Handout 12

advertisement

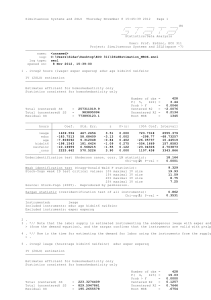

Research Method Lecture 12 (Ch16) Simultaneous Equations Models (SEMs) © 1 Introducdtion We have learned two “sources” of endogeneity. 1. Omitted variables 2. Errors in variables In this handout, we will learn another source of endogeneity: Simultaneity. 2 In econometrics, “endogeneity” usually means that an explanatory variable is correlated with the error term. In simultaneous equation models, endogeneity means that the observed variable is determined by the equilibrium. For example, an observed quantity is determined by the equilibrium between demand and supply. When a variable is endogenous in ‘simultaneous equation’ sense, it is usually endogenous in econometric sense (i.e., correlated with the error term). We will see this soon. 3 The nature of simultaneous equation. Consider the following model describing equilibrium quantity of labor (in hours) in agricultural sector in a country. Labor supply : hs=α1w+β1z1+u1 Labor demand: hd=α2w+β2z2+u2 hs is the hours of labor supplied, and hd is the hours of labor demanded. These quantities depends on the wage rate, w, and other factors, z1 and z2. 4 z1 would be the wage rate of the manufacturing sector. If the manufacturing wage increases, people would move to manufacturing sector, reducing hours worked in agricultural sector. z1 is called the observed demand shifter. u1 is called the unobserved demand shifter. z2 would be agricultural land area. The more land available, more demand for labor. z2 is the observed supply shifter. u1 is the unobserved supply shifter. 5 Demand and supply describes entirely different relationships. The observed labor quantity and wage rate are determined by the equilibirum between these two equations. The equilibrium: hs=hd 6 Consider you have country level data. Then, for each country, we observe only the equilibirum labor supply and wage rate. Demand: hi=α1wi+β1zi1+ui1 Supply: hi=α2wi+β2zi2+ui2 where i is the country subscript. These two equations constitute a simultaneous equations model (SEM). These two equations are called the structural equations. α1,β1, α2, 7 β2 are called the structural parameters. In SEM framework, hi and wi are endogenous variables because they are determined by the equilibrium between the two equations. In the same way, zi1 and zi2 are exogenous variables because they are determined outside of the model. u1 and u2 are called the structural errors. One more important point: Without z1 or z2, there is no way to distinguish whether one equation is demand or supply. 8 Simultaneous equation bias Consider the following simultaneous equation model. y1=α1y2+β1z1+u1…………….(1) y2=α2y1+β2z2+u2…………….(2) In this model, y1 and y2 are endogenous variables since they are determined by the equilibrium between the two equations. z1 z2 are exogenous variables. 9 Since z1 and z2 are determined outside of the model, we assume that z1 and z2 are uncorrelated with both of the structural errors. Thus, by definition, the exgoneous variables in SEM are exogenous in ‘econometric sense’ as well. In addition, the two structural errors, u1 & u2, are assumed to be uncorrelated with each other. 10 Now, solve the equations (1) and (2) for y1 and y2, then you get the following reduced form equations. y1=п11z1+п12z2+v1 y2=п21z1+п22z2+v2 where п11= β1/(1- α1 α2) п112= α1 β2/(1- α1 α2) v1 =(u1+ α1 u2)/(1- α1 α2) п21 =α2β1/(1- α2 α1) п22 = β2/(1- α2 α1) v2=(α2u1+u2)/(1- α2 α1) These parameters are called the reduced form parameters. 11 You can check that v1 and v2 are uncorrelated with z1 and z2. Therefore, you can estimate these reduced form parameters by OLS (Just apply OLS separately for each equation). 12 However, you cannot estimate the structural equations with OLS. For example, consider the first structural equation. y1=α1y2+β1z1+u1 Notice that Cov(y2, u1) =[α2/(1-α2α1)]E(u12) =[α2/(1-α2α1)]σ21 ≠0 Thus, y2 is correlated with u1 (assuming that α2 ≠0.) In other words, y2 is endogenous in ‘econometric sense’. 