Chipotle and Panera Paper

advertisement

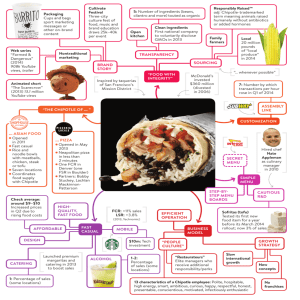

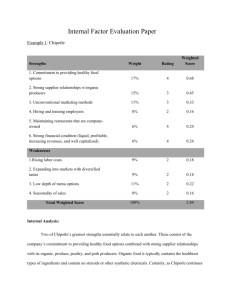

Section 1: Chipotle and Panera are the leaders of the rapidly growing fast casual restaurant segment. The fast casual segment focuses on fresh food, which is why many customers choose to eat there, although restaurants in the industry typically have a higher price point and appeal primarily to whites, Hispanics, males, and young working professionals. However, Panera has an advantage in terms of their brand recognition and overall profitability in the segment, as well as the broad appeal that their menu has. Panera does well with white people of all ages, but struggles in with minority consumers. By contrast, Chipotle does well with minority customers and young professionals, but struggles with whites and older and younger customers. Additionally, a majority of Chipotle’s customers enjoy ethnic food, nearly twice the rate of those visiting other fast casual restaurants. Additionally, their struggle with consumers of certain ages could be linked back to their restaurant style, which encourages a quick stay and isn’t built for comfort. Both are continuing to grow, but Panera uses product innovation to frequently update their menu, while Chipotle continues to live by one of their positioning statements: “A Few Things, A Thousand Ways.” In general, both Chipotle and Panera have room to continue to expand, but Chipotle must work to make their restaurant appeal to a broader range of people to amass the following that Panera has. To do this, Chipotle should create geographic menu items for more conservative customers, a restaurant model with a more comfortable seating environment for families and older Americans, and a bigger budget marketing strategy focusing on the people they want to attract to Chipotle instead of social responsibility. Section 2: Key Aspects of Fast Casual Panera and Chipotle are competitors in the fast casual restaurant segment, where customers expect high quality food in an efficient manner. Panera has both the highest name recognition and the highest usage frequency in the segment.1 Although chains in the industry vary in the types of cuisines that they sell, most of the restaurants lack table service and a focus on freshness, flavor, and healthy food.1 The taste, quality, and freshness of the meal are why 94 percent of diners choose fast casual restaurants.1 Fast casual restaurants focus heavily on food quality, while working to balance that with prices.1 Higher meal quality, along with healthier food, defines segment That focus on food quality is reflected in the marketing done by restaurant in the segment, with “fresh,” followed by “real,” “artisan,” and “flavor” as the most frequently used words.1 Besides providing a fresh meal, fast casual restaurants also seek to appeal to the health conscious. Because the United States has an obesity rate of nearly 34 percent for adults, healthy alternatives are poised to become increasingly popular.2 70 percent of adults who visit fast casual restaurant restaurants believe that the food is healthier, creating a popular perception that appeals to many consumers.1 To supplement this reputation, fast casual restaurants have led the field in providing nutritional information on their food, a regulation from the Patient Protection and Affordable Care Act in 2010.1 Mintel Group Ltd. (2010, August). Fast casual restaurant . Retrieved from http://academic.mintel.com/sinatra/oxygen_academic/search_results/show&/display/id=521488 2 CDC (2011, July 21). US obesity trends . Retrieved from http://www.cdc.gov/obesity/data/trends.html 1 1 Perception of prices has more effect than recession Meals tend to cost between five and twelve dollars, more than fast food, but less than casual dining restaurants, putting these restaurants in a unique position to appeal to a broad sector of income levels.1 The industry as a whole has increased in sales by 29 percent from 2006 to 2010.1 As a result, the recession and the subsequent decrease in disposable income hasn’t impacted fast casual restaurants as drastically. The chains provide value conscious consumers high quality food at a reasonable price, which is what consumers search for in economically troubling times. Still, those with a higher income are more likely to have utilized a fast casual restaurant, showing that these restaurants have to work to develop brand loyalty from people of all income levels.1 26 percent of people that have not used a fast casual restaurant believe it is too expensive, an idea that, through marketing and offering lower cost menu items, can be changed. 1 Hispanics, women offer possibilities for future growth For the future, demographics are working in favor of the fast casual industry, as the growing adult population has a taste for convenient, but high quality food.1 However, only 38 percent of adults have visited a fast casual restaurant within the past month, less than the 78 percent that have been to a fast food restaurant, which shows that the restaurants within this industry are likely in the growth strage.1 Customers tend to be between 25 and 34, or the age of young professionals.1 Knowing where the industry’s base is, these restaurants can work to appeal to baby boomers, who are on the verge of retiring and may enjoy the better food for a good value concept that fast casual restaurants present, as well as working families (Generation X and Generation Y), who want to feed their children