financial management and audit

advertisement

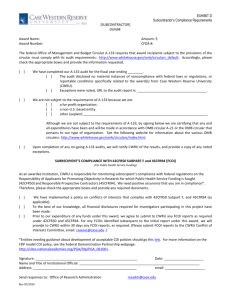

FINANCIAL MANAGEMENT AND AUDIT ANNE SHERMAN PAT DEHOOP KAL MARCHI APRIL 13, 2010 1 COURSE TOPICS 1. 2. 3. 4. 5. 6. Policies Financial Management Cost Transfers Effort Reporting Closeout Procedures and Reports Audits 2 1. POLICIES • Federal - OMB Circular A-21 - OMB Circular A-110 - OMB Circular A-133 • • • • Federal Demonstration Partnership (FDP) State of Texas Laws and Regulations Agency/Sponsor Policies University Policies 3 RULES GOVERNING CONTRACT AND GRANT FUNDS Individual Agreement Terms University Policies & Procedures Sponsor Cost Policies Federal Cost Policies 4 OMB CIRCULAR A-21 COST PRINCIPLES • Direct and F&A Cost • Reasonable, Allowable and Allocable • Cost Accounting Standards (CAS) 5 OMB CIRCULAR A-21 COST ACCOUNTING STANDARDS (CAS) • 501 – Consistency in Estimating, Accumulating, And Reporting Cost • 502 – Consistency in Allocating Costs Incurred for the Same Purpose • 505 – Accounting for Unallowable Costs • 506 – Cost Accounting Period 6 OMB CIRCULAR A-110 UNIFORM REQUIREMENTS OMB Circular A-110 contains administrative management standards for research grants. 7 OMB CIRCULAR A-110 UNIFORM REQUIREMENTS • Financial and Program Management - Payment Methods, Cost Sharing, Program Income • Reports and Record Retention - Financial Reporting, Retention Requirements 8 OMB CIRCULAR A-110 UNIFORM REQUIREMENTS • Termination and Enforcement • After-the-Award Requirements - Closeout Procedures (90 Day Requirement) 9 OMB CIRCULAR A-133 AUDIT REQUIREMENTS OMB Circular A-133 requires independent, regularly scheduled audits of federally funded research and student financial aid programs. Annual audits include reviews of internal controls and compliance tests of financial activity. 10 OMB CIRCULAR A-133 AUDIT REQUIREMENTS • Consistency and Uniformity • Audit • Auditees • Auditors 11 AGENCY POLICY • Agency Requirements • Expanded Authorities • Federal Demonstration Partnership (FDP) • Agency Specific FDP Guidelines 12 STATE OF TEXAS & UNIVERSITY POLICY • State of Texas • Board of Regents • UH Systems (SAMs) University of Houston (MAPP) UH – Clear Lake UH – Downtown UH – Victoria UH – System at Fort Bend 13 2. FINANCIAL MANAGEMENT • New Award Processing • Award Cost Center Information • F & A Cost Set-Up 14 Award Issued to UH AWARD PROCESSING AT UH Negotiation/Acceptance Issue Notice of Award to PI Office of Contracts and Grants Log in Award Document Review Award Set-Up Prepare Notice of Award Negotiation Create Account Acceptance Project Management PI: - Performs research - Initiates expenditures - Technical reports - Continuations - Renewals Dept: - Post award management - Process expenditures - Approve expenditures - Record-keeping - Reconcile accounts OCG: - Post-Award admin. - Approves expenditures - Subcontracts - Prior approvals - Award adjustments RFS: - Invoices - Financial Reports - Close-Outs - Audits 15 AWARD COST CENTER INFORMATION (Sample Data) Business Unit Department Fund Program Project/Grant ID 00730 H0076 5022 B0001 G005461 PS Expense Budget Levels 16 F&A COST SET-UP • Identify F&A Cost Basis • Determine Exempt Categories • Specify PS Account Codes to be Excluded or Included 17 F&A COST RATE EXCEPTIONS • F&A Reduction • F&A Waiver • Sponsor Mandated Rate Restrictions 18 UH F&A COST ANALYSIS • Are there exempt categories affecting F&A costs? • Have we prepared an F&A (IDC) analysis? • Is agency prior approval required to reallocate costs between direct to F&A? 19 3. COST TRANSFERS Cost transfers (reallocations) occur when goods or services originally paid for under one award (or department cost center) are subsequently transferred to another award (or department cost center). 20 COST TRANSFERS Once an expense entry has been recorded in a cost center in the general ledger, it is appropriate to make expenditure adjustments only in the following situations: To correct an erroneous recording To redistribute certain departmental costs that are applicable and allowable to a sponsored project (e.g. long distance) 21 COST TRANSFERS Cost transfers involving federal and state funds should be A V O I D E D altogether or kept to a minimum. Expenses should be charged directly to the cost centers which they benefit. Processing cost transfers should not be an SOP for managing your cost centers! 