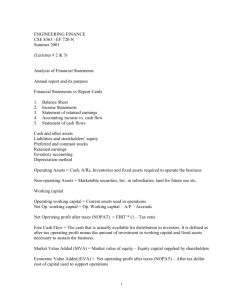

PDF Document - Pulse Consultants

advertisement