Benefits and New Hire Enrollment

Welcome to NEO A&M College

Benefits & New Hire Enrollment

Presented by:

NEO Human Resources Department

Topics

• Retirement

• Norse Pride

• Annual Leave/Vacation/Sick Time

• BCBS Health Plans

• Flexible Spending Accounts

• Premium Rates

• Dental Insurance

• Vision Insurance

• Life Insurance

• Long-Term Disability

• Enrollment Forms

• American Fidelity Supplemental Plans

NEO Retirement

• Faculty & Staff are eligible to participate in

Oklahoma Teachers Retirement (OTRS) provided you are a full-time employee.

• After 5 years a retiree becomes vested under

OTRS.

• Retirement under OTRS at age 62 with 5 years of service or when age plus service equals 80 or 90.

• Retirees should get estimate from OTRS at least

90-120 days prior to retirement.

NORSE PRIDE

“Keeping the Tradition Alive”

Should you wish to support a specific NEO department on campus, athletic program, etc you may elect to have a specific amount withheld from your paycheck on a recurring basis. The authorization for payroll deduction form may be obtained in the Human

Resources office.

Up through 5

6 through 10

11 or more

Up through 5

6 through 10

11 or more

Up through 5

6 through 10

11 or more

Up through 5

6 through 10

11 or more

Administrative & Faculty Vacation

****ADMINISTRATIVE & FACULTY VACATION****

40 hr. Work Week Monthly Accumulation

10 HOURS

13.36 HOURS

14.64 HOURS

****EMPLOYEE (STAFF) VACATION****

12 MONTHS' EMPLOYMENT

40 hr. Work Week Monthly Accumulation

6.667 HOURS

8 HOURS

10 HOURS

11 MONTHS' EMPLOYMENT

40 hr. Work Week Monthly Accumulation

6.667 HOURS

8 HOURS

10 HOURS

10 MONTHS' EMPLOYMENT

40 hr. Work Week Monthly Accumulation

5.81 HOURS

7.0 HOURS

8.75 HOURS

9 MONTHS' EMPLOYMENT

40 hr. Work Week Monthly Accumulation

6.667 HOURS

8 HOURS

10 HOURS

Maximum Vacation Accumulation

240 HOURS

320 HOURS

352 HOURS

Maximum Vacation Accumulation

160 HOURS

192 HOURS

240 HOURS

146.67 HOURS

176 HOURS

220 HOURS

116 HOURS

140 HOURS

175 HOURS

120 HOURS

144 HOURS

180 HOURS

Up through 5

6 through 10

11 or more

****FACULTY & STAFF SICK LEAVE****

****ADMINISTRATIVE & FACULTY SICK LEAVE****

40.0 HOURS PER WEEK = 14.0 HOURS PER MONTH

****PROFESSIONAL, CLASSIFIED, AND HOURLY ACCRUE SICK LEAVE AT****

40.0 HOURS PER WEEK = 8.0 HOURS PER MONTH

BlueCross BlueShield

Health Insurance

Eligibility for BlueCross BlueShield

• Employee Eligibility:

6-Month Regular Appointment at least 75%

FTE

• Health Benefits:

Employee Only Coverage

Employee/Spouse Coverage

Employee/Child(ren) Coverage

Family Coverage

• Dependent Coverage:

Coverage to age 26

NEO Health Plans

• BlueOptions

Features two Network Options

Helpful Terms

• Network

Group of Providers who agreed to discount charges

• Deductible for Calendar Year

Amount you pay before benefits are paid by Plan

• Co-insurance

Amount you pay after the deductible is met

• Annual Maximum Out-of-Pocket

Maximum amount you pay each calendar year before the Plan pays 100%

Helpful Terms

• Portability

Continuous coverage with another major medical plan (no more than a 63-day break)

Pre-existing condition exclusion is waived

• Pre-existing Condition Exclusion

Treated, diagnosed, or medication prescribed six months prior to beginning coverage, BCBS excludes those conditions 12 months from initial enrollment

BlueOptions

Health Insurance Plan

BlueOptions

Network Information

• Network Options

BluePreferred Network

BlueChoice Network

• Provider Listings www.bcbsok.com/osu

Call: 877-258-6781

• BlueOptions PPO Discounts

Use any BluePreferred or BlueChoice Provider Freedom to go out-of-network

BlueOptions

• $30 PCP/$50.00 Specialist office visit co-pay, innetwork

• $750 individual, $2,250 family deductible

• 80/20 co-insurance BluePreferred Network

• 70/30 co-insurance BlueChoice Network

• $3,000 per person out-of-pocket max, after deductible, $3,500.00 per person, non-network.

