Group 6

advertisement

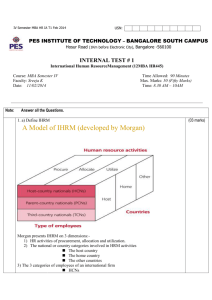

Global Human Resource Management & Accounting in the International Business 組員:劉倚帆。周珈慶。張詩卿。詹新韡。王振宇 Human Resource Management • HRM:Refers to the activities an organization carries out to use its human resources effectively. • Four major tasks of HRM – – – – Staffing policy Management training and development Performance appraisal Compensation policy The Strategic Role of International HRM • In this chapter we will see that success also requires HRM policies to be congruent with the firm’s strategy. • For example, a transnational strategy imposes different requirements for staffing, management development, and compensation practices than a localization strategy. The Role Of Human Resource in Shaping Organization Architecture Staffing Policy • Staffing policy – Selecting individuals with requisite skills to do a particular job – Tool for developing and promoting corporate culture • Types of Staffing Policy – Ethnocentric – Polycentric – Geocentric Ethnocentric Staffing Policy • A ethnocentric staffing policy is one in which all key management positions filled by parent-country nationals. • Ex:Japanese & South Korean firms Ethnocentric Staffing Policy • Advantages: – Overcomes lack of qualified managers in host nation – Unified culture – Helps transfer core competencies • Disadvantages: – Limits advancement opportunities for host-country nationals. – Cultural myopia • Ex:Mitsubishi Motors Polycentric Staffing Policy • A polycentric staffing policy recruits host-country nationals to manage subsidiaries while parentcompany nationals occupy key positions at corporate headquarters. •Ex:台灣佳企電子 Mcdonald’s Polycentric Staffing Policy • Advantages: – Alleviates cultural myopia – Inexpensive to implement • Disadvantages: – Limits opportunity to gain experience of host country nationals outside their own country – Can create gap between home and host country operations – Federation • Ex:Unilever Geocentric Staffing Policy • A geocentric staffing policy seeks the best people for key jobs throughout the organization, regardless of nationality. • Ex:花王 Geocentric Staffing Policy • Advantages: – Enables the firm to make best use of its human resources – Equips executives to work in a number of cultures – Helps build strong unifying culture and informal management network • Disadvantages: – National immigration policies may limit implementation – Expensive to implement due to training and relocation – Compensation structure can be a problem Comparison of Staffing Approaches Expatriate Managers • Expatriate: citizens of one country working in another. – Ethnocentric policy:the expatriates are all home country nationals who transferred abroad. – Geocentric policy:the expatriates need not be home country nationals;the firm does not base transfer decisions on nationality. • Inpatrites: expatriates who are citizens of a foreign country working in the home country of their multinational employer – Ex:Acer Expatriate failure • Expatriate failure: premature return of the expatriate manager to his/her home country Reasons for Expatriate Failure US multinationals Inability of spouse to adjust Manager’s inability to adjust Other family problems Manager’s personal or emotional immaturity Inability to cope with larger overseas responsibilities European multinationals Inability of spouse to adjust Japanese Firms Inability to cope with larger overseas responsibilities Difficulties with the new environment Personal or emotional problems Lack of technical competence Inability of spouse to adjust Expatriate Selection • Reduce expatriate failure rates by improving selection procedures. • An executive’s domestic performance does not (necessarily) equate to his/her overseas performance potential. • Employees need to be selected not solely on technical expertise, but also on cross-cultural fluency . Four Attributes that Predict Success Self-Orientation Possessing high self-esteem, self-confidence and mental well-being Others-Orientation Ability to develop relationships with host country nationals Willingness to communicate Perceptual Ability The ability to understand why people of other countries behave the way they do Being nonjudgmental and flexible in management style Cultural Toughness Relationship between country of assignment and the expatriate’s adjustment to it Training and Management Development Training of expatriates • Lesson A Well-designed lesson Expatriates success Training of expatriates • Development Training of expatriates • Training and development – Global competition – Cross-company TRAINING DEVELOPMENT Training of expatriates • Reasons of failure – Expatriate not adapted to the environment – Family • Solution training – Cultural training – Language training – Practice training Training of expatriates • Cultural training – Increasing the familiarity to the environment – Ease the conflict between the different cultural • Language training – English maybe not the only – New language helps a lot Training of expatriates • Practice training – Life style – Expatriate group Repatriation • Problems – Where? – What? • Issue – the first or the last process? Management development and strategy • Development programs designed to increase the overall skill levels of managers through: – Ongoing management education – Rotation of managers through a number of jobs within the firm to give broad range of experiences • Ends – Integration performance Performance appraisal Appraisal • Problems – Bias • Host country • Home country • Guideline – Reduce the bias that caused by different cultural misunderstanding Compensation Compensation • Issues – Pay executives in different countries according to the