FACS GR8 SLO - Transition to Common Core

advertisement

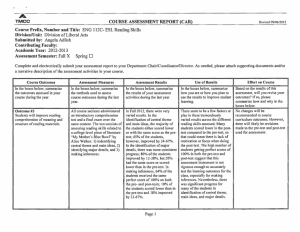

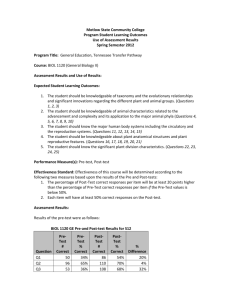

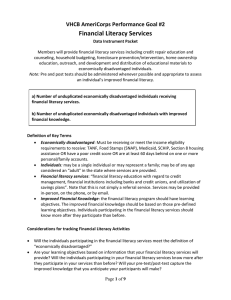

4-15-13 Name of Teacher: School: HCPSS Student Learning Objective 8th Grade – Family and Consumer Sciences Component Student Learning Objective (SLO) Description 100% of the students will demonstrate growth toward mastery in applying financial literacy vocabulary in order to make informed, financially responsible decisions. Population All students enrolled in 8th grade Family and Consumer Science Learning Content Maryland State Curriculum for Personal Financial Literacy: standards, indicators and objectives for grades 6-8. Instructional Interval The financial literacy unit is part of the quarter-long Family and Consumer Sciences course. Evidence of Growth All students complete a pre-test before instruction begins. The curriculum culminates with a four-day computer simulation after which students complete a post-test. The pre-test results will be used to guide instruction with the goal to increase student financial knowledge and skills as measured by the post- test. Baseline The pre-test average was %. System-wide data shows students had more difficulty choosing the correct response to pre-test questions that required knowledge and application of vocabulary specific to financial literacy (e.g., gross, net, fixed and variable). Based on a class size of students, the following are results from the pre-test: students scored 0-20% students scored 21-41% students scored 42-48% students scored > 48% (Attach class roster to share students’ scores on Beginning-of-theYear Assignment/Performance Task/Assessment.) Rationale for Student Learning Objective Productive knowledge of content specific vocabulary is the foundation of conceptual learning. Students must master the use of financial literacy terms in order to analyze choices and make informed decisions. This SLO is a sample. Targets need to be adjusted based on your students’ data. Student growth should be achieved for all students. 4-15-13 Target Based on a class size of students, the following are targets for the post-test: Students scoring from 0-20% on the pre-test will score at or above 65% on the post-test Students scoring from 21-41% on the pre-test will score at or above 75% on the post-test Students scoring from 42-48% on the pre-test will score at or above 85% on the post-test Students scoring >48% on the pre-test will score at or above 95% on the post-test *Please note: Students identified by IEP teams as having significant cognitive disabilities will have individual targets. Criteria for Effectiveness Strategies Full Attainment of Target Partial Attainment of Target More than 90% of students meet agreed upon learning targets. 75-90% of students meet agreed upon learning targets. Insufficient Attainment of Target Less than 75% of students meet agreed upon learning targets. Provide explicit vocabulary instruction including paraphrasing and creating mnemonics. Provide activities linking financial literacy terms to students’ experiences and prior knowledge. Reinforce knowledge of financial literacy terms through multiple exposures to vocabulary in varied settings and circumstances. This SLO is a sample. Targets need to be adjusted based on your students’ data. Student growth should be achieved for all students.