13 Thus, endogenous variables in SEM are usually endogenous in ‘econometric sense’ as well. Thus, you cannot apply OLS to the structural equations. Cov(y2, u1) =[α2/(1-α2α1)]σ21 can be used to predict the direction of bias. If this is positive, OLS estimate of α1 will be biased upward. If it is negative, it will be biased downward. The formula above does not carry over to more general models. But we can use this as a guide to check the direction of the bias. 14 An example Suppose that you are interested in estimating the effect of police size on the city murder rate. Notice that the ‘supply’ of murder would be a function of police size. But the ‘demand’ for police is a function of murder rates. 15 Thus, the observed murder rate and the police size are determined simultaneously by the following model. (Murder)=α1(police)+β10+β1(Income per capita)+u1..(3) (Police)=α2(Murder)+ β20+β2(other vars)+u2………..(4) Allthe variables are the city-level variables. (Murder) is the number of murders per capita. (Police) is the number of police officers per capita. We are interested in estimating the effect of police on the murder rate: equation (3). 16 However, since murder rate and police force are determined simultaneously, (police) is endogenous in equation (3). Thus OLS estimate for α1 is biased. Question: What would be the direction of the bias? 17 Identifying and estimating a structural equation: 2 equations case When we learned OLS, a parameter was said to be identified when the explanatory variable is not correlated with the error. In 2SLS chapter, we learned how to identify (i.e., eliminate the bias) by apply IV method. In SEM, the term ‘identification’ is used slightly differently. 18 Suppose the following model describing the supply and demand. Supply: q =α1p+β1z1+u1 Demand: q =α2p+u1 Note that supply curve has an observed supply shifter z1, but demand has no obsedved supply shifter. Given the data on q, p and z1, which equation can be estimated? That is, which is an identified equation? 19 Demand Supply: location is different depending on the value of z1. These are the data points. Notice: data points trace the demand curve. Thus, it is the demand equation that can be estimated. 20 Because there is observed supply shifter z1 which is not contained in demand equation, we can identify the demand equation. It is the presence of an exogenous variable in the supply equation that allows us to estimate the demand equation. In SEM, identification is used to mean which equation can be estimated. 21 Now turn to a more general case. y1 10 1 y2 11z11 1k z1k u1 y2 20 2 y1 21z21 2l z2l u2 (z11~z1k) and (z21~ z2l ) may contain the same variables, but may contain different variables as well. When one equation contains exogenous variables not contained in the other equation, this means that we have imposed exclusion restrictions. 22 The condition for identification is the following. The condition for identification: The first equation is identified if and only if the second equation contains at least one exogenous variable (non zero coefficient) that is excluded from the first equation. 23 The above condition have two components. First, at least one exogenous variable should be excluded from the first equation (order condition). Second, the excluded variable should have non zero coefficients in the second equation (rank condition). The identification condition for the second equation is just a mirror image of the statement. 24 Example Labor supply of married working women. Labor supply equation: hours 1lwage 10 11educ 12age 13kids6 14 ( NonWifeIncome) u1 Wage offer equation: lwage 2 hours 30 21educ 22 exp 23 exp 2 u2 In the model, hours and lwage are endogenous variables. All other variables are exogenous. (Thus, we are ignoring the endogeneity of educ 25 arising from omitted ability.) Suppose that you are interested in estimating the first equation. Since exp and exp2 are excluded from the first equation, the order condition is satisfied for the first equation. The rank condition is that, at least one of exp and exp2 has a non zero coefficient in the second equation. Assuming that the rank condition is satisfied, the first equation is identified. In a similar way, you can see that the second equation is also identified. 