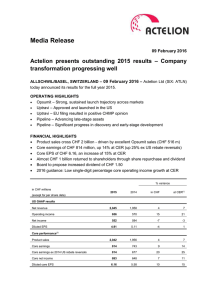

Media Release English

advertisement

Page 1 of 10 Media Release 21 July 2015 Actelion delivers excellent first half 2015 results ALLSCHWIL/BASEL, SWITZERLAND – 21 July 2015 – Actelion Ltd (SIX: ATLN) today announced its results for the first six months of 2015. OPERATING HIGHLIGHTS Opsumit® – Sales of CHF 208 million, increased patient recruitment momentum Opsumit – Launched in Japan and Spain in June 2015 Selexipag (Uptravi®) – FDA, EMA regulatory procedures on track Specialty franchise – Immunology portfolio advances Creation of vaccine start-up Vaxxilon – Innovating together with Max Planck Society FINANCIAL HIGHLIGHTS Product sales of CHF 1,008 million – Strong growth driven by Opsumit uptake Core earnings of CHF 423 million – Driven by commercial performance 2015 financial guidance upgrade: Mid- to high-teen percentage core earnings growth at CER (ex 2014 US rebate reversals) Return to shareholders: CHF 680 million via share repurchase program and dividend % variance in CHF millions H1 2015 H1 2014 in CHF at CER(1) 1,011 993 2 4 Operating income 344 347 -1 4 Net income 287 420 -32 -28 Diluted EPS 2.50 3.62 -31 -27 Product sales 1,008 993 2 4 Core earnings 423 421 0 4 Core earnings ex 2014 US rebate reversals 423 368 15 19 Core net income 357 378 -5 0 Diluted core EPS 3.11 3.25 -4 1 (except for per share data) US GAAP results Net revenue Core performance(2) page 2 of 10 H1 2015 H1 2014 Operating cash flow 278 259 Capital expenditure (11) (12) (540) 63 430 970 in CHF millions Cash flow Free cash flow (3) Net cash position (1) (2) (3) CER percentage changes are calculated by reconsolidating both the H1 2014 and H1 2015 results at constant currencies (the average monthly exchange rates for H1 2014). Actelion continues to measure, report and issue guidance on its core operating performance, which management believes more accurately reflects the underlying business performance. The Group believes that these non-GAAP financial measurements provide useful supplementary information to investors. These non-GAAP measures are reported in addition to, not as a substitute for, US GAAP financial performance. Free cash flow is reconciled with the change in net cash position and consequently includes share purchases of CHF 715 million during the first half of 2015 (H1 2014: CHF 392 million). Jean-Paul Clozel, MD, Chief Executive Officer, commented: “We have had an excellent first half of the year with continued strong demand for our PAH products, boosted by Opsumit. Our effort to establish additional specialty franchises from our R&D pipeline, in particular in the field of immunology, is progressing well. We have also been actively pursuing our share repurchase program in order to ensure continued value creation for shareholders. All in all, we have delivered on all key elements of our strategy.” Otto Schwarz, Chief Operating Officer, commented: “We continue to be extremely pleased with the performance of Opsumit as it drives not only sales growth but also an expansion of the ERA market as a whole. Patient recruitment remains strong in all markets where available and at end of June more than 9,800 patients were already profiting from the long-term outcome benefits of Opsumit.” André C. Muller, Chief Financial Officer, commented: “Excellent execution across the commercial organization along with disciplined management of the business resulted in very good half year results. On the back of this strong performance, we are very happy to once again upgrade guidance for the full year. We now expect that, unforeseen events excluded, core earnings will increase in the mid- to high-teen percentage range, at CER and excluding prior year US rebate reversals.” HALF YEAR REPORT Full details on the progress made during the first six months of 2015 are available in Actelion's 2015 Half Year Report, available from www.actelion.com. UPCOMING EVENTS 9M 2015 Financial Results reporting on 20 October 2015 FY 2015 Financial Results reporting on 9 February 2016 ### - First Half 2015 Financial Results - page 3 of 10 NOTES TO THE EDITOR BUSINESS REVIEW Dear Shareholders, Once again, I am pleased to present an excellent progress report for Actelion. The first half of 2015 has seen continued strong demand for our pulmonary arterial hypertension (PAH) products. Growth has been driven by the strong uptake of Opsumit® (macitentan): the launch momentum has been sustained as the roll-out is extended to additional countries. Excitement is building as the registration process advances for our next big opportunity – selexipag (Uptravi®), the first selective oral IP prostacyclin receptor agonist. The first scientific