Contact Information

advertisement

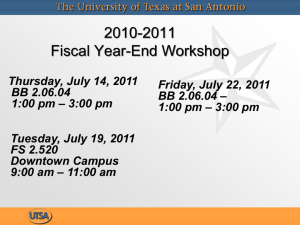

2011-2012 Fiscal Year-End Workshop Wednesday, July 18, 2012 UC 2.01.28 9:00 am – 11:00 am Thursday, July 26, 2012 BV 3.324 Downtown Campus 9:00 am – 11:00 am Tuesday, July 24, 2012 BB 2.06.04 – 2:00 pm – 4:00 pm Fiscal Year-End Workshop Agenda: • • • • • • • • • Opening Remarks Lapse Guidelines for Fiscal Year-End Balances – Lenora C. Chapman Fiscal Management Sub-Certification Process – Diana Macias-Ollervidez Accounting Services – Charlotte Mikulec Disbursements/Travel Services – Nora Compean Break Purchasing – Yvette Medina Payroll Management Services – Diana Macias-Ollervidez Human Resources – Henry Barrera Controller’s Website The year-end workshop PowerPoint presentation and calendar are posted on the Controller's website. Download the calendar to your Outlook calendar or print copies. FMOG’s/Forms/FAR Presentations LAPSE GUIDELINES FOR FISCAL YEAR-END BALANCES Lapse Guidelines – Educational & General Funds (14 – Accounts) Special Items & Research Development Funding must be fully expended in the 2nd year of the biennium. Deficits must be covered during the lapse process. Budget will coordinate with affected areas. Disposition of E & G balances is based on each Vice President’s direction for their areas. (New eff. FY12) Certain accounts are not subject to the lapse, including reserves, GIT & lab fees Lapse Guidelines Designated Funds (19 – Accounts) Deficits not cleared prior to year-end will be cleared during the lapse process. Budget will coordinate with affected areas. Disposition of 19-7 account balances other than Reserves that do not lapse, is based on each Vice President’s direction for their areas. (New eff. FY12) Designated Funds - Exceptions to Lapse Guidelines (19 – Accounts) The following Designated 19-Accounts are not subject to lapse (carry forward 100%): Most 19-accounts sourced from fees - other than 19-7 Facilities & Administration (F & A) 19-8 accounts − F&A balances under $100 will be swept to next highest level, e.g. Department, College, etc. in accordance with the F&A MOU. Overview of Lapse Policy Changes by Area Applies only to those budget groups that in prior year’s would have been subject to lapse in fund 14 and 19-7 accounts: Academic Affairs –please see Academic Affairs Lapse Policy-FY12 Business Affairs, Community Services, President’s Office, Research, Student Affairs and University Advancement – all funds lapse to Reserves. Lapse Guidelines – Service Centers (18Accounts) Not subject to lapse (carry forward 100%) Any surplus/deficit exceeding 10% requires special exception and approval of AVP-Financial Affairs or Asst. VP Financial Affairs/University Controller. Subject to Service Center Policy for compliance with OMB Circular A-21. Contact Carol Hollingsworth at x4229 with questions Lapse Guidelines – Other Fund Groups Year-end balances in the following funds are not subject to lapse (carry forward 100%) Grant and Contracts (26 Accounts) Auxiliary Enterprise (29 Accounts) Gift/Restricted Funds (30 Accounts) Plant Funds (36 Accounts) Fiscal Management Sub-Certification Process Electronic sub-certification conducted through the Office of Institutional Compliance and Risk Services in September of each year Required by UT System Administration Policy UTS 142.1 – Policy on the Annual Financial Report. Review New Financial Management Operational Guidelines (FMOG), Fiscal Management SubCertification Work Plan, Section 1: Internal Control Fiscal Management Sub-Certification Process Annually, each Account Administrator should provide a fiscal management sub-certification for accounts with activity of $3,000 or more to the Financial Reporting Officer- the Associate Vice President for Financial Affairs. The fiscal management sub-certification certifies that, among other items, their accounts are being reconciled timely, duties are properly segregated and no material weakness exists relative to their internal control. Highlights of the Fiscal Management Sub-Certification Acknowledgement of