26 Estimating SEM using 2SLS Once we have determined that an equation is identified, we can estimate it by two stage least square. 27 Consider the labor supply equation example again. You are interested in estimating the first equation. hours 1lwage 10 11educ 12age 13kids6 14 ( NonWifeIncome) u1 lwage 2 hours 30 21educ 22 exp 23 exp 2 u2 Suppose that the first equation is identified (both order and rank conditions are satisfied). lwage is correlated with u1. Thus, OLS cannot be used. 28 However, exp and exp2 can be used as instruments for lwage in the first equation. Why? First, exp and exp2 are uncorrelated with u1 by assumption of the model (instrument exogeneity satisfied). Second exp and exp2 are correlated with lwage by the rank condition (instrument relevance satisfied). 29 In general, you can use the excluded exogenous variables as the instruments. 30 Exercise Consider the following simultaneous equation model. hours 1lwage 10 11educ 12age 13kids6 14 ( NonWifeInc ) u1 lwage 2 hours 30 21educ 22 exp 23 exp 2 u2 Q1: Which equation(s) is/are identified? Q2: Estimate the identified equation(s). 31 Answer . reg hours lwage educ age kidslt6 nwifeinc, robust Linear regression Number of obs F( 5, 422) Prob > F R-squared Root MSE hours Coef. lwage educ age kidslt6 nwifeinc _cons -2.046796 -6.62187 .5622541 -328.8584 -5.918459 1523.775 Robust Std. Err. 82.02275 18.43784 5.360839 126.681 3.385146 309.4226 t P>|t| -0.02 -0.36 0.10 -2.60 -1.75 4.92 0.980 0.720 0.917 0.010 0.081 0.000 = 428 = 2.46 = 0.0324 = 0.0361 = 766.63 [95% Conf. Interval] -163.2708 -42.86331 -9.975019 -577.8629 -12.57231 915.5734 OLS 159.1772 29.61957 11.09953 -79.85399 .7353893 2131.976 . ivregress 2sls hours educ age kidslt6 nwifeinc (lwage=exper expersq), robust Instrumental variables (2SLS) regression hours Coef. lwage educ age kidslt6 nwifeinc _cons 1639.556 -183.7513 -7.806092 -198.1543 -10.16959 2225.662 Instrumented: Instruments: Robust Std. Err. 593.3108 67.78742 10.48746 208.4247 5.287486 603.0964 Number of obs Wald chi2(5) Prob > chi2 R-squared Root MSE z 2.76 -2.71 -0.74 -0.95 -1.92 3.69 P>|z| 0.006 0.007 0.457 0.342 0.054 0.000 lwage educ age kidslt6 nwifeinc exper expersq = = = = = 428 12.60 0.0274 . 1344.7 [95% Conf. Interval] 476.6879 -316.6122 -28.36114 -606.6592 -20.53287 1043.615 2SLS 2802.423 -50.89039 12.74896 210.3506 .1936911 3407.709 32 . reg lwage hours educ exper expersq, robust Linear regression Number of obs F( 4, 423) Prob > F R-squared Root MSE lwage Coef. hours educ exper expersq _cons -.0000565 .1062139 .0447035 -.0008585 -.4619955 Robust Std. Err. .0000654 .0133269 .0152503 .0004166 .2113449 t -0.86 7.97 2.93 -2.06 -2.19 P>|t| 0.388 0.000 0.004 0.040 0.029 = 428 = 20.24 = 0.0000 = 0.1601 = .6659 [95% Conf. Interval] -.0001852 .0800187 .0147277 -.0016773 -.8774124 .0000721 .1324091 .0746793 -.0000397 -.0465786 . ivregress 2sls lwage (hours=age kidslt6 nwifeinc) educ exper expersq, robust Instrumental variables (2SLS) regression lwage Coef. hours educ exper expersq _cons .0001259 .11033 .0345824 -.0007058 -.6557254 Robust Std. Err. .0002924 .0148178 .0185052 .0004265 .4097655 Number of obs Wald chi2(4) Prob > chi2 R-squared Root MSE z 0.43 7.45 1.87 -1.65 -1.60 P>|z| 0.667 0.000 0.062 0.098 0.110 = 428 = 83.56 = 0.0000 = 0.1257 = .67545 [95% Conf. Interval] -.0004472 .0812877 -.0016872 -.0015418 -1.458851 .000699 .1393723 .0708519 .0001302 .1474001 Instrumented: hours Instruments: educ exper expersq age kidslt6 nwifeinc 33 Note on the terminology In the previous slides, the exogenous variables excluded from the equation were called the instruments. In SEM (and in usual IV method too), people often refer to all the exogenous variables (regardless of whether they are included or excluded) as the instruments. The instruments that are excluded from the equation is called specifically as the ‘excluded instruments’. 