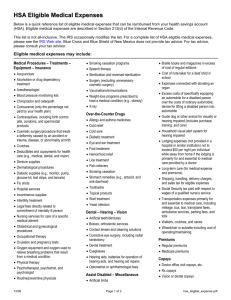

Health Savings Account (HAS)

advertisement

High Deductible Health Plan (HDHP) & Health Savings Account (HSA) Peru Community Schools Fall, 2009 What is an HSA? Qualified High Deductible Health Plan Health Savings Account In Network Coverage Lifetime Maximum - $5,000,000 Health Care Expenses Health Plan Pays After you reach the out-of-pocket maximum, the health plan pays 100% of covered charges You Pay 100% of the deductible $3,000 - Single / $6,000 - Family Preventive Care covered at 100% • Intended to cover serious illness or injury • IRS sets parameters on plan design Examples: Minimum deductible levels; no copayments for office visits • Preventive care can be covered at 100% HSA funds can be used for qualified medical expenses • Tax free growth • Tax free distributions (for qualified expenses) **MPL contributed $1,008 to employees who elected the HSA plan on January 1, 2009. This contribution was contributed in two equal sums in January and mid-year. What are Health Savings Accounts? • Congress created Health Savings Accounts (HSAs) to help individuals save for qualified medical and retiree health expenses on a tax-free basis. • Pairs a qualified high deductible health plan with a savings account for eligible individuals to help pay for qualified medical expenses • Combines the pre-tax treatment of a health flexible spending account, the portability and carry-over characteristics of a 401(k) plan, and the tax-free distribution of a Roth IRA For eligible individuals it is: • Very similar to a personal checking/savings account that is owned by you, the account holder, and used to pay for qualified medical expenses • You and/or your employer can fund the account • The HSA is a “custodian account” held at a trustee/bank/Insurance company • Account balances can be carried over year to year Who is Eligible? • To be eligible to contribute to an HSA you: – Must be covered by a qualified high deductible health plan (HDHP) – Cannot be enrolled in Medicare (generally age 65) – Cannot be covered by other health insurance that is not an HDHP • Additional coverage for dental and vision is allowed • Cannot have a broad based health Flexible Spending Account through employer or spouse’s employer – Cannot be eligible to be claimed as a dependent on another persons taxes – May not participate in both Section 125 FSA & HSA How Does the HSA Work? • • • • • You enroll in the qualified high deductible health plan You establish your HSA account You and/or your employer make contributions to the account You receive health care services You pay your out of pocket costs associated with your health plan (deductible and coinsurance) • You decide whether to take money out of your HSA account to reimburse yourself for “qualified” expenses • The money in your HSA account that you do not use stays with you and is available to use for future costs What are “Qualified” Expenses? • Qualified Medical Expenses are described in section 213(d) of the Internal Revenue Service code – Refer to IRS Publication 502 for examples • Health insurance premiums are not a qualified medical expense except: – For HSAs, the following can be reimbursed taxfree: • COBRA premiums • Qualified long term care premiums • Health insurance premiums while unemployed and receiving unemployment • Medicare premiums (Part A, B, C, & D) How Much Can I Contribute to an HSA? The IRS determines the annual contribution limits for HSA. These are based on either single or family enrollment. The contribution limits can change from year to year. For 2010 you may contribute up to: $3,050 Single $6,150 Family *Individuals age 55 and older can also make additional “catch-up” contributions of $1,000 per year. • Pros Pros & Cons to Consider: – Tax savings – Potential retirement savings – More control over how you choose to spend your health care dollars – Can help cover health expenses for periods of unemployment – Lower health plan premiums – HSA belongs to you and is portable – Employees currently contributing to Section 125 FSA could deposit that same amount in an HSA. With the HSA, there is no “use it or lose it” rule • Cons – Employee is responsible for tracking expenses, monitoring HSA contributions/distributions – Must become better healthcare consumer – Could result in higher out-of-pocket expenses, especially if you don’t fully fund your HSA Interested in an HSA? • Questions to Ask Your Bank or Other Financial Institution: – How long have you been administering HSAs? – How many HSA accounts are currently open through your [bank, institution]? – What is the minimum deposit required to open an HSA? – Do you have a process in place to prevent me from exceeding my annual contribution