healthy food without breaking the bank. Additionally, whites and Hispanics are almost equally likely to have used a fast casual restaurant in the past month (58 and 59 percent, respectively).1 With a booming Hispanic population in the United States, this is a key market to target through multicultural marketing and offering options that appeal to the Hispanic consumer, like spicier meals. Still, only 43 percent of African Americans have visited a fast casual restaurant in the past month, making that an excellent market to address.1 The market in general has more male consumers; therefore, when trying to attract women to come to fast casual chains, brands must be cautious, as women when surveyed are calorie conscious, as well as less likely to request spicy food.1 Although there is a focus on quality in the fast casual industry, over the past two years, there has been an increased demand by consumers for faster service and convenience.1 Technology can make this easier; restaurants like Chipotle allow for mobile and online ordering. Section 3: Chipotle Positions, Targets with Integrity and Choice 2 The brand is a leader in the fast casual chain, behind only Panera in usage rates.1 Chipotle attracts an overwhelming crowd of those of the 18-44 crowd, as well as a higher percentage of African-Americans, Asians, and Hispanics. Age 18-24 25-34 35-44 45-54 55-63 65+ Index Index 222 131 190 98 119 91 64 98 41 106 49 97 Races Index Index White 88 117 African-American 145 16 Asian 256 56 Hispanic 104 56 Figure 1 and 2: Chipotle does well with younger and minority customers, with areas of growth in terms of older consumers and whites. Their areas of strength are those of Panera’s weakness. However, in terms of age, Panera attracts a broader group of consumers than Chipotle. From Simmons Choice. However, compared with Panera, Chipotle has a limited menu, allowing consumers to customize their meal, leading to one of their positioning statements: A Few Things, Thousands of Ways. The meal includes fillings for variants of burritos, ranging in price from six to eight dollars. However, the food served is different than most of the sandwich establishments that Chipotle is competing against, making product differentiation a core part of their strategy. Additionally, they use differential positioning, working as an alternative to the local delis and sandwich based locations that dominate the fast casual industry.1 This idea of having a limited menu allows Chipotle to only provide two meals a day, and not be appealing as a snack option, restricting their profits. Additionally, there is always the concern that Chipotle’s specific menu won’t work in every market that it is introduced to. The second key positioning idea is Food with Integrity, a statement addressing social responsibility which has led to all pork used being naturally raised and 40 percent of beans organically grown.3 Chipotle Expands Market with New Marketing, Distribution Centers The highest penetration of Chipotle’s stores are in California, Colorado, Ohio, and Texas, with three international stores.2 The brand has been focused on market development because of their growth strategy.4 The average location sits 55 people and is 2,600 square feet.2 Chipotle is testing additional stores that are smaller and more efficient, meant for areas with fewer consumers.5 A store is planned to be opened in D.C. applying Chipotle’s Food with Integrity concept to Asian food.3 Packaged Facts. Packaged Facts , (2010). Lunch trends in the u.s. foodservice market. Rockville, MD: Chipotle. (2011). 2010 annual report and proxy statement. Retrieved from http://phx.corporateir.net/External.File?item=UGFyZW50SUQ9NDIxMjg4fENoaWxkSUQ9NDM4OTQzfFR5cGU9MQ==&t=1 5 Chipotle mexican grill inc in consumer foodservice . (2011, August 10). Retrieved from http://www.portal.euromonitor.com/Portal/Pages/Analysis/AnalysisPage.aspx 3 4 3 Their promotion relies on word of mouth, giving up their advertising agency, the fourth in five years, in 2010, believing that their food itself is the message.6 The brand uses billboards, mobile, online, transit, and radio ads to a degree, tending to focus on, in fast casual fashion, fresh ingredients, as well as their socially responsible practices.4 Chipotle aims to release loyalty cards next year, and will be their form of sales promotion. Direct marketing is done online with emails and social media applications. Panera Utilizes Growth, Menu Development Strategy Panera has the highest patronage rate in the sector, and is financially the most successful.2 White consumers making over $75,000 are most likely to eat at Panera.2 Those using the restaurant tend to eat healthier foods (71 percent) and enjoy trying new types of food (61 percent).2 The restaurant has both market development and product development strategies, rapidly expanding the number of stores, but also constantly adding additional products to their menu. Panera’s strategy has been menu development, high quality operations, and emphasis on fresh food.1 The brand positions itself as offering similar goods to a full service restaurant, while being priced and timed closer to fast food.1 Panera’s Extensive Menu and Fresh Foods Benefit Company In regards to their menu, Panera has a wide variety of products, from soups, salads, and sandwiches to breakfast items, pastries, and specialty drinks. The company has began to introduce more gourmet sandwiches with a higher price point, including meat like salmon and steak, as well as