34 Simultaneous equations models with panel data. Consider the following SEM. yit1 1 yit 2 zit11 (ai1 uit1 ) yit 2 2 yit1 zit 2 2 ( ai 2 uit 2 ) The notation zit11 is a short hand notation for 11z1t1 1k z1tk . The same for zit 2 2. Due to the fixed effect term ai1 and ai 2 , zvariables are correlated with the composite error terms. Therefore, the excluded exogenous variables cannot be used as 35 instruments unless we do something. To apply 2SLS, we should first (i) firstdifference, or (i) demean the equations. First-differenced version yit1 1yit 2 zit11 uit1 yit 2 2 yit1 zit 2 2 uit 2 Time demeaned (fixed effect) version yit1 1 yit 2 zit11 u it1 yit 2 2 yit1 zit 2 2 u it 2 36 Then zit1 , zit 2 or zit1 , yit1 are not correlated with the error term. Thus we can apply the 2SLS method. Estimation procedure is the same. First, determine which equation is identified. Then, use the excluded exogenous variable as the instruments in the 2SLS method. 37 An application The effect of prison population on the violent crime rate (Levitte 1996). This paper answers to the following question: To what extent an increase in prison population would decrease the violent crime? 38 Consider the following model. log( crime)it t 1 log( prison ) zit11 (ai1 uit1 )......( 4) (Crime): the number of violent crimes per capita. (Prison) prison population per capita. t : intercepts (different at each year: just include year dummies.) z1: police per capita, log of income per capita, unemployment rate, proportions of black and those living in metropolitan areas, and age distributions. 39 First-differece the equation to eliminate the fixed effect ai. log( crime)it t 1 log( prison ) zit11 uit1......(5) Even after eliminating the fixed effect, there still is the simultaneous equation bias, because the prison population is determined by the crime rate as well. 40 The simultaneity can be expressed in the SEM framework as: log( crime)it 1t 1 log( prison )it zit11 uit1......(6) log( prison ) it 2t 2 log( crime) (Exogenous Vars) it 2 uit 2 .............................................(7) (Exogenous vars) in equation (7) could contain zit1 . However, in order to identify the crime equation (6), (exogenous vars) should contain variables that are not included the crime equation. What can be the variable? 41 Levitte (1996) used the overcrowding litigation as the excluded instruments. In the US, prisoner’s right groups have filed law suits to mitigate the overcrowding of the prisons. When the law suit is successful, the court orders the prisons to mitigate the overcrowding of the prisons. It usually takes the form of population caps. 42 Thus, overcrowding litigation, if victories are achieved, will affect the change in the prison population. At the same time, it is reasonable to assume that the overcrowding litigation affect crime rate only through prison population. Thus, the model is now: log( crime)it 1t 1 log( prison )it zit11 uit1......(8) log( prison )it 2t 2 log( crime) (Final) it 2 (Other Factors) uit 2 ..............(9) Whether the final decisions about the overcrowiding litigation is reached. 43 The results . reg gcriv gpris gpolpc gincpc cunem cblack cmetro cag0_14 cag15_17 cag18_24 cag25_34 > y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93, robust Linear regression Number of obs F( 23, 690) Prob > F R-squared Root MSE gcriv Coef. gpris gpolpc gincpc cunem cblack cmetro cag0_14 cag15_17 cag18_24 cag25_34 y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93 _cons -.1808974 .0514239 .7383676 .41126 -.0147435 .5383056 .989306 4.98384 2.412758 2.879946 -.0686258 -.0407726 -.0421775 -.0136596 .0094042 .0440948 -.0239597 .0347581 .0253571 .0871704 .038884 .0081502 .0087141 -.0056706 Robust Std. Err. .0557664 .0553029 .2294963 .399978 .0336211 1.417525 2.38922 4.998959 2.937888 2.549853 .0203006 .0225609 .024122 .0240967 .0229413 .0272085 .0237496 .0221166 .0235964 .0226556 .0235126 .0245474 .0271283 .0282869 t -3.24 0.93 3.22 1.03 -0.44 0.38 0.41 1.00 0.82 1.13 -3.38 -1.81 -1.75 -0.57 0.41 1.62 -1.01 1.57 1.07 3.85 1.65 0.33 0.32 -0.20 P>|t| 0.001 0.353 0.001 0.304 0.661 0.704 0.679 0.319 0.412 0.259 0.001 0.071 0.081 0.571 0.682 0.106 0.313 0.117 0.283 0.000 0.099 0.740 0.748 0.841 = = = = = 714 10.66 0.0000 0.2311 .07893 [95% Conf. Interval] -.2903896 -.0571583 .2877727 -.3740601 -.0807554 -2.244874 -3.701708 -4.831156 -3.355514 -2.126456 -.1084842 -.0850688 -.0895389 -.0609713 -.0356389 -.0093267 -.0705898 -.0086658 -.0209723 .0426883 -.0072807 -.0400464 -.0445498 -.0612093 -.0714052 .1600061 1.188963 1.19658 .0512685 3.321485 5.68032 14.79884 8.18103 7.886347 -.0287675 .0035237 .0051838 .033652 .0544473 .0975162 .0226704 .0781819 .0716865 .1316525 .0850488 .0563468 .0619781 .0498682 Simple first differenced model. The coefficient would be biased. 