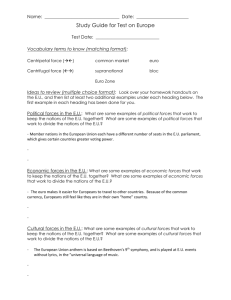

EMEA S&O Market Network Event 26/27th April 2010

advertisement

Understanding an uncertain future… Megatrends that will shape the world economy & trade over the next decades May 3rd, 2012 Theodore Papakonstantinou Manager Deloitte Business Solutions S.A. Key Objectives To discuss 5 megatrends + 1 key risk that are expected to shape the future of the world economy and trade To briefly touch upon strategic principles that can help companies respond to the challenges that lay ahead 1. The world population is growing, ageing and moving to the cities 2. East (…and South) as the New West 3. We are running out of fuel… and water… and food… and habitat… Agenda 4. Diffusion of technology and innovation will shape the future 5. Towards a more complex and interconnected world 6. Can you imagine the world after the Euro? 7. What next? Strategic principles for companies who want to exist (and thrive in global markets) in 2030 1 2 3 As of March 2012, the world population is estimated to have exceeded 7 billion. Growth will most likely continue, at a lower pace, driven mainly by Asia and Africa. By 2030… The world population is expected to substantially exceed 8 billion The population of developing countries will grow from around 5.6 billion to more than 7.0 billion The population of developed countries will modestly grow from 1.2 billion to approx. 1.3 billion Negative population growth already experienced in some countries (especially in CEE) is quite soon expected also for Japan and certain countries in Western Europe. Source: United Nations Department of Economic and Social Affairs 4 The world population is ageing fast due to a declining birth rate and longer life expectancy. Global fertility rate (children / women) 5.0 Global demographic development 4.9 16% Global population > 65 years Global population < 5 years 4.5 14% 4.0 12% 3.5 10% 3.0 8% 2.6 Projection 2.5 2.0 2.0 1950 1960 1970 1980 1990 2000 2010 2020 2030 2040 6% 4% 1980 1990 2000 2010 2020 2030 2040 2050 Projection Source: United Nations World Population Projections 5 Ageing has dramatic dimensions and it affects industrialized nations and many emerging economies alike. The old-age dependency ratio of Greece was around 30 in 2010 and is expected to exceed 50 in 2040. Source: United Nations World Population Prospects 2010, Eurostat 6 On the other hand, Africa and Middle East are currently experiencing a prominent youth bulge which means that they are in good position to harness this human capital and achieve economic growth in decades to come. Males Females millions Source: United Nations Department of Economic and Social Affairs 7 Urbanization will keep rising at a faster rate (8.5%), compared to the last 20 years (7.8%). By 2030, 60% (~4.8 billion) and by 2050, 70% of the world's population will be urban, up from around 50% today. Percentage of urban population and agglomerations by size class (1960 – 2025) 1980 2011 2025 1960 Source: United Nations Department of Economic and Social Affairs 8 Changing demographics have various economic implications worth taking into consideration by global companies. Implications for developed countries… Pressure on government budgets & debt due to pension and health care costs Pressure on GDP growth due to less employees Population Growth Population Ageing Population Urbanization New attractive markets (e.g. countries with growing population and growing income per capita such as India, China, Nigeria, Indonesia, Brazil, Philippines, Turkey, Egypt and Mexico) New attractive market segments (e.g. “silver” segment) New sources of cheap labour (e.g. Africa) Changing demand patterns due to urbanization (e.g. more convenience, greater choices, faster and greener solutions, more services, smart products using limited space) 9 10 Globalization is likely to continue as exports and FDI will continue to grow faster than GDP. After twenty years, exports will account for 33% of GDP, compared to 26% today and 17% in 1990. Real exports of developing countries will rise nearly twice as fast as those of developed countries The integration of developing countries’ national economies into the international economy will accelerate Developing countries will claim a rising share of received FDI inflow Source: WTO, IMF; Goldman Sachs; Standard Chartered Bank; EIU; World Bank; Roland