File

advertisement

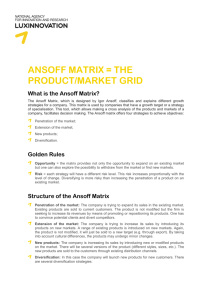

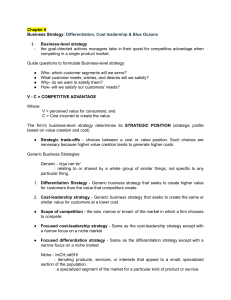

Ansoff’s Growth Vector Growth Strategies: One of the objectives of the firms is to continuously increase their sales and profit. At some point of time, a firm faces a situation that the expected sales and profit from its existing business do not reach the desired levels. The firms need to adopt suitable strategies to fill this strategic gap. The firms can adopt three possible approaches: Identify opportunities for further growth within the existing businesses (Intensive growth) Identify opportunities to build or acquire businesses related to the existing businesses (Integrative growth) Identify opportunities to add attractive businesses, unrelated to the existing businesses (Diversification growth) H. Igor Ansoff first published the now well-known vector matrix or product-matrix in the Harvard Business review in Sep/ Oct edition of 1957. The matrix also appeared in the book written later by Ansoff and published in 1965- corporate strategy. Although the matrix was published a long time ago, it still remains one of the most popular matrices and is used to identify the basic alternative strategies, which are options for a firm wanting to grow. Ansoff developed the matrix out of his realization that a firm needs a well-defined scope and growth direction. For most companies growth is often the perquisite for survival. Ansoff felt that many of the theorists had too broad a concept of business and that the traditional identification of a firm with a particular industry had become too narrow. This was because many firms acquired a diverse range of products through policies of vertical and horizontal integration to protect their existing markets, and also through new product development, done to exploit technological innovations and to develop new market with opportunities to growth. The vector matrix is based on joint consideration of the implication of change in the product (technology) and/ or the market and is perhaps the simplest and most basic statement of the strategic alternatives open to the firm who desires growth. PRODUCTS Existing Market penetration strategy MARKET Existing 1. More purchase and usage from existing customers 2. Gain customers from competitors 3. Convert non users into users Market development strategy New 1. New market segment 2. New distribution channels 3. New geographic areas New Product development strategy 1. Product modification via new features 2. Different quality levels 3. ‘New’ product Diversification strategy 1. 2. 3. 4. Organic growth Joint ventures Mergers Acquisition/take-over’s Fig: Market/ product expansion grid This grid may be also used to make an analysis of the marketing personality/ outlook of the individual/ firm Current products and current market: market penetration Market penetration: the firm seeks to: a. Maintain or increase its share of the current market with current products. b. Secure dominance of growth markets. c. Restructure a mature market by driving out competitors. d. Increase usage by existing customer. Present products and new markets: market development a. New geographical areas and export markets b. Different package sizes for food and other domestic items so that those who buy in bulk and small quantities are catered for. c. New distribution channels to attract new customers (e.g. organic foods sold in supermarkets not just specialist shops) d. Differential pricing policies to attract different types of customer and create new market segments. New products to present markets: product development a. Advantage – Product development forces competition to innovate, new comers to the market might be discouraged. b. The drawbacks include the expense and the risk. New products and new markets: diversification Diversification occurs when a company decides to make new products for new markets. It has to have a clear idea of what it hopes to gain from diversification. There are two types of diversification, related and unrelated diversification. a. Growth - new products and new markets should be selected which offer prospects for growth, which the existing product market mix does not. b. Investing surplus – funds not required for other expansion needs: but the funds could be returned to shareholders. c. The firms strengths matches the opportunity if – outstanding new products have been developed by the company’s research and development department. The profit opportunities from diversification are high.