Economics for Today 2nd edition Irvin B. Tucker

advertisement

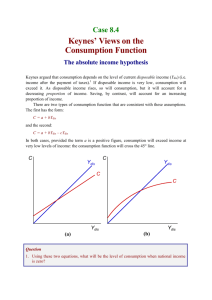

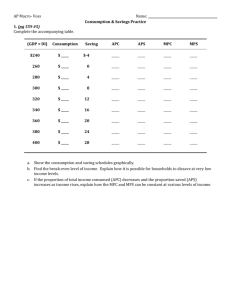

Chapter 18 The Keynesian Model • Key Concepts • Summary • Practice Quiz • Internet Exercises ©2002South-Western College Publishing 1 Who were the Classical economists? The Classical economists believed that a continuing depression is impossible because markets will eliminate persistent shortages or surpluses 2 When were the ideas of the Classical economists widely accepted? Prior to the Great Depression of the 1930’s 3 What is Say’s Law? The belief of the Classical economists that the economy was always tending toward full employment 4 What does Say’s Law say? Supply creates its own demand 5 Why is Say’s Law a full employment theory? Generally speaking, producers produce goods that consumers want and consumers have the money to buy because of the wages they were paid 6 Under Say’s Law, is unemployment possible? Yes, but it is a short-lived adjustment period in which wages and prices decline or people voluntarily choose not to work 7 What changed people’s mind about Say’s Law? The Great Depression and the publication of The General Theory of Employment, Interest, and Money published in 1936 8 Why did Keynes’ believe that “supply did not create its own demand”? Aggregate expenditures (demand) can be forever inadequate for an economy to achieve full employment 9 What is the main idea of this chapter? Keynes’s theory for the determination of consumption and investment expenditures 10 What determines your family’s spending for goods and services? Disposable income 11 What is the consumption function? The graph that shows the amount households spend for goods and services at different levels of disposable income 12 What is savings? Disposable income minus consumption, the amount households do not spend for consumer goods and services 13 What is dissaving? The amount by which personal consumption expenditures exceed disposable income 14 How do people dissave? Negative savings is financed by by drawing down previously accumulated financial assets or by borrowing 15 What is autonomous consumption? Consumption that is independent of the level of disposable income 16 What happens when disposable income is zero? Spending will equal autonomous consumption because households will dissave to satisfy basic consumption needs 17 What is the marginal propensity to consume? The change in consumption resulting from a given change in real disposable income 18 C MPC = Yd 19 What is marginal propensity to save? The change in saving resulting from a given change in real disposable income 20 S MPS = Yd 21 MPC + MPS = 1 22 Real Consumption Trillions of $ per year 8 7 6 5 4 3 2 1 The Consumption Function C = Yd Dissaving C Yd 45° C Saving Real Disposable Income Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 23 What happens if factors other than income change? There is a shift or relocation in the consumption schedule 24 Real Consumption Trillions of $ per year 8 7 6 5 4 3 2 1 45° The Consumption Function C = Yd C2 C1 MPC = .75 MPC = .50 Real Disposable Income Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 25 Real Consumption Trillions of $ per year The Consumption Function 8 C = a + bY 2 2 d 7 6 nonincome 5 B determinant 4 A 3 C1 = a1 + bYd 2 Disposable Income 1 real consumption Real Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 26 Why does the consumption function shift? • Expectations • Wealth • Price level • Interest rate • Stock of durable goods 27 How do expectations affect the consumption function? Consumers expectations of things to happen in the future will affect their spending decisions today 28 How does wealth affect the consumption function? Holding all other factors constant, the more wealth households accumulate, the more they spend at any current level of disposable income 29 How does the price level affect the consumption function? Any change in the general price level shifts the consumption schedule by reducing or enlarging the consumers purchasing power 30 How does the interest rate affect the consumption function? A high interest rate will discourage people from borrowing money and a low interest rate will encourage people to borrow money 31 How does the stock of durable goods affect the consumption function? When durable goods are suppressed, like during WWII, afterwards there is an increase in the demand for goods not previously made available 32 How does consumption compare with investment? Consumption is more stable than investment 33 According to the Classical Economists, what determined the level of investment? The interest rate 34 According to Keynes, what determines the level of investment? Expectations of future profits is the primary factor, the interest rate is the financing cost of any investment proposal 35 What is the investment demand curve? The curve that shows the amount businesses spend for investment goods at different possible