presentations of results from the pivotal Phase III outcome study, GRIPHON, were met with great enthusiasm, which bodes well for the future growth of our PAH business. This year, we have made significant progress with our efforts to develop additional specialty franchises from our R&D pipeline, focusing on opportunities in the field of immunology and antibiotics. We have also been actively pursuing our share repurchase program so as to ensure continued value creation for shareholders. EXCELLENT FIRST HALF OF 2015 Our key financial performance indicators all demonstrate the strength of our business, with product sales rising to just over 1 billion Swiss francs (+11% at CER, excluding prior-year US rebate reversals). Core earnings increased to 423 million Swiss francs (+19% at CER, excluding prior-year US rebate reversals), resulting in core earnings per share (EPS) of 3.11 Swiss francs. As product sales continue to exceed our forecasts, we are upgrading our financial guidance for the full year 2015. SUSTAINING AND GROWING THE PAH FRANCHISE With further launches of Opsumit – notably in Japan and Spain – our PAH portfolio continues to go from strength to strength. Just over 18 months after the first launch, at the end of June more than 9,800 patients were already profiting from the long-term outcome benefits of Opsumit, which generated sales of 208 million Swiss francs in the first half of 2015. This is a very strong performance in a competitive environment. At launch, one target group has been newly diagnosed (treatment-naive) patients, and in many countries Opsumit has achieved a leading share in this segment within the first 12 months on the market. A second target group has been patients already receiving PDE5 inhibitor monotherapy. Clearly, physicians are increasingly recognizing the outcome evidence from SERAPHIN and moving to combination therapy – Opsumit plus a PDE5 inhibitor. As a result, combination therapy is growing in many markets where Opsumit is available, with the US, Germany and the UK leading the way – driving overall growth of our endothelin receptor antagonist (ERA) business. Demand for Tracleer remains strong in markets where Opsumit is not yet available and also in Europe, thanks to the digital ulcer indication and the pediatric formulation. Sales for the first half of 2015 amounted to 645 million Swiss francs. Following the Pediatric Investigation Plan (PIP) compliance statement from the European - First Half 2015 Financial Results - page 4 of 10 Committee for Medicinal Products for Human Use (CHMP), applications for extension of the Supplementary Protection Certificate (SPC) were filed in 19 EU countries, and the first extensions of patent protection for Tracleer have already been granted. The last month of the first half of 2015 also saw the successful launch of Veletri in France – a very important market for i.v. epoprostenol. Overall, Veletri continues to grow strongly, increasing its share of the i.v. epoprostenol market in all countries where it is available. As announced last year, selexipag – discovered by our partners at Nippon Shinyaku – was shown to be effective in a large Phase III outcome study with PAH patients: the risk of a morbidity/mortality event was reduced by 40% (p<0.0001) versus placebo. The result is particularly impressive considering 80% of patients were already receiving an oral PAH treatment – with one third receiving an ERA combined with a PDE5 inhibitor. The tolerability of selexipag was consistent with therapies targeting the prostacyclin pathway. In March 2015, data on selexipag from the GRIPHON study were presented at the American College of Cardiology congress, where they were enthusiastically received. Since then, scientific presentations have also been given at the International Society for Heart & Lung Transplantation meeting in Europe and at the American Thoracic Society conference. Feedback from clinicians on the data has been very encouraging. Regulatory dossiers for selexipag were filed with the EMA and the FDA at the end of 2014, and further filings have taken place this year. The regulatory procedures are on track for first marketing authorization decisions by the end of this year or early in 2016; all the necessary resources are being made available to support the regulatory process. We also aim to extend the clinical utility of both macitentan and selexipag beyond PAH into the broader pulmonary hypertension setting, as well as in other promising indications. The results from the Phase II study in combined pre- and post-capillary pulmonary hypertension due to left ventricular dysfunction (CpcPH-LVD) with macitentan are expected before the end of