Internal Control - Glendale Community College

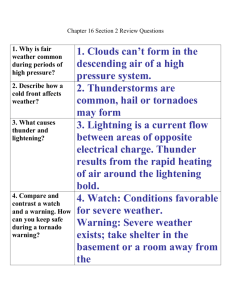

advertisement

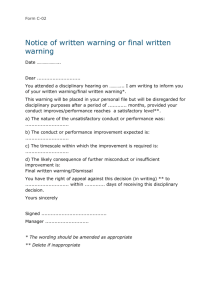

Internal Controls “There is no kind of dishonesty into which otherwise good people more easily and frequently fall than that of defrauding the government.” Benjamin Franklin How Does Fraud Occur? Poor internal controls – Lack of proper authorizations – No separation of authorization, custody, and record keeping – No independent checks on performance – Lack of clear lines of authority – Inadequate documentation Management override of internal controls Collusion between employees and 3rd parties Collusion between employees and management Limited, unclear, or no policies and procedures Poor or non-existent ethics and/or policy “We all can learn from audit standards” Statement on Auditing Standards No. 99 Exercise professional skepticism Conduct brainstorming Identify and assess risks Communicate Challenges We Face 74% of us believe our ethics are higher than those of our peers 83% of us say that at least one-half of the people we know would list us as one of the most ethical people they know 92% of us are satisfied with our ethics and character Would you commit a felony to pay for needed surgery for your child? Yes – 97 percent Would you commit a felony to pay for needed surgery for your spouse? Yes – 42 percent “In the real world, successful people do what they have to do to win, even if others consider it cheating.” We do what we must to win 200 Olympians 1. Performance enhancing drug, no one will find out, no side affects, and win all races next 5 years 195 2. Performance enhancing drug, win all races next 5 years, then die from side affects, but no one will find out 100 Future Work Force (College) 11% reported cheating in 1963 49% reported cheating in 1993 75% reported cheating in 2003, 2005, 2006, 2007 50% in graduate school in 2006 Trust Is Not A Control Former Director, Federal Emergency Management Agency Assistant City Manager, Emergency Services Division Assistant to the City Manager Trust Is Not A Control Former Deputy Chief Information Officer, U.S. Department of Homeland Security Bachelor’s Degree (1993), Master’s Degree (1995), and Doctorate (2000) Hamilton University Unaccredited fee-for-degree “distance learning” center (“Diploma Mill”) Bachelor’s Degree (2000), Master’s Degree (2000), and Doctorate (2001) Reasons We Miss Fraud Reasons We Miss Fraud Personalities Pressure Face Value Auditor v. Investigator Avoid Conflict Business Operations Checklists The “Right” People Education Warning Signs Personalities Clients’ strong personalities create difficulties Taken in by friendly personalities Need to be liked by the client Personalities Auditors requested to see a sampling of 400 invoices for ZZZZ Best work. Of those 400, the auditors would select 20. ZZZZ Best provided 20 fake invoices. Auditors asked to see 400 original invoices – CFO protested and auditors backed down. Face Value Accept answers on face value Lack of skepticism – never taught and not in personality Face Value Crazy Eddie’s – one of the 20th century’s most infamous financial statement frauds Employees helped auditors with inventory counts 10 equals 25 Watch What They Say “The balance sheet is strong.” “The third quarter is looking great.” “Our stock is an incredible bargain at current prices.” -- CEO Ken Lay, Enron Watch What They Say “We are confident in our marks and the reasonableness of our valuation methods.” “We have a high degree of certainty in what we have booked to date.” -- CEO Martin Sullivan, AIG Watch What They Say “Our liquidity and balance sheet are strong.” “We don’t see any pressure on our liquidity, let alone a liquidity crisis.” -- CEO Alan Schwartz, Bear Stearns Watch What They Say “We are on the right track to put these last two quarters behind us.” -- CEO Richard Fuld, Lehman Brothers “Our liquidity pool also remains strong at $42 billion.” -- CFO Ian Lowitt, Lehman Brothers Watch What They Say “In today’s regulatory environment, it’s virtually impossible to violate rules.” -- Bernard Madoff Oct. 20, 2007 Avoid Conflict “People are just too damn lazy.” -- ZZZZ Best’s former CFO Rather than drive out to confirm an address where ZZZZ Best was supposedly doing $45 million in business, the auditors would make a phone call and were satisfied. Checklists Use too many checklists – try to get them done versus understanding the questions Too narrow focused – don’t look to see if things make sense from a broader perspective Budget & task oriented Fraudsters Stay One Step Ahead Electric wheelchair $5,000 Billed at least 1,000 times ($5 million) for same wheelchair Checklists • Do you? • How? • Have you? • Describe? • Can you? • What? • Are you? • Explain? Education Fraud and stupid can look just a like More of a mind-set Focus on exceptions, oddities, accounting irregularities, and patterns of conduct Education “No one ever asked.” -- Mark Morze, ZZZZ Best’s former CFO Education Does the company possess all of the licenses it needs to conduct the business it does? How does the company generate the 30%, 40%, 50%, and 60% profit margins that appear on its books? Why do the