rates of interest 36 12% Interest rate 16% Movement along the firm’s investment demand curve A Investment Demand Curve B 8% 4% Real investment 5 10 15 20 37 16% 12% 8% Interest rate Shift in the firm’s investment demand curve C B 4% Real investment 5 10 I1 15 I2 20 38 Why is investment demand unstable? • Expectations • Technological change • Capacity utilization • Business taxes • Autonomous reasons 39 How do expectations affect investment? Businesspeople are quite susceptible to moods of optimism and pessimism 40 How does technological change affect investment? The introduction of new products and new ways of doing things have a big impact on investment decisions 41 What happens when capacity utilization is low? When capacity utilization is low, firms can meet an increase in demand without expanding 42 What happens when capacity utilization is high? When capacity utilization is high, firms must increase investment to meet an increase in demand 43 How do business taxes affect investment? Business decisions depend on the expected after-tax rate of profit 44 What is autonomous expenditure? Spending that does not vary with the current level of disposable income 45 Aggregate Investment Demand Curve Interest Rate 16% 14% 12% 10% 8% 6% 4% 2% A Autonomous investment Real Investment .2 .4 .6 .8 1.0 1.2 1.4 1.6 46 Aggregate Autonomous Investment Demand Curve 1.6 1.4 1.2 1.0 .8 .6 .4 .2 Autonomous investment Real Disposable Income trillions of dollars per year 1 2 3 4 5 6 7 8 47 What is the aggregate expenditure function? The function that represents total spending in an economy at a given level of real disposable income 48 8 7 6 5 4 3 2 1 Aggregate Expenditures Schedule and Function AE C E Real Disposable Income trillions of dollars per year 1 2 3 4 5 6 7 8 49 Key Concepts 50 Key Concepts • Who were the Classical economists? • When were the ideas of the Classical economists widely accepted? • What is Say’s Law? • What does Say’s Law say? • Why did Keynes’ believe that “supply did not create its own demand”? • What determines your family’s spending for goods and services? 51 Key Concepts cont. • • • • • • • What is the consumption function? What is savings? What is dissaving? What is autonomous consumption? What is the Marginal Propensity to Consume? What is Marginal Propensity to Save? What happens if factors other than income change? 52 Key Concepts cont. • Why does the consumption function shift? • According to the Classical economists, what determined the level of investment? • According to Keynes, what determines the level of investment? • What is the investment demand curve? • Why is investment demand unstable? • What is autonomous expenditure? • What is the aggregate expenditure function? 53 Summary 54 Say’s Law is the classical theory that “supply creates its own demand” and therefore the Great Depression was impossible. Say’s Law is the belief that the value of production generates an equal amount of income and, in turn, total spending. 55 The Classical economists rejected the challenge that underconsumption is possible because they believed flexible prices, wages, and interest rates soon establish balance between supply and demand. 56 John Maynard Keynes believed that unless aggregate spending is adequate, the economy can experience prolonged and severe unemployment. 57 The consumption function (C) is determined by changes in the level of disposable income. 58 Autonomous consumption is consumption that occurs even if disposable income equals zero. Changes in such nonincome determinants as expectations, wealth, the price level, interest rates, and the stock of durable goods cause shifts in the consumption function. 59 Real Consumption Trillions of $ per year 8 7 6 5 4 3 2 1 The Consumption Function C = Yd Dissaving C Yd 45° C Saving Real Disposable Income Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 60 The marginal propensity to consume (MPC) is the change in consumption associated with a given change in disposable income. The MPC tells how much of an additional dollar of disposable income households will spend for consumption. 61 The marginal propensity to save (MPS) is the change in saving associated with a given change in disposable income. The MPS measures how much of an additional dollar of disposable income households will save. 62 The investment demand curve (I) shows the amount businesses spend for investment goods at different possible rates of interest. 63 The determinants of investment demand curve are the expected rate of profit and rate of interest. Shifts in the investment demand curve result from expectations, technological change, capacity utilization, and business taxes. 64 An autonomous expenditure is spending that does not vary with the current level of disposable income. 65 The Keynesian model autonomous expenditure to investment. As a result, the investment demand curve is a fixed amount determined by the rate of profit and the interest rate. 66 The aggregate expenditures function (AE) shows the total spending in an economy at a given level of disposable income. 