responsibility Reconciliations are completed monthly and all transactions were appropriate Errors were adjusted timely Transactions were reviewed and approved Segregation of duties were in place − Enter and approve transactions; receive cash and reconcile accounts Highlights of the Fiscal Management Sub-Certification (cont’d) Sound internal controls No misstatements or omissions are evident on your Statement of Account Fraud has not occurred Compliance with Code of Ethics related to award of contracts Fiscal Management Sub-Certification Process Account administrators failing to complete the subcertification are reported to their respective Vice President, Auditing & Consulting Services, and Assistant Vice President Financial Affairs/University Controller. The Office of Institutional Compliance & Risk Services utilizes administrator responses (or lack thereof) when performing the annual risk assessment to determine account administrators selected for Quality Assurance Reviews (QAR). Common Errors Account administrator is not correct Account is inactive or zero balance ‒ Complete Unit and Account Request Form ‒ Send to Accounting Office Account administrator must complete subcertification if any expenditures were processed during the fiscal year and totaled $3,000 or more Not the same as Annual Compliance Acknowledgments ACCOUNTING SERVICES Contact Information Main line: Fax line: Location: E-mail: Website: 458-4212 458-4222 University Heights, Tech2, 1.104 accounting.ofc@utsa.edu Accounting Services Contact Information Name Title Ext. # VACANT Director 4826 Charlotte Mikulec Associate Director 4841 Cynthia Schweers Senior Accountant 4216 Regina Moore Accountant III Assigned to PeopleSoft Marlene Zacarias Accountant III 4826 Kimmung Doan Accountant II 4834 Jorge Solis Accountant II 4827 Justin Avants Accountant II 4525 Ashley Zaldivar Accountant II 8525 Priscilla Ybarra Accountant I 6939 Critical Accounting Deadlines July 19 Corrections for Sept-May due to Accounting Services by 5pm July 26 Corrections for June due to Accounting Services by 5pm August 22 Corrections for July due to Accounting Services by 5pm September 4 Inventory Reconciliation due to Accounting Services by 5pm September 6 First close of August September 10 Electronic SOA sent by MRAS no later than NOON September 13 Corrections for August due to Accounting Services by NOON Year-End Accounting Functions Pre-Payments Entry made to allocate expenses between fiscal years or expense for next year − (i.e. maintenance agreements, software licenses, registration fees, etc) Funds to cover pre-payment will be allocated during FY13 from FY12 budget Materiality factor of >$1,000 per item Reminder - Memberships will be excluded from prepayments – expense will be recognized in full in the year it is paid. Year-End Accounting Functions Accruals Accrue for services rendered or goods received as of August 31st Materiality factor of > $1,000 per item Vouchers for $1,000 or less must be to DTS by August 24 to be included in FY11/12 expenses Service Centers (18 Accounts) Bill for services rendered for FY12 by calendar deadlines Inventory Complete inventory count due by 8/31/12 and reconciliation should be completed by 9/04/12 and sent to Accounting by 5PM General Accounting Information Maintenance of Accounts - required to comply with an audit finding and facilitate efficient reporting Scrubbing of accounts is required for UT Share PeopleSoft Project ‒ May receive queries from AVP, Accounting or Grants & Contracts Send an e-mail to Accounting Services to inactivate accounts with zero balances (no encumbrances) Review accounts with small balances that are not in use and close these accounts by: - A transfer of funds to an appropriate account - Expense as appropriate General Accounting Information NACUBO classification review Account administrators are requested to review NACUBO classification on their accounts Why: To ensure accuracy of financial reporting Previous review was two years ago Send e-mail to Accounting Services for NACUBO changes