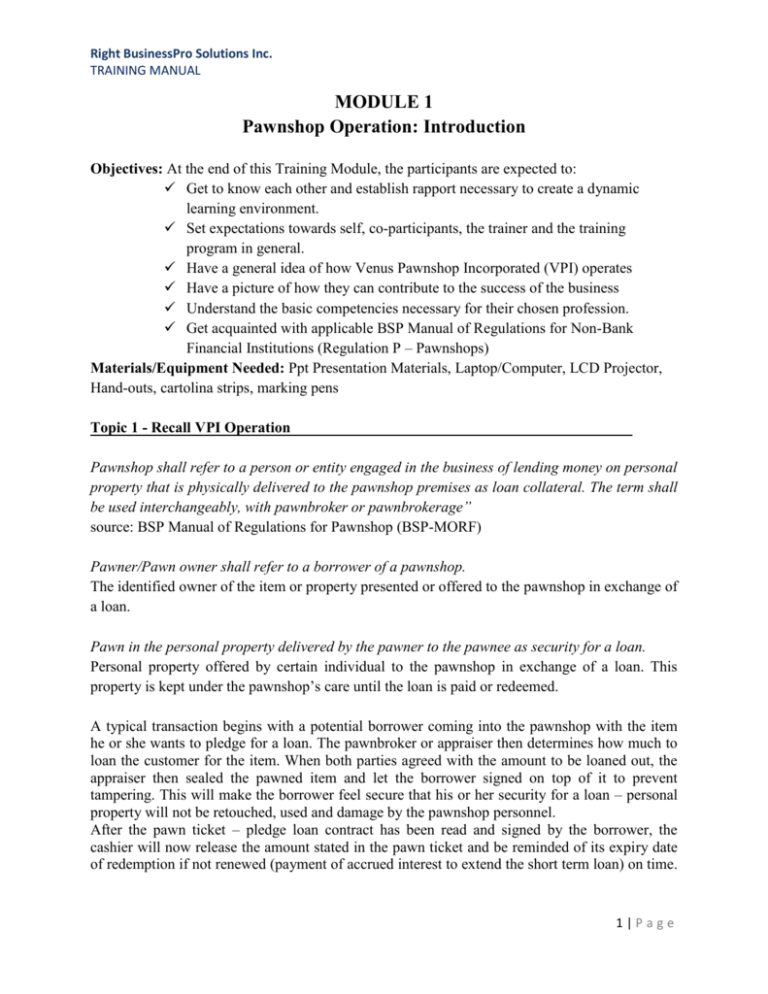

rbsi-tm-revised-030515-2

advertisement