the year. While we were disappointed with the results of our exploratory study of selexipag in Raynaud’s phenomenon secondary to systemic sclerosis (the efficacy data do not support further pursuit of this indication), our search for other potential indications will continue. In the meantime, of course, we are focusing on the registration process for selexipag in PAH. BUILDING ADDITIONAL SPECIALTY FRANCHISES Our ongoing success in PAH has enabled us to make significant progress with the second element of our strategy. In particular, we have taken action to build an additional specialty franchise in immunology. Our thorough understanding of the clinical potential of selective S1P 1 receptor modulation, together with advances in the field of immunology, has given us the confidence to advance two of our compounds into multiple therapeutic areas. Following a broad scientific, medical and commercial evaluation, we have initiated Phase III development of our lead compound ponesimod in patients with relapsing multiple sclerosis. In parallel, we have initiated a Phase II study with ponesimod in patients suffering from chronic graft-versus-host disease. In addition, a - First Half 2015 Financial Results - page 5 of 10 second selective S1P1 receptor modulator will advance into Phase II clinical development in patients with systemic lupus erythematosus. In the Phase III development program to assess the efficacy and safety of our novel antibiotic cadazolid in Clostridium difficile-associated diarrhea, patient recruitment has now surpassed a third of the planned total. With almost 200 sites on board around the world, the recruitment rate is increasing, which should make it possible to complete enrollment by the end of 2016. The promising innovations resulting from our R&D efforts make us confident that we can realize our ambition to build additional specialty franchises. Apart from organic growth opportunities, Actelion has clearly indicated its interest in acquisitions that would create further value for our shareholders. Should an opportunity be identified in the marketplace through our ongoing evaluation activities, the Actelion Board of Directors will not hesitate to act swiftly and decisively. Other approaches to value creation for shareholders are also being pursued. One example is the recent creation, together with the Max Planck Society, of a new company in the field of synthetic carbohydrate vaccines – an exciting opportunity with great potential, which could become a commercial reality within the next decade. This investment represents an innovative way of finding synergies between the worlds of academia and industry. Our specialty products on the market continue to contribute to overall growth, with total specialty product sales amounting to 60 million Swiss francs. OPTIMIZING PROFITABILITY – UPGRADED GUIDANCE One result of our commitment to maintain and increase profitability is the substantial returns achieved for shareholders. At this year’s Annual General Meeting, you approved an increased dividend of CHF 1.30 per registered share, which was paid out in May. In addition to the ongoing first-line share purchase program designed to service employee stock ownership plans, we have been pursuing a new second-line share repurchase program (up to 10 million shares within three years); here, over 4 million shares have already been purchased. With a strong first-half sales performance, mainly driven by intrinsic growth, we expect to deliver higher profitability in 2015 than originally forecast; as a result, we are raising our full year guidance. Barring unforeseen events, we now expect 2015 core earnings growth to be in the mid- to high-teen percentage range (at CER, excluding the impact of 2014 US rebate reversals). VALUE CREATION In recent years, we have created significant value as an independent company, but I believe we are only beginning to realize Actelion’s full potential. Our leading PAH portfolio, our financial discipline, and the progress we have made in building additional specialty franchises all combine to paint a bright future for Actelion – for our patients and their physicians, for our employees, and for our shareholders. Thank you for joining us on this exciting journey, which is making a difference to so many people’s lives. - First Half 2015 Financial Results - page 6 of 10 Yours sincerely, Jean-Paul Clozel, Chief Executive Officer SALES UPDATE Actelion’s commercial performance in the first six months of 2015 was strong, driven by the continued successful uptake of Opsumit, consistently strong recruitment of new patients across markets, and ERA market expansion due to increased combination therapy