limit? – What types of reports/statements will I get with my HSA? How frequently are these provided? – What account fees are associated with your HSA? Please indicate ALL fees involved. – How will I access my HSA funds; i.e. checks, debit card? – What interest rates and investment options can you offer and at what account balance would these become available? Employer Contribution Rules Employers can make contributions to your employees' HSAs but these must be “comparable” to all comparable participating employees' HSAs. Your contributions are comparable if they are either: – the same amount, or – the same percentage of the annual deductible limit under the HDHP covering the employees Exception: collectively bargained employees are not comparable participating employees Eligibility Guidelines for 1/1/2010 Question: Are all insurance eligible personnel or just employees who already have Plan 1 or 2 allowed to transfer to Plan 3 (HDHP) 1/1/2010? Answer: The HSA enrollment will only be a transfer period where members who are already enrolled in one of the medical plans can move to Plan 3 (HDHP). (Members not currently enrolled could join any plan upon the experience of a HIPAA Qualifying Event.) Question: When can I transfer between medical plans within the consortium? Can I transfer out of Plan 3 (HDHP)? Answer: As it currently stands, there is an annual election period for the consortium where members can move to a lower costing plan each August for an October 1, effective date. Because Plan 3 (HDHP) is the lowest cost plan, the only way that you can move to Plan 1 or Plan 2 from Plan 3 is if you experience a HIPAA Qualifying Event. In Summary • Individuals must be eligible to contribute to an HSA; not required for distributions • The individual is responsible for compliance with IRS rules • If you don’t use your HSA money, you keep it for future years. • Contributions are subject to limits determined in reference to HDHP annual deductible and statutory limits • Contributions are tax free, earnings are tax free, and distributions are tax free if used for qualifying medical expenses By taking time to understand how each of the Group Health Plan options affect you and your family, you can make an informed choice that will best meet your healthcare and financial needs. It’s Your Money! What expenses can be paid by an HSA? Your HSA covers a wide variety of medical expenses. These medical expenses must be necessary for the treatment or alleviation of a specific illness or injury. They may include hospital or clinic services, prescription drugs and medications, certain over-the-counter drugs, and many other health related expenses as defined by Section 213(d) of the Internal Revenue Code. Medical expenses covered under the HSA can include expenses that are not covered under the high deductible health plan such as chiropractic, dental, orthodontia, or vision expenses. For more information about eligible expenses, please consult Publication 502 available at your local IRS office or from the IRS website: www.irs.qov. Your HSA can also be used to pay premiums for COBRA, Medicare, long-term care insurance (federal limits apply), and health plan coverage you may have while receiving unemployment compensation. The following are examples of qualified medical expenses: Acupuncture Alcoholism Treatment Ambulance Artificial Limbs/Teeth Aspirin Bandages Birth Control Pills Blood Pressure Monitoring Devices Blood Sugar Test Kit Body Scan Chelation (EDTA) Therapy Chiropractors Circumcision Copays/Deductibles Condoms Contact Lenses/Related Material Contraceptives Counseling (excludes marriage) Crutches Dental Treatment Dentures Diabetic Supplies Diagnostic Services Drug Treatment Drugs/Medicines Egg Donor Fees Eye Exams/Glasses Fertility Treatment Flu Shots Glucose Monitoring Devices Guide Dog Hearing Aids Home Care Hormone Replacement Therapy Hospital Services Immunizations lnclinator Insulin Laboratory Fees Laser Eye Surgery Learning Disability Medical Records Charge Medical Services Medications/Drugs Nursing Services Obstetrical Expenses Occlusal Guards Operations Optometrist Organ Donors Orthodontia Osteopath Over-the-counter Drugs/Medicines Ovulation Monitor Oxygen Physical Exams Physical Therapy Pregnancy Test Prescription Drugs Prosthesis Psychiatric Care Psychoanalysis Psychologist Reading Glasses Screening Tests Sleep Deprivation Treatment Smoking Cessation Programs Sterilization Procedures Supplies for Medical Condition Surgery Therapy Transplants Vaccines Vasectomy Vision Correction Procedures Wheelchair X-Ray Fees Questions? For more information, please refer to the United States Department of Treasury website: http://www.ustreas.gov/offices/ publicaffairs/hsa/