WHAT IS STOCK?

advertisement

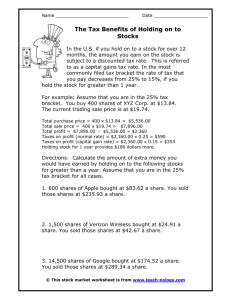

WHAT IS STOCK? Stock represents ownership in a corporation (unlike bonds, which represent debt) Stock, also called equity, is bought and sold in portions called shares Shares represent a percentage of ownership * Most major companies have millions/billions of shares, so buying 25, 50, 100 shares gives you a very limited slice of the pie! WHY A STOCK MARKET? Like other types of markets, the stock market links buyers and sellers The stock market provides investment opportunities for buyers of stock The stock market provides businesses with the opportunity to raise capital Initial Public Offering (IPO): when a company sells stock in itself for the first time Going Public: term used when a company is planning an IPO STOCK EXCHANGES New York Stock Exchange (NYSE) Oldest, largest, and most influential exchange in U.S. In general, handles largest and most influential companies Trading takes place on its floor NASDAQ Created in 1971 Trading is done electronically (no faceto-face meeting of representatives of the buyer and seller) HOW DOES ONE BUY STOCK? Stocks are bought through a stockbroker Brokers charge a fee (%) per transaction Two ways to earn profits with stocks: 1. Dividends – quarterly payments to stockholders from company’s profits. 2. Capital Gains – selling shares at a higher price than you bought them. What do these 30 companies have in common? 3M American Express AT&T Boeing Caterpillar Chevron Cisco Systems Coca Cola Dupont Exxon Mobil General Electric Goldman Sachs Hewlett-Packard Home Depot IBM Intel Johnson & Johnson JP Morgan Chase McDonald’s Merck Microsoft Nike Pfizer Proctor & Gamble United Health Group United Technologies Verizon Communications Visa Wal-Mart Walt Disney THE DOW The Dow Jones Industrial Average tracks the price changes of 30 of the largest companies in the economy in various industries It can indicate a “bull market” (average price of stock rising) or a “bear market” (average price dropping) Using a few representative stocks, it is supposed to measure the market and mirror the economy Critics of the Dow claim it is not accurate due to only 30 of the strongest (“blue-chip”) stocks being included…but since 1896 it does have a strong track record Other prominent indexes include the S & P 500 and the NASDAQ Composite STOCK CAN BE CLASSIFIED BY WHETHER OR NOT IT… PAYS DIVIDENDS… Income Stock: pays dividends (payments made quarterly – every three months) Growth Stock: pays no dividends because company reinvests $$$ into itself …OR GIVES STOCKHOLDERS A VOTE ON COMPANY POLICY Common Stock: investors are voting owners Preferred Stock: investors can’t vote, but get paid before common stockholders CHARACTERISTICS OF STOCK (abbreviations you’ll find on a stock report) Ticker symbol: 3-letter company abbreviation Last Trade Price: price at that moment Price change (% price change): amount price has changed during day (% price change for the day) Previous close: price of stock at end of trading day before Open: price of stock at beginning of trading day Day’s range: high and low price of stock for the day STOCK CHARACTERISTICS (continued) 52-week range: high and low price of stock for the year Volume: number of shares traded that day Market Capitalization: total value of all shares of that company’s stock Earnings per share (EPS): annual profits divided by total # of shares of stock in company Dividend (yield%): annual dividend per share (dividend divided by share price – use to compare with other investments) BUYING ON MARGIN (Margin Buying) Buying on margin is buying stock on credit Investors must start an account with a minimum balance of $2,000 (they can put in more if they want) Investors can now borrow as much as the $ amount in their account Ex.: with $2,000 in their account, investors have $4,000 in purchasing power BUYING ON MARGIN (example) If you open a margin account with $5,000, you can purchase $10,000 worth of stock If you buy 500 shares of Coca Cola at $20/share, you have $5,000 in equity (the part that is yours) and you owe $5,000 to the broker If the stock increases to $30 (now worth $15,000), you now have $10,000 in equity, while still owing $5,000 If the stock decreases to $10/share (now worth $5,000), you now have no equity, but still owe $5,000 STOCK SPLITS Splits are initiated if a company thinks that its share price is too high to attract investors Splits occur when a single share is divided up into more than one share (thus doubling shares in a 2-for-1 split) At the same time, the share price is cut in half (thus keeping the total value the same as before the split) Ex: 100 shares @ $50 per share become 200 shares @ $25 per share After a stock split share prices often rise STOCK SPLITS Total Value: 100 x $600 = $60,000 #1. A. 200 B. $300 C. 200 x 300 = $60,000 D. $320 E. 200 x 320 = $64,000 #2 A. 400 B. $160 C. 400 x 160 = $64,000 D. $180 E. 400 x 180 = $72,000 MUTUAL FUNDS Mutual funds: professionally managed pools of investors’ money invested according to predetermined investment strategies “professionally managed”: the mutual fund company makes daily decisions about buying/selling in the fund “pools of investors’ money”: investors buy individual shares in the funds “predetermined investment strategies”: each mutual fund focuses on one or more types of stocks (ex: telecommunication stocks), bonds (ex: municipal), or various combinations (ex: “balanced fund” = 60% stocks, 40% bonds) Advantages of mutual funds: 1. instant diversification (one fund can contain hundreds of stocks, bonds, etc.) 2. easy to buy and sell (liquid)