standards in each country or equalize pay on a global basis – Method of payment Compensation in Various Countries Expatriate Pay • Typically use balance sheet approach – Equalizes purchasing power to maintain same standard of living across countries – Provides financial incentives to offset qualitative differences between assignment locations The Balance Sheet Approach Components of Expatriate Pay • Base Salary – Same range as a similar position in the home country • Foreign service premium – Extra pay for work outside country of origin • Allowances – Hardship, housing, cost-of-living, and education allowances • Taxation – Firm pays expatriate’s income tax in the host country • Benefits – Level of medical and pension benefits identical overseas International Labor Relations International labor relations • Key Issue – Degree to which organized labor can limit the choices of an international business • Aims to foster harmony and minimize conflicts between firms and organized labor – Concerns of Organized Labor – Strategy of Organized Labor – Relationship between firms and organized labor Concerns of organized labor • Better fees, safety and conditions • Bargaining power • Attempts to import employment practices and contractual agreements from multinational’s home country Strategy of organized labor • Attempts to establish international labor organizations • Lobby for national legislation to restrict multinationals • Attempts to achieve international regulations on multinationals through such organizations as the United Nations Relationship between firms and organized labor • Centralization vs. decentralization Accounting in the International Business 國際企業會計 Introduction 1. the language of business 2. International business are confronted with a number of accounting problems that do not confront purely domestic business. 3. IASB International Accounting Standards Board Country Differences in Accounting Standards 1. Different countries have different accounting systems. 2. In many European countries , government regulations require firms to publish detailed information about their training and employment policies . Factors influence the development of a country’s accounting system The relationship between business and the providers of capital. Political and economic ties with other countries. The level of inflation. The level of a country’s economic development. The prevailing culture in a country. Relationship Between Business and Providers of capital 1) United States and the Great Britain Both have well-developed stock and bond markets. 2) Switzerland, Germany, and Japan, a few large banks satisfy most of the capital needs of business enterprises. Political and economic ties with other countries 1) The U.S. system has influenced accounting practices in Canada and Mexico, and since passage of NAFTA. 2) The accounting systems of EU members such as Great Britain, Germany, and France have been quite different, but under EU rules, they are now converging on IASB norms. Inflation Accounting 1) Many countries accounting is based on the historic cost principle. 2) If inflation is high, the historic cost principle underestimates a firm’s assets. 3) 1980 current cost accounting Level of Development 1) Developed nations tend to have large, complex organizations. 2) Accounting problems are far more difficult than those of small organizations. CULTURE Uncertainty avoidance refers to the extent to which cultures socialize their members to accept ambiguous situations and tolerate uncertainty. case • Enron~ The Smartest Guys in The Room 安隆企業破產案是美國華爾街史上最大的商業 醜聞。造成員工失業、員工領不到退休金,也 造成投資人血本無歸等諸多問題。 安隆企業曾是美國第七大企業,掌握能源及電 力的未來價格。 跨國企業與其查核會計公司間的假帳密謀。 全球五大會計師事務所之一的亞瑟安達信被美 國證期會吊銷執照。 National and International Standards • Accounting standards – Rules for preparing financial statements • Auditing standards – Rules for performing an audit Lack of Comparability • National differences in accounting and auditing standards – R&D costs (U.S. & Spain) – Depreciation (German & British) • Gross profit of $1.5 million, net profit of – $34,000 in the U.S. – $260,600 in Britain – $240,600 in Australia Lack of Comparability • Transnational financing – Raise capital for the sale of stocks or bonds in another country • Transnational investment – Invest in stocks or bonds of a firm in another country Lack of Comparability • Transnational financial reporting – Lack of comparability between accounting standards in different national can lead to confusion • Financial position looks significantly different • Have difficulty identifying the firm’s true worth International Standards • Companies raise money from providers outside national borders • Providers are demanding consistency in financial results • Facilitate the development of global capital markets International Standards • International Accounting Standards Board (IASB) – International Accounting Standards Committee (IASC) – To issue a new standard, 75% of the 14 members must agree. • Financial Accounting Standards Board (FASB) – Writes generally accepted accounting principles (GAAP) International Standards • Under an agreement reached in 2002, IASB and FASB will increasingly work together • IASB – Develop accounting standards for firms seeking stock listings in global markets • FASB – Join force with accounting standard steers in Canada, Mexico, and Chile 《國際金融》外國公司在美上市, 2007年財報開始不須兩本帳 • 美國放寬在美上市外國公司會計法規,從二 ○○七年的財報開始,使用國際會計標準的 外國公司將不再需要調整他們的財報以符合 美國會計法規。分析師指出,此一調整有助 提高外國公司申請在美國上市的意願。 • 此舉將使倫敦的國際會計標準理事會所認可 的會計標準,更加順暢地在國際間通行。 