A process for supply chain continuity planning • Establish senior executive support for supply chain risk planning team • Dedicated cross-functional planning committee with authority to drive business cases . Governance • Criteria: Who will be impacted? Who has knowledge? Supply Chain Risk Planning Strategic Redundancies • Identify critical suppliers and employees that would impact operations and market share in the event of a major disaster (“downside risk”) • Identify key bottlenecks that would impact capacity in a rapid growth scenario (“upside risk) • Develop scenarios and ‘what if’ analyses to stress test supply chain • Establish requirements for redundant resources at impacted enterprise supply chain nodes bearing the highest risk • Develop business case, present to leadership team, and execute • Defined action plans and education for critical employees and suppliers Supply Chain • Collaborate with supply chain partners on role plays, drills, simulations, Education & etc. on a periodic basis as required. Training 17 Challenge your team to identify not the EVENTS, but the major areas impacted internally or in your supply chain Pandemic or health threat (of any sort) • Workforce decreases by 30%.... • Supplier capacity cut in half…. Economic meltdowns (or sudden surge) • Ability to flex up or down • Suppliers experiencing financial distress or lack of access to capital Terrorist Cyber Attack / Travel Shutdown • Systems compromised • Logistics network shut down • Travel restrictions to critical regions 18 Exercise: Think of recent “near misses” or disruption that resulted in a major business impact….. Examples • Iceland volcano • Storms or weather • Supplier mergers or acquisitions • Bank failures • HSSE near misses? Post-mortem lessons learned? • Inventory positioning? • Contract reviews and renegotiations? • Dual sourcing agreements? • IT systems redundancy? • Others?... • What are the implications for WHO should be on a supply chain continuity team? 19 Begin by classifying internal enterprise functions that would disrupt operations or limit growth… High High Opportunity, Low-Hanging Fruit High likelihood, high impact Purchasing Field Supply Call Center Enterprise & Supply Chain Business Critical? (bottleneck, Single source, Etc.) Operations Security Logistics IT Systems. Warehouse Facilities HVAC Janitorial Health Providers Customer Billing Benefits Low Retail Associates Software Maintenance Sales Agents Legal Acct. Payable Cafeteria Likely to be impacted? (Direct impact or proximity to threat) High 20 Identify critical assets/parties in the supply chain that would be impacted… High High Opportunity, Low-Hanging Fruit High likelihood, high impact IT Systems Call Center Field Contract Supply Mfg. Billing Enterprise & Supply Chain Business Critical? Contract Research IT Maint. Direct Materials Field Support Distrib. Third Party Logistics Energy Security Facilities Maint. Lab Services Janitorial Legal Insurance Office Supplies Low Food Services High Likely to be impacted? (Physical proximity or directly dependent on resource) 21 Classify each party/relative to risk and impact, and establish mitigation requirements Step 1: Generate/Validate Initial Critical Supply Chain List Risk Step 2: Initial Impact Assessment (Decision Tree) Mitigation Strategy, Scorecard Mitigation Strategy, Scorecard M Scorecard, Auditing Scorecard, Auditing L No Action Scorecard, Auditing H Included H/M or L L Excluded (L) Step 3: Supplier Risk Assessment 1 Performance 2 Supply Chain 3 Financial 4 HR 5 Continuity 6 Relationship 22 High Or Medium M Impact H Step 4: (H/H and H/M) Mitigation Strategy These steps represent a supplier risk management strategy. Step 4: (H/L, M/M and M/H) Scorecard, Auditing Predicting failure points and potential impacts requires structured brainstorming with SME’s… CAUSES (Categories of Predictive Measures) Relationship Supplier Attributes Performance Human Resources Supply Chain Disruption Situational Factors Financial Health Environmental Disruption EVENTS Misalignment of Interests Quality, Delivery, Service Problems Supplier Union Strike, Ownership Change, Workforce Disruption Supplier Locked Tier II Stoppage Supplier Bankruptcy (or financial distress) Disasters (Weather, Earthquake, Terrorists) Copyright© 2006 Supply Chain Redesign, LLC CONSEQUENCES (Impacts) Sudden Loss of Supplier Finished Goods Shipments Stopped Recall for Quality Issues Locate and Ramp Up Back up Supplier EFFECTS Revenue Losses and Recovery Expenses Emergency Buy and Shipments Emergency Rework and Rushed FG Shipments Reputation Market Share Loss 23 OTHER IMPACTS Forgone Income Strategically redundant assets and plans are required for high risk high impact elements with business case identified Management Identify Resources and Implement YES Analysis of Potential High Risk Product/ Supplier Who? What? Supply Chain Analyst · · Develop Potential Mitigation Strategies Mitigation recommended? Supply Chain Analyst, MEs, Procurement, Quality as needed Supply Chain Analyst Basic information from