22 COST TRANSFERS “DON’Ts” Some invalid reasons for requesting cost transfers: • Lack of planning or projecting – convenience (i.e., yearly review) • Lack of funds on a different grant • Unspent balances at or near expiration • Waiting for a new award, so “I will just use this other one until then.” • F & A advantage “My ARP/ATP doesn’t charge IDC so I will move my salary and wages to that award from DOD and move my equipment from my ARP/ATP to my DOD award.” 23 COST TRANSFER GUIDELINES Cost transfers must be fully explained, justified and approved by the Principal Investigator, the certifying signatory and the Office of Contracts and Grants. Supporting documentation as required by sponsor and UH Policy should be on file with transfer request forms. 24 COST TRANSFER GUIDELINES Cost transfers are a red flag to an auditor. If you have a cost that should be direct charged to more than one cost center, it is better to allocate it to those cost centers then, rather than waiting until after the charge has posted to reallocate it. When you expect a new award, you should not temporarily use an existing one. We recommend interim funding to deal with that circumstance. 25 COST TRANSFER GUIDELINES If an employee transfers from one award to another: • Process a PAR and position request (if needed) immediately. • Do not allow payroll to continue to charge the original cost center; do not reallocate later. • Make correction in the month following the error. 26 COST TRANSFER GUIDELINES Cost transfers made within the last 90 days of the award period: • Highly subject to audit. • Auditors will examine both sides of the transfer to determine if an overdraft and/or unexpended balance were evident before the transfer. 27 COST TRANSFERS • Cost transfers are categorized as . . . Payroll Transfers Non-Payroll Transfers 28 PAYROLL TRANSFERS • Justification and documentation required • Authorized Signatures • Payroll Account Reallocation Form • Still accomplished on paper, not through Work Flow 29 NON-PAYROLL TRANSFERS Reasons for non-payroll transfer: • Overdrafts • Correcting a data entry error • SCR from recharge center • Account Code Change (i.e. equipment fabrication costs) • Accomplished through WorkFlow 30 4. EFFORT REPORTING • After-the-fact Effort Reporting • Quarterly • Directly paid from Sponsored Project • Cost Shared Effort • Reporting through RD2K • Paper Signature Certification (biweekly personnel still use time sheet) 31 5. CLOSING PROCEDURES AND REPORTS • Closing Notices • Cost Share Reporting • Required Documentation (non-cost share) • Closing Process 32 CLOSING NOTICES Advance Notice 90-60-30 day notice prior to grant end date to Business Administrators and PI providing guidance on how to handle the closeout of the award 33 CLOSING NOTICES At expiration, a notice goes to Business Administrator with copy to PI notifying them that account is expired and is or will be frozen. 34 CLOSURE NOTICES In the month that the final report/invoice is due to the Sponsor, Research Financial Services will request from Business Administrator and PI: • • cost-share documentation or any other required documents for preparation of the final report or invoice. 35 FINAL INVOICE Research Financial Services generates final financial invoice or report and sends to Business Administrator and PI for review before submission to the sponsor. Department Business Administrator and PI have 4 working days to respond before submission. 36 COST SHARE REPORTING Cost Sharing – must be certified by DBA and copies of expenditure documents must be maintained in the department and supplied to OCG upon request. Some projects require backup documentation to be submitted with invoices. • • • UH Participation Matching Third-party contributions 37 CLOSING PROCESS After project end date: • Project-to-date account reconciliation – Department • Unallowable review – Department • F&A Reconciliation – Research Financial Services • Cost Share Report – Department • Financial Report and Invoice – Research Financial Services 38 CLOSING PROCESS • Other closing documents: Property Report Invention/Patent Report Contractor Release Assignment of Rebates, Refunds, and Credits 39 CLOSING PROCESS • Sponsor Approval of Final Report/Invoice • Final Payment Received • Cash Reconciliation • Residual Funds transfer (for fixed cost awards) • RD2K Close and PeopleSoft Inactivation 40 6. AUDIT 41 AUDITS COULD BE PERFORMED BY THE FOLLOWING: • Sponsor • An A-133 Auditor such as the State Auditors Office or an external CPA firm like KPMG • The UH Internal Auditing department 42 AUDIT REQUEST ITEMS A request from the sponsor or those conducting a single federal audit could ask for any or all the following information: • Desk procedures • List of accounts • List of contracts and grants • Copy of log maintained by the person monitoring contract performance 43 AUDIT REQUEST ITEMS • Copies of the “Disclosure or Potential Conflict of Interest Form” and the “Related Party Disclosure Form” • Copy of the most recent account reconciliation • Copies of the most recent time and effort reports • Documentation of cost transfers • Other items 44 UH INTERNAL AUDIT REQUESTS A request from the UH Internal Audit department will also cover the following areas: • Department Policies and Procedures Baseline Standards • Reconciliation of Account Balances • Cash Handling • Petty Cash 45 UH INTERNAL AUDIT REQUESTS • Long Distance/Mobile Phone Charges • Contract Administration • Property Management • Conflict of Interest/Related-Party Disclosure • Accounts Receivable • Negative Budget or Fund Balances 46 AREAS OF POSSIBLE EXAMINATION • • • • • • • • Activities allowed or un-allowed Allowable Cost / Cost Principles Cash Management Davis-Bacon Act (wages of workers on federal construction project must be not less than local wages) Eligibility (unique to each program) Segregation of certain expenses (i.e. Participant Support) Equipment and Real Property Management Matching, Level of Effort, and Earmarking 47 AREAS OF POSSIBLE EXAMINATION • • • • • • • Period of availability of federal funds Procurement, Suspension, and Debarment Program Income Real Property Acquisition/Relocation assistance Reporting – Technical or Financial Sub-recipient Monitoring Special Tests and Provisions (usually unique to each program and involve laws, regulations, and the provisions of contract or grants) 48 AUDIT RED FLAGS • Cost overruns • Inadequate documentation of costs • Cost transfers • Costs incurred outside of funding period • Recharge activities with financial surpluses • Incomplete Effort Reports 49 AUDIT RED FLAGS • Recharge rates not approved or not applied consistently to all users • Account coding errors • Unallowable costs charged to project • Personnel Activity Request (PARs) not property certified • Technical reports not filed on time 50 ADVERSE AUDIT FINDINGS (Questioned Costs) • Unallowable costs • Undocumented costs • Unapproved costs • Unreasonable costs 51 ADVERSE AUDIT FINDINGS (Examples) • Program income not deposited to a designated program income cost center for a particular project • Indirect costs charged as direct costs (i.e. personnel) • Improper transfers from grants accounts • Unauthorized equipment purchases • Improper asset disposal methods 52 POTENTIAL IMPACT OF ADVERSE AUDIT FINDINGS • Cost disallowances • Statistical extrapolation of errors in an audit test sample • Withdrawal of funding • Increased scrutiny for future funding – Audit finding may have to be disclosed with future applications and proposals 53 WHAT TO DO NOW TO PREPARE? • Do not wait for the Auditors. Prepare NOW. • Read over the handouts • Conduct an audit of your own operations • Audit each other • Have Research Financial Services conduct an informal review 54 AVOIDING AUDIT PROBLEMS • • • • Review award documentation and setup Monitor financial activity and compare to budget Complete effort reports and reconcile to payroll Keep PI informed of the financial status of their contracts and grants • Avoid cost transfers • Submit timely reports to sponsoring agencies • Ask for assistance 55 COMMON AUDIT FINDINGS • • • • • • • Improper draw-downs Program conditions or eligibility requirements not met Untimely reporting to sponsoring agencies Undocumented / late cost transfers Fixed assets not managed properly including asset disposal Administrative processes and procedures not followed Effort reports not completed or inconsistent with payroll records Source: UCSB Internal Audit Services 56 SOURCES • • • • • Board of Regents Policy National Council of University Research Administrators (NCURA) Society of Research Administrators (SRA) University of California Santa Barbara Training Program Office of Management and Budget Circulars A-21, A110, and A-133 57