• No lifetime maximum on health benefits

BlueOptions

• Receive a $250 credit towards BlueOptions deductible each year by completing assessment.

• Complete your Health Risk Assessment (HRA)

– Take before any claims are incurred

– Input information into BlueAccess for Members

• Available to employee and spouse, if covered

BlueOptions

• Received a $250 credit towards BlueOptions deductible each year by completing HRA.

• Available to employee, spouse and dependents, if covered

• Enroll in Special Beginnings Maternity Program

– Call BlueCross BlueShield to enroll

– Enroll within first trimester

Pharmacy Coverage BlueOptions

Pharmacy Coverage

• Generics $4

• $50 name Brand Drugs

• $100 Non-Preferred

• $150 Triessent Specialty

• $200 Non-Triessent Specialty

Pharmacy Extras

• No lifetime maximum for Pharmacy coverage

• Pharmacy and medication lists are available at www.bcbsok.com/osu or call 877-258-6781

• Mail order available

• BlueCard access available

BlueCross BlueShield Information

BlueExtras and BlueRewards

• BlueAccess for Members-www.bcbsok.com/osu

– Personal Health Manager

– Immediate access to healthcare information

– Easy to use tools

– Take health risk assessments

– Set Doctor appointment reminders

– Check status of claims

– Obtain estimated costs for various medical procedures

– 24/7 Nurseline

BCBS Helpful Information

• Insurance ID Cards

– Receive in 4-6 weeks

– Mailed to home address

– Print temporary cards at www.bcbsok.com/osu

– Important phone numbers on card

• BCBS Member Services

• Pre-certification

• Keep in your wallet for proof of insurance

BCBS Helpful Information

• OSU BlueCross BlueShield Team

– 877-258-6781

• www.bcbsok.com/osu

• Need Additional Help

- Contact the HR Department

BCBS Premiums

• Please refer to your new hire materials received upon hire or contact the Human

Resources Office for current health premiums.

Flexible Spending and Dependent

Care Accounts

Flexible Spending & Dependent Care

Accounts

• Healthcare FSA

– Out-of-pocket medical expenses, prescription drugs, deductibles, copayments, dental, and vision for you and your eligible dependents

– Pre-funded

– Minimum Annual Goal of $300.00 up to $2,500 Current Max per IRS

Regulations

(Refer to IRS for updated max)

• Dependent Care FSA

– Daycare expenses for children under 13

– Not pre-funded

– Maximum of $5,000 per tax year for reimbursement of dependent care expenses ($2,500 if you are married and file a separate return –

Per IRS Regulations – Refer to IRS for updated max)

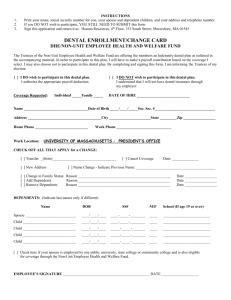

OMES: EGID - OSEEGIB

Dental and Vision Eligibility

State Insurance Board Dental and

Vision Insurance

• Dependent Coverage

– Member must be covered before dependents are covered

– Dependents enrolled in same plan as member

– Cover dependents until age 26

• Spouse Exclusion

– Dental coverage only

– Vision coverage requires spouse to have other group coverage

– Signature is required on enrollment form

OMES: EGID - OSEEGIB

Dental Insurance

Dental Plan Options

• Dental Plans

– HealthChoice

(Has the most providers)

– Assurance Freedom Preferred

– Assurant Heritage Plus with SBA (Prepaid)

– Assurant Heritage Secure (Prepaid)

– CIGNA Dental Care Plan (Prepaid)

– Delta Dental PPO

– Delta Dental Premier

– Delta Dental PPO Choice

Provider listings at sib.ok.gov

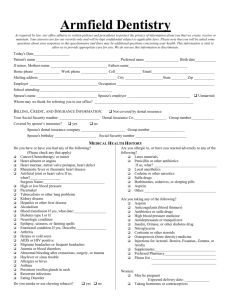

Dental Coverage

-

–

• Dental Coverage

– HealthChoice

• Has the most providers

• $2,000 Calendar Calendar Year Maximum

• No Lifetime Maximum for Orthodontia

– Pays 50%

– 12 month waiting if not covered by another group dental plan prior to enrolling

Dental Plans Cover

Two cleanings and a set of X-rays per year

Check your Employee Benefit Options Guide or Online

HealthChoice Dental Premiums

• Refer to current rate guide for most up-todate premiums. The rate guide can be found on the web http://www.ok.gov/sib/Member/Handbooks/index.html

• Remember

– Current Premiums in Option Guide

– Cover yourself to cover dependents

– Cover one dependent, cover all dependents

OMES: EGID (OSEEGIB) Vision

Insurance

Vision Plan Options

• Vision Plans

– Vision Service Plan (VSP)

– Primary Vision Care Services

– Superior Vision Plan

– United Healthcare Vision

– Humana/Comp Benefits Vision Care Plan

– Primary Vision Care

Vision Coverage

• Vision Service Plan (VSP)

Has the most providers

No ID Card

• Calendar Year Benefits Include

Exam, $10 co-pay

Prescription Glasses, $25 co-pay o Lenses and/or frames covered up to $120 each year o 20% discount on remaining balance

Contact lens covered up to $120 each year, no co-pay o Mail order available

» Check your Employee Benefit Options Guide for further details and updated info.

Vision Service Plan Premiums (VSP)

• Please contact the Personnel Office should you need a copy of the current monthly premiums for VSP or any other Vision plans.

Life Insurance (ING)

ING Employee Benefits

• NEO Employee Coverage

– Provided by ING Employee Benefits/Reliastar

• NEO pays the monthly life premium as a benefit up to two times your annualized salary

– With $200,000 maximum

– Benefits reduce at age 65

• Accidental Death and Dismemberment

- Safe Driver Benefit – 10%

- Safe Driver Benefit with Airbags – 15%

Updated each December 31

ING Employee Benefits

• NEO Employee Coverage

– Provided by ING Employee Benefits/Reliastar

– Opportunity to purchase up to two-times annualized salary

• 5,000 increments

• Not to exceed $250,000

• With Proof of Good Health

– Employee may increase up to five times annualized salary, not to exceed

$750,000

• Portability

- If you leave NEO you may keep your Supplemental Life. However premiums would be paid by the employee and premiums are not tax sheltered.

ING Employee Benefits Supplemental Life

• Voluntary enrollment

– Employee

– Spouse

– Dependent(s)

• Premiums paid by employee

• Premiums not tax sheltered

ING Employee Benefits Supplemental Life

• New Employee Enrollment

– Spouse guaranteed issue within first 30 days of hire

– Opportunity to purchase up to one-times employee annualized salary

• $5,000 increments

• Not to exceed $125,000

• With Proof of Good Health

– Employee may increase spouse life, not to exceed 50% of employees combined amounts, up to $375,000

• Cannot cover spouse if spouse is an NEO employee

Premiums are paid be employee – Premiums are not tax sheltered

ING Employee Spouse Supplemental Rates

Age as of December 31

Under 25

25-29

30-34

35-39

40-44

45-49

50-54

55-59

60-64

65-69

70+

Monthly Rate per $5,000

0.25

0.30

0.40

0.45

0.50

0.85

1.60

2.60

3.90

7.25

12.00

ING Child(ren) Supplemental Rates

Coverage Units

$2,500

$5,000

$7,500

$10,000

Cost per Month

$0.45

$0.90

$1.35

$1.80

If you and your spouse are employed by NEO, only one parent can cover child(ren)