procurement, mfg. engr., quality Key risk drivers · · · · Improved coordination Increased inventory New source Product redesign Additional Resources Required to Implement? NO Implement Risk Mitigation Strategy Supply Chain Analyst · Coordinate/perform activities as needed 24 We need to re-think current contracting behaviors and recognize risk as a shared component of the relationship….upfront collaboration can solve many problems that occur later on… Where do managers spend Critical Elements of Contracting time in contract negotiation? Cooperation Economic exchange Planning for the future Potential external sanctions Social control and manipulation Limitation of Liability Indemnification Price / Charge / Price Changes Intellectual Property Confidential Information Data Protection Service Levels and Warranties Delivery / Acceptance Payment Liquidated Damages “Classical law views cooperation as being ‘of little interest’ and external to the contract. In part, this is because it assumes a common base of presumed rules by the parties.” – Ian McNeil, 1969 25 Source: T. Cummins, Commitment Matters, June 2009. Case Example: Pandemic Exercise “While pandemics have happened several times in the past, never before have we had all of the tools of today. Never before have we possessed the wealth of knowledge on the problem and the ability to prepare. The challenge is immense, but so is our will to protect and preserve.” 26 Michael Levitt, Department of Health and Human Services, Pandemic Planning Update II, July 2006. Pandemic “Dogma” 1. Only H1, H2 and H3 viruses could infect humans, H5, H7, and H9 subtypes jumped from birds to infect people (Incorrect) 2. Pandemic viruses emerge from Asia, the cradle of flu viruses (H1N1 originated in Mexico) 3. Pandemics are triggered by antigenic shifts or small mutations which resulted in the H1N1 virus. (Actually, almost everyone alive has antibodies to H1 viruses). 4. Emerging pandemics can be extinguished with quick use of antiviral drugs (this virus spread before anyone had time to distribute) antiviral drugs) 5. Pandemics are easy to spot and occur during flu season (this one started in the offseason) 6. Governments can quickly respond to a pandemic virus once it is spotted (The WHO took many weeks to actually raise the level of infection to a level that required emergency actions) 7. People will clamor for pandemic vaccine (Many people resisted taking the vaccine in 2009). 8. Vaccine would be ready in time (the length of the spread of the vaccine made it difficult to plan release of vaccines and distribution was problematic). Source: Branswell, Helen, Nov 4, 2009, “Flu dogma being rewritten by a strange virus no one pegged to trigger a pandemic”, The Canadian Press. 27 How well prepared are companies for a pandemic? 60 50 Governance SC Risk Impacts Redundant Resources Training 40 Number of organizations Completed 30 In Progress Not Started 20 10 Create governance team 0 Implement Drill / Exercise Identify critical resources Ancillary workforce Plan for scenarios Determine Impact on Financials IT System Backup Emergency Communications 28 Best Case: Financial Services Pandemic Plan • Pandemic team reports to enterprise business continuity senior executive, with scope over planning, associate availability, and customer impact • Includes executives from lines of business, supply management, IT, finance, Governance HR, and others as required. Supply Chain Risk Planning Strategic Redundancies • Industry-wide pandemic simulation exercise in 2007 led to discoveries of critical nodes in the supply chain impacted in a pandemic • Critical categories: Armored vehicles, ATM’s, utilities • Outsourced IT providers in India also deemed high risk – effects unknown. • Recognition that further analysis of supply chain impacts needed • Establish requirements for stockpiling a number of critical supplies, including gloves, masks, sanitizer, anti-virals,and hand towels • IT bandwidth issues identified as an area for redundancy • Industry action groups reviewed findings of meeting and shared best practices Supply Chain • Specific individual roles and functional impacts identified for in-depth Education & training as required Training S o 29 Parting Thoughts Black Swan events have always been part of our economic climate; only recently have we begun to recognize that uncertainty is part of our fabric, and that successful firms are those who don’t rely on forecasts, but instead plan for uncertainty and exploit their relative position when surprises occur. Accept • ….that you’re operating in an uncertain world. • Confront the fact that many, many different possibilities are plausible. • Pull together experts from nontraditional areas Assess • …how different events might unfold. • Be willing to gather and consider more data and judgments than you normally would. • Establish the range of possibility, then… Augment • …the range of uncertainty that you are comfortable with. • The range of potential outcomes is consistently underestimated. • Avoid “futureperfect” thinking. 30