Commercial Law - Professor Beyer

advertisement

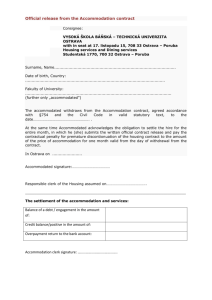

No, not him! Instead, you want to borrow money or obtain goods/ services on credit, i.e., you need to become a debtor. 1. Refuse to grant credit 2. Be happy with promise to pay ▪ Promissory note ▪ Open account (account receivable) 3. Obtain collateral ▪ Real property = mortgage (foreclosure) ▪ Personal property = security interest (Article 9) (repossession) 4. Require surety ▪ Promises to pay or perform if debtor doesn’t Love and affection. Friendship. Compensation. Stupidity (not understanding consequences of what doing) Principal Debtor Creditor 1. underlying contract 3. Reimbursement 2. Surety Contract Surety Problem 131, p. 426 1. Reimbursement If surety pays, surety obtains reimbursement from principal. 2. Exoneration Surety’s ability to compel principal to perform at maturity. 3. Subrogation If surety pays creditor, surety obtains whatever rights creditor had (e.g., a security interest in collateral or priority claim in bankruptcy). 4. Contribution Sub-sureties – presumption – recover all from prior surety (for UCC purposes, presumed if in chain of title) Co-sureties – need express agreement – recover only proportional or agreed share (for UCC purposes, presumed if not in chain of title) 5. Strictissimi Juris Change to underlying agreement discharges surety. If creditor releases principal or gives binding extension of time, the surety is discharged unless: surety consents, or creditor “reserves rights” against surety. Liable in capacity in which accommodation party signs, such as: 1. Maker 2. Indorser (name outside chain of title) Statute of Frauds irrelevant State law requirements for other surety contracts do not apply. Consideration not needed. The accommodated party need not receive consideration. It is sufficient that the contract goes through. Entitled to reimbursement from accommodated party. No liability to accommodated party. 1. Anomalous indorsement An indorsement by a non-holder (i.e., a person outside the chain of title) is notice of accommodation. 2. Express language 1. Presumed to be a guaranty of payment. Accommodation party required to pay; no requirement holder first try to recover from accommodated party. 2. Express limitation to collection only. Can include express “guaranty of collection only” language so accommodation party liable only if: ▪ ▪ ▪ ▪ Execution against accommodated returned unsatisfied Accommodated party insolvent (bankrupt) Accommodated party cannot be served with process Apparent that accommodated party cannot pay Problem 132, p. 429 Problem 133, p. 430 “guarantee [payee] against loss by reason of nonpayment of this note” Is this payment or collection guaranty? Margaret Maker Accommodation Party ONB Payee Holder Portia Indorser (anomalous – not in chain of title) Accommodated Party Why would a holder refuse a tender of payment? 1. Effect on person making tender On principal = none On future interest = discharged 1. Effect on person with right of recourse against person making tender Discharged for amount of tender Saul Maker Accommodated Party Cather Accommodation Maker tender (b) tender (a), (c) Stout Payee Indorser Goodwin Holder Basic Idea – Certain changes to the contract between accommodated party and holder may discharge the accommodation party. 1. Impairment of Collateral -- § 3-605(d) Impairment discharges accommodation party to extent of impairment. ▪ ▪ ▪ ▪ Not perfect interest in collateral If in possession of collateral, not preserve its value Not follow rules regarding repossession and resale Release collateral without getting substitute collateral Problem 136, p. 435 1. Impairment of Collateral -- § 3-605(d) Chemical Bank v. Pic Motors Pic Bank Borrower Lender Siegel Guarantor • Not UCC case has guaranty not on note. • Lender not keep watchful eye on collateral. • Guarantor had consented so too bad collateral impaired. 2. Modifications not covered by special rules -- § 3-605(c) Accommodation party discharged only if modification causes loss (e.g., any increased liability caused by the modification). 3. Extension of time to pay -- § 3-605(b) Accommodation party discharged only if extension causes loss (e.g., increased liability). Accommodation party’s obligation also extended, unless Party granting extension retained right to enforce against accommodation party under original time frame. 1. Reimbursement from accommodated party. 2. Discharge if had right of reimbursement against person whose tender of payment refused. 3. Collateral impaired. 4. General modification caused loss. 5. Extension of time to pay caused loss. 4. Release -- § 3-605(a) If release does not preserve rights against accommodation party, accommodation party discharged. Accommodation party discharged if loss. If check indorser is the accommodation party, accommodation party discharged. If obligor gave consideration for the release (e.g., partial payment), the accommodation party is discharged to that extent. 4. Situations where no discharge -- § 3605(f) Accommodation party consents. Accommodation party has waived right to use suretyship defenses. Note: Parties often include waivers in original instrument and get consent to keep accommodation party liable. Problem 138 – p. 441 Point Maker Accommodated Party Shadbolt Accommodation Maker [skim only, but note subquestion (d)] Yeoman National Bank Fact Pattern Note One becomes due and the maker who is unable to pay gives the holder Note Two payable at a later date. Holder retains Note One as security. This is considered an extension of time to pay. What is impact on liability of indorsers and accommodation parties? Problem 139 – p. 445 Note #1 ▪ ▪ ▪ ▪ Maker = Rex Lear Accommodation Maker = Cordelia Payee = Kent Due 6/8 Note #2 ▪ Maker = Rex Lear (with more collateral) ▪ Payee = Kent (keeping Note #1 as security) ▪ Due 9/25 Problem 140 – p. 445 Marty Maker Payee Dogfish Sam Surety Hammerhead HDC