PPT Unit 1

advertisement

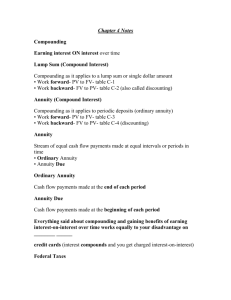

Unit 1 - Understanding the Time Value of Money • As managers, we need to be fully aware that money has a time value • Future euros are not equivalent to present euros, since euros in hand may be used for immediate consumption or invested • Inflation is the erosion of a currency’s purchasing power • Interest rates, which represent the return on investment, compensate for foregoing present consumption, loss of purchasing power due to inflation, and other risks associated with uncertain investment outcomes Understanding Future Values • The purpose of investing is to grow money, resulting in an increase in future purchasing power • Money in the present is referred to as present value; future money is referred to as future value • Interest rates are the mechanism used to equate future values with present values • Simple interest is an arithmetic process, whereby each period interest is calculated as a function of the principal invested, and added to the total. • Compound interest is a geometric process, whereby each period interest is calculated as a An Example of Simple Interest A 100,000 euro investment earns 5% simple interest for 20 years: 100,000 = the present value 5% = the simple interest rate 20 = the number of periods Solve for future value 100,000 x .05 = 5,000 euros annual interest 5,000 x 20 years = 100,000 euros total interest earned Future value = 100,000 + 100,000 = 200,000 euros An Example of Compound Interest A 100,000 euro investment earns 5% compound annual interest for 20 years: 100,000 = the present value 5% = the compound annual interest rate 20 = number of periods Solve for future value 100,000(1.05) = 105,000; 105,000(1.05) = 110,250; 110,250(1.05) = 115,762.50;115,762.50(1.05) = 121,550.625; 121,550.625(1.05) = 127,628.15, … or Future Value = 100,000(1.05)20 = 265,329.77 euros Simple versus Compound Interest Compound interest grows geometrically; simple interest grows arithmetically 300,000 250,000 200,000 Simple Compound 150,000 100,000 50,000 Y ea r Y 9 ea r1 2 Y ea r1 5 Y ea r1 8 r6 Y ea r3 Y ea Y ea r0 0 Notes on Compounding to Future Values • The difference in the two preceding examples, 265,330 – 200,000 = 65,330 euros, is due to earning interest on previously earned interest • This is the definition of compounding; each period builds on the previous period, resulting in a geometric growth rate • Most business investments and financial instruments use compound, not simple, interest • The more frequent the compounding period, the greater the interest earned on previous interest and, therefore, the greater the rate of growth in the money Examples of More Frequent Compounding Periods A 100,000 euro investment earns 5% compounded annually for five years: Future Value = 100,000(1.05)5 = 127,628.15 euros If semiannual compounding, Future Value = 100,000(1.025)10 = 128,008.45 euros If monthly compounding, Future Value = 100,000(1.0042)60 = 128,335.87 euros Annuities • An annuity is a series of payments of equal amounts that occur at equivalent intervals • Examples of an annuity would include a house payment on a mortgage loan, or a lease payment on a piece of rented equipment • An annuity structured so that each payment is made at the end of the period is known as an Ordinary Annuity • An annuity structured so that each payment is made at the beginning of the period is known as an Annuity Due • The difference in an ordinary annuity and an annuity due is that an annuity due involves an extra compounding period, since the first payment begins accruing interest immediately Discounting – Understanding Present Values • An important concept for managers in utilizing the time value of money to make sound economic decisions is discounting • Discounting is the process of taking future money and converting it into present money • Discounting is the exact opposite of compounding; periodic interest is deducted each period from the future date back to the present • Discounting is important because managers make decisions in the present, therefore money variables should be expressed in present values to make economically logical decisions An Example of Discounting An investment promises to pay off 500,000 euros in 10 years. If the appropriate interest rate is 8%, what is the present value of the investment? 500,000 = the future value 8% = the interest rate 10 = number of periods Solve for Present Value 500,000(1.08) -10 = 231,596.74 euros