with PDE5 inhibitors. In the US, sales increased by 21% at CER (excluding 2014 rebate reversals), driven by Opsumit momentum and ERA market share gains, as well as price increases across major products. European sales increased by 1% at CER, driven mostly by Opsumit launches and Tracleer growth in the digital ulcer indication, and impacted by some price erosion. Sales in Japan increased by 3% at CER, driven by sales of Veletri and Zavesca (Japanese trade name Brazaves®). Sales in the rest of the world increased by 12% at CER, driven by strong growth in emerging PAH markets such as the Middle East, China and Taiwan and the successful launch of Opsumit in Australia. Comparing average exchange rates for the first half of 2015 with those for the first half of 2014, the Swiss franc appreciated against most major currencies, resulting in a negative currency variance of 26 million Swiss francs. Sales by product – year-to-date % variance H1 2015 H1 2014 in CHF at CER Opsumit® 208 53 nm nm Tracleer® in CHF millions 645 741 -13 -9 Veletri® 38 30 29 32 Ventavis® 57 54 6 0 Valchlor® 12 3 nm nm Zavesca® 44 52 -15 -9 3 2 50 59 1,008 934 8 11 - 58 1,008 993 2 4 Others Total product sales ex US rebate reversals US rebate reversals Total product sales Sales by product – quarterly % variance in CHF millions Q2 2015 Q2 2014 in CHF at CER Opsumit® 113 38 nm nm Tracleer® 301 372 -19 -14 Veletri® 19 16 19 23 Ventavis® 26 29 -11 -16 Valchlor® 7 2 nm nm Zavesca® 25 27 -8 0 2 1 67 79 493 484 2 6 - 40 Others Total product sales ex US rebate reversals US rebate reversals - First Half 2015 Financial Results - page 7 of 10 Total product sales 493 524 -6 -3 Sales by region – year-to-date % variance H1 2015 H1 2014 in CHF at CER United States 495 383 29 21 Europe 329 368 -11 1 Japan 86 92 -6 3 Rest of the world 97 91 8 12 1,008 934 8 11 - 58 1,008 993 2 4 Q2 2015 Q2 2014 in CHF at CER United States 243 210 16 9 Europe 161 189 -15 -2 Japan 45 43 4 16 Rest of the world 45 42 7 13 493 484 2 6 - 40 493 524 -6 -3 in CHF millions Total product sales ex US rebate reversals US rebate reversals Total product sales Sales by region – quarterly % variance in CHF millions Total product sales ex US rebate reversals US rebate reversals Total product sales Opsumit® Sales of Opsumit (macitentan) amounted to 208 million Swiss francs for the first half of 2015, reflecting the continued highly successful launch. The strong patient recruitment trend continued during the first half of 2015 with just over 9,800 patients on drug at the end of June with the contribution from Tracleer patient switches in early launch markets decreasing. The strong enrollment is driven by a significant market share of ERA naïve patients combined with early combination with PDE5 inhibitors. In June 2015, Opsumit was launched in Japan (where it is co-promoted with Nippon Shinyaku) and Spain. As per June 30, 2015, Opsumit was available to patients in 30 countries around the globe. Tracleer® Sales of Tracleer (bosentan) amounted to 645 million Swiss francs for the first half of 2015, a decrease of 9% at CER compared to the first half of 2014 excluding the impact of prior-year US rebate reversals. This decrease is mainly due to erosion in markets where Opsumit is available, as well as pricing pressure in Europe, increased generic bosentan competition and growing competitive pressures in Japan. Tracleer sales were supported by price increases in the US, the digital ulcer indication in Europe and continued solid demand in markets where Opsumit is not yet available. Underlying units sold globally decreased by 7%. - First Half 2015 Financial Results - page 8 of 10 Veletri® Sales of Veletri (epoprostenol for injection) amounted to 38 million Swiss francs for the first half of 2015, an increase of 32% at CER compared to the first half of 2014 excluding the impact of prior-year US rebate reversals. The increase was mostly driven by increased market penetration, successful launches in additional markets and continued growth in Japan despite a price cut of 5% on March 1, 2014. In June 2015, Veletri became available to patients in France, the biggest European i.v. epoprostenol market in terms of prostacyclin patients. At the end of June 2015, Veletri was available in 15 countries around the globe. Ventavis® Sales of Ventavis (iloprost) amounted to 57 million Swiss francs for the first half of 2015, unchanged at CER compared to the first half of 2014, or 8% lower including the impact of prior-year US rebate reversals. The underlying unit decrease of 20%, due to continued competitive pressure, was offset by price increases. Specialty Products Valchlor® Sales of Valchlor (mechlorethamine) for the first