Berger 11 A shift from West to East in global trade is evident… World merchandise export shares by selected economy (1963 - 1993 - 2010) 1963 25,5% USA 14,9% Germany France Italy UK 3,5% 1,3% 5,7% 2,5% China Japan Africa 6,4% Six Asian Traders* South & Central America *Six East Asian Traders: Hong Kong; Malaysia; South Korea; Singapore; Taiwan and Thailand. Source: WTO 12 A shift from West to East in global trade is evident… World merchandise export shares by selected economy (1963 - 1993 - 2010) 1993 25,8% USA Germany France Italy UK 11,2% 1,2% 4,5% 5,8% 8,0% China Japan Africa 4,4% Six Asian Traders* South & Central America *Six East Asian Traders: Hong Kong; Malaysia; South Korea; Singapore; Taiwan and Thailand. Source: WTO 13 A shift from West to East in global trade is evident… World merchandise export shares by selected economy (1963 - 1993 - 2010) 2010 17,7% USA Germany France Italy UK 8,6% 10,6% 3,4% 5,2% China Japan 10,1% Africa 3,9% Six Asian Traders* South & Central America *Six East Asian Traders: Hong Kong; Malaysia; South Korea; Singapore; Taiwan and Thailand. Source: WTO 14 The global economic imbalance grew substantially during the first decade of the millennium. Nevertheless, after the global economic crisis of 2008-09, there are signs of a global rebalancing. 15 BRIC countries are expected to assume leading role in the world economy and Next 11 to become the most rapidly developing countries with the greatest economic potential. Russia Turkey India Mexico Brazil Vietnam Philippines Pakistan Nigeria South Korea China Iran Bangladesh Egypt Indonesia BRIC Next 11 16 BRIC and Next 11 countries are expected to account for nearly 50% of global GDP and 35% of global exports by 2030, shifting the world economy’s centre of gravity more to the East and South. BRIC 36% of global GDP in 2030, compared to 18% today 23% of global exports in 2030 (same as Europe), compared to 14% today China to overtake USA as the world's largest economy as early as 2016 and probably no later than 2026 Dominant global suppliers… o China & India: manufactured goods and services o Brazil & Russia: raw materials Middle class will grow 150%, from 0.8 billion today to 2.0 billion in 2030 200 million more people with annual income over USD 15,000 into the world's economy by 2025 All of them could already be members of G8 (only Russia is) Source: Goldman Sachs; IMF; EIU; World Bank; Roland Berger Next 11 Large and growing populations, combined with significant industrial capacity or potential 11% of global GDP in 2030 with average annual growth rate of 6% 12% of global exports in 2030, compared to 9% today Mexico, South Korea, Indonesia and Turkey larger economies and exporters Middle class will grow 120%, to around 720 million in 2030 Next 11 countries can be categorized as: o Developing: Bangladesh, Iran, Nigeria, Pakistan and Vietnam o Newly Industrialized: Egypt, Indonesia, Mexico, the Philippines, and Turkey o Developed: South Korea 17 While the BRIC and Next 11 countries have significant growth potential, certain factors could hinder them from following their forecasted growth path and could alter the envisaged global landscape. Political events may restrict growth prospects whereas unforeseen events, such as natural disasters, can result in severe supply chain disruptions that adversely affect the growth prospects of a country. The factors and advantages that propel high growth in developing countries - low-cost labor and easy technology adoption - disappear when they reach middle- and uppermiddle-income levels. The USA and other debtor countries like the United Kingdom must save more, import less and export more. On the other hand, China will have to stimulate consumer spending. Commodity price volatility and sharply rising transportation costs together with currency, political, and weather related risks may force firms to move from a hub-and-spoke model to a more localized production model. 