introducing menu items relating to a season or holiday through a new product development strategy. Panera has even begun to expand outside of the bakery-café concept by selling a limited number of soups at Costco stores.2 Their meals range in price from approximately five to nine dollars. Their places in which they distribute their dishes are 706 company owned restaurants, and 790 franchised establishments.7 The company makes the most money from what they sell in company owned restaurant (85.7 percent for the year ending December 2010). To do this, the chain has made their restaurants into a place where people can spend time after their meals, with fireplaces, couches, and WiFi. Their advertising efforts have grown significantly, as the company recently launched a $40 million advertising campaign in June 2011, including TV in thirty markets, radio, and social media elements, its most expansive campaign to date.8 The focus is on the brand, as oppose to the focus on freshness that has been a staple of past advertising. In the past, Panera has used primarily billboards and radio.8 Public relations plays a role, especially in terms of their pay what one what can stores.9 Sales promotion is only used in conjunction with the loyalty cards, and Panera uses direct marketing through their emails to subscribers. Section 4: Recommendations Chipotle will need to make changes to their traditional business model and menu to further expand and reach new consumers. Although fast casual is a growing segment and Chipotle is a leader, the broad appeal of Panera means that Chipotle needs to employ further strategies to reach consumers including a revamped marketing approach that diversifies itself from the rest of the fast casual segment, a restaurant model that Edwards , J. (2010, September 30).So crazy it just might work: Chipotle axes all its advertising. Retrieved from http://www.bnet.com/blog/advertisingbusiness/so-crazy-it-just-might-work-chipotle-axes-all-its-advertising/6045 7 Panera Bread Company. (18 April 2011). 2010 annual report to stockholder. Retrieved from http://www.panerabread.com/pdf/ar-2010.pdf> 8 Morrison, M. (2011, June 13).Panera launches first major tv campaign. Retrieved from http://adage.com/article/news/panera-launches-major-tvcampaign/228163/ 6 Skidmore, S. (2011, January 12).Panera opens pay-what-you-wish location in oregon. Retrieved from http://abcnews.go.com/Business/wireStory?id=12600397 9 4 encourages people to stay and relax for longer at the restaurant, and an extended menu that appeals to geographic areas, creating specific menus that with food options that appeal to customers in the area that may be wary of trying a more ethnic meal. Marketing People and Combinations, Not Freshness As mentioned earlier, fast casual firms typically market their ingredients, making the segment one that is thought of as having healthy, fresh foods. Chipotle should focus less on the quality of food, as that is implied for fast casual restaurants, and more on the options that people have in creating their meals.1 Panera’s current marketing campaign is also diversifying, focusing on the brand of Panera and the intangible benefits one receives from the restaurant, like the atmosphere that is provided.8 Chipotle should follow the idea of moving away from showing their meals. To do so, they can show different consumers with their favorite Chipotle meal, explaining what they put in their burrito. Conversely, an alternative ad could have people explaining why they go to Chipotle, with their combination of choice visible in the advertisement. Chipotle also plays conservatively with their promotional techniques, relying heavily on buzz marketing. While brand loyalist that are willing to spread the word are fantastic to have, to maintain such an extensive growth strategy that Chipotle has been engaging in, their marketing campaign must keep us with the pace.4 Additionally, advertising should focus on older Americans, whites, and families to encourage those customers to come to Chipotle, as these are sectors in which Chipotle struggles (Figures 1, 2). To accomplish this Chipotle could look into placing ads in web and print channels that appeal to these their weaker consumer base, as well as featuring relatable people in their ads. Broader television and radio commercials can be applied as well, utilizing what was discussed in the above paragraph, with a variety of consumers of all types showing their favorite burrito and saying or having listed on the screen what they put into it. Additionally, considering Chipotle is a good food to eat during a lunch hours, they could consider putting advertisements in public transportation or on billboards specifically for business consumers to see. To reach families with children that may want to give their children a quick and healthy meal on the way to practice, Chipotle could consider sponsoring local tournaments in areas with a large number of families and doing advertisements in family magazines. Essentially, with the number of restaurants that Chipotle has, they should consider using a more diverse and bigger budget strategy to reach potential customers. This strategy strays far from what Chipotle typically does, and requires a makeover of their marketing efforts in terms of both materials and funding. As social responsibility is crucial to the brand, it might be difficult to convince executives to make the switch to their other positioning statement as their marketing focus. Geographic Menu Expansions