BMP: Brand Management Process

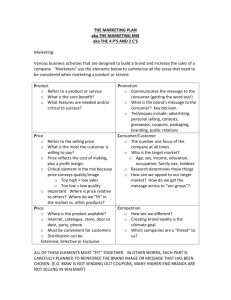

advertisement

BMP: Brand Management Process • Establishing BRAND POSITIONIING • Creating BRAND DESIGN • Measuring BRAND PERFORMANCE • Sustaining BRAND EQUITY Why Measure? • How strong is our brand? • Impact of Marketing Activity • Overall value of the Brand RETURN ON MARKETING INVESTMENT (ROMI) Brand Value Chain Marketing Inputs Consumer Mindset Market Performance Measuring Brand Performance Quantitative Research Quantitative: Tracking Study • • • • Continuous rolling panels Survey Method Pre-Defined Parameters Study the Impact of Marketing Inputs – Level of Impact – Degree of Impact Product-Brand Tracking • Brand Awareness – Recall (TOM/Unaided/Aided) – Recognition • Ad Awareness • Brand Associations – Benefit Associations – Quality Associations – Image Associations • Brand Consideration ATP by Millward Brown • 50 to 100 per week • 10-12 Minute interviews over brand & comp. • Covering awareness, positioning, loyalty, response to communication ATP Sample Data Methodology What? Who? Millward Brown ATP MALES Aged 25- 50 years From SEC A/B Working Full Time Decision maker for financial products in the household FEMALES Aged 25- 50 years From SEC A/B Working Decision maker OR Joint Decision maker for financial products in the household Where? Mumbai, Delhi, Kolkata, Chennai, Bangalore, Hyderabad, Ahmedabad When? October – December, 2004 Top spenders across markets – Press* Oct’04 – Dec’04 In Rs. Lakhs Mumbai Chennai LIC 65 LIC 21 ICICI Prudential 62 HDFC 15 HDFC Standard 48 Max New York 9 Aviva 33 ICICI Prudential 9 SBI Life 24 AMP Sanmar 7 1. ICICI Prudential 235 2. HDFC Standard 178 3. LIC 136 4. SBI Life 101 5. Aviva 86 6. Bajaj Allianz 84 7. AMP Sanmar 48 8. Max New York 53 9. Birla Sun Life 44 10. Tata AIG 29 LIC 50 Tata AIG 1 11. ING Vysya 17 ICICI Prudential 33 SBI Life 4 HDFC Standard 27 Om Kotak 0 12. Om Kotak 15 SBI Life 15 MetLife 2 13. MetLife 8 Aviva 12 Max New York 4 Delhi Bangalore Ahmedabad LIC 64 LIC Total 19 ICICI Prudential 15 HDFC Standard 36 HDFC Standard 15 HDFC Standard 12 Aviva 28 ICICI Prudential 12 LIC 11 Max New York 26 SBI Life 9 SBI Life 8 ICICI Prudential 26 Aviva 8 Aviva 5 Kolkata *Normalized to 100cc Hyderabad Source: Mind Share Snapshot – 7 markets (Mumbai+Delhi+Kolkata+Chennai+Bangalore+Hyderabad+Ahmedabad) I-Pru LIC TATA-AIG Brand Awareness TOM Recall Spontaneous Recall 6 54 87 99 0 28 Ad Awareness Spontaneous Recall 28 60 10 Consideration Top box Top 2 boxes 2 42 86 91 0 10 Image The best company to have a relationship with 26 96 8 Offers the best returns 23 86 6 Comes out with new & innovative products 30 86 8 7222 169 17 245 3313 38 All figures are in % Base - 3654 respondents GRPs Press Spends (Rs. Lakhs) LIC has the highest scores on brand health, imagery and consideration. Communication Awareness COMMUNICATION AWARENESS All markets I-PRU 3654 % 41 LIC 3654 % 53 SBI 3654 % 11 TATA-AIG 3654 % 10 HDFC 3654 % 7 AMP 3654 % 7 29 6 12 1 34 10 23 1 6 2 3 - 7 2 2 - 2 2 2 - 5 1 1 1 Detailed recall (TV) Proven recall (TV medium) Brand generic Execution-specific Saath Phera Wrong recall (brand/product) 1500 % 67 19 12 7 6 4 1948 % 59 7 7 - 388 % 45 27 4 23 378 % 42 16 3 13 243 % 26 1 1 - 260 % 66 27 27 - - - - - - GRPs (TV) Press spends 1032 34 2 19 358 14 473 4 0 25 345 7 Base: All respondents Total Brand communication aware (across media) TV Newspapers Hoardings Radio Base: All claimed TV recallers Overall brand communication awareness is high for LIC followed by I-Pru. Overall, proven recall is low