company’s bids for complicated, million-dollar projects fit on a single page? Education Why is the company constantly in need of additional cash? Why did the company waste $2 million on equipment it could have rented for 90% less? Can we (the auditors) speak to at least one satisfied customer? Education Why is business conducted only with cashier’s checks? How can the company’s revenues grow by 400% in 6 months, while the company’s general & administrative costs barely grow at all? Why aren’t any of the company’s vendors in the Yellow Pages? Education Why do the company’s estimates for project costs always equal— to the penny—the supply sheets from the vendors? Why are there no addresses on the work invoices? Where are all the government forms regarding permits, licenses, etc.? Education Where is all the paperwork on vendor deliveries? Could the auditors have a tour of one or two of the company’s warehouses or other facilities? Can the auditors speak with a few of the company’s vendors or subcontractors? If not, why not? The “Right” People Too much time on prior year testing & tick marks Spend too little time talking to the “right” people The “Right” People Chairman Chief Accounting Officer Chief Executive Officer Chief Compliance Officer Chief Operating Officer Chief Audit Executive Chief Financial Officer Chief Legal Officer The “Right” People Accounting Manager Payroll Manager A/P Manager H/R Manager Warehouse Foreman Q/A Manager Billing Manager Contracting Officer Why Warning Signs are Important? “The average fraud scheme lasted 24 months before it was detected.” -- ACFE 2008 Report to the Nation Professional Services Contract Effective Date Contract Amount Contract Price 09/12/04 $ 85,850 $ 85,850 Mod #1 11/22/04 $ 30,800 $116,650 Mod #2 04/08/05 $ 78,400 $195,050 Mod #3 09/12/05 $ 1,400 $196,450 Mod #4 09/30/05 $148,600 $345,050 Warning Signs Unexplained employee absences Refusal to produce records, files or documents Excessive overtime Missing documentation Warning Signs Payments to a vendor post office box No original source documents Lack of competitive bidding No exceptions or errors Warning Signs Significant life-style changes Refusal to take vacation Excessive movement of funds between accounts Single vendor Warning Signs Excessive or unjustified changes in accounting personnel Premature or excessive destruction of controlled documents Excessive cash transactions High rate of employee turnover Warning Signs Customer complaints Can’t talk to people (protection) Turning down promotions or transfers Improperly trained employees Warning Signs Delivery location not the office, plant or job site Invoices with minimal information Increase in purchasing inventory but no increase in sales Lack of physical security over assets / inventory Warning Signs Increase in scrap materials and reorders for same items Inventory that is slow to turnover Vendors that pick up payments Consistent cash flow problems Warning Signs Significantly outpace other companies in same industry Frequently change auditors, banks, and attorneys Dramatic changes in key ratios or ratios too good Excessive number of checking accounts Warning Signs Failure to reconcile bank statements or a conflict of duties on the part of performing reconciliations Accounts receivable grows substantially faster than sales Growth in accounts payable substantially exceeds revenue growth Warning Signs Majority of net income comes from one-time gains Operating expenses decline sharply relative to sales Company cash flows come primarily from assets sales, borrowings or equity offerings Change in accounting principles and estimates Warning Signs Numerous adjustments Key personnel going to work for vendors Lack of segregation of duties Inappropriate shipping costs Warning Signs (Accounts Payable) Recurring identical amounts from same vendor Multiple vendors with similar names in accounting system Multiple remittance addresses for same vendor Vendor addresses don’t agree with application Warning Signs (Accounts Payable) Sequential invoice numbers from same vendor Lack of segregation of duties: Process invoices & updates to vendor master file Check preparation & posting to vendor account Check preparation & mailing signed checks Warning Signs (Accounts Payable) Excessive credit adjustments to specific vendor Systematic pattern of adjustments for goods returned Paid invoices not properly canceled Unrestricted access to blank checks, signature plates, and checksigning equipment Warning Signs (Inventory/Production) Fluctuations in inventory accounts between months (e.g. debit balance one month, credit balance the next) Excessive inventory write-offs without documentation or approvals Unrestricted access to inventory storage areas Warning Signs (Inventory/Production) No segregation of duties: Receipt of inventory & issuing of materials Recording of inventory accounts & ordering materials Identification of obsolete & surplus materials and sale/disposal of such materials Warning Signs (Inventory/Production) No policy on identification, sale, and disposal of obsolete and surplus materials No policy on inventory levels to be maintained (i.e., minimums, maximums, reorder