Include justification for change Link to NACUBO definitions Chart of Accounts (Chart of Accounts: Section 3: Fund Accounting Principles) General Accounting Information Review Financial Management Operational Guidelines (FMOG): ‒ Statement of Accounts (SOA) Reconciliation Process, Section 1: Internal Control ‒ Internal Control, Section 1: Internal Control ‒ Year-End Closing and Accounting, Section 4: General Accounting General Accounting Information Unit and Account Request Form ‒ Form required to add or modify budget groups, subaccounts and unit codes ‒ Is now available in PDF format with some drop down availability ‒ Go to Forms and Worksheets and always use the most current form ‒ http://www.utsa.edu/financialaffairs/Forms/details.cfm?form_number=68 General Accounting Information Sub-Account 69 ‒ Effective 6/1/10 use Sub-Account 69 Operation and Maintenance (O & M) of Plant for work order requests ‒ Why: To properly account for work order request expenditures to NACUBO function Operation and Maintenance of Plant ‒ Do not charge work order request to Sub-Account 69 for telephone services work request, event setup and major/minor renovations greater than $100K General Accounting Information Sub-Account 69 (cont’d) ‒ Unless notified Sub-Account 69 will be pooled with SubAccount 50 to eliminate the need to process budget transfers ‒ Excludes budget groups in the following funds: Service Centers (18 accounts), Auxiliary (29 accounts and some 19 accounts) and Sponsored Grants and Contracts (26 accounts) General Accounting Information Statement of Account Reconciliation ‒ Reconcile monthly ‒ Required by UT System Policy UTS 142.1 General Accounting Information Access to Statement of Account Information A report is run after the monthly close and sent out electronically ‒ To update personnel list, refer to DEFINE Departmental User Access Form (Sections I, III, IV) ‒ http://www.utsa.edu/financialaffairs/Forms/details.cfm?form_number=10 ‒ New improved electronic SOA commenced in May 2012 ‒ Only ONE e-mail to account administrators and reconcilers ‒ Additional reports added Departments can access balance and transactional information via UTDirect and download as needed. Training: Understanding the Statement of Accounts ‒ Sign up via TXClass – Course ID AM 506 General Accounting Information Corrections: Send all corrections except for 26-accounts to accounting.ofc@utsa.edu Send corrections for 26-accounts to Office of Post Award Administration (OPPA) General Accounting Information Corrections (cont’d) Provide the following information: ‒ Document ID number ‒ Original account number used ‒ New account number for correction ‒ Amount of correction ‒ Reason for the correction ‒ Copy administrator on account being charged ‒ Approval is implied by Administrator unless otherwise noted Upcoming Audits for Fiscal Year 2013 Deloitte & Touche Audit (UT System) Currently reviewing interim items ‒ Fieldwork done by UTSA Internal Audit staff DISBURSEMENTS AND TRAVEL SERVICES (DTS) & PROCARD/TRAVEL CARD ADMINISTRATION (PTCA) Contact Information Disbursements/Travel main line: 458-4213 Disbursements fax line: 458-4829 E-mail: Disbursements.travel@utsa.edu Website: Disbursements and Travel Services Contact Information Employee Name Title Ext. # Disbursement Vendor Responsibilities Lisa Cartier Director 5915 Temporarily assigned to the PeopleSoft Implementation Team Nora Compean Asst. Director 4831 Cheryl Gay Disbursements and Travel Services Supervisor 4828 D - H, Utilities, NSF's, PO Disencumbrances (VE2 & VE3 documents) VP5: In/Out State and Foreign, Travel Advances, VJ1’s, Citibank CLIBA payment approval Susanita Duenas Disbursements and Travel Services Supervisor 6525 N -T, NSF's, PO Disencumbrances (VE2 & VE3 documents), VT5 Interdepartmental Review/Approval, UTHSC Due to/Due from final approval, Citibank CLIBA payment approval Lily Wang Disbursements and Travel Services Supervisor 4825 VP5: In/Out State and Foreign, Travel Advances, VJ1’s, Citibank CLIBA payment approval Contact Information Employee Name Title