67 Assuming investment spending is autonomous, the slope of the AE function is determined by the MPC. 68 8 7 6 5 4 3 2 1 Aggregate Expenditures Schedule and Function AE C E Real Disposable Income trillions of dollars per year 1 2 3 4 5 6 7 8 69 Chapter 18 Quiz ©2002 South-Western College Publishing 70 1. The French classical economist Jean Baptiste Say transformed the equality of production and spending into a law that can be expressed as follows: a. The invisible hand creates its own supply. b. Wages always fall to the subsistence level. c. Supply creates its own demand. d. Aggregate output does not always equal consumption. C. Says law was developed in the early 1800s and is the cornerstone of classical economics. 71 2. Autonomous consumption is a. positively related to the level of consumption. b. negatively related to the level of consumption. c. positively related to the level of disposable income. d. independent of the level of disposable income. D. Autonomous consumption is the amount of spending from savings or borrowing that occurs even when disposable income is zero. 72 3. The consumption function represents the relationship between consumer expenditures and a. interest rates. b. saving. c. the price level. d. disposable income. D. Keynes argued the most important determinant of aggregate spending for consumer goods is personal income after taxes. 73 4. John Maynard Keynes’s proposition that a dollar increase in disposable income will increase consumption, but by less than the increase in disposable income, implies a marginal propensity to consume that is a. greater than or equal to one. b. equal to one. c. less than one, but greater than zero. d. negative. C. Each dollar change in disposable income is divided between changes in consumption and saving. 74 5. Above the break-even disposable income for the consumption function, which of the following occurs? a. Dissaving. b. Saving. c. Neither (a) nor (b). d. Both (a) and (b). B. Dissaving occurs below the breakeven point on the consumption function. 75 Real Consumption Trillions of $ per year 8 7 6 5 4 3 2 1 The Consumption Function C = Yd Dissaving C Yd 45° C Saving Real Disposable Income Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 76 6. Which of the following changes produces an upward shift in the consumption function? a. An increase in consumer wealth. b. A decrease in consumer wealth. c. A decrease in autonomous consumption. d. Both (b) and (c) . A. Decreases in wealth and autonomous consumption shift the consumption function downward. 77 Real Consumption Trillions of $ per year 8 7 6 5 4 3 2 1 45° The Consumption Function C = Yd C2 C MPC = .75 MPC = .50 Real Disposable Income Trillions of $ per year 1 2 3 4 5 6 7 8 9 10 78 7. An upward shift in the consumption schedule, other things being equal, could be caused by households a. becoming optimistic about the state of the economy. b. becoming pessimistic about the state of the economy. c. expecting future income and wealth to decline. d. none of the above. A. If consumers expect good economic ties ahead, they increase spending at each level of disposable income in the current 79 time period. 8. The investment demand curve represents the relationship between business spending for investment goods and a. GDP. b. interest rates. c. disposable income. d. saving. B. As the interest rate declines, more business investment projects become profitable and investment spending increases. 80 9. Which of the following changes produces a leftward shift in the investment demand curve? a. A wave of optimism about future profitability. b. Technological change. c. High plant capacity utilization. d. An increase in business taxes. D. An increase in business taxes decreases after-tax profits on investment projects and businesses invest less at various possible interest rates. 81 16% 12% 8% Interest rate Shift in the firm’s investment demand curve C B 4% Real investment 5 10 I1 15 I2 20 82 10. The aggregate expenditures function (AE) represents which of the following? a. The consumption function only. b. Autonomous consumption only. c. The investment demand curve only. d. All three of the above combined. e. A combination of (a) and (c) . D. 83 8 7 6 5 4 3 2 1 Exhibit 11 Aggregate Expenditures Schedule and Function AE C E Real Disposable Income trillions of dollars per year 1 2 3 4 5 6 7 8 84 11. In Exhibit 11, what is the households’ marginal propensity to consume (MPC)? a. 0.5 b. 0.67 c. 0.75 d. 0.80 B. MPC is the change in consumption divided by the change in income. In this case, the change in consumption to income is two to three, or 0.67. 85 12. In Exhibit 11, aggregate income will equal consumption plus investment and the economy will be in equilibrium when real disposable income is a. $2.33 trillion. b. $3 trillion. c. $7 trillion. d. $10 billion. C. The AE curve crosses the 45 degree line at $7 trillion. 86 END 87