11

THE NATURE OF FINANCIAL

MANAGEMENT

Copyright © Cengage Learning. All rights reserved.

11.2

Installment Buying

Copyright © Cengage Learning. All rights reserved.

Installment Buying

Two types of consumer credit allow you to make installment

purchases. The first, called closed-end, is the traditional

installment loan.

An installment loan is an agreement to pay off a loan or a

purchase by making equal payments at regular intervals for

some specific period of time.

There are two common ways of calculating installment

interest. The first uses simple interest and is called add-on

interest, and the second uses compound interest and is

called amortization.

3

Installment Buying

In addition to closed-end credit, it is common to obtain a

type of consumer credit called open-end, revolving credit,

or, more commonly, a credit card loan.

MasterCard, VISA, and Discover cards, as well as those

from department stores and oil companies, are examples of

open-end loans.

This type of loan allows for purchases or cash advances up

to a specified maximum line of credit and has a flexible

repayment schedule.

4

Add-On Interest

5

Add-On Interest

The most common method for calculating interest on

installment loans is by a method known as add-on

interest.

It is nothing more than an application of the simple interest

formula.

It is called add-on interest because the interest is added to

the amount borrowed so that both interest and the amount

borrowed are paid for over the length of the loan.

6

Add-On Interest

You should be familiar with the following variables:

P = AMOUNT TO BE FINANCED (present value)

r = ADD-ON INTEREST RATE

t = TIME (in years) TO REPAY THE LOAN

I = AMOUNT OF INTEREST

A = AMOUNT TO BE REPAID (future value)

m = AMOUNT OF THE MONTHLY PAYMENT

N = NUMBER OF PAYMENTS

7

Add-On Interest

8

Example 1 – Find a monthly payment

You want to purchase a computer that has a price of

$1,399, and you decide to pay for it with installments over 3

years. The store tells you that the interest rate is 15%.

What is the amount of each monthly payment?

Solution:

You ask the clerk how the interest is calculated, and you

are told that the store uses add-on interest.

Thus, P = 1,399,

r = 0.15,

t = 13, and N = 36.

9

Example 1 – Solution

cont’d

Two-step solution

I = Prt

= 1,399(0.15)(3)

= 629.55

A=P+I

= 1,399 + 629.55

= 2,028.55

10

Example 1 – Solution

cont’d

One-step solution

A = P(1 + rt)

= 1,399(1 + 0.15 3)

= 2,028.55

The amount of each monthly payment is $56.35.

11

Annual Percentage Rate (APR)

12

Annual Percentage Rate (APR)

Suppose you borrow $2,000 for 2 years with 10% add

on-interest. The amount of interest is

$2,000 0.10 2 = $400

Now if you pay back $2,000 + $400 at the end of two years,

the annual interest rate is 10%.

However, if you make a partial payment of $1,200 at the

end of the first year and $1,200 at the end of the second

year, your total paid back is still the same ($2,400), but you

have now paid a higher annual interest rate.

13

Annual Percentage Rate (APR)

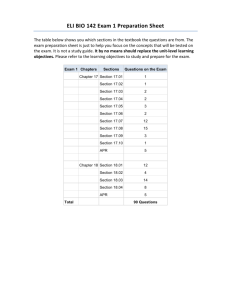

Take a look at Figure 11.1.

Interest on a $2,000 two-year loan

Figure 11.1

14

Annual Percentage Rate (APR)

On the left (figure 11.1) we see that the interest on $2,000

is $400. But if you make a partial payment (figure on the

right), we see that $200 for the first year is the correct

interest, but the remaining $200 interest piled on the

remaining balance of $1,000 is 20% interest (not the

stated 10%).

Note that since you did not owe $2,000 for 2 years, the

interest rate, r, necessary to give $400 interest can be

calculated using I = Prt:

(2,000)r(1) + (1,000)r(1) = 400

15

Annual Percentage Rate (APR)

3,000r = 400

This number, 13.3%, is called the annual percentage rate.

16

Example 3 – Find an APR for a installment purchase

In Example 1, we considered the purchase of a computer

with a price of $1,399, paid for in installments over 3 years

at an add-on rate of 15%. Use the given APR formula

(rounded to the nearest tenth of a percent) to approximate

the APR.

Solution:

Knowing the amount of the purchase is not necessary

when finding the APR.

17

Example 3 – Solution

cont’d

We need to know only N and r. Since N is the number of

payments, we have

N = 12(3) = 36, and r is given as 0.15:

The APR is approximately 29.2%.

18

Open-End Credit

19

Open-End Credit

The most common type of open-end credit used today

involves credit cards issued by VISA, MasterCard,

Discover, American Express, department stores, and oil

companies.

Because you don’t have to apply for credit each time you

want to charge an item, this type of credit is very

convenient.

When comparing the interest rates on loans, you should

use the APR.

20

Open-End Credit

Earlier, we introduced a formula for add-on interest; but for

credit cards, the stated interest rate is the APR.

However, the APR on credit cards is often stated as a daily

or a monthly rate. For credit cards, we use a 365-day year

rather than a 360-day year.

21

Example 6 – Find APR from a given rate

Convert the given credit card rate to APR (rounded to the

nearest tenth of a percent).

a. per month

b. Daily rate of 0.05753%

Solution:

a. Since there are 12 months per year, multiply a monthly

rate by 12 to get the APR:

22

Example 6 – Solution

cont’d

b. Multiply the daily rate by 365 to obtain the APR:

0.05753% 365 = 20.99845%

Rounded to the nearest tenth, this is equivalent to

21.0% APR.

23

Open-End Credit

Many credit cards charge an annual fee; some charge $1

every billing period the card is used, whereas others are

free.

These charges affect the APR differently, depending on

how much the credit card is used during the year and on

the monthly balance.

If you always pay your credit card bill in full as soon as you

receive it, the card with no yearly fee would obviously be

the best for you.

24

Open-End Credit

On the other hand, if you use your credit card to stretch out

your payments, the APR is more important than the flat fee.

For our purposes, we won’t use the yearly fee in our

calculations of APR on credit cards. Like annual fees, the

interest rates or APRs for credit cards vary greatly.

Because VISA and MasterCard are issued by many

different banks, the terms can vary greatly even in one

locality.

25

Credit Card Interest

26

Credit Card Interest

An interest charge added to a consumer account is often

called a finance charge.

The finance charges can vary greatly even on credit cards

that show the same APR, depending on the way the

interest is calculated.

There are three generally accepted methods for calculating

these charges: previous balance, adjusted balance, and

average daily balance.

27

Credit Card Interest

28

Example 7 – Contrast methods for calculating credit card interest

Calculate the interest on a $1,000 credit card bill that shows

an 18% APR, assuming that $50 is sent on January 3 and is

recorded on January 10. Contrast the three methods for

calculating the interest.

Solution:

The three methods are the previous balance method,

adjusted balance method, and average daily balance

method. All three methods use the formula I = Prt.

29

Example 7 – Solution

cont’d

30

Credit Card Interest

Many credit cards charge no interest if you pay in full within

a certain period of time (usually 20 or 30 days). This is

called the grace period.

On the other hand, if you borrow cash on your credit card,

you should know that many credit cards have an additional

charge for cash advances—and these can be as high as

4%. This 4% is in addition to the normal finance charges.

31