Retail Excellence Ireland

RECESSION – WHAT RECESSION?

AGENDA

- What Retail Is About Today?

- Some Truths About Town Revival

- Two Brief Town Revival Case Studies

- 10 Quick Wins For Towns

AGENDA

What Retail Is About Today?

THINGS HAPPENING

1.

RETAIL IS

NOT

ABOUT A

PRODUCT

ON A

SHELF

2.

MIDWEEK

CONVENIENCE

WEEKEND

EXPERIENCE

3.

RETAIL IS

NOT ALL

ABOUT

PRICE

WHY ARE THEY GROWING

EXPERIENCE

Shared Experience

OPEN

Heritage & Beliefs

CAPTIVE

Thru Difference

CLEAR

Clarity of Offer

PERSONAL

Engage thru People

PRICE

€

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X X

X

X

X

X

X

X

X

X X

X

X

X

X

X

X X

X

X

X

RETAIL MUST BE:

EXPERIENTIAL – PROVIDE AN EXPERIENCE THAT CAN BE SHARED

OPEN – COMMUNICATE YOUR HERITAGE & BELIEFS

CAPTIVATING – ENGAGE CONSUMERS THROUGH DIFFERENCE

CLEAR – PROVIDE A CLARITY OF OFFER

PERSONAL – ENGAGE CUSTOMERS THROUGH YOUR PEOPLE

A STORE MUST OFFER AN

EXPERIENCE

Experiential

– Provide an experience that can be shared

A STORE MUST BE

OPEN

OPEN

– Communicate your heritage and beliefs – have a personality

OPEN

– Communicate your heritage and beliefs – have a personality

A STORE MUST BE

CAPTIVATING

CAPTIVATING

– Engage customers through difference

CAPTIVATING

– Engage customers through difference

CAPTIVATING

– Engage customers through difference

CAPTIVATING

– Engage customers through difference

A STORE MUST BE

CLEAR

CLEAR

– Provide a clarity of offer

CLEAR

– Provide a clarity of offer

CLEAR

– Provide a clarity of offer

CLEAR

– Provide a clarity of offer

LAVENDER

€7.95

Hardy – I survive the cold

Evergreen – I keep my leaves on – all year round

Locally Sourced – I am good for local jobs

Good Colour – I retain my colour all year round

Fragrance – I will smell great in your garden

When I Grow Up – I will be 4 foot Tall

CLEAR

– Provide a clarity of offer

A STORE MUST BE

PERSONAL

PERSONAL

– Engage customers through your people

Acknowledgement

Closing Offer of Help

Up-selling Qualifying

Recommendation Knowledge

PERSONAL

– Engage customers through your people

PERSONAL

– Engage customers through your people

High

Service

Expectation

Footwear

Pharmacy

Pet

Jewellery

Fashion

Telco

Sports

Home|Gift

Electrical

Furniture

Entertainment

Forecourt

Grocery

Low

Service

Expectation

Discount

Low Customer Lifetime Value

(ATV, Loyalty, Expectation)

High

AGENDA

Some Truths About Town Revival

The Problem

Out of town retailer preference

Weak town centre mix

Over retailed

Planning policy

Greater consumer mobility

Car parking charges & enforcement

Mixed landlord base

Accessibility

E-Commerce competition

Changing consumer behaviour

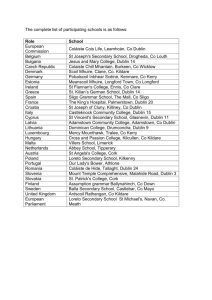

Towns & Cities Review 2012

Sample –

11,287 citizens

5,027 stakeholders

Face to face interviews – Conducted September 2012

KINDLY SUPPORTED BY

The Town & City Review investigated –

1. What are the most important factors for a consumer in deciding to visit a town or city.

2. How do citizens rate their town or city.

3. How do stakeholders rate their town or city.

TOP QUARTILE

Town | City County

Westport

Killarney

Swords

Ashbourne

Dungarvan

Mayo

Kerry

Dublin

Meath

Waterford

Carrickmacross Monaghan

Clonakilty Cork

Malahide

Skerries

Listowel

Dublin

Dublin

Kerry

Kilkenny City Kilkenny

Castleknock Dublin

Tramore Waterford

Galway City Galway

Tullamore Offaly

Wexford Wexford

Ratoath Meath

Carrick on Shan.

Leitrim

Cobh Cork

Kinsale

Monaghan

Midleton

Cork City

Letterkenny

Carlow

Cork

Monaghan

Cork

Cork

Donegal

Carlow

TOTAL

SCORE

85.61%

84.58%

83.92%

82.28%

80.40%

80.10%

79.31%

78.07%

78.06%

77.55%

76.54%

76.50%

75.06%

75.02%

74.48%

74.04%

73.99%

73.00%

71.80%

71.45%

71.34%

71.21%

70.78%

70.77%

70.47%

TOTAL

RANK

11

12

13

14

15

8

9

6

7

10

1

4

5

2

3

20

21

22

23

16

17

18

19

24

25

% CITIZEN

SCORE

87.62%

87.89%

85.21%

84.58%

81.77%

78.36%

78.90%

79.11%

79.27%

79.15%

75.24%

77.76%

80.51%

77.31%

77.63%

73.40%

72.98%

74.17%

74.06%

72.75%

74.38%

72.53%

72.08%

73.41%

74.38%

CITIZEN

RANK

15

12

6

14

13

11

10

9

7

8

2

4

5

1

3

24

17

26

27

21

23

18

19

20

16

% STAKEHOLDER STAKEHOLDER

SCORE RANK

80.93%

76.84%

80.91%

76.89%

77.20%

84.15%

80.25%

75.65%

75.25%

73.82%

79.59%

73.57%

62.33%

69.69%

67.13%

75.54%

76.34%

70.27%

66.52%

68.43%

64.24%

68.13%

67.74%

64.61%

61.33%

5

14

58

19

35

1

4

10

12

13

2

7

6

8

3

25

50

27

30

11

9

17

43

48

65

2nd QUARTILE

Town | City

Athlone

Birr

Buncrana

Cahir

Carrigaline

Castlebar

Cavan

Clonmel

Dalkey

Donabate

Dublin City

Dunboyne

Gorey

Kilrush

Lucan

Maynooth

Mitchelstown

New Ross

Newbridge

Roscommon

Tralee

Trim

Waterford City

Wicklow

Youghal

County

Westmeath

Offaly

Donegal

Tipperary

Cork

Mayo

Cavan

Tipperary

Dublin

Dublin

Dublin

Meath

Wexford

Clare

Dublin

Kildare

Cork

Wexford

Kildare

Roscommon

Kerry

Meath

Waterford

Wicklow

Cork

3rd QUARTILE

Town | City

Arklow

Ballina

Ballybofey

Blackrock

Bray

Clane

Clondalkin

Drogheda

Dun Laoghaire

Dundrum

Ennis

Enniscorthy

Fermoy

Leixlip

Mountmellick

Mullingar

Naas

Nenagh

Newcastle West

Portlaoise

Rathmines

Roscrea

Tallaght

Thurles

Tuam

County

Wicklow

Mayo

Donegal

Dublin

Wicklow

Kildare

Dublin

Louth

Dublin

Dublin

Clare

Wexford

Cork

Kildare

Laois

Westmeath

Kildare

Tipperary

Limerick

Laois

Dublin

Tipperary

Dublin

Tipperary

Galway

BOTTOM QUARTILE

Town | City

Ardee

Athy

Balbriggan

Ballinasloe

Bandon

Blessington

Carrick-On-Suir

Celbridge

Dundalk

Dunshaughlin

Edenderry

Greystones

Kells

Kilcock

Kildare

Limerick City

Longford

Loughrea

Macroom

Mallow

Navan

Portarlington

Sallins

Sligo

Tipperary

County

Louth

Kildare

Dublin

Galway

Cork

Wicklow

Tipperary

Kildare

Louth

Meath

Offaly

Wicklow

Meath

Kildare

Kildare

Limerick

Longford

Galway

Cork

Cork

Meath

Laois

Kildare

Sligo

Tipperary

KEY DETERMINATES OF A TOWN OR CITY VISIT

Importance of towns proximity to where you live

Importance of the standard of retail

(Women /

Day Time

Economy)

Importance of dining & entertainment alternatives

(Men /

Evening

Economy )

Importance of car parking access

Importance of the town/city atmosphere

/ safety

Importance of car parking price

Importance of town/city streetscape, public realm and presentation

Importance of town proximity to where you work / go to college

Importance of events and promotions

Importance of public transport

74.69%

1 st

70.76%

2 nd

69.82%

3 rd

67.25%

4 th

66.74%

5 th

66.08%

6 th

65.21%

7 th

62.91%

8 th

60.46%

9 th

56.37%

10 th

Key Learnings -

• If the retail & hospitality mix is not right, they wont come

• All parts of the day are important:

- Daytime Retail – More important to women

- Evening Economy – More important to men

• Accessibility to parking is more important than price (women with kids)

• Citizens want a streetscape which revives and does not drain

• We must communicate better and provide citizens with a “Call to

Action”

• Stakeholders must be a central part of the solution

AGENDA

Two Town Case Studies

LIMERICK

Town Team with a Town Plan

LIMERICK CITY REVIVAL WORKFLOW PLAN

OBJECTIVE 1 – Retail & Hospitality Investment

OBJECTIVE 2 – Citizen Engagement

OBJECTIVE 3 – The Town Product (Streetscape, Standards, Service, Safety)

Outcomes –

• Definition of the Limerick inner core

• Database of all stakeholders in the inner core

• Database of vacant premises

• Publication of “Limerick Vision”

• Quantification of local spend and opportunity to trade

• Publication of Limerick Prospectus

• Identification of “wanted brands” for the city

• Planned redevelopment of anchor shopping sites

• Investment briefings – Limerick and Dublin

• Appointment of a Town Coordinator

• Rates grant for “wanted” new entrants

• 35 new stores with a 95% occupancy level in the inner core

UPPER BAGGOT STREET

SOME POTENTIAL OBJECTIVES?

1. Build a retail mix, a streetscape and create an ambience which will appeal to a wider geographic radius. In effect move from being a convenience based street to being a destination

2. Create an identity for Upper Baggot Street – the identity might be centred around being a cosmopolitan & chic urban village

3. Engage and communicate with local residents and workers in a more proactive manner

4. Ensure that standards are maintained in the street. Shop fronts, street cleaning, painting scheme, hanging baskets etc...

OBJ 1: DESTINATION

OBJ 1: DESTINATION

- Define The Upper Baggot Street Inner Core – a congregation point

- Select an Appropriate Retail Mix for all day parts

- Soften the Streetscape – awnings, planting, planters

- Traffic Calming Measures

- Implement Street Furniture and Seating

OBJ 1: DESTINATION: RETAIL MIX ASSESSMENT

OBJ 1: DESTINATION - STREETSCAPE

-A congregation point

-Enhance dwell time

-Appeal to wider radius

OBJ 2: IDENTITY

- A Brand – Foster Ownership & Sense of Place

- On Street Identify with Uniformity & Symmetry

- A Sense of Arrival

OBJ 2: IDENTITY

OBJ 2: IDENTITY – A SENSE OF ARRIVAL

OBJ 3: COMMUNICATION

- Citizen Database

- Communications Calendar

- Loyalty Card

OBJ 3: COMMUNICATION

SIGN UP TO RECEIVE UPDATES

BENEFITS AND LOTS OF LOVE!

-Invitation to Events

- Special Discounts

- Food & Wine Tastings

- Friday Music

NAME

MOBILE

DUBLIN’S URBAN VILLAGE

OBJ 4: STANDARDS

- Statute of Behaviour

- Identify & Audit Standards

- Act Where Improvements Are Needed

- Gardai / Stakeholder Communication

OBJ 4: STANDARDS

AGENDA

10 Quick Wins For Towns

10 QUICK WINS FOR TOWNS

GETTING STARTED

DEFINE THE INNER CORE

ENGAGE WITH

STAKEHOLDERS

RETAIL & HOSPITALITY INVESTMENT

LIST REQUIRED RETAIL /

HOSPITALITY INVESTORS

CREATE AN INVESTMENT

PROSPECTUS

CITIZEN ENGAGEMENT

CITIZEN DATABASE

COMMUNICATIONS /

PROMOTIONS STRATEGY

CHAMBER SHOP LOCAL

INCUBATED SPENDING

THE TOWN PRODUCT – STREETSCAPE, STANