Cost Sharing Summer 2015 Presentation

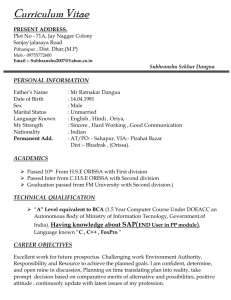

advertisement

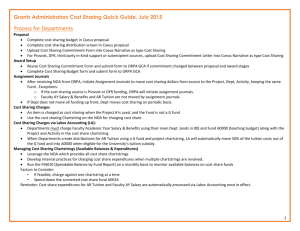

Cost Share Business Process July/August 2015 Glynis L. Sherard, Director, SRA Marcia Black, Assistant Director, ORPA Kyle Burkhardt, Senior ERA Manager, ORPA Agenda Review Cost Share Basics Cost Sharing Systems Overview Proposal Award Converted Awards Data cleanup Assignment Journals Charging & Managing Cost Sharing Information Warehouse Reports Appendix Quiz 2 Review Cost Share Basics 3 Review Cost Share Basics KEY DEFINITIONS Cost sharing is when a portion of the total cost of a sponsored project or program is paid by the University rather than the sponsor and represents a binding obligation of the University. Mandatory if it is required by the sponsor as a condition of the award. Voluntary if it is offered by the PI when no mandatory cost sharing requirements exist, or is in excess of mandatory cost sharing requirements. 4 Review Cost Share Basics KEY DEFINITIONS Cash contributions: The recipient’s cash outlay, including the outlay of money contributed to the recipient by third parties. In-kind contributions: Non-cash contributions in the form of real property, equipment, supplies, and other expendable property, and the value of goods and services benefitting and specifically identifiable to the project or program. 5 Review Cost Share Basics ALLOWABLE COST SHARE EXPENDITURES Must satisfy all of the following criteria: Verifiable from the official University records; Not previously used as cost share for another project (the same cost share expenditures cannot be used for multiple projects); Necessary and reasonable for proper and efficient accomplishment of the project; Allowable under the terms of the award; Conforms to other provisions of OMB Circular A-110, or Uniform Guidance as applicable; Incurred during the effective dates of the grant or during the pre-award phase when authorized by the sponsor; and Not paid by the federal government under another award. 6 Review Cost Share Basics UNALLOWABLE COST SHARE EXPENDITURES Costs considered unallowable by the University or by the sponsor; Costs considered unallowable under OMB Circular A-21 or Uniform Guidance as applicable; Salary amounts exceeding a regulatory salary cap (e.g., National Institutes of Health); University facilities such as laboratory space. PIs should not commit the use of facilities OR existing equipment as cost sharing, but rather characterize as "available for the performance of the sponsored agreement at no direct cost to the project." 7 Review Cost Share Basics SOURCE OF FUNDS The PI is responsible for identifying all sources of funds for cost sharing of direct costs. The PI may NOT utilize funds from another federal award as the source of cost sharing, except as authorized by statute. The PI may utilize funds from non-federal awards as the source of cost sharing ONLY when specifically allowed by the non-federal sponsor. Cost-sharing is typically funded by tuition subsidy, gifts, endowment income, operating budgets, or other department designated funds. Unrecovered indirect costs or F&A can only be included as cost share with the prior approval of the Federal awarding agency 8 Proposal Stage 9 Proposal Stage 1. The PI should confer with the Chair and/or Dean regarding a cost-share strategy to meet the sponsor’s requirements. 2. The PI or department should then contact ORPA well in advance of the proposal deadline to discuss the specifics of the proposal and to determine the sources of funds to meet this requirement. 3. ORPA will forward all voluntary cost sharing requests to the Dean for Research for approval in advance of the proposal submission. 4. After this determination has been made, the proposal is submitted to ORPA. 10 Proposal Stage COST SHARING IN PROPOSAL – APPROVAL PROCESS Does the sponsor require cost sharing? Yes = Mandatory No = Voluntary 1. PI creates cost sharing plan and receives approval from Chair/Dean on cost share strategy and sources 2. PI/Dept. routes approved proposal with cost sharing to ORPA 3. ORPA evaluates cost sharing proposal 4. If proposal is satisfactory, ORPA submits approved proposal with cost sharing to sponsor 1. PI submits request for cost sharing to ORPA 2. ORPA submits cost sharing request to DFR 3. DFR evaluates request to either approve or deny 4. If DFR approves voluntary cost sharing, PI creates cost sharing plan and follows steps above for mandatory cost sharing 11 Proposal Stage UNIFORM GUIDANCE IMPACT (all federal proposals submitted and new federal awards issued on or after 12/26/14) Subpart D – Post Federal Award Requirements §200.306 Cost sharing or matching Under Federal research proposals, voluntary committed cost sharing is not expected. It cannot be used as a factor during the merit review of applications or proposals, but may be considered if it is both in accordance with Federal awarding agency regulations and specified in a notice of funding opportunity. 12 Cost Sharing Systems Overview 13 Documentation 14 Cost Sharing Systems Overview CS Charged & Managed Proposal Award Assignment Journals Dept enters Cost Sharing Info in Coeus (Budget, Distribution, Commitment Letters & Commitment Form) Dept submits Commitment Form (if commitment changed) & Budget Form Method of moving cost sharing dollars from source to the Project, Dept, Activity A charge to a Project is cost sharing if the Fund is not a G fund ORPA GCA reviews ORPA GCA reviews ORPA initiates assignment journals for DFR and Provost Dept uses cost sharing Chartstring on the NOA for charging cost share ORPA submits proposal ORPA Award Specialist enters info from the Commitment & Budget forms into PS Grants Dept initiates Deptto-Dept assignment journals (between depts and within own hierarchy) NOA sent to Dept, PI, SRA Note: Assignment Journals are not created for Faculty AY S&B or AR Tuition Reports View Cost Sharing Commitments, budgets and charges via IW reports 15 Proposals Pre- and Post-Prime Similarities & differences 16 Proposal Pre-Prime vs. Post-Prime Budget Pre-Prime Post-Prime Dept entered cost sharing budget into Coeus Pre-Prime Budget items Dept enters cost sharing budget into Coeus Post-Prime Budget items Cost sharing amounts Cost sharing amounts 17 Coeus cost sharing budget Item without F&A 18 Coeus cost sharing budget Item with F&A Coeus calculates F&A on cost sharing, regardless of if the sponsor will allow F&A to be used toward the university commitment. Unchecking Apply box generates positive underrecovery: Box must stay checked 19 Coeus cost sharing budget Period screen Pre- and post-Prime Coeus calculates F&A on cost sharing, regardless of if the sponsor will allow F&A to be used toward the university commitment. 20 Proposal Cost Sharing Distribution After entering cost sharing for all budget items, the cost sharing must be distributed. 21 Proposal Cost Sharing Distribution Pre vs. Post-Prime Pre-Prime Fiscal Year Post-Prime Fiscal Year Amount Amount Source Source (mandatory Coeus field) 3 digit Dept # or 7 digit PG # Including Subrecipient & Third Party InKind Support 5 (mandatory Coeus field) digit Dept # Including Subrecipient & Third Party InKind Support 600 Provost Science Funds 51005 Provost Science Funds 680 DFR 51700 DFR 40000 AR Tuition 51701 F&A or Unrecovered F&A 970 AR 670 Tuition F&A or Unrecovered F&A 22 Proposal Cost Sharing Distribution 23 Coeus Proposal Notes Pre- and Post-Prime Budget screen: Budget items and cost Equipment Travel has $60k in cost sharing has $20k in cost sharing Commitments 2 screen: Amounts and Dept depts are contributing cost sharing No connection between Budget items and Dept in Coeus. How much is each dept contributing for each budget item? 24 Proposal Post-Prime What about Fund? Coeus has no place for Fund If Fund is entered next to the Dept #, Coeus can’t print the Coeus cost sharing forms Maybe Coeus programmers can reprogram the forms Use the Cost Sharing Commitment Form to record Fund 25 26 Proposal Post-Prime Dept & Fund are blank on the Form for the following* Subrecipient Third Party In-Kind Support F&A or unrecovered F&A (if the sponsor allows it to be included toward the cost sharing commitment) *Coeus requires a Dept #; the Form does not There is no Dept & Fund for these cost sharing sources. 27 Coeus Cost Sharing Narratives Upload the Cost Sharing Commitment Form as narrative type cost sharing For Provost, DFR, third party inkind support or subrecipient sources, upload Cost Sharing Commitment Letters as narrative type cost sharing 28 Proposal Stage – Coeus Pre-Prime in Coeus Post-Prime in Coeus Enter cost sharing budget items Enter cost sharing budget items Enter cost sharing distribution Enter cost sharing distribution Upload cost sharing commitment letters • Upload cost sharing commitment letters for Provost, DFR, third party in-kind support & subrecipient sources • Fill out Cost Sharing Distribution Form and upload it into Coeus narrative 29 Responsibilities at Proposal Stage – Coeus Dept GCA • Completes cost sharing budget • Completes cost sharing distribution screen in Coeus proposal • Uploads Cost Sharing Commitment Form in Coeus narrative • For Provost, DFR, third party in-kind support or subrecipient sources, uploads Commitment letters into Coeus narrative • Reviews cost sharing 30 Awards Pre- and Post-Prime Similarities & Differences 31 Award Pre-Prime New award with cost sharing (since summer 2010) Award set up in Coeus Created child account for the cost sharing - Fund 30 “Internal Cost Sharing” sponsor for the Fund 30 32 Award Commitment Pre-Prime Cost sharing commitment for the length of the entire award Cost sharing type (not budget item) Year Source of the cost sharing (7 digit PG # or 670 if sponsor allowed F&A or Unrecovered F&A) Destination - Fund 30 Amount Comments Commitment printed on the NOA 33 Pre-Prime NOA 34 Award Budget Pre-Prime No cost sharing budgets were ever entered in Coeus Money and End Dates tab was for sponsor funding only Cost sharing expenses tracked off line 35 New Award Post-Prime New award with cost sharing since 7/1/14 Award set up in PS Grants A separate project is not created for cost sharing. Why not? Sponsor budget and cost sharing budget can be included in one PS project budget One more Chartstring to remember Reports in IW would have to be run twice Once to see the sponsor’s dollars and/or budget Once to see the cost sharing dollars and/or budget 36 New Award Post-Prime Both the cost sharing commitment and cost sharing budget for the entire length of the award are entered in PS Grants Regardless Cost Sharing Commitment Types by Fiscal Year, source Dept, Fund, amount Cost Sharing Budget Budget Not items by Dept, Fund, amount by year Cost Sharing Commitment and Cost Sharing Budget Appear of how the sponsor funds award on the NOA, and other IW reports Charging is done to the Cost Sharing Chartstring 37 Cost Sharing Process at the Award Stage If the cost sharing commitment changed between proposal and award, the Dept must submit the updated commitment form to the GCA Otherwise the cost sharing commitment form uploaded to Coeus proposal is ok Dept fills out and submits Cost Sharing Budget Form to the GCA GCA reviews Commitment and Budget Forms Award Specialist enters the commitment and budget into PS Grants The commitment and budget prints on the NOA NOA is sent to Dept, PI, SRA 38 New Award Post-Prime Rules Amounts Commitment and budget reflect all years of cost sharing, regardless of how the sponsor funds the award Fund Fund is the always the same for the commitment and the budget Dept Commitment What Dept is the source of the cost sharing about Dept for budget? 39 New Award Post-Prime Rules Each award has at least one project, and each project has a “project owning dept” Could be Dept’s Main Dept # (ends in 00) 23000: Could APC - Applied & Comp Math be subdept in Dept hierarchy 25402: ELE – Research 26021: WWS - Ctr Res Chld Welbng 25807: PSM - MIRTHE Center 40 New Award Post-Prime Rules Cost sharing budget Dept is the project owning dept, and cost sharing dollars are moved by Assignment Journal from the source to the project owning Dept, Project, and Activity except: Faculty AY salary & benefits are not moved Dept # MUST be the Contributing Dept’s Main # (ends in 00) since it is linked to the A0000 teaching budget, which cannot be reallocated to a sub-dept Dept might not be the project owning dept Fund is A0000 AR Tuition is not moved Dept # is the project owning dept Fund is A0000 41 New Award Post-Prime Rules Subrecipient, Third Party In-Kind Support, F&A and Unrecovered F&A appear in the commitment but not in the budget (tracked offline) Why not? There is no Dept or Fund # for them 42 Commitment/Budget Dept/Fund chart Source Budget Dept** Provost Science Funds Commitment Dept* 51005 Project Owning Dept Commitment & Budget Fund A0003 SEAS Science Funds 25000 Project Owning Dept A0003 DFR 51700 Project Owning Dept AR Tuition 40000 Project Owning Dept Commitment and budget Fund should match A0000 Faculty AY Salary & Benefits Contributing Dept’s Main # (ends in 00) Blank on Form (Proposal Lead Unit # in Coeus) Blank on Form (51701 in Coeus) Contributing Dept’s Main A0000 # (ends in 00) Subrecipient Third Party In-Kind Support F&A Unrecovered F&A Not included in PS Blank commitment Budget (Tracked offline) Not included in budget Not included in PS Blank commitment Budget (Tracked offline) Not included in budget *Coeus Cost Sharing Distribution, Commitment Form, NOA Commitment **Budget Form, NOA Cost Sharing Budget 43 Multiple Depts Contributing Example: Physics and Chemistry have cost sharing on Chemistry’s award, and they are each contributing cost sharing from their main dept. The project dept is chemistry, 23500. Source examples Commitment Dept Budget Dept Budget Fund 23800-Physics 23800 23500 Same as committed 23500-Chemistry 23500 23500 Same as committed 44 Main dept & subdepts in hierarchy are contributing cost sharing Example: PNI’s main dept 24400 and one of its subdepts 24407 are contributing cost sharing to a project. The project owning dept 24415 PNI-Real-Time Imaging. Source examples Commitment Budget Dept Dept Budget Fund 24400 PNI – Main Dept 24400 24415 Same as committed 24407 PNI – Scully Center 24407 24415 Same as committed 45 AR Tuition Example: The project owning dept is 23307 – MOLResearch/Teaching Source Commitment Budget Dept Commitment & Dept Budget Fund AR Tuition 40000 23307 A0000 46 Faculty Academic Year S&B Electrical Engineering has a research subunit; all their project owning depts are 25402– ELE-Research Faculty AY Salary & Benefits must be the main (“ends in 00”) dept level and cannot be moved. In this example, the Budget Dept is not the project owning dept Source Commitment & Budget Dept Commitment & Budget Fund Faculty Academic Year Salary & Benefits 25400 A0000 47 Faculty Academic Year S&B Multiple Depts MAE 25100 and CEE 25200 are contributing cost sharing Project owned by 25204 – CEE-Research In this example, the Budget Dept is not the project owning dept Source Commitment & Commitment & Budget Dept Budget Fund Faculty Academic Year 25100 S&B– MAE A0000 Faculty Academic Year 25200 S&B– CEE A0000 48 Example: Award Proposal is in 23300-Molecular Biology Award is in a subdept: 23307-MOL Research Award covers two Fiscal Years 49 Example: Commitment Form 50 Example: NOA Cost Sharing Commitment 51 52 Example: Budget Form If "Faculty Academic Year S&B" or “Non-Faculty S&B" is selected on commitment form, the salary and benefits should be broken into two lines in the budget form: the appropriate salary line and a separate benefits line. 53 Example: NOA Cost Sharing Budget 54 55 Cost Sharing Process After the award is set up in PS Grants, the NOA is sent by the Award Specialist to the Dept, SRA and the PI 56 Converted Awards Cost Sharing Commitments & Budgets 57 Converted Awards CS Commitments Commitments for all converted awards were manually copied from Coeus to PS Active and Closed Status Commitments are for the entire length of the award 43 awards were converted that had Fund 30 child accounts 16 awards were converted that had cost sharing from Fund 20’s (pre-Fund 30 days) 58 Converted Award CS Budgets Budgets are for Fund 30’s only Budgets for Fund 20’s (prior to Fund 30’s) tracked offline like they were pre- Prime Converted award status must be Accepted Cost sharing budgets were not added to Closed awards Was any cost sharing money moved before 6/30/14? If yes, SRA provided the budgets for money that was previously moved If no, GCAs reached out to depts to get cost sharing budgets, or Grants Manager sent the budgets to ORPA. Award Specialists entered the cost sharing budgets into PS Grants. 59 Converted Awards & Fund Fund A0016 is for converted awards that had cost sharing dollars moved before 6/30/14 This is because the true source of the cost sharing dollars cannot be traced If cost sharing dollars are moved after 6/30/14 for a converted award, Fund A0016 cannot be used. Fund A0016 cannot be used for any new awards 60 Unresolved converted award situations What if some but not all of the money was moved for an award prior to 6/30/14? Then we do not have the cost sharing budget for all award years Depts will need to move the cost sharing dollars for the remainder following the process for new awards Note: Fund A0016 is not used for moving funding after 6/30/14, even for converted awards 61 Data cleanup for Active Converted Fund 30’s and new awards set up after 7/1/14 Adding cost sharing budget for entire award, regardless of how sponsor funds the award Verifying Dept & Fund are correct for Commitment & Budget 62 Assignment Journals 63 Assignment Journals - Roles & Responsibilities Key Roles Serve as the primary mechanism for funding cost share commitments Provide visibility for source depts. to monitor fund balances for tracking and reporting purposes Safeguards any restrictions associated with a particular fund See Appendix A for more information about assignment journals 64 Assignment Journals - Key Responsibilities Source Depts. are responsible for initiating assignment journals to the project owning department upon receipt of the NOA Source Depts. may initiate assignment journals for the entire cost share amount up front or on an incremental basis Project Owning Depts. are responsible for informing the Source Depts. to initiate the assignment journals upon receipt of the NOA ORPA is responsible for initiating assignment journals for Dean for Research (DFR) and Provost Science Funds Example: From Source Dept. MAE (25100) to Project Owning Dept. EE-Research (25402) 65 Assignment Journals – When are they required? Appears in Budget? Requires Assignment Journal? Faculty AY Salary & Benefits Yes No AR Tuition committed as CS Yes No Subrecipient No No Third Party In-Kind Support No No F&A No No Unrecovered F&A No No Anything else? Yes Yes Cost Sharing Type *Important: Assignment journals are not applicable to Labor Accounting Distributions for Faculty AY Salary and AR Tuition cost share commitments See Appendix A for more information about assignment journals 66 Charging & Managing Cost Sharing 67 Charging & Managing Cost Share Step 1: Identify Your Funding Sources & Amounts Use NOA to identify cost share funding sources & chartstrings: External Dept. Sources (via Assignment Journals, ex. A0003) Internal Dept. Sources (Charge source directly or Assignment Journals ex. A0000) Converted Fund 30s (via A0016) 68 Charging & Managing Cost Share Step 2: Develop a Spending Plan Leverage the NOA which provides all cost share chartstrings Develop internal practices for charging cost share expenditures when multiple chartstrings are involved. Factors to Consider: Spend down the converted cost share fund A0016 If feasible, charge against one chartstring at a time Be aware if a chartstring has a specific purpose (e.g. equipment only) Remember if funding is being provided at different time periods Reminder: Cost share expenditures for AR Tuition and Faculty AY Salary are automatically processed via Labor Accounting once in effect. 69 Charging & Managing Cost Share Step 3: Monitor Your Balances – Funds via Assignment Journal FIN016 – Transaction Extract Report (Financial Management Folder) Key Report Elements: Data is by Fiscal Year and not Inception to Date Cost share activity is always included (No option to include or exclude) Includes Revenue from Assignment Journals (4802) Can run by Dept., Fund, Account, Program and Project Excludes A0016 converted balances, but includes expenditures Allows for easier manipulation of data No subtotals Converts easily to excel format for sorting and filtering Run on a periodic basis to monitor available balances on cost share funds 70 Charging & Managing Cost Share Step 3: Monitor Your Balances – Funds via Assignment Journal EXAMPLE - FIN016 – Transaction Extract Report – Downloaded in Excel Format Run report by Project only to identify all revenue and expenses. View Report in Excel format to allow sorting and filtering capabilities Filter OUT all G Fund chartstrings to isolate the cost share activities Sort and total by assignment journal and expenses to determine available balance. You must do this analysis for each Fiscal Year (FY15 and FY16). Perform this analysis periodically to monitor revenue and ensure all cost share commitments have been fully funded from the various Source Depts. Perform this analysis periodically to monitor expenses to avoid undercharging or overcharging the cost share project 71 Charging & Managing Cost Share Step 4: Monitor Your Balances – A0016 Converted Cost Share Funds 1. Retrieve converted balance from the former SPR SPR Balance as of 6/30/14 $100,000 2. Use the FIN016 Transaction Extract Report to run by A0016 Fund to identify expenses for each fiscal year – always beginning with FY15 FY15 and FY16 Expenses $75,000 3. Subtract the total expenses from the total balance to determine the current available balance Converted Balance $100,000 Less Expenses -$ 75,000 Available Balance $ 25,000 72 Charging & Managing Cost Share Step 5: Monitor Budget vs. Actuals Review your Award and Project Summary Reports to monitor your overall expenditures in comparison to the approved cost share budget Pay attention to AR Tuition and Faculty AY Salary expenditures since they are processed in Labor Accounting. Work with your ORPA GCA if there are concerns about meeting your cost share obligations Remember that certain cost share commitments are tracked offline: Subrecipient Third party In-kind Facilities & Administration Costs (F&A) Unrecovered F&A 73 Charging Cost Share – Chartstring Requirements (for non-Labor Accounting Distributions) Cost Share Chartstring (Ex. Capital Equipment over $5k) Department Fund = Project Owning Dept. (Ex. 24415 – PNI) = Non G Fund source (Ex. E2345) Account = expense code (Ex. 6551) Program = N/A Project = XXXXXXXX (Ex. 10001234) Activity = 10X (Ex. 101) 74 Charging Cost Share – Chartstring Requirements (Labor Accounting Distributions – Faculty AY Salary) Cost Share Chartstring: Department Fund = Main unit (ends in 00) = A0000 Account = one of the Faculty Salary Codes Program = N/A Project = XXXXXXXX Activity = 10X 75 Charging Cost Share- Chartstring Requirements (Labor Accounting Distributions – AR Tuition) The Graduate School provides 50% AR tuition subsidy on sponsored research awards that allow full F&A costs – which makes it an ideal option for cost sharing purposes. Fifty percent of AR tuition costs will automatically default as university commitment for eligible students when distributions are approved in Labor Accounting. Two rows are automatically system generated in Labor Accounting after the distribution to the G fund and Project is created The first line of the screenshot is