Ext. # Disbursement Vendor Responsibilities Ana Geigenmiller Disbursements and Travel Specialist II 4215 A - C; NSF's, PO Disencumbrances, VP3's, USAS, Scholarship Vouchers, Citibank CLIBA payment approval Dorothy Cheatham Disbursements and Travel Specialist II 4836 I - M, Aramark, NSF's, PO Disencumbrances, Direct Deposit & Garnishments, Vendor ID Set Up Process, Citibank CLIBA payment approval Elisabeth Cuadros Disbursements and Travel Specialist II 4832 VP2's, Registrations, VP5: In/Out State and Foreign, VJ1’s, Travel Advances and Settlements, TAC cards, Citibank CLIBA payment approval Kelly Rock Disbursements and Travel Specialist II 4278 U - Z, NSF's, PO Disencumbrances (VE2 & VE3 documents), Daily Check Run Processing, Vendor Holds & Check Reissues Norma Dailey Disbursements and Travel Specialist II 4840 All Specialty Vendors, Praxair, Comdata, Fischer Scientific, Texas Folk and Asian Festivals, NSF's, PO Disencumbrances, VP3’s, Citibank CLIBA payment approval Contact Information Employee Name Title Ext. # Disbursement Vendor Responsibilities Geneva Carroll Disbursements and Travel Specialist I 6979 All Specialty Vendors (Fischer Scientific, Eshipglobal, Praxair, Texas Disposal Systems, Time Warner, Xerox, Fed Ex, AT&T, Utilities, Copiers, Cell phones, Texas Folk & Asian Festivals, etc.) Pauline Phillips Disbursements and Travel Specialist I 4843 I- M, VT5 approval, UTHSC Due to/Due From, High Volume Vendors (Lopez Printing, Monarch Trophy, Nike, Lone Star, Invintogen, and Integrated DNA) Patty McCrea Disbursements and Travel Specialist I 4833 DTS mail, N. High Volume Vendors, (Dell, Hi-Ed/Campus Technologies, Nolan’s) Wanda Burns Disbursements and Travel Specialist I 4839 B and S, High Volume Vendors (Grainger, Alpha Bldg, Siemens, Sigma Aldrich, Simplex Grinnell and Star Shuttle), OFPC Invoices, Property Lease Contact Information Employee Name Title Ext. # Disbursement Vendor Responsibilities Sue Davidson Disbursements and Travel Specialist I 4214 O - R, T & V, High Volume Vendors (Charles Rivers, Office Depot, and VWR) Cathy Smith Disbursements and Travel Specialist I 4477 D - H, High Volume Vendors (Apple, Today’s Office, and CDW Governmental, Data Projections, 360 Integrated and Horizons Telephone Systems) Robyn Rigney Disbursements and Travel Specialist I 4213 Disbursements front desk duties, VP2 Creation, Mail for Travel, Travel disencumbrances (VE3) Vacant Contact DTS for Assistance Disbursements and Travel Specialist I 4213 A, C, U, W – Z, High Volume Vendors, ((Cato Electric, Heaven Sent, 2 Fat Guys and Clear Channel) Critical Disbursements and Travel Services Deadlines July 20 All June-July expenses, includes VP2, VP5, travel card payments, student travel due August 10 PBO – last date to create. August 13 Departments must submit ALL vouchers, manual or electronic, for any expenses incurred thru August 8th to the DTS office by 5:00PM. August 17 PBO – last day for departments to final approve. August 20 Departments must submit ALL vouchers, manual or electronic, for any expenses incurred thru August 17th to the DTS office by 5:00PM. August 24 Departments must submit ALL vouchers, manual or electronic, for any expenses incurred from August 18th to August 23rd to the DTS office by noon. August 29 ALL electronic vouchers without proper documentation will be returned to the departments unprocessed. These vouchers will have to be resubmitted with proper documentation AFTER Sept 1. The same doc ID number can be used, however; the creator will have to change the year in DEFINE to FY12/13. August 29 All remaining FY11/12 voucher amounts $1,000 or less will be charged to FY12/13. August 29 FY11/12 IDT vouchers must be sent to DTS by 5:00PM to in included in August 2012 Statement of Accounts. Year-End DTS Functions Travel encumbrances are disencumbered 08/30/12. Per the travel advance guidelines (Travel Advances, FMOG Section 9) all outstanding travel advances must be settled within 30 days. If your travel occurs in August, the travel advance must be settled and be in DTS office by