DEXIA « Impact Seminar - Université Libre de Bruxelles

advertisement

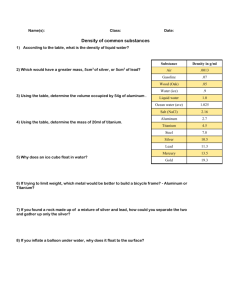

Silver Mining Professor André Farber Solvay Business School Université Libre de Bruxelles Question 1 - Data • Three months ago the company entered into a forward contract to sell 10,000 ounces of silver, the quantity that Silver Mining expected to produce in the first half of 2006 in one of their mines. • The forward contract matures in 9 months from now and the delivery price had been set at $6 per ounce. As a consequence of a major earthquake, silver extraction had to be stopped. Production is not expected to resume in the near future. The forward contract is no longer necessary. • The current price of silver is $7 per ounce and the current 9-month interest rate is 4% per annum with continuous compounding. • To offset the initial forward contract, you are asked to enter into a new forward contract to buy silver in 9 months. • Assume first that the cost of storing silver is zero. October 31, 2005 Silver Mining - Solution |2 1. What is the forward price of this new contract? Forward price: future value of spot price F Se rT 7 1.03 7.21 Underlying assumption: no arbitrage Value of new forward contract is 0: f = S – Fe-rT = 0 October 31, 2005 Silver Mining - Solution |3 2. How would you proceed to create a synthetic forward contract if a counterparty for the new forward contract is impossible to find? Silver Mining is SHORT on a 9-month forward contract for 10,000 oz with delivery price K = $6. To close the position, they should go LONG (buy forward). If no forward contract is available, they would create a SYNTHETIC foward. Now At maturity Buy spot -70,000 10,000 ST Borrow + 70,000 -72,132 Total 0 10,000 (ST – 7.2132) October 31, 2005 Silver Mining - Solution |4 3. What is the value of your net position? At maturity 10,000 (6 – ST) Short position 10,000 (ST – 7.2132) Synthetic forward Total -12,132 The value of the position today is the present value of -12,132 = -11,773 Remember that the unit value of a long forward contract with delivery price K is: f = (F – K) e-rT As Silver Mining is short, the value of of their position is: 10,000 (6 – 7.2132) e-3%×0.75 = -11,773 October 31, 2005 Silver Mining - Solution |5 4. You receive a fax from Mineral Trading confirming that they are ready to buy or sell forward silver in 6 months at $6.25 per ounce. What, if any, arbitrage opportunity does this create? The trader at Mineral Trading should follow a class in Derivatives! You make money by buying forward @ 6.25 from Mineral Trading and selling forward @ 7.21, the current 6-month forward price. You might have to create a synthetic short forward contract: Short silver (borrow silver and sell spot) Invest the proceed at the risk free rate Note: 1. Taking a short position is easy on paper – but you have to find someone willing to lend silver for 6 months. 2. Beware of credit risk. What if Mineral Trading doesn’t deliver at maturity? October 31, 2005 Silver Mining - Solution |6 5. Assume now that the storage costs are $0.25 per ounce per year payable quarterly in advance. Calculate the futures price of silver for delivery in 9 months. F ( S U )erT where U is the present value of the cost of storage. The cost of storage is $0.25 / 4 = $0.0625 per quarter to be paid at time t = 0, t = 0.25 and t = 0.50 U = 0.0625 + 0.0625 e-4%×0.25 + 0.0625 e-4%×0. 50 = 0.186 F (7 0.186)e4%0.75 $7.40 October 31, 2005 Silver Mining - Solution |7 Question 2 - Data • Silver Mining will have to invest in the coming months to repair its mining installations. The Treasurer plans to borrow $1 million in 6 months from now for a period of 6 months. He is considering taking a position on a 6×12 FRA to hedge the interest rate risk. The 6-month LIBOR rate is 3.5% per annum and the 12-month USD LIBOR rate is 4.3% (both with continuous compounding). October 31, 2005 Silver Mining - Solution |8 6. Calculate the fixed rate on the 6×12 FRA. • The fix rate on the FRA is equal to the 6×12 forward rate with simple compounding. dT 1 1 e3.50%0.50 R ( 1) ( 4.50%1 1) 5.17% T * T dT * 0.5 e Where does this formula come from? A quick review Consider a forward contract on a zero-coupon with face value 1+R(T*-T) and forward price = 1. What should be R in order for the value of the contract to be zero? Spot price of Zero Coupon S [1 R (T * T )]e r*T * Forward price F 1 Se rT Solve: e r*T * dT 1 R(T * T ) rT e dT * October 31, 2005 Silver Mining - Solution |9 7. What position (long or short) should Silver Mining take? Explain. • The payoff on the FRA at time T is: CFFRA LONG FRA: M (rT R)(T * T ) 1 rT (T * T ) receives Floating rate rT pays Fix rate R Silver Mining should go LONG on an FRA October 31, 2005 Silver Mining - Solution |10 8. Suppose that, 6 months later, the 6-month LIBOR rate (with continuous compounding) is 4.5% per annum. Verify the effectiveness of the hedge. 6-month Libor with simple compounding: 1 r 0.50 e4.50%0.50 r 4.55% Long 6x12 FRA Notional amount * (rSpot-Rfra) * Contract period = PV Interest paid Payoff FRA Total Interest rate per annum October 31, 2005 $100,000 -0.61% =4.55% – 5.17% 0.5 (year) At time T* -$307 At time T -$300 -$2,276 -$307 At time T* -$2,583 5.17% Silver Mining - Solution |11 Small difference due to rounding