to Appeal to Conservative Consumers Only 35 percent of those that eat at fast casual restaurants dine there for the ethnic food options.1 However, data has also found that 62 percent of those that dine at Chipotle enjoy trying ethnic food.2 To appeal to those more conservative consumers, Chipotle should create geographically specific menu items. To expand the menu rapidly the way that Panera does would go against one of their key positioning statements. However, by adding accessories to the meals, Chipotle would be able to attract consumers by offering menu items that seem less foreign. Instead of them trying an entirely new dish, they would be eating familiar items in a new way. For example, in coastal areas, Chipotle may want to consider offering seafood as a meat option. In the southwest, the brand may consider making their salsa spicier. These slight variations to 5 the menu can do wonders in terms of diversifying the restaurant from others. It expands their menu without moving away from the positioning statement, attracting new consumers that want more familiarity with their menu items. Conversely, those who like to experiment will be able to change up their usual order with the new options. Besides attracting consumers with a basic food that is an important part of their diet, it also shows that Chipotle thinks on a local level. The company has taken the time to customize the menu to geographic food preferences, showing its commitment to remain local even though it is rapidly growing. The best peer to peer marketing can come from this because it shows Chipotle’s commitment to satisfying its consumers. It would work best as a marketing ploy featured in local advertisements within the community. However, this approach can get expensive in terms of adding additional sides, especially in find adequate suppliers because of Chipotle’s high standards for their meats and sides, and it may not appeal to all consumers in the given area. Another issue arises in terms of how to split up geographic areas, as well as how to determine what should be used in each market. Comfortable Restaurant Models to Encourage Longer Stays, More Purchases Chipotle’s restaurant models are designed for efficiency, not comfort for the consumers. From the new restaurant model that is being unveiled to their current setups, with the hard silver benches and stark wood, the restaurant stands in contrast to Panera’s model of couches, fireplaces, and WiFi encouraging customers to say for longer periods of time and bring groups of people with them for a meal, rather than a quick bit to eat. Figure 3: The interior of a Chipotle restaurant. Evident is the hard chairs and silver barriers around, making for a colder and less inviting set up than other restaurants, especially Panera in the fast casual segment and casual dining restaurants. From Chipotle’s About Us Page: http://www.chipotle.com/en-US/company/about_us.aspx Figure 4: The interior of a Chipotle restaurant in St. Louis, MO. Used as a contrast to the image of Chipotle’s dining room, there is evidently an emphasis on comfort here, as well as a large amount of space. Other spaces include fireplaces and couches (not able to be seen in this Two keys areas of weakness for Chipotle are in their ability to attract children under 12 and teenagers 10-17, photograph). or bringing in families, as well as baby boomers in the 45+ age group (see Figures 1 and 5). By creating an From Panera Bread’s Media Page: 6 http://www.panerabread.com/about/press/photos.php environment that encourages consumers taking time to stay and eat as opposed to eating quickly and leaving as those coming alone and those coming with co-workers and other adults may do, as well as appealing to the groups that typically require larger spaces and more comfortable seating arrangements. Alone Other Adults Children Under 12 Teens 10-17 Friends/Coworkers Chipotle Panera Index Index 150 143 137 122 68 92 83 113 164 131 Figure 5: The chart compares usage for Chipotle and Panera. Panera does well with all segments, but Chipotle lags with much younger customers. From Simmons Choice. Older consumers fear being rushed at a fast casual restaurant, and prefer to take their time while eating.1 Much of this conceived notion could be tied to how the restaurant is styled, with a model not encouraging consumers to take their time as they eat, but rather, eat and leave quickly. To appeal to families, Chipotle has included a children’s menu at certain locations, including quesadillas and fewer tacos, something that is a staple at every Panera restaurant.1 Still, these attempts are very limited, and should be encouraged to appeal to families. By creating an environment for consumers to stay longer, Chipotle will need to expand their menu to include group dishes, which also encourages consumers to purchase more food as they stay longer. This could include appetizers like nachos or dessert options for consumers, also addressing a niche snack market that Chipotle is unable to address with their current menu.2 This approach could get expensive in terms of building the new establishments, and it takes a significant amount of market research to determine the best model. However, this model is one that fits well into the growth strategy of Chipotle, and should be considered nothing more than an alternative model for locations with higher concentrations of families or older Americans. It would, for example, not be necessary for areas with a high concentration of workers. 7