August 27th. New year helpful travel tips: − Change year to 12/13 when processing electronic RTA (VE5) in new fiscal year. − When travel crosses fiscal years create electronic RTA in new fiscal year. − Example: Travel begins August 29 thru September 3, create RTA in FY 12/13. Procard/Travel Card Administration Office (PTCA) PTCA handles: – Procurement Card (Procard) and Corporate Liability Individual Billed Accounts (CLIBA Travel cards) – Application Processing – Cardholder Training – Cardholder Maintenance Requests (CMR) • Credit limit increases; Merchant Category Codes (MCC) – Reporting and Compliance – Reconciliations and Collections – Procard Audits – Generate Procard Payments Procard/Travel Card Administration Office (PTCA) Procard Office transitioned from Purchasing to Controller’s Office on January 2, 2012 Procard Program ‒ ‒ ‒ ‒ ‒ Developed FMOG Combined Application and Agreement Updated Transaction Log New Citibank Affidavit of Unauthorized Use Form New Citibank Government Cards Cardholder Dispute Form Card Maintenance Request Form (CMR) ‒ Used to make changes to existing CLIBA card, TAC card and/or Procurement card PTCA Contact Information Employee Name Title Ext. # PTCA Responsibilities Lisa Bixenman Credit Card Program Manager 7993 Credit Card program administration, Cardholder training, reconciliations, reporting compliance and cardholder maintenance Anne Jackson Procard Specialist 4059 Application processing, Procard training, procard audits Email: procard.travelcard@utsa.edu Fax: 210-458-4849 Website: http://utsa.edu/financialaffairs/ptca/ Critical Pro-Card Voucher Deadlines for Citibank August 6 VP7 voucher creation date for July 4th – August 3rd purchases. August 10 Recommended: Last day to charge using Pro-Card for FY11/12. August 15 Departmental approval due by 5:00pm for July 4th – August 3rd VP7’s. August 17 After 12:30pm – VP7 vouchers creation date for August 4th thru August 15th transactions. August 28 Departmental approval due by 5:00pm for August 4th – August 15th VP7’s. This will be the final approval for charges to go against the FY11/12 year. September 5 VP7 voucher creation date for August 16th – September 3rd purchases will be charged to the FY12/13 year. September 20 Departmental approval due by 5:00pm for August 16th – September 3rd VP7’s Year-End PTCA Functions CLIBA – All outstanding balances on the travel cards must be paid in full by August 20th. Pro-Card (VP7) – Outstanding balances must be approved by the deadlines listed on the year-end calendar. Never use the Procard or CLIBA card to complete personal purchases, even if the cardholder plans to reimburse UTSA. Stipend Process Reminders Monthly Stipend Approval Cycle ‒ Approval originates with the department ‒ Approval of stipends each month during the designated approval period ensures timely payments to students. ‒ Accounts used to pay stipends should always have sufficient funds ‒ Effective September 1st, stipend payments not approved within monthly stipend cycle will have to wait until the next stipend cycle Stipend Process Reminders What happens when departments do not approve stipends timely or have insufficient funds to pay? ‒ Delays transmission to bank for student direct deposit payments, resulting in delays for all stipend payments ‒ Creates financial burden for students as payments are not received when expected ‒ A department will submit a request that student be paid outside the automated stipend process, which results in: ‒ Manual creation and approval of a VP2 to pay students ‒ Delays student payments; as vouchers must now be processed manually ‒ Results in overpayments to students during the fiscal year, since the manually created vouchers are not considered within the automated stipend process Stipend Process Reminders Accounts with insufficient funds, results in the automated voucher to reject ‒ DTS must then contact department to transfer funds to account ‒ Transfers to cover stipend payments are not always immediately processed or approved ‒ Bank direct deposit file is delayed until