44 . ivregress 2sls gcriv (gpris= final1 final2) gpolpc gincpc cunem cblack cmetro cag0_1 > 4 cag15_17 cag18_24 cag25_34 y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93, robust Instrumental variables (2SLS) regression gcriv Coef. gpris gpolpc gincpc cunem cblack cmetro cag0_14 cag15_17 cag18_24 cag25_34 y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93 _cons -1.031956 .035315 .9101992 .5236958 -.0158476 -.591517 3.379384 3.549945 3.358348 2.319993 -.0560732 .0284616 .024703 .0128703 .0354026 .0921857 .004771 .0532706 .0430862 .1442652 .0618481 .0266574 .0222739 .0148377 Instrumented: Instruments: Robust Std. Err. .3314008 .0602729 .3257538 .4809308 .0403465 1.603944 2.938685 5.910124 3.321347 2.87316 .0251341 .0390173 .0388549 .0320581 .0308006 .0385744 .0320625 .0284254 .0292807 .036031 .0303677 .0300795 .0340501 .0367185 Number of obs Wald chi2(23) Prob > chi2 R-squared Root MSE z -3.11 0.59 2.79 1.09 -0.39 -0.37 1.15 0.60 1.01 0.81 -2.23 0.73 0.64 0.40 1.15 2.39 0.15 1.87 1.47 4.00 2.04 0.89 0.65 0.40 P>|z| 0.002 0.558 0.005 0.276 0.694 0.712 0.250 0.548 0.312 0.419 0.026 0.466 0.525 0.688 0.250 0.017 0.882 0.061 0.141 0.000 0.042 0.375 0.513 0.686 = = = = = 714 145.87 0.0000 . .09385 [95% Conf. Interval] -1.68149 -.0828178 .2717334 -.4189114 -.0949254 -3.73519 -2.380332 -8.033685 -3.151374 -3.311297 -.105335 -.0480108 -.0514511 -.0499624 -.0249655 .0165812 -.0580704 -.0024422 -.0143029 .0736458 .0023285 -.0322974 -.044463 -.0571292 -.3824227 .1534478 1.548665 1.466303 .0632302 2.552156 9.1391 15.13358 9.868069 7.951282 -.0068113 .104934 .1008572 .0757031 .0957707 .1677902 .0676124 .1089833 .1004754 .2148846 .1213676 .0856122 .0890109 .0868047 First-difference plus 2SLS to eliminate the simultaneous equation bias. gpris gpolpc gincpc cunem cblack cmetro cag0_14 cag15_17 cag18_24 cag25_34 y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93 final1 final2 45 The results of the overidentifying restriction test and endogeneity test. . estat overid Test of overidentifying restrictions: Score chi2(1) = .012929 (p = 0.9095) . estat endog Tests of endogeneity Ho: variables are exogenous Robust score chi2(1) Robust regression F(1,689) = = 6.14067 9.09532 (p = 0.0132) (p = 0.0027) 46 The first stage regression First-stage regressions Number of obs F( 24, 689) Prob > F R-squared Adj R-squared Root MSE gpris Coef. gpolpc gincpc cunem cblack cmetro cag0_14 cag15_17 cag18_24 cag25_34 y81 y82 y83 y84 y85 y86 y87 y88 y89 y90 y91 y92 y93 final1 final2 _cons -.0286921 .2095521 .1616595 -.0044763 -1.418389 2.617307 -1.608738 .9533678 -1.031684 .0124113 .0773503 .0767785 .0289763 .0279051 .0541489 .0312716 .019245 .0184651 .0635926 .0263719 .0190481 .0134109 -.077488 -.0529558 .0272013 Robust Std. Err. .033455 .1941286 .3106113 .0259464 .8617595 1.665526 3.739701 1.630762 1.813735 .0156429 .0174195 .0170559 .0190171 .0175523 .0212384 .0178416 .0171349 .0174176 .0175546 .0176008 .0175037 .0201717 .0162845 .0195862 .0224239 t -0.86 1.08 0.52 -0.17 -1.65 1.57 -0.43 0.58 -0.57 0.79 4.44 4.50 1.52 1.59 2.55 1.75 1.12 1.06 3.62 1.50 1.09 0.66 -4.76 -2.70 1.21 P>|t| 0.391 0.281 0.603 0.863 0.100 0.117 0.667 0.559 0.570 0.428 0.000 0.000 0.128 0.112 0.011 0.080 0.262 0.289 0.000 0.135 0.277 0.506 0.000 0.007 0.226 = = = = = = 714 5.64 0.0000 0.1522 0.1226 0.0624 [95% Conf. Interval] -.0943781 -.1716025 -.4481988 -.0554198 -3.110379 -.6528087 -8.951316 -2.248492 -4.592794 -.0183022 .0431486 .0432907 -.008362 -.0065574 .0124491 -.0037587 -.0143979 -.0157328 .0291257 -.0081856 -.0153188 -.0261945 -.1094613 -.0914117 -.016826 .0369938 .5907068 .7715178 .0464671 .2736011 5.887423 5.73384 4.155228 2.529427 .0431248 .111552 .1102663 .0663146 .0623676 .0958488 .066302 .0528878 .052663 .0980595 .0609295 .053415 .0530164 -.0455148 -.0144999 .0712287 Overcrowding litigation reduces the prison population growth. 47