Beneficiaries

• Primary Beneficiary

– First in line

– Share equally

– Person/Corporation/Charitable Institution

• Contingent

– Collect in Primary Predeceases

• Keep Beneficiary Information Current

• Contact NEO Human Resources to Update

American Fidelity Assurance (AFA)

Long-Term Disability

Long-Term Disability

• Long-Term Disability

– Salary Protection Program

– 30 days to enroll

– NEO pays premium 100%

– Pre-existing condition clause

• LTD Process

– First 180 days, Elimination

– Next 6 months, Own Occupation

– After 12 months, Any Occupation

» See your AFA LTD Certificate for more details

Example for 60% LTD Cost paid by NEO:

$29,000/12=$2,417/100=$24.17 x .49 = $12.56 per month

Long-Term Disability

• Your Plan Pays A Monthly Disability Benefit

– 60% of you Monthly Compensation not to exceed:

(1) a maximum Monthly Disability Benefit of

$3,600.00; (b) a maximum covered Monthly

Compensation of $6,000.00; and (3) the amount for which premium is being paid. If applicable, your Disability Benefit will be reduced by

Deductible Sources of Income.

Long-Term Disability

• Less Income From Other Sources

– AFA will ask you to apply for:

• Social Security Disability

• Oklahoma Teachers’ Retirement Disability

• Workers’ Compensation

• Unemployment Compensation

• AFA will calculate your salary guarantee

Example of 60% LTD pay out:

AFA salary guarantee:

SS = $600.00

OTR = $950.00

____________________

$1,550.00

AFA will pay $100 minimum benefit

American Fidelity Assurance (AFA)

*Cancer Protection*

*Accident Only Insurance Plan*

*AF Term Life Insurance*

*Short Term Disability*

*AF Critical Choice*

Cancer Protection

• Offers financial help for out-of-pocket expenses

– Annual Screenings

– Travel and Lodging

– Loss of Income

– Child care expenses

• Limitations, exclusions, and waiting periods apply

• Employee pays premiums

• Answer medical questions

One-on-one appointment contact:

Diane Czachowski

800-365-2782 ext. 405

Cancer Protection

• Screening & Follow-up Benefits

• Treatment & Procedures Benefits

• Facilities & Equipment Benefits

• Care & Consultation Benefits

• Transportation & Lodging Benefits

• Additional Benefits

Accident Insurance Plan

• Provides one-time cash payment when suffering a covered accident diagnosed by a physician.

– Basic Plan

– Enhanced Plan

• Accident Benefit Enhancement Rider

Accident Insurance Plan

• Hospital ER Treatment Benefit

• Accident Follow-up Treatment Benefit

• Medical Imaging Benefit

• Hospital Confinement Benefits

• Wellness Benefit

• Ambulance Benefit

• Transportation Benefit

• Family Member Lodging & meals Benefit

• Appliances Benefit

• Blood, Plasma and Platelets Benefit

• Burns Benefit

• Skin Graft Benefit

• Dislocations Benefit

• Exploratory Surgery Without Surgical Repair Benefit

• Eye Injury Benefit

• Fractures Benefit

• Internal Injuries Benefit

• Physical Therapy Benefit

• Prosthesis Benefit

• Ruptured Disc or Torn Knee Cartilage Benefit

• Tendons, Ligaments and Rotator Cuff Benefit

• Emergency Dental Work Benefit

• Paralysis Benefit

• Concussion Benefit Benefit

Opportunities for Enrollment Changes

Annual Benefit Enrollment Period

• Open Enrollment held October 1 st – 31 st

• Opportunity to make changes to benefits

• E-mail notifications, posters and announcements on campus

• Changes effective January 1

– Plan year January 1-December 31

Mid-Year Changes

• Qualifying Event Examples

– Marriage, Divorce

– Birth, Adoption

– Child reaching age 26

– Custody Judgment

– Gain or loss of other group coverage

• Must be made within 30 days of the event

– If not within 30 days, must wait for Annual Enrollment

• Contact the Human Resources Office for instructions

Questions?

• Please feel free to contact the Benefit Provider directly

• If you need assistance, please don’t hesitate to contact the Human Resources Department