transfers are completed General Information To expedite voucher processing: Attach supporting documentation − Original invoices − Original receipts Ensure Business Expense Form is complete as it relates to Entertainment and Hospitality Operational Guide (FMOG Section 7) − Proper signatures (certification) − Completed and approved within 90 days of date expense occurred − Type of event and relevance of business or purpose − Type of funding used − Date and location of event − Total number of participants − Name and business relationship (or job title) of each participant up to 10 − Include all vendors associated with event General Information To expedite voucher processing (cont’d): Verify the accuracy of information: − Remittance address − EID − Direct deposit information Review critical deadlines for voucher process. For information on specific invoices, please email Disbursements.travel@utsa.edu or contact the appropriate staff member responsible for the vendor alphabet. General Information To expedite voucher processing (cont’d): Use direct deposit when possible for staff, faculty and vendors. −Eliminates checks being lost, misplaced or remitted to State as unclaimed property −Saves University money −Saves time it takes to pick-up and deposit to checking account Must update direct deposit information in DEFINE and Payroll separately to expedite payment. Direct Deposit Form Run Encumbrance Report ‒ Check encumbrance balances and notify DTS for release ‒ Instructions for downloading Encumbrance Report found on the Disbursements and Travel Services website BREAK PURCHASING & DISTRIBUTION SERVICES Purchasing and Distribution Services Contact Information Main line: 458-4060 Fax line: 458-4061 E-mail: purchasing@utsa.edu Website: Purchasing and Distribution Services Purchasing & Distribution Services IMPORTANT YEAR-END DATES May 18 First Day PB4 request can be create using FY12-13 Funds July 13 Last Day PB4 requests Over $25,000 can be submitted to Purchasing using FY11-12 Funds August 3 Last Day PB4 requests can be created using FY11-12 Funds August 10 Last Day PB4 requests Less than $25,000 can be submitted to Purchasing using FY11-12 Funds August 10 Last Day PB0 requests can be created using FY11-12 Funds August 10 ProCard- Recommended last day to purchase utilizing current fiscal year funds pending financial institution's posting dates August 17 Last Day PB0 can be final approved by department using FY11-12 Funds August 30 First Day PB0 requests can be created using FY12-13 Funds Purchasing & Distribution Services Plan Ahead: Between August 10th and August 30th, departments will NOT have the ability to create Purchase Orders using current year funds (FY11-12). If your department plans to make large procurements using current fiscal year money, start planning today. Start reviewing your past procurements to identify multi-year contracts: Note: Purchase requests received after the deadlines stated above will be processed as a FY12-13 purchase. Purchasing & Distribution Services Helpful Contacts If goods or services are to delivered directly to your department, contact Central Receiving to initiate a PD1 to ensure the vendor is paid. Email: crw@utsa.edu Contact your departmental buyer if you have any questions. You can find the department/buyer assignment on the UTSA Purchasing Website: www.utsa.edu/purchasing If you have an agreement that needs to be reviewed, contact the Business Contracts Office, ext. 4975 Purchasing & Distribution Services Buyers are assigned to specific departments. Please coordinate your purchasing activities with your appropriate assigned buyer. Employee Name Title Ext. # Paul Duke Buyer III 4064 Julie Gohlke Buyer II 5076 Amanda Alvarado Buyer II 4598 Patty Burrier Buyer II 4062 Rose Smith Buyer I 5077 Yvette Medina E-Procurement Specialist 4974 Lane Brinson Asst. Director Purchasing 4066 PAYROLL MANAGEMENT SERVICES Contact Information Main line: Fax line: E-mail: 458-4280 458-4236 payroll@utsa.edu Website: Payroll Management Services Contact Information Name Title