0 - Abrams, Howard E.

advertisement

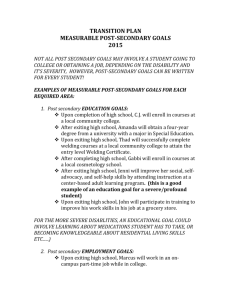

Howard E. Abrams Sell the partnership interest Sections 741, 751(a), 743(b) Receive a liquidating distribution of cash Sections 731, 751(b), 734(b) Receive a liquidating distribution of property Sections 751(b), 732, 734(b) Note: You cannot do a like-kind exchange with a partnership interest. Gain or loss is recognized based on a comparison of the sale price to outside basis. The ordinary income component equals the exiting partner’s distributive share of the ordinary income inside the partnership. Note that this can exceed the total gain on the sale. The capital gain component equals the total gain on the sale less the ordinary income component. The purchasing partner takes a cost basis in the partnership interest. Under section 743(b), the purchasing partner takes a cost-basis in each of the purchased assets. If the purchasing partner pays more or less than liquidation value, the capital assets will take a greater or lesser basis. Note: the purchasing partner’s capital account is carried-over from the selling partner. (The purchase of a partnership interest is not a book-up event.) Gain or Loss is Recognized to the Distributing Partner. The Exiting Partner’s Share of Ordinary Income Is Captured Under Section 751(b). Inventory is Captured only if “Substantially Appreciated” No look-Thru on Capital Gain: Rate Equals 15% Inside Basis Is Adjusted Under Section 734(b) for Exiting Partner’s Gain Or Loss. No Gain or Loss on Distribution Outside Basis is Pushed into Distributed Assets Inventory Items Remain Ordinary Income Assets for 5 Years After Distribution; Unrealized Receivables Remain Ordinary Income Assets Forever A condominium development ends badly, with the final unsold units distributed to the partners. One of the partners holds the unit for two years and then sells it. Any gain or loss on the sale is ordinary because the unit was inventory in the hands of the partnership. To convert the gain into capital gain, the partnership must change its holding of the property prior to distribution. X and Y are 50% partners. XY owns cash of $120 and a capital asset with basis of $80 and fair market value of $300. Each partner has a capital account and outside basis of $100.The cash is distributed to X. X recognizes a capital gain of $20 on the distribution. The partnership increases its inside basis from $80 to $100. If the partnership then sells its asset, there will be a gain of only $200, allocable half to X and half to Y. The partnership now owns cash of $300. X has been taxed on $120 and Y has been taxed on $100. The total is correct, but X has been overtaxed and Y has been undertaxed. Gain or loss from the sale or exchange of a partnership interest or triggered by a distribution of cash from the partnership will be long-term or shortterm depending on the partner’s holding period in the partnership interest. A partner now can have a bifurcated holding period in his partnership interest. That is, gain or loss can be both long-term and short-term. When property is contributed to a partnership, holding period carries over from the contributed property into the partnership interest. If multiple assets are contributed, a proportion of the partnership interest will receive a holding period from each contributed asset in proportion to the relative fair market value of each contributed property. X contributes cash of $1,000, capital asset #1 with value of $2,000 and a sixth-month holding period, and capital asset #2 with value of $3,000 and a holding period in excess of one year. X will have a new holding period as to one-sixth of the partnership interest, a six-month holding period as to one-third of the partnership interest, and a long-term holding period as to one-half of the partnership interest. If a partner contributes cash or property to the partnership, a portion of the holding period will be redetermined in proportion to the value of the contribution as compared with the value of the partnership interest. Example: X owns a partnership interest with value of $500 and a long-term holding period. X contributes cash of $250. As a result of the contribution, X has a new holding period in one-third of the partnership interest. In general, the distribution of cash or property does not affect the holding period of the distributee partner in the partnership interest. However, cash (but not property) distributed from the partnership up to 12 months prior to recognition of gain from sale (or deemed sale) of the partnership interest is netted against any contributed cash (but not property) to reduce the amount of gain treated as short-term. While contributing cash or property will convert a portion of the partnership interest into short-term property, such contributions have no affect on the partnership’s holding period with respect to assets it already owns. Accordingly, the sale