across brands. Execution Recall – ICICI Prudential Execution-recall Base : Proven recallers of I-Pru Har Vaada ad Shown man emptying suitcase of angry wife Voice-over: Saat janmo tak suraksha karoonga Shown old man help wife get into an escalator Shown couple walking around fire Husband applies sindoor on wife’s head Any mention of ICICI Prudential 90 % 9 7 10 74 60 43 Impressions Made you more interested to know about pdts of I-Pru What it said was relevant to me What it said was believable Told me something new Is an enjoyable ad More likely to consider the next time % Agree strongly 20 21 29 29 55 26 Mean score 3.73 3.88 3.95 3.85 4.34 3.69 Weak recall of executional lements; seen more as an enjoyable ad and evokes lower than desired scores on response measures. Profile of proven recallers Base : Proven recallers of I-Pru ad Mumbai Delhi Chennai Bangalore Hyderabad Ahmedabad 90 % 23 10 61 1 1 3 25-35 years 36-50 years 64 36 SEC A1+ SEC A1 SEC B 22 33 44 Recall of I-Pru largely led by Chennai and amongst younger audience. SLOGAN RECALL All figures are in % All Currently Invested Aware Currently Invested Rejecter of L.I Non-Rejecter of L.I Non-Rejecter of L.I ZINDAGI KE SAATH BHI, ZINDAGI KE BAAD BHI Life Insurance Corporation (LIC) 59 40 65 56 ICICI Prudential Life Insurance 11 22 11 8 SBI Life Insurance 1 4 1 0 1580 131 741 708 34 22 38 32 Life Insurance Corporation (LIC) 23 25 27 18 Base: All respondents recalled the slogan____ HAR VAADE MEIN AAPKE SAATH ICICI Prudential Life Insurance Kotak Mahindra 1 - 1 1 SBI Life Insurance 1 3 2 1 Tata AIG Life Insurance 1 1 1 2 1011 72 459 480 Life Insurance Corporation (LIC) 22 29 23 19 ICICI Prudential Life Insurance 10 8 13 6 Tata AIG Life Insurance 6 1 7 5 Base: All respondents recalled the slogan____ JEENE KI AZAADI Kotak Mahindra Base: All respondents recalled the slogan____ 3 3 2 4 964 106 417 441 SLOGAN RECALL All figures are in % All Currently Invested Aware Currently Invested Rejecter of L.I Non-Rejecter of L.I Non-Rejecter of L.I KAL PAR CONTROL Aviva Life insurance 21 4 19 26 ICICI Prudential Life Insurance 10 4 12 8 Life Insurance Corporation (LIC) 9 25 11 5 Kotak Mahindra 3 0 3 5 Tata AIG Life Insurance 3 4 2 3 552 48 242 262 MetLife Insurance 65 44 66 67 Life Insurance Corporation (LIC) 3 6 5 1 ICICI Prudential Life Insurance 1 8 1 0 Max New York Life Insurance 1 3 1 1 Base: All respondents recalled the slogan____ 902 62 427 413 Base: All respondents recalled the slogan____ HAVE YOU MET LIFE TODAY Brand Associations BRAND IMAGE PROFILING IMAGE PROFILES - An Illustration Pvt. Brand PSU Brand 30 40 55 38 55 55 29 27 30 35 45 45 47 52 50 45 50 15 37 30 70 35 4 5 6 Innovative services 50 40 Pvt. Brand PSU Brand This brand is most visible Offers good value to customers Good network of agents 15 Good schemes Open on convenient times 12 -8 Promptness - complaints Modern organisation -2 5 wide range of products Responsive Company personnel Innovative schemes 7 10 7 5 -20 15 22 19 10 15 6 -18 3 2 25 Very trustworthy % Associations 2 Differentiation © BIP – 7 markets (Mumbai+Delhi+Kolkata+Chennai+Bangalore+Hyderabad+Ahmedabad) I-PRU Best Insurance Co. to have a relationship with -1 4 3 Takes care of its customers Offers the best returns -1 4 -1 Different policies for the entire family -3 Ensures safety of my money -3 2 1 1 1 -1 0 1 -2 0 0 1 4 0 2 1 Will settle claims quickly 2 Addresses queries promptly 2 Avg. Asso : -1 2 -4 Agents could be trusted to give correct information -1 Base : 1 1 Easy access for buying a policy /pay premiums Can be trusted to