Ext. # Javier Martinez Director Temporarily assigned to PeopleSoft Implementation Team Payroll Operations Christine Bodily Payroll Supervisor 4283 Elizabeth Ortiz Payroll Specialist II 6221 Lisa Bartee Payroll Accountant 4283 Lori Contreras Payroll Specialist I 4280 Payroll Benefits Patty Titus Sr. Payroll Accountant 4281 Rosa Casas Payroll Accountant 4713 Critical Payroll Deadlines August 3 Retroactive Funding Assignments modification to Human Resources (Sept - July) August 3 Retroactive Hourly Salary Transfers to Payroll Office August 21 Assignments for September 1st Payday to Human Resources August 29 Assignments for September 6th Payday to Human Resources – Last payday of fiscal year September 4 Voucher Cutoff for September 6th Payday Only one (1) day for voucher approvals Deadline Questions? General Information Payroll website: http://www.utsa.edu/payroll/ − Payroll deadlines − Regulation and law changes Timely process of pay vouchers (OV1, OV5, paper vouchers) − Meet deadlines − Be aware of approver’s absence HRMS DEFINE Roll – Over August 19th & 22nd General Information Sign-up for online Earnings Statements – UTDirect − Secure − Print as needed − Prevent loss of confidential data and identity theft General Questions? Over Payment Warning What is a Default account? A monthly employee assignment is allowed in the HRMS system regardless of funding availability. 16 Default accounts were established in November 2009 to cover employee assignments to accounts with insufficient funding. – – Allows timely payment and allocation of fringe benefits for monthly salaried employees. Monitored by Default Account Owners and Budget. Default accounts should be used as a last resort option at payroll processing time. – Departments are required to clear entries reported in default accounts in a timely manner. Default Account Owners Vice Presidents have the fiduciary responsibility to assure sufficient annual budget to fund all salary costs. Divisional Financial Officers are responsible for review and reconciliation of default accounts on a regular basis and to ensure modify documents are timely processed using appropriate funding sources. Year End Deadline for Clearing Default Account Encumbrances Encumbrance balances in Default Accounts must be funded prior to payroll processing. Default account balances MUST be ZERO by July 31st 2012 and remain zero for the remainder of FY 2012. Budget Office provides oversight working closely with Divisional Financial Officers and Default Account Owners on a monthly basis. For more information, refer to FMOG Section 10: Budget Approvals for Assignments – HRMS Default Account Maintenance HUMAN RESOURCES 2012-2013 Reassignments All assignments without an end date in HRMS will automatically rollover to the new fiscal year. ‒ Any employee’s assignment not continuing into the next fiscal year, needs to be terminated in HRMS. Any assignments with an end date in HRMS of 8/31/2012 will automatically expire on 8/31/2012. ‒ ‒ Any employee expected to continue working into the next fiscal year, needs to be reassigned in HRMS. Reassignments must be completed otherwise the employee will not get paid after 8/31/2012. 2012-2013 Reassignments VERY IMPORTANT: ALL RETURNING BENEFITS ELIGIBLE EMPLOYEES must have their FY 2012 reassignment FINAL APPROVED by 5:00 PM on 8/31/2012. ‒ Please do not create the assignment on 8/31/2012 and expect it to be approved by 5:00. You must give time for the document to route. If assignment is not final approved by 5:00 pm on 8/31/2012, their benefits may terminate. Current benefits eligible employees with an assignment end date of 8/31/2012. ‒ Open-ended assignments will automatically rollover and won’t impact benefits. 