Baytree Health Savings Account Disclosure

advertisement

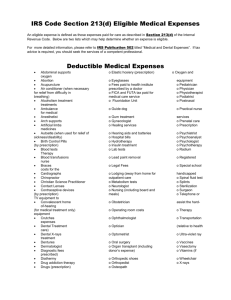

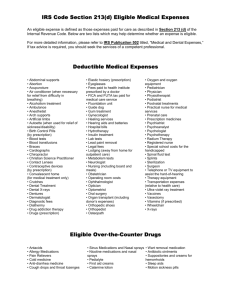

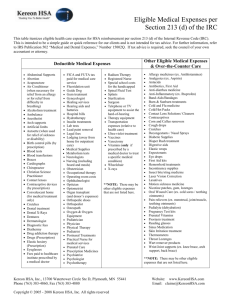

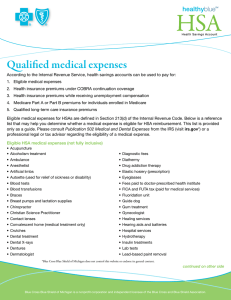

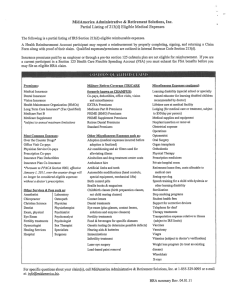

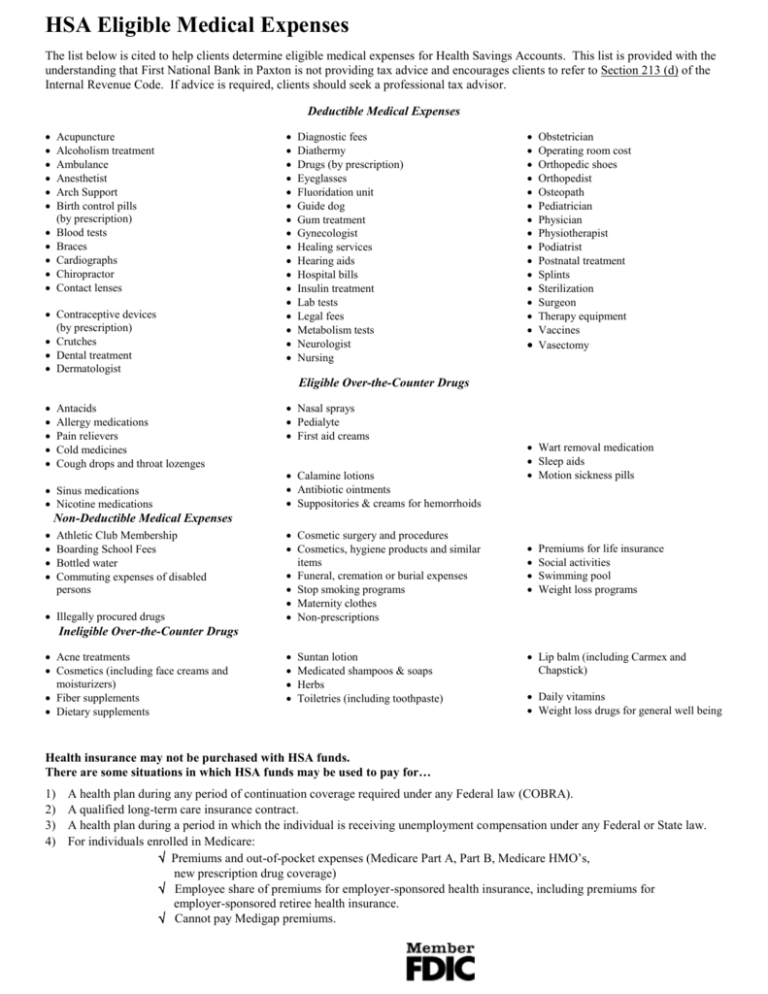

HSA Eligible Medical Expenses The list below is cited to help clients determine eligible medical expenses for Health Savings Accounts. This list is provided with the understanding that First National Bank in Paxton is not providing tax advice and encourages clients to refer to Section 213 (d) of the Internal Revenue Code. If advice is required, clients should seek a professional tax advisor. Deductible Medical Expenses Acupuncture Alcoholism treatment Ambulance Anesthetist Arch Support Birth control pills (by prescription) Blood tests Braces Cardiographs Chiropractor Contact lenses Contraceptive devices (by prescription) Crutches Dental treatment Dermatologist Diagnostic fees Diathermy Drugs (by prescription) Eyeglasses Fluoridation unit Guide dog Gum treatment Gynecologist Healing services Hearing aids Hospital bills Insulin treatment Lab tests Legal fees Metabolism tests Neurologist Nursing Obstetrician Operating room cost Orthopedic shoes Orthopedist Osteopath Pediatrician Physician Physiotherapist Podiatrist Postnatal treatment Splints Sterilization Surgeon Therapy equipment Vaccines Vasectomy Eligible Over-the-Counter Drugs Antacids Allergy medications Pain relievers Cold medicines Cough drops and throat lozenges Sinus medications Nicotine medications Nasal sprays Pedialyte First aid creams Calamine lotions Antibiotic ointments Suppositories & creams for hemorrhoids Wart removal medication Sleep aids Motion sickness pills Non-Deductible Medical Expenses Athletic Club Membership Boarding School Fees Bottled water Commuting expenses of disabled persons Illegally procured drugs Cosmetic surgery and procedures Cosmetics, hygiene products and similar items Funeral, cremation or burial expenses Stop smoking programs Maternity clothes Non-prescriptions Premiums for life insurance Social activities Swimming pool Weight loss programs Ineligible Over-the-Counter Drugs Acne treatments Cosmetics (including face creams and moisturizers) Fiber supplements Dietary supplements Suntan lotion Medicated shampoos & soaps Herbs Toiletries (including toothpaste) Lip balm (including Carmex and Chapstick) Daily vitamins Weight loss drugs for general well being Health insurance may not be purchased with HSA funds. There are some situations in which HSA funds may be used to pay for… 1) 2) 3) 4) A health plan during any period of continuation coverage required under any Federal law (COBRA). A qualified long-term care insurance contract. A health plan during a period in which the individual is receiving unemployment compensation under any Federal or State law. For individuals enrolled in Medicare: Premiums and out-of-pocket expenses (Medicare Part A, Part B, Medicare HMO’s, new prescription drug coverage) Employee share of premiums for employer-sponsored health insurance, including premiums for employer-sponsored retiree health insurance. Cannot pay Medigap premiums.