Net Take Away

advertisement

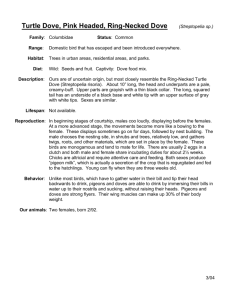

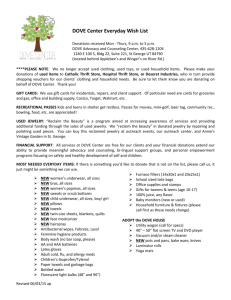

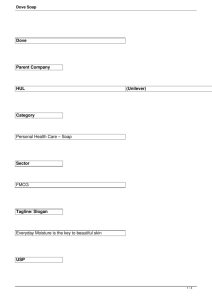

A BRAND DOSSIER ON DOVE Submitted by : Abhimanyu Hazra Anisha Rathi Kunal Ghosh Sayak Bannerjee AGENDA Brand Overview The Logo Early History Evolution Dove Early History • • • • • Owned by Unilever Launched in 1957 Entered India in 1995 Imported and marketed by HUL In 1999 sales reached around USD 1 billion and was growing at 20% per annum The Logo • The logo is a silhouette profile of a dove, the color of which often varies • It symbolizes the purity and softness of dove in its products Evolution 1940 1950 1960 1970 1980 1990 • Formula for dove bar (Mild Soap) • Refined to original dove beauty bar • Launched in the market • Popularit y increased as a milder soap • Leading brand recomme nded by physician s • Dove beauty wash successfu lly launched 2000 Present • Extension of Dove’s range of products Positioning and Repositioning Initial Positioning • Dove initially positioned itself as a beauty bar • Targeted the premium market segment • “Trial for results” Subsequent Repositioning • Dove as a moisturizing cream bar • Aesthetic need for consumers - Featuring regular women in their ads • Shifted to digital media • Soaps for summers • Launched men products The 4P’s Contd. PRODUCT • A combination of moisturizer and softness • Focused on women PRICE • Initially it was priced at 50 • Later the price was reduced to 28 • Attracting the upper middle class consumers • Product bundling pricing PLACE • The HUL network • Popular in metropolitan cities PROMOTION • Positioned as real beauty • Good for people of all ages • Awareness campaigns SWOT Analysis Contd. • The target market of Dove is only the upper middle class women • Critic - using women as objects • Tapping into the market segment of men • Unified advertising technique • Unconventional strategy In advertising • New and better campaigns • Loyal customers Weakness Strengths Opportunities Threats • Increased competition in the market segment • Zero market share in rural areas • Launched soaps only for the premium customers Competition of Dove Soap Generic competitors • Body wash • Rose water + milk • Body scrub Direct Competitors • • • • Pears Camay Vivel Fiama Di Wills Strategies Adopted Marketing Strategy Real women for endorsement Attract people through people Availability in more than 80 countries Health and beauty market Price reduction Target Group - Upper and upper middle class Distribution Strategy Strong sales and distribution channel of HUL Market Segment Strategy Demographic Segmentation Psychographic Segmentation • Target Group - Girls and women, working women, higher income group • Beauty lies in all women • Targeted ageing women Market Research Analysis • Hypothesis • Sampling Plan • Data Analysis Tools • Analysis of data & Inferences Drawn • Net Take Away Hypothesis • People buy dove soap as it gives a moisturising effect to the skin • Men use dove men soaps as it has a brand name attached to it • Dove gives the best quality in its price segment Sampling Plan • Sample Size - 70 • Region - Kolkata • Target Audience - Both men and women - Age group is between 20-45 years of age - People in the urban areas Data Analysis Tools • Pie Chart • Bar Diagram • Report : To summarize the above two pictorial tools Analysis of data & Inferences drawn People buy dove soap as it gives a moisturising effect to the skin [H1] MOISTURISATION 5 4 3 MEAN… 2 BRANDS PEARS DOVE FIAMA DI WILLS MEAN SCORE 3.03 4.3 2.49 1 0 PEARS DOVE FIAMA DI WILLS • The