Business and Nonbusiness Bad Debt

advertisement

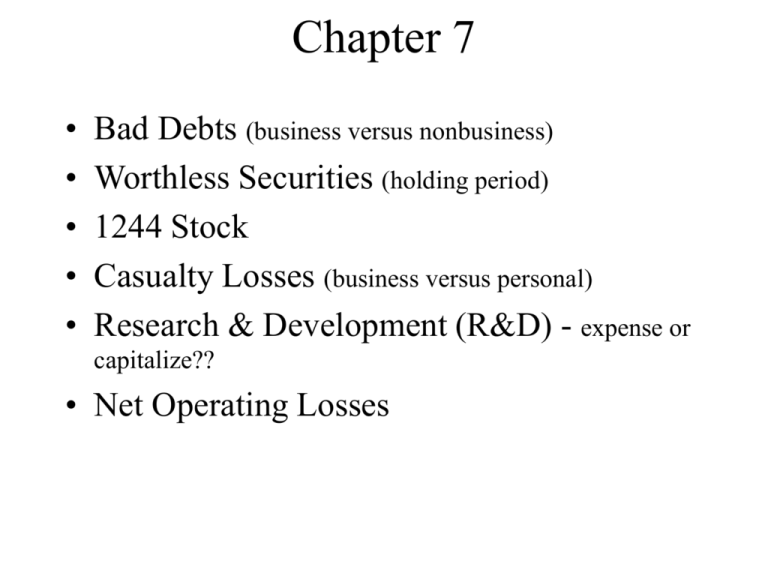

Chapter 7 • • • • • Bad Debts (business versus nonbusiness) Worthless Securities (holding period) 1244 Stock Casualty Losses (business versus personal) Research & Development (R&D) - expense or capitalize?? • Net Operating Losses Business and Nonbusiness Bad Debt • Business Bad Debt is deductible as an ordinary loss in the year incurred. • NonBusiness Bad Debt is always treated as a SHORT TERM CAPITAL LOSS. No loss recognized until the debt is completely worthless Worthless Securities • Capital loss is allowed for securities (stocks, bonds) that become completely worthless during the year. Loss is considered to have become worthless on the last day of the taxable year. • 1244 Stock – Small business stock that when issued meets certain qualifications. Loss is considered to be ordinary (not capital). Only individual shareholders qualify, and the loss is limited to $50,000 per taxpayer ($100K joint). 1244 applies only to losses, not gains. Casualty Loss • Casualty – sudden, unusual and unexpected. (fire, tornado, hurricane, storm, theft) • Casualty rules apply to business as well as nonbusiness (personally owned) property. But the rules are different between the two. • Generally, deducted in the year the loss occurs (for theft, year of discovery). If reasonable prospect of recovery (insurance) is expected, no loss permitted. If you expect a partial recovery, a partial deduction can be taken. • Disaster Area Losses – deduct in prior year or current year. Casualty Loss – Computing Loss • Business Loss / Completely Destroyed – loss is equal to adjusted basis at time of loss (reduced by insurance recovery). • Business Loss / Partial Destruction – loss is equal to lesser of: • Adjusted basis • Difference between FMV before and after the event (the decrease in value due to the casualty) Casualty Loss – Personal • Personal Loss – loss is equal to lesser of: • Adjusted basis • Difference between FMV before and after the event (the decrease in value due to the casualty) • Amount of the loss must be reduced: • $100 per event (per tornado, per fire etc.) • 10% of AGI (aggregate of all casualites) Casualty Loss – Personal (con’t) • Are casualty losses deductions FOR AGI or deductions FROM AGI?? Answer: it depends. • Can we have gains from casualty losses? How are they treated? • In determining the 10% of AGI reduction, net all casualties together including gains or losses. Research and Development Expense • Definition – costs associated with the development of an experimental model, plant process, a formula, invention, etc. • Does Not Include: expenditures relating to testing or inspecting products for quality control. Advertising or promotion, or consumer surveys do not qualify. Efficiency studies or management studies do not qualify. R & D (con’t) • Expense Method – election can be made to expense all R&D expenditures in the current year and all subsequent years. Cannot change methods once you start. Why would you want to change? • Capitalize and Amortize – R&D expenses are accrued and amortized over 60 180 months beginning in the month in which taxpayer realizes benefits from the expenditure. Net Operating Losses • Net Operating Loss (NOL’s) occur when deductions exceed revenue leaving the taxpayer with a net loss for the taxable year. • NOL’s may are first carried back to the preceeding two tax years and then forward for as many as twenty years. • An irrevocable election may be made not to carry the loss back but only to carry it forward. Salary 100,000 Rental Loss -10,000 Dividends 1,000 1244 Gain 30,000 1244 Loss 40,000 Personal Casualty Gain 6,000 Personal Casualty Loss -8,000 Business loan of $40,000 made in 2001. Borrower indicates in 2004 that the company is liquidating and expects to pay 50 cents on the dollar once assets are sold. Expect to receive payment in 2005. Nonbusiness loan of $10,000 is made in 2002. Borrower files for bankruptcy in the summer of 2004. Lender receives 20 cents on the dollar at November 18th, 2004 in final settlement. Bought 100 shares of ABC stock on September 1, 2003. Paid $10,000 for the shares. The stock went worthless on June 26, 2004. What is the AGI?