initiated by the department and creates the distribution for AR tuition on the G fund and project The LA system creates the second distribution line to cost share 50% of the AR tuition by defaulting to A0000 fund/AC390 program and is denoted by the cost share symbol The LA system also creates the third line to remove 50% of the AR tuition distribution from the G fund and is also denoted by the cost share symbol 76 Charging Cost Share – Chartstring Requirements (Labor Accounting Distributions – AR Tuition) Cost Share Chartstring (System generated): Department = Project Owning Dept. (LA defaults to same Dept. in G fund chartstring) Fund = A0000 Account = 5602 (Assistants in Research Tuition) Program = AC390 (LA defaults to this program code.) Project = XXXXXXXX Activity = 10X 77 Managing Cost Sharing – Manual Exclusions MANUAL EXCLUSION of expenses that automatically default and appear as cost share: Graduate student AR tuition subsidy - when not part of the cost share commitment must be manually excluded from your analysis. NIH Salary Cap overages are unallowable as cost share and must always be manually excluded SRA will also need to exclude these amounts when reporting cost share expenditures to awarding agencies 78 Reports 79 Cost Sharing on Sponsored Research Reports 80 Reports with “Include Cost Share” box Default is set to not include cost sharing for these reports: Sponsored Award Summary Sponsored Project Summary Sponsored Project Detail 81 FIN021 – Sponsored Award Summary 82 FIN022 – Sponsored Project Summary 83 FIN050 - Sponsored Project Detail 84 FIN027 – Cost Share Commitments 85 FIN025 - NOA 86 Responsibilities at Award Stage Department • Revises Cost Sharing Commitment Form if commitment changed between proposal and award stages • Completes Cost Sharing Budget form prior to award setup • After receiving NOA, initiates Assignment Journals as needed • If Dept does not move all funding up front, moves cost sharing on periodic basis • Charges and manages cost sharing ORPA • GCA Reviews • Award Specialist adds cost sharing commitment and budget to PS Grants • Administrative Assistant initiates assignment journals for Provost and DFR funds • If Provost or DFR does not move all funding up front, Administrative Assistant moves cost sharing on periodic basis SRA • Validates cost share expenditures to ensure allowability and compliance with federal regulations, award terms and conditions and university policies. • Ensures cost share commitment was fully met for financial reporting to awarding agencies. 87 Appendix A Creating & Searching for Assignment Journals 88 How to create Assignment Journals 89 90 91 Assignment Journals keep the same Fund Assignment Journals that are not approved by the end of the month are automatically deleted No Assignment Journal is needed for AR Tuition and Faculty AY Salary & Benefits 92 Assigning cost sharing to project owning dept (one dept to another dept) From 25100 – MAE to 25402 - ELE-Research (Project Owning Dept) 93 Assigning cost sharing to project owning dept (in same dept hierarchy) From 23100 - Astro to 23105 AST-Plasma Physics (Project Owning Dept) 94 How to search Assignment Journals 95 Example The list of assignment journals then appears at the bottom of the screen; click on each to see details. 96 Who initiates the assignment journals? Source Dept. to Project Owning Dept Initiates Assignment Journal From One Dept to Another Dept • From Physics to Chemistry Source Dept. From main Dept # to subdept # in the same hierarchy • From 24400 PNI-Princeton Neuro Inst. to 24415 PNI-RealTime Imaging Authorized Dept. Personnel From one subdept to another subdept in the same Dept hierarchy • From 24407 PNI-Scully Center to 24415 PNI-Real-Time Imaging Authorized Dept. Personnel SEAS Science Funds Source Dept. Provost Science Funds (A0003) ORPA (Robin) Dean For Research (DFR) ORPA (Robin) AR Tuition (A0000) Not Required Faculty AY Salary & Benefits (A0000) Not Required 97 The end 98