half of 2015 amounted to 12 million Swiss francs. The company is continuing its efforts to establish Valchlor as an option in the treatment algorithm for early-stage MF-CTCL. In France almost 200 patients benefitted from the drug under temporary authorization for use (“ATU”) program initiated during the second half of 2014. In addition, in the second quarter of 2015, the company filed the dossier for Valchlor (under the trade name Ledaga®) with the EMA. The dossier has been accepted and is under review. Zavesca® Sales of Zavesca (miglustat) amounted to 44 million Swiss francs for the first half of 2015, a decrease of 9% at CER compared to the first half of 2014 excluding the impact of prior-year rebate reversals. Underlying units sold decreased by 4%. Sales in the US were lower mainly due to competitive pressure in type 1 Gaucher disease. Outside the US, Zavesca sales were almost stable with increased patient demand in the NiemannPick type C indication (particularly in Japan where it is marketed as Brazaves ®), offset by the launch of generic miglustat, which has become commercially available (approved for the type 1 Gaucher disease indication only) in Spain, Sweden and the Czech Republic. CLINICAL UPDATE As announced on 16 April 2015, the company is accelerating its clinical development efforts in the field of immunological disorders, following a broad scientific, medical and commercial evaluation of a series of its selective S1P1 receptor modulators, discovered in-house. Actelion has initiated Phase III development with ponesimod, its lead compound, in patients suffering from relapsing multiple sclerosis, with patient enrollment expected imminently. In parallel, Actelion will also initiate a Phase II study with ponesimod in patients suffering from chronic graft versus host disease. In addition, a second selective S1P 1 receptor modulator will advance into Phase II clinical development in patients with systemic lupus erythematosus. - First Half 2015 Financial Results - page 9 of 10 During the first half of 2015, a new chemical entity entered into man for neurological disorders. Other projects in the clinical development pipeline are progressing according to plan. Clinical Development Pipeline Phase Compound Indication Study Status Registration Selexipag PAH GRIPHON Submissions ongoing III Cadazolid Clostridium difficile-associated diarrhea IMPACT Ongoing III Macitentan Eisenmenger syndrome MAESTRO Ongoing III Ponesimod Multiple sclerosis OPTIMUM Ongoing II Macitentan Chronic thromboembolic pulmonary hypertension MERIT Ongoing II Macitentan Combined pre- and post-capillary pulmonary hypertension MELODY Ongoing II Ponesimod Graft-versus-host disease - Ongoing II S1P1 modulator Systemic lupus erythematosus - Ongoing Ib Lucerastat Fabry disease - Ongoing I Macitentan Glioblastoma - Ongoing I NCE Cardiovascular disorders - Ongoing I NCE Neurological disorders - Ongoing RECONCILIATION US GAAP TO CORE RESULTS FOR THE FIRST HALF OF 2015 To access the reconciliation table for the first half of 2015 click here RECONCILIATION US GAAP TO CORE RESULTS FOR THE SECOND QUARTER OF 2015 To access the reconciliation table for the second quarter of 2015 click here - First Half 2015 Financial Results - page 10 of 10 ABOUT ACTELION LTD. Actelion Ltd. is a leading biopharmaceutical company focused on the discovery, development and commercialization of innovative drugs for diseases with significant unmet medical needs. Actelion is a leader in the field of pulmonary arterial hypertension (PAH). Our portfolio of PAH treatments covers the spectrum of disease, from WHO functional class (FC) II through to FC IV, with oral, inhaled and intravenous medications. Although not available in all countries, Actelion has treatments approved by health authorities for a number of specialty diseases including type 1 Gaucher disease, Niemann-Pick type C disease, digital ulcers in patients suffering from systemic sclerosis, and mycosis fungoides-type cutaneous Tcell lymphoma. Founded in late 1997, with now over 2,400 dedicated professionals covering all key markets around the world including Europe, the US, Japan, China, Russia and Mexico, Actelion has its corporate headquarters in Allschwil / Basel, Switzerland. Actelion shares are traded on the SIX Swiss Exchange (ticker symbol: ATLN) as part of the Swiss blue-chip index SMI (Swiss Market Index SMI®). All trademarks are legally protected. For further information please contact: Andrew Weiss Senior Vice President, Head of Investor Relations & Corporate Communications Actelion Pharmaceuticals Ltd, Gewerbestrasse 16, CH-4123 Allschwil +41 61 565 62 62 www.actelion.com - First Half 2015 Financial Results -