Test #1 - Chagrin Falls Schools

advertisement

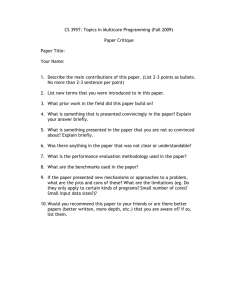

Economics Syllabus Mr. Serluco Jim.Serluco@Chagrin Schools.org Ext 4476 Requirements1. Read each chapter listed on the syllabus prior to class discussion. 2. Define the terms listed at the beginning of each section of each chapter. (A word bank of these terms will be present on tests.) Terms must be completed before each test. 3. Correctly answer the objectives listed below. 4. Participate in the “stocks game”. 5. Answer questions that coincide with the “stocks game”. 6. Participate in a debate in the 4th qtr. . 7. Complete occasional daily assignments. 8. Actively participate in assigned study groups on the day prior to tests. 9. Complete tests on dates listed on the syllabus with at least a 70%. If you score below a 70% you are required to take a retake test. 10. Complete a 3rd quarter test and a Final Semester exam. 3rd Quarter Course Objectives We will start with this chapter to kick off the stocks game. Chapter 11- Financial Markets Section 1 a. What constitutes the financial system? b. What benefits do mutual funds offer to individual investors? Section 2 c. What issues should be considered when making investment decisions? d. What kind of risk is involved in putting money in a bank savings account? e. Why are long-term investors generally more tolerant of risk than short-term investors? Section 3 f. Discuss why people buy stocks. g. Describe how stocks are traded. h. Explain how the performance of stocks is measured. Section 4 i. Discuss why people buy bonds. j. Describe the different kinds of bonds. k. Explain the factors that affect bond trading. l. Outline investment options other than stocks and bonds. Answer these objectives on paper to turn in by Friday, January 25th. The terms from this chapter will not be due until the start of the 4th quarter. Unit 1 Economics and Choice Chapter 1, section 1 1. What is the economic way of thinking? 2. Scarcity leads to what three economic questions? 3. What are the four factors of production and how do they relate to scarcity? Chapter 1, section 2 4. Why is it important to consider marginal benefits and costs when you do a cost benefit analysis? Chapter 1, section 3 5. What are three things a production possibilities curve shows? Chapter 1, section 4 6. Who was Adam Smith? Chapter 2, section 1 7. Identify the three types of economic systems and briefly explain each. Chapter 2, section 2 8. Adam Smith used the “invisible hand” as a metaphor for the forces that balance a free market. What might be a good metaphor for the forces at work in a command economy? Explain your answer. Chapter 2, section 3 9. What is one advantage and one disadvantage of a market economy? Chapter 2, section 4 10. Why is it said that the U.S. has a mixed economy? 11. In most of the former command economies in Eastern Europe, one of the first economic changes instituted was establishing the right to own private property. Why do you think the leaders of these countries considered this feature of market economies so important? Chapter 3, section 1 12. What legal rights are built into the free enterprise system? 13. Do you agree with Milton Friedman when he says that societies are structured on greed and that capitalism can reduce the harm caused by greed? Explain your answer. Chapter 3, section 2 14. What role does the government play in the economy’s circular flow? Chapter 3, section 3 15. Besides providing public goods, what two purposes can a government serve in a market economy? TEST #1 (9 DAYS) Thursday, February 7th. MICROECONOMICS Unit 2 Market Economies at Work Chapter 4, section 1 16. Does quantity demanded always fall if the price rises? List several goods or services that you think would remain in demand even if the price rose sharply. Why does demand for those items change very little. Chapter 4, section 2 17. What causes a change in demand? Give three example and briefly explain each. Chapter 4, section 3 18. What are the factors that determine elasticity? 19. How does the total revenue test help business owners decide whether to lower prices? Chapter 5, section 1 20. Why do price and supply have a direct relationship? 21. Why might producers not always be able to sell their products at the higher prices they prefer? Think about the laws of demand and supply and the different attitudes that consumers and producers have toward price. How might the market resolve this difference? Chapter 5, section 3 22. Name and briefly explain four factors that cause a change in supply. Chapter 5. Section 4 23. How is elasticity of supply similar to elasticity of demand? How is it different? TEST #2 (7 DAYS) Wednesday, February 20th Chapter 6, section 1 24. Why is it difficult for markets to maintain equilibrium? 25. Why is the market always moving toward equilibrium? Chapter 6, section 2 26. What are the characteristics of the price system in a market economy and briefly explain each? 27. How do shortage and surplus send signals to producers? Chapter 6, section 3 28. Why is a price ceiling set below equilibrium price rather than above it? What about price floor? 29. How does the existence of the black market work against the intended purpose of rationing? Chapter 7, section 1 30. What are the characteristics of perfect competition and briefly explain each? Chapter 7, section 2 31. What are the characteristics of a monopoly and briefly explain each? Chapter 7, section 3 32. Why does increased competition give companies an incentive to improve their products? 33. Which market structure seems to offer the best balance of benefits to producers and consumers? Chapter 7, section 4 34. What factors does the government consider in deciding whether to approve a merger? 35. Why do economists generally favor deregulation of most industries? TEST # 3 (7 DAYS) Friday, March 1st. Unit 3 Partners in the American Economy Chapter 8, section 1 36. Explain the advantages and disadvantages of sole proprietorship. Chapter 8, section 2 37. Explain the advantages and disadvantages of a partnership. Chapter 8, section 3 38. What are the main advantages and disadvantages of a corporation? Chapter 8, section 4 39. What are the main advantages and disadvantages of a franchise? 