18 19 Within a few decades, energy, water, food and other commodities such as some metals and minerals will become scarce. Moreover, more stress will be put on the ecosystem and its biodiversity. Water consumption will rise, mainly in agriculture and industry Estimated time since depletion of energy sources: Oil: <50 years Natural Gas: <70 years Coal: <120 years Water scarcity will lead to higher prices and need for efficiencies Energy Very high demand for raw materials by developing countries Prices will skyrocket, especially in rare metals and minerals (e.g. indium) Other Commodities Global temperature to rise 0.5 – 1.5 oC in 20 years Rising sea levels, desertification and more extreme weather are to be expected Global Warming Water Food Food prices will rise as demand will grow faster than production (which is threatened to even decrease) Ecosystem Stress Conversion and destruction of land and loss of biodiversity will continue due to agriculture, infrastructure, climate change and forestry 20 21 Technology diffusion, faster technology adoption and innovations with shorter cycles are expected to change our lives in the decades to come. Faster Technology Adoption & Shorter Innovation Cycles Technology Diffusion Major Innovation Areas ICT & the Postdigital Enterprise Robotics Life sciences (pharmaceuticals , medical devices & biotechnology) Nanotechnology Energy & environment 22 23 The changing global economic order, greater global complexity, technological advancement, risk of political and environmental crises and shifting social phenomena shape a more complex and interconnected world. Global & Enterprise Knowledge & Social Networks Global Accountability, Cooperation & Coordination War for Talent Multipolar Global Governance Issue Focused Global Networks & NGOs Narrower Gender Gap Regulation 24 25 The risk of a Eurozone break-up is one of the greatest concerns for business people worldwide… Source: Deloitte CFO Survey 2012 26 …whereas public opinion in many European countries is neither very supportive nor confident about the future of the Euro. Grey bars represent respondents who answered “Yes” to the question, “Do you think the euro will remain your nation’s currency in 10 years?” Red bars represent respondents who answered “Yes” to the question, “Do you prefer the euro to your past national currency?” Source: Nomura FX Strategists, Wall Street Journal 27 Different scenarios have been considered by the markets but the outcome remains unknown. The Future of the Euro? Fiscal compact agreed and targets met ECB & EFSF/ESM provide required financing Sovereign debt restructured in weaker countries Euro strengthens on positive market reaction Euro survives but economies still in recession Stronger countries move to fiscal compact and one or more weaker countries leave the Euro Euro rises as Eurozone consists of stronger economies Euro survives but possibly with fewer countries Stronger countries abandon Euro and form new currencies which appreciate strongly Other countries continue to use the Euro All other countries revert to domestic currencies which depreciate Euro falls sharply as Eurozone consists of weaker economies Eurozone collapses and Euro ceases to exist Euro disappears or weakens significantly 28 A break-up of Eurozone is expected to cause value erosion to almost all national currencies. 1.6 1,3% 1.4 -6,7% -6,8% 1.2 1,34 -7,1% -9,4% -23,9% -28,6% -27,3% 1.0 -35,5% 0.8 0.6 -47,2% -57,6% 1.25 1.25 1.36 1.25 1.21 1.02 0.96 0.97 0.4 0.86 0.71 0.57 0.2 0.0 Greece Austria Belgium Finland France Germany Ireland Italy Netherlands Portugal Spain The chart above shows the fair value estimate for new national currencies of the 11 original Eurozone members if the Eurozone was to break-up. They represent an initial benchmark for where currencies may trade in a “new equilibrium” following a potentially lengthy and extremely volatile transition period, and thus they have been calculated based on a 5 year horizon following a potential Eurozone breakup. The percentages included in the chart represent the degree of appreciation or depreciation from the EUR/USD value, which stood at roughly 1.34. as of early December 2011. Source: Nomura FX Strategists 29 30 Certain strategic principles can assist companies position themselves in the future global markets. Scenario & Contingency Planning Rethink your business model and global footprint Strive for efficiencies and reduce dependencies Focus on innovation and adapt to the postdigital era Strategic principles for the decades to come Focus on growth regions / markets and segments (e.g. middle income, silver segment) Establish cooperative partnerships and networking Place talent management high on your agenda Focus on sustainability and CSR 31