of assets by the partnership will be unaffected by the bifurcation rule applicable to partnership interests. To avoid gain to the distributee partner, distribute property rather than cash. Note: marketable securities are treated much like cash. Can the distributee partner go shopping with the partnership’s money similar to a Starker exchange under §1031? In ILM 200650014, the Service determined that, at least when no other partner would at any time have an economic interest in the property, the answer is no. If a partner exits a partnership that own loss inventory via a cash distribution, the partner’s share of the loss will be recognized as a capital loss because §751(b) speaks only to inventory that is “substantially appreciated.” But if the partner exits via a sale of the interest, the loss will be ordinary under §751(a). If the inventory is distributed in kind, the loss will be preserved in the inventory and, when it is sold, the loss will be ordinary under §735(a)(2). If a partner exits a partnership owning loss capital assets, the exiting loss will be capital if the partner exits by sale, exchange, or liquidating distribution. Abandonment of the interest will convert the loss into an ordinary loss so long as the exiting partner has no share of partnership liabilities. Abandonment requires the subjective intention to abandon plus an affirmative act of abandonment. Abandonment of the assets by the partnership is an alternative strategy. If a partner exits the venture in exchange for a cash distribution, capital loss recognized by the exiting partner will reduce the partnership’s inside basis if a §754 election is in effect or the basis reduction is “substantial.” Here, “substantial” means that the basis reduction exceeds $250,000. If the partners sells his partnership interest, a “substantial” basis reduction means that the partnership’s assets have a net loss in excess of $250,000. The adjustment is only the exiting partner’s share of that loss. The P partnership has assets with value of $500,000 and inside basis of $800,000. X, owning a 0ne-tenth interest in P with an outside basis of $80,000, receives a liquidating distribution of $50,000. X recognizes a capital loss of $30,000. If no election under §754 is in effect, the partnership does not adjust inside basis. If X instead sells her interest for $50,000, there is again a capital loss to X of $30,000 but now an equivalent inside basis adjustment is mandatory. If a new partner will replace an exiting partner, the new partner can purchase an interest in the venture or can contribute cash for a new interest. If the new partner purchases an interest in the venture, the incoming partner takes the exiting partner’s capital account, potentially limiting subsequent loss allocations. But if the incoming partner contributes cash, capital account equals the amount of cash contributed. Disguised sale of a partnership interest challenge? A partner who sells an interest in a partnership owning depreciated real estate is subject to the 25% capital gain rate applicable to “unrecaptured §1250 gain.” But an exit in exchange for a liquidating distribution is not subject that this higher rate. And an election under §754 will eliminate the exiting partner’s share of the higher-rate gain permanently. Note: this strategy has no effect on gain actually recaptured by §1250 (or by §1245). EO and TO each contribute $100 to the partnership in exchange for a 50% interest in profits, losses, and capital. The partnership purchases two capital assets for $100 each. CA #1 increases in value to $200 while CA #2 increases in value to $190. CA #2 is distributed to EO and CA #1 is sold for cash. How do the books of the venture read? EO CA TO OB CA Explanation OB $ 100 $ 100 $ 100 $100 Contributions 45 0 45 0 Book-Up of #2 (190) (100) 0 0 Distribution 50 50 50 50 Sale of CA #1 5 50 195 150 Totals Y has a 50% interest in the XY partnership (the other partners collectively are referred to as “X”). XY owns an asset with cost basis of $200 and current value of $1,000. Y must receive cash of $500 by liquidation, sale of the interest, or combination of the two. XY can borrow $500, guaranteed by X. A liquidating distribution of cash to Y will produce a capital gain of $400 and an inside basis increase of the same amount. A sale of the asset will then produce a capital gain to X of $400 as well. Each partner is taxed properly. ______X______ CA OB $ 100 $ 100 0 490 400 0 0 0 $ 500 $ 590 Assets Property Value $ 1000 ______Y______ CA OB $ 100 $ 100 0 0 400 0 ( 490) ( 490) $ 10 $ 0 Basis $ 590 Debt ($ 490) ______X______ CA OB $ 500 $ 590 0 205 0 ( 490) $ 500 $ 305 ______Y______ CA OB $ 10 $ 0 0 205 0 0 $ 10 $ 205 Assets Cash Basis $ 510 Value $ 510 Debt -0- ______X______ CA OB $ 500 $ 590 0 205 0 ( 490) 0 0 $ 500 $ 305 ______Z______ CA OB $ 10 $ 10 0 205 0 0 0 ( 205) $ 10 $ 10 Assets Cash Basis $ 510 Value $ 510 Debt -0- Howard E. Abrams