40. What are some purposes of nonprofit organizations? Chapter 9, section 1 41. What market forces influence wages? 42. List and briefly explain the four factors that contribute to differences in wages. Chapter 9, section 2 43. How has the labor market in the U.S. changed since the 1950’s? 44. Name two new developments in the way Americans work. Chapter 9, section 3 45. How did the government strengthen unions during the depression? 46. Do you think unions have outlived their usefulness? If so, why? If not, what issues may become part of their future agenda? TEST # 4 (7 DAYS) Tuesday, March 12th. 3rd Qtr. Test Tues.,Wed. March 19-20 END OF 3rd QUARTER –Friday, March 22nd 4th Quarter COURSE OBJECTIVES MACROECONOMICS Unit 4 Money, Banking, and Finance Chapter 10, section 1 1. What functions does money perform? Chapter 10, section 2 2. List the developments of U.S. banking in it’s origins, the 19th Century, and the 20th Century. 3. Why was the system of national banks unable to create economic stability? 4. Why are the three kinds of financial institutions more similar now than in the past? 5. What was different about the original purpose of commercial banks and savings and loan associations? 6. What are two ways that credit unions are different from other financial institutions? Chapter 10, section 3 7. Banks allow customers to do what three things? 8. What do a mortgage and a credit card have in common? 9. Discuss the changes that deregulation has brought to banking. 10. Explain how technology has changed banking in the United States. THIS TEST WILL ALSO INCLUDE ALL OF THE TERMS FROM CHAPTER 11 Test #1 (6 DAYS) Tuesday, April 9th. UNIT 5 Measuring and Monitoring Economic Performance Chapter 12, section 1 11. When calculating GDP, economists add the expenditures from what four sectors of the economy? Chapter 12, section 2 12. Briefly explain the four stages of the “business cycle”. 13. Are business cycles inevitable? 14. Why do business cycles occur? Chapter 12, section 3 15. What four factors drive economic growth? Chapter 13, section 1 16. Discuss the impact that unemployment has on the economy. Chapter 13, section 2 17. What might James Baldwin have meant by saying it is “expensive” to be poor? Chapter 13, section 3 18. How is inflation measured? 19. What causes inflation? 20. What are three effects of inflation? Test #2 ( 7 DAYS) Thursday, April 18th Chapter 14, section 1 21. Why are sales and property taxes considered regressive rather than proportional? Do you think that this is the way it should be? 22.Why might government give tax rebates to new businesses in economically depressed areas? 23. Taxes have an impact on resource allocation, productivity and growth, and the economic behavior of individuals and businesses. Briefly explain the impact in each area. 24. What taxes do we pay in the state of Ohio? 25. How does our tax rate compare to other states? 26. What taxes do we pay locally? 27. Where do these local tax dollars go? Chapter 15, section 1 28. The government can use a combination of taxing and spending policies to stimulate a sluggish economy or to slow down an overheated economy. At what point in the business cycle do you think the economy is today? (go back to pages 358-359) What type of fiscal policy do you think the government should apply at this time? (according to pages 446450) 29. Pick two of the four limitations that could affect the success of fiscal policy and briefly explain. Chapter 15, section 2 30. Do you agree or disagree with the Keynesian Theory of economics? Why? 31. How are supply-side and demand-side economics different? Chapter 15, section 3 32. How does government finance deficit spending? 33. How does deficit spending contribute to the national debt? Test #3 ( 6 DAYS) Friday, April 26th Chapter 16, section 1 34. What is the structure of the FED? Chapter 16, section 2 35. What are the functions of the Federal Reserve? Chapter 16, section 3 36. Monetary policy involves Federal Reserve actions that change the money supply in order to influence the economy. There are three actions the Fed can take to manage the supply of money. What are they? 37. Monetary policy is designed to even out the extremes of the business cycle by expanding or contracting the money supply. Explain how the actions listed under Expansionary Policy increase the supply of money and those under Contractionary Policy decrease the supply of money. Chapter 16, section 4 38. The goals of both fiscal policy and monetary policy are to stabilize the economy. How do both accomplish this? 39. Why might it be important to coordinate monetary and fiscal policy? Chapter 17, section 1 40. Why should nations specialize in what they produce most efficiently and trade for the rest? 41. What are some advantages of free trade? 42. How does trade affect a national economy? 43. In what aspects of the world economy is the United States a leading nation? Chapter 17, section 3 44. How does the value of the U.S. dollar affect the U.S. trade surplus or deficit? Chapter 17, section 4 45. How is the EU different from other regional trading groups? 46. What are some advantages of NAFTA? Test #4 (7 DAYS) Tuesday, May 14th DEBATES Week of April 29-May 3 Senior Project begins Monday May 6th Chapter 18, section 1 47. Give an example of a developed, transitional and less developed nation. Tell why each falls under these categories. Chapter 18, section 2 48. What does a nation need to develop economically? 49. What political systems seem most likely to be riddled with corruption? Why? Chapter 18, section 3 50. Briefly summarize the transition to a market economy in the former Soviet bloc and in China. Test #5 (3 DAYS) Tuesday, May 17th. Final Stocks game paper due Wednesday, May 1st Final Exams- June 3rd, 4th, 5th