2007/11/17 14:54 時報資訊 • Adopt of IASC accounting principles in the 1990’s – Increase interest by foreign investors • 1994 financial statements in accordance with IASC guidelines and restarted its 1992 results • In 2000, attract U.S. investors • In 2002, adopt full U.S. accounting principles in addition to IASB principles Multinational Consolidated Financial Statements • Economically, all the companies in a corporate group are interdependent • Only assets, liabilities, revenues, and expenses with external third parties are shown in consolidated financial statements • Required to keep own accounting records and financial statements Cash Receivables Parent Foreign Subsidiary $1,000 $250 3,000* 900 Payables 300 500* Revenues 7,000** 5,000 Expenses 2,000 3,000** • • *Subsidiary owes parent $300 **Subsidiary pays parent $1,000 in royalties for products licensed from parent. Eliminations Parent Subsidiary Cash $1,000 $250 Receivables 3,000* 900 300 500* $300 500 5,000 1,000 11,000 Payables Revenues 7,000** Expenses 2,000 • • 3,000** Debit Credit Consolidated $1,250 $300 1,000 *Subsidiary owes parent $300 **Subsidiary pays parent $1,000 in royalties for products licensed from parent. 3,600 4,000 Currency Translation Foreign subsidiaries will prepare their financial statements in the currency of their locating country When multinational prepares consolidated accounts it must convert all statements into the currency of its home country The Current Rate Method The Temporal Method The Current Rate Method • We use current exchange rate to consolidate financial statements,it is incompatible with the historic cost principle although this may seem logical. • For example: 假設1999年台幣比日 幣為1:4 假設2007年台幣比日 幣為1:3 The Temporal Method • The Temporal Method translates assets valued in a foreign currency into the home-country currency using the exchange rate that exists when the assets are purchased. • There is a problem in Temporal Method… Ex:exchange rate seldom remain stable for long (Japan&U.S.) Balance sheet America’s Japanese subsidiary January 1, 2004 Yen Cash Owners’ equity 10000000 10000000 Exchange Rate U.S. Dollars 1:100(美元比日幣) 100000 1:100(美元比日幣) 100000 Balance sheet America’s Japanese subsidiary March 1, 2004 Yen Exchange Rate U.S. Dollars Fixed assets 5000000 1:95(美元比日幣) 52632 Inventory 5000000 1:90(美元比日幣) 55556 Total 10000000 Owners’ equity 10000000 108188 1:100(美元比日幣) 100000 +8188 Current U.S. Practice No.1 U.S. based multinational firms must follow the requirements of Statement 52,which issued by the FASB in 1981 No.2 Self-sustaining、autonomous Foreign subsidiary No.3 Integral to the activities of the parent company Self-sustaining、autonomous Integral to the activities of the parent company Functional currency: local currency Functional currency: U.S. currency Accounting Aspects of Control Systems 1/2 • There are three main steps for corporate headquarter to control subunits: Head office and subunit management jointly determine subunit goal for the coming year Throughout the year,the head office monitors subunit performance against the agreed goals If a subunit fails to achieve its goals,the head office intervenes in the subunit to learn why the shortfall occurred,taking corrective action when appropriate Accounting Aspects of Control Systems 2/2 • Accounting System plays an important role in measuring subunits’ performance • Usually headquarters and subunit managers discuss new budget for next year. (Using AIS examined) • The most important to evaluate subunits’ performance is the subsidiary’s actual profits compared to budgeted profits Exchange Rate Changes and Control Systems The Lessard-Lorange Model • To deal with exchange rate problems,Lessard and Lorange point out three exchange rates: The Initial Rate the spot exchange rate when the budget is adopted The Projected Rate The spot exchange rate Forecast for the end of the budget period The Ending Rate the spot exchange rate When the budget and performance are being compared Rate Used Translate Actual Performance for Comparison with Budget Initial (I) (I) Budget at initial Actual at initial Projected (P) Budget at initial Actual at projected Rate Used for Translating Budget at projected Budget at projected Budget Actual at projected (P) Actual at initial Budget at ending Actual at initial (E) Budget at ending Actual at projected Ending (E) Budget at initial Actual at ending Budget at projected Actual at ending Budget at ending Actual at ending Transfer Pricing • A product (including service) might be designed in one country,some of it components manufactured in a second country,and then sold worldwide. • The price at which such products or services transferred is referred to as the transfer price (Ex:A French subsidiary of U.S. parent) Case-transfer pricing in China No.1 大陸運輸業隨著石油價格上漲,運輸成本逐漸攀升 No.2 運輸會決定向付貨人提出每一公里增加一元的燃料加油 費,成本隨之上升 No.3 成本逐漸上升,迫使許多人放棄從事運輸業工作 隱藏意 涵 當運輸業者成本提高,價格亦會提高,其中子公司間的 貨物移轉價格相對上升 A French subsidiary of U.S. parent Before Change After 20 Percent in Transfer Price Increase in Transfer Price $230 230 Cost of component per unit 100 120 Other costs per unit 100 100 Profit per unit $30 10 Revenues per unit Separation of subsidiary & Manager Performance Subsidiary’s performance Manager’s performance return of investment other indicators of profitability Managers will have different performance according to different environment (ex: economic、political、social conditions ) , thus we can not evaluate them as the same with subsidiary’s performance For example:manager of a subsidiary in an adverse environment that has an ROI of 5 percent may be better than the manager of a subsidiary in a benign environment that has an ROI of 20 percent Suggest:we suggest that when we evaluate a subsidiary and manager’s performance,we have to separate them because of different environment Q&A • 外派人員失敗最主要的原因為何? • 全球兩大會計標準為何? • 國際企業會計提到的個案例子公司為哪一個? Thank you for your attention!!