2012-2013 Reassignments Students must be reassigned for the fall semester. ‒ Cannot extend summer assignment to the fall. ‒ Enrollment must be verified prior to assigning. ‒ This is done at the department level – Not HR. ‒ Cannot exceed 19 or 20 hours (depending on title), while enrolled in classes. ‒ All student assignments, with the exception of GRA’s, GA’s and TA’s, can be assigned for the fall & spring. GRA, GA, TA Assignments GRA & GA assignments have to be FYA’d to the Graduate School at “TA/GRA APP” ‒ TA assignments will automatically route to the Graduate School. Must be reassigned for the fall semester. Cannot exceed 20 hours while enrolled in classes. GRA’s, GA’s and TA’s have to be assigned within semester dates ‒ ‒ ‒ Fall – September 1 to January 15 Spring – January 16 to May 31 Summer – June 1 to August 31 GRA, GA, TA Assignments Assignment end date must be the last day of classes to avoid becoming benefits eligible. ‒ ‒ For example: 9/1/2012 to 12/15/2012 Cannot be reassigned until the start of the next semester Cannot break an assignment for a few days to solely deny benefits. Effective 9/1/2011: Benefits eligible students will have to pay 50% of medical cost ‒ Departments CANNOT force an employee to waive benefits Enrollment Requirements Title Fall/Spring Summer Graduate Research Assistant (GRA) 6 hours 3 hours Graduate Assistant (GA) 6 hours 3 hours Student Assistant (work-study) 6 hours See Financial Aid Teaching Assistant (TA) 6 hours 3 hours Undergraduate Research Assistant (URA) 9 hours 6 hours Checking Document Routing and Status Concurrent Assignments The department needs to check if the employee has a concurrent assignment before routing a new assignment. If concurrent assignment is being ended or the hours are being modified by the other department, the remarks/notes need to be indicated as such. If there aren’t any notes indicating the concurrent assignment will be ending, or the hours are being modified, the document will be returned if the employee is over the hour limit. How to Check Concurrent Assignments Pooled Assignment Non- Pooled Assignment Work-Study Assignments Work-Study Assignments INCORRECT CORRECT Termination Reasons “End Assignment” is only used for pre-determined end dates. Reason is no longer “End Assignment” if employee leaves before original assignment end date. Termination Termination Payroll Vouchers are ONLY paid out on semimonthly payroll dates. For tenure & tenure-track faculty, benefits will expire on termination date regardless of quadruple deductions or salary spread. A non-tenure track (NTT) faculty has an end date in HRMS of 8/31/2012, however shows 5/31/2012 in DEFINE. ‒ Therefore, end date needs to be modified in HRMS if leaving prior to 8/31/2012 HRMS Online Tools Self-service tool for HRMS HRMS screenshots Accessible via HR Website ‒ Login using computer sign-on HR Important Dates August 3: Retroactive funding changes to HR. August 14: Assignments due to HR for 8/22 Semi-monthly payday August 20: FY 12-13 assignments can be routed forward. August 21: Assignments due to HR for 9/1 Monthly payday August 19: Automated rollover in HRMS August 29: Assignments due to HR for 9/6 Semi-monthly payday **last payday for FY 10-11** HRMS Hands-On Workshop Wednesday, August 8 ‒ ‒ 8:00-10:00 10:00-12:00 Bring actual HRMS documents you’re currently having trouble with to class. Sit down with an HR Representative one-on-one. Sign up on our HR Website. Contact Information Name Title Ext. # Bruce Tingle Associate Director Employment/Comp 4651 HRMS Henry Barrera HR Specialist II 7563 Kristin Howell HR Technician II 4648 Lucinda Crane HR Technician I (part-time) 4410 Compensation Catina Rover HR Specialist II 4259 Jenny Jung Compensation Analyst I 4254 Contact Information Name Title Ext. # Employment Paperwork Sandra Hernandez HR Specialist II 4257 STARS Ron Fosmire HR Advisor 4256 Diane Mazuca HR Specialist II 4304 Day ONE Samantha Hernandez HR Specialist II 8007 Jennifer Evetts HR Specialist I 7962 Hattie Arnold HR Specialist I 6618 Contact Information Name Title Ext. # Benefits Georgina AnguianoElliott Benefits Manager 4253 Fran Thibodeaux HR Specialist II Alpha A-G 4652 Jaime Lopez HR Specialist II Alpha H-O 6710 Mary Lou Aguilar HR Specialist II Alpha P-Z 4258 Thank you We would like to thank everyone for attending and assisting us in having a successful year-end close. 7/11/12