results shows that Dove has the highest mean score • Higher number of consumers consider dove when it comes to moisturisation Contd. DOVE ATTRIBUTES 16% Quality 10% 13% Status Softness Gentleness 61% • Softness is due to moisturisation • Maximum no of respondents – First word – Softness • Thus from the above two tables we can infer that people buy dove as it provides moisturisation effect to the skin • This hypothesis has proved to be correct Men use dove men soaps as it has a brand name attached to it [H3] BREAK UP OF (A) 18% Dove Men Care Products 18% 64% VARIANTS Division of (A) Dove Men Care Products 6.06% Dove Gentle Exfoliating 6.06% Dove Gentle Fresh 21.21% Dove Gentle Exfoliating Dove Gentle Fresh •The break up here is of the users who use variants of dove regularly which is 33.33% •From this we can infer that that out of 33 only 11 have used dove variants. Contd. Dove Men Care Soaps Total Regularly Don't Respons Question Aware Used Use Know es Aware 56% 38% Used Dove Men Care Soaps 27 2 2 39 70 Dove Gentle Exfoliating 22 11 2 35 70 Dove Gentle Fresh 28 24 7 11 70 Regularly Use Don't Know 3% 3% • We can clearly infer that many people are aware of men care products but very less people are have tried it Contd. Use/Awareness 8% Dove Men Care Products 52% 40% Dove Gentle Exfoliating VARIANTS Use/Awareness Dove Men Care Products 6.45% Dove Gentle Exfoliating 31.43% Dove Gentle Fresh 40.68% Dove Gentle Fresh • From the above two we can clearly infer that many people are aware of men care products but very less people have tried it • This might be due to the communication problem Contd. Regularly used/Use VARIANTS 26% Dove Men Care Products Dove Gentle Exfoliating 57% Dove Men Care Products Dove Gentle Exfoliating Dove Gentle Fresh Dove Gentle Fresh 17% • Relationship between trials and repeat purchase • We see that 50% men who have tried dove products have purchased dove again Regularly used/Use 50.00% 15.38% 22.58% Contd. DON’T KNOW/TOTAL RESPONSES 13% Dove Men Care Products 46% 41% Dove Gentle Exfoliating Dove Gentle Fresh VARIANTS Dove Men Care Products DON’T KNOW/TOTAL RESPONSES 55.71% Dove Gentle Exfoliating 50.00% Dove Gentle Fresh 15.71% • This clearly shows that there are still many people who do not know about the variants at all • We can infer from all of the above tables that variants are not helping dove to grow as a brand, Thus this hypothesis has proved to be incorrect. Dove gives the best quality in its price segment [H3] QUALITY BRANDS 4.5 PEARS DOVE FIAMADI WILLS 4 3.5 MEAN SCORE 3 3.51 3.99 2.76 2.5 MEAN SCORE 2 1.5 1 0.5 0 PEARS DOVE FIAMA DI WILLS • This graph clearly reveals that the respondents consider that dove gives the best quality • It can be inferred that dove provides better quality as it has the highest mean score • Thus the hypothesis is proved to be correct Brand’s Future • Launching new products Sunscreen lotions Cosmetics Hair removal creams • Launching new soap variants • Attracting age group of less than 20 years Net Take Away • • • • • Marketing Jargons Analytical and practical skills Scales and tools for analysis Brand building Fundamental and practical understanding of marketing THINGS WE DISCOVERED ABOUT DOVE Dove Cream Bar was originally developed to heal the burns of soldiers in war 1.4 billion Cream Bars were sold around the world in 2003 – which is equivalent to 44 bars a second If all the Cream Bars sold in one year were laid end-to-end they would encircle the globe Dove is the only personal care brand that has used women ‘from real life’ in its advertising for more than 40 years Thank you