Deceptive Trade Practices Enforcement in Private Student Loans

advertisement

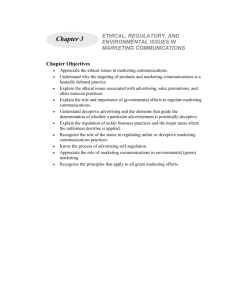

Deceptive Trade Practices Enforcement in Private Student Loans Dino Tsibouris Tsibouris & Associates, LLC Deceptive Trade Practices: FTC Act • Consumer protection statute • Enforced by the Federal Trade Commission • Section 5(a): "unfair or deceptive acts or practices in or affecting commerce ...are...declared unlawful." • 15 U.S.C. Sec. 45(a)(1)) Deceptive Trade Practices: FTC Act • "Unfair" practices are defined as those that "cause[] or [are] likely to cause substantial injury to consumers which is not reasonably avoidable by consumers themselves and not outweighed by countervailing benefits to consumers or to competition" (15 U.S.C. Sec. 45(n)). Deceptive Trade Practices: FTC Act • Privacy Violations: – Deception when a company fails to comply with its own privacy policy or security claims – Unfair practices that caused substantial injury, not reasonably avoidable by consumers Deceptive Trade Practices: FTC Act • Marketing Representations: Deception: – Using names, seals, logos, or other representations similar to those of government agencies – Using promotions like gift cards, credit cards, and sweepstakes prizes to distract Deceptive Trade Practices: FTC Act • Collection Practices: – Consumers expect debt collection contacts to be accurate – Actions based on inaccurate information (including failing to confirm accuracy) can be considered false or misleading and constitute deceptive acts or practices Deceptive Trade Practices: FTC Act • Collection Practices: – Excessive collection calls without verifying information provided by lender – Not resolving disputes – Not forwarding updated information to credit bureaus – Fees not allowed in the loan – Fees in violation of state law Deceptive Trade Practices: State Law Florida Statutes Title XXXIII Chapter 501 501.204 Unlawful acts and practices.– Unfair methods of competition, unconscionable acts or practices, and unfair or deceptive acts or practices Deceptive Trade Practices: State Law Florida Statutes Title XXXIII Chapter 501 501.204 Unlawful acts and practices.– “Due consideration and great weight given to interpretations of the Federal Trade Commission Act” Student Loan Express • • • • • Silver State Helicopters: Failed trade school 12-18 month course $69,900 tuition per student 2700 students, 34 schools, 17 states Bankrupt in 2008 Student Loan Express • • • • Private loans Over 50% of borrowers received no certification “Business plan destined to fail” Should lender be liable to forgive balances? Student Loan Express • • State claims involving the FTC Holder Rule Banks which make purchase money loans containing the notice will be subject to all claims and defenses which the consumer could assert against the seller. Student Loan Express NOTICE ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED WITH THE PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR HEREUNDER. Student Loan Express • • State AG’s claimed a violation of state law and Section 5 of the FTC Act to not include this language Claimed that if a seller arranges direct loan financing, can’t accept proceeds of the loan as payment for a sale, unless any loan contract has the provision Student Loan Express • • Lender potentially responsible if it has "referring relationships" with schools Potential payment refund/cancellation of debt Student Loan Express • Multistate AG settlement forgiving $112M of balances • • • Up to 75% of a borrower’s balance Citibank – forgave balances in 2008 KeyBank not yet determined Deceptive Trade Practices: NY Law SLATE Act • • • No logos on solicitations appearing to be from the federal government or the student's current lender No fake checks/false rebates No iPods, gift cards, etc. Deceptive Trade Practices: NY Law SLATE Act • • • • No Referral gifts to friends of the borrower No false/misleading loan comparisons No sample rates/benefits only available to small percentage of borrowers unless disclosed Guaranty borrower benefits survive sale of the loan Deceptive Trade Practices: Higher Education Opportunity Act • Section 140 • Preventing Unfair and Deceptive Private Educational Lending Practices and Eliminating Conflicts of Interest