points) Lack of regular physical inventories by independent personnel Warning Signs (Inventory/Production) Consistent production overruns beyond sales demand and backlog orders Excessive production waste, spoilage, or other loss of raw materials Extended delay of good marked “for shipment” maintained within shipping area Warning Signs (Accounts Receivable) Lack of policies regarding write-offs No supervision or review of write-offs Duties of posting to accounts & receiving cash not segregated Warning Signs (Accounts Receivable) Frequent undocumented or unapproved adjustments, credits, and write-offs Dramatic increase in allowance for doubtful accounts Reluctance to reserve for or write off accounts receivable Warning Signs (Accounts Receivable) Accounts receivable increasing or decreasing in a way not in accord with changing sales figures Unexplained deterioration in collection cycle Warning Signs (Construction Projects) One company repeatedly wins contracts Competitors continually submit bids that are unreasonably high, late, or are disqualified An exclusive, consistent group of contractors bids on projects, and winning bidders appear to be on rotation basis or follow a particular pattern Warning Signs (Construction Projects) Bids submitted by contractors are vastly higher than on similar jobs by the same vendor Successful bidders subcontract work to competitors that submitted excessive, unreasonable bids for the same job Bid paperwork submitted by various vendors contains similarities or even identical items Warning Signs (Construction Projects) Bidders who are qualified and capable of bidding do not bid Winning vendor is always the last to bid Numerous or large dollar change orders Change Orders Estimate Low Bidder Actual Cost Claims $1,500,000 $860,000 $5,200,000 $15,000,000 Contractor tried to recover cost overruns by using inflated change orders: 134 change orders: Average contractor proposal: $50,000 Average negotiated amount: $15,000 Warning Signs (Construction Projects) Certain contractors always bid against each other or never bid against each other New vendors receive disproportionate number of winning bids Refusal to produce records, files or documents SEC Report of Investigation (“Madoff”) The SEC focused its investigation too narrowly. The SEC did not seek records from an independent third-party, but sought copies of such records from Madoff himself. The teams assembled were relatively inexperienced. There was insufficient planning for the examinations. No significant attempts made to analyze the numerous red flags. SEC Report of Investigation (“Madoff”) Even when Madoff’s answers were seemingly implausible, the SEC examiners accepted them at face value. The relatively inexperienced staff failed to appreciate the significance of the analysis in the complaint, and almost immediately expressed skepticism and disbelief. When Madoff provided evasive or contradictory answers to important questions in testimony, they simply accepted as plausible his explanations. They conducted their examination by simply asking Madoff about their concerns and accepting his answers. SEC Report of Investigation (“Madoff”) Madoff was the examiners primary contact and he carefully controlled to whom they spoke at the firm. Examiners had a real difficult time dealing with Madoff as he was described as growing increasingly agitated during the examination, and attempting to dictate to the examiners what to focus on in the examination and what documents they could review. Never verified Madoff’s purported trading with any independent third parties. • Madoff records indicated $2.5 billion in 100 equities – third party records showed less than $18 million worth of equities. SEC Report of Investigation (“Madoff”) Shortly after the Madoff Enforcement investigation was effectively concluded, the staff attorney of the investigation received the highest performance rating available at the SEC, in part, for her “ability to understand and analyze the complex issues of the Madoff investigation.” Fight Fraud – Who’s Responsible? Strong controls against fraud are the responsibility of everyone in the organization. All levels of staff, including management, should have a basic understanding of fraud and be aware of the red flags. Source: Managing the Business Risk of Fraud: A Practical Guide (sponsored by IIA, AICPA, and ACFE) Leverage Technology Vendors and employees with the same address (34 instances) Checks issued before invoice dates (45 instances) Vendors with no activity for a 2-year period (1,800 instances) Leverage Technology Checks with no payee addresses (130 instances) Sequential invoice numbers from the same vendors (1,000 instances) Multiple invoices from the same vendor on the same date (4,500 instances) Leverage Technology Missing check numbers (8,300 instances) Recurring identical amounts for the same vendors (630 instances, ranging from 2 to 78 instances) Checks processed on Saturdays or Sundays (2,100 instances) Contact Information Don Mullinax Shareholder Forensic/Strategic Solutions, PC 2272 Colorado Blvd., Suite 1347 Los Angeles, CA 90041 213-617-1301 (office) 626-372-3657 (cell) don@forensicstrategic.com