be there ten years from now 1 -6 -1 -5 -3 -1 1 1 0 -1 0 0 0 -1 0 0 -2 1 0 1 0 1 9 -1 1 0 0 0 0 0 0 0 0 0 0 0 0 -3 0 -1 0 -1 1 2 KOTAK -1 0 -1 ING V -2 -1 -1 Delivers what it promises -1 2 -5 T-AIG 1 -2 -3 2 Helps in choosing a policy HDFC 2 -4 Comes out with new & innovative products Makes products for people like me SBI LIC 0 10 -1 0 -1 0 (3452) (3654) (2878) (2867) 25 89 17 11 1 (2614) 8 -1 (1938) (2411) 5 5 Imagery • ICICI Prudential – Differentiates on following attributes • Has different policies for entire family (Ahmedabad) • Comes out with products that are new and innovative (Delhi, Mumbai) • Takes care of its customers through good service (Hyderabad, Mumbai) • Best Insurance company to have a relation with (Hyderabad) • Will settle claims quickly (Hyderabad) • Has knowledgeable agents who help me in choosing a policy (Bangalore, Chennai) • Ensures safety of my money (Chennai) • Will settle claims quickly (Chennai) • Addresses queries promptly (Chennai) • Can be trusted to be there ten years from now (Chennai)` Imagery • LIC – Not differentiated in Chennai & Hyderabad – Differentiates on following attributes • Best Insurance company to have a relation with (Ahmedabad, Bangalore, Delhi, Kolkata, , Mumbai) • Company delivers what it promises (Ahmedabad) • Addresses queries promptly (Bangalore) • SBI Life – Differentiates on following attributes • Takes care of its customers through good service (Chennai, Mumbai) • Ensures safety of my money (Chennai, Hyderabad, Mumbai) • Can be trusted to be there ten years from now (Chennai, Hyderabad, Mumbai) • Best Insurance company to have a relation with (Hyderabad) • Company always delivers what it promises (Mumbai) Brand Consideration BRAND CONSIDERATION Q1’01 % Q2’01 % Q3’01 % 11 16 16 One of 2 or 3 brands I would consider 30 22 32 The only brand I would consider One of several brands 11 8 7 Brand I might consider 7 8 11 Brand I would not consider 41 47 34 © Millward Brown International 2001 JXXXX A2BS00 INTENTION TO PURCHASE All figures are in % All Currently Invested Aware Currently Invested Rejecter of L.I Non-Rejecter of L.I Non-Rejecter of L.I Extremely unlikely to purchase 31 68 17 36 Quite unlikely to purchase 15 10 13 19 Quite likely to purchase 22 14 30 14 Extremely likely to purchase 15 6 21 12 3654 375 1705 1574 Base – All respondents RECOMMENDED LIFE INSURANCE COMPANY Currently Invested Aware Currently Invested Rejecter of L.I Non-Rejecter of L.I Non-Rejecter of L.I Life Insurance Corporation (LIC) 87 84 82 95 ICICI Prudential Life Insurance 3 8 3 2 SBI Life Insurance 1 3 1 0 Kotak Mahindra 0 1 0 0 Tata AIG Life Insurance 0 1 0 0 3654 375 1705 1574 All figures are in % Base – All respondents All Brand Dynamics BRAND DYNAMICS MODEL What is Brand Dynamics? • Brand Dynamics both measures and explains a brand's Consumer Equity or Value. • It bridges the gap between consumer perceptions and sales – By identifying the perceptions & attitudes that will most effectively strengthen the brand – And estimating the impact on sales of changing them Components of Brand Dynamics Consumer Value CONSUMER VALUE is the potential value of each consumer to the brand. Measured through a “consideration” scale which is suitably adjusted for effects such as brand size, consumer typology, brand price etc. Consumer Value correlates very well with value share of the brand. Components of Brand Dynamics Brand Pyramid : the “dynamics” of Consumer Value Helps to explain why the strength of someone’s relationship with a brand might vary based on their brand associations. This is done through the Brand Pyramid framework which draws a hierarchy of consumers for each brand - depending on their relationship with the brand. BRAND PYRAMID BrandDynamics™ PYRAMID The Brand Pyramid is the framework for defining how consumers relate to brands Bonded Advantage Performance Relevance Presence Millward Brown International [c:\andy aequity \afsell3.ppt\23] THE FIVE LAYERS OF THE PYRAMID Presence is the gateway to the market Consumers without presence are of little current value to the brand. PRESENCE THE FIVE LAYERS OF THE PYRAMID The size of the market available to the brand is defined by the relevance of the brand to the consumers needs and pocket. RELEVANCE PRESENCE THE FIVE LAYERS OF THE PYRAMID For a consumer to buy the brand repeatedly, it must deliver acceptable product performance. PERFORMANCE RELEVANCE PRESENCE THE FIVE LAYERS OF THE PYRAMID For consumers to commit more expenditure to the brand, it must have an advantage for them over other brands. ADVANTAGE PERFORMANCE RELEVANCE PRESENCE THE FIVE LAYERS OF THE PYRAMID The more unique the perceived advantage, the greater the chance of consumers becoming bonded to the brand. BONDING ADVANTAGE PERFORMANCE RELEVANCE PRESENCE CALCULATING CONVERSION PROFILES Conversion Pyramid Conversion Profile Expected Conversion Bonding 29% 29/68 = 43% 58% Advantage 68% 68/85 = 80% 69% Performance 85% 85/85 = 100% 95% Relevance 85% 85/85 = 100% 88% Presence 85% 85/100 = 85% 75% -15 11 5 12 10 CASE STUDY -PEPSODENT- BRAND PYRAMIDS - PEPSODENT : DELHI Q3’00 % Q1’01 % 29% Performance 19% 21% 38 25% 69 68% 85% 50% 52% 82% 75% Relevance 85% 82% 76% Presence 85% 83% 81% (650) (650) Base : Q3’01 % 40 Bonding Advantage Q2’01 % (550) 79 67% 99 94 81 84% 85% 86% (650) 100 99 86 DIAGNOSIS OF ADVANTAGE Q2 ’01 % Acceptable Price Q3’01 % 68 57 Appeals More Better Performance 52 49 48 39 65 Different 56 Growing popular 58 71 61 72 High Opinion Most Popular 30 32 Base : 414 549 Consumers at product performance level (or above) © Millward Brown International 2001 JXXXX A2BS00 Measuring Brand Performance Qualitative Research Association Techniques Respond to the presentation of a stimulus with the first thing(s) that comes to mind Word association -- Free word / Successive word Personification [Exercise: Axe/FAL/CP/Surf] Analogies and Metaphors [Cricketer: Enfield] Picture Association Film and Song Titles Completion Techniques Respondents are required to complete an incomplete stimulus Sentence completion Story building Cartoon completion Clues and scenarios Make an advertisement Construction Techniques Require the respondent to produce/construct something Brand Mapping [Cold Drinks] Classification/Grouping [Indian Filmmakers] Family Trees [Toothpaste] Laddering [Sony Plasma] Life Cycle [Detergent] Expressive Techniques Techniques that enable a respondent to better express his perceptions about the brand Role Play [Nike vs. Reebok] Brand Party [Jeans] Autobiography/Matrimonials/Obituary [Red Bull] Political Speech [Lakme] Horoscope [Rooh Afza] Nightmares / Fantasies [Enfield] Creativity Techniques Techniques which use the consumer’s creativity to derive perceptions about the brand Random Input [Nike without ‘Just do it’] Pictionary [Surprise Surprise!] Transformation [Dabur Chavanprash] Re-birth [Yamaha RX100] Group Assignment Bajaj has launched Pulsar 135 Study the impact of this launch on brand image amongst existing Pulsar owners Quantitative: Survey -- 20 Respondents Qualitative: Any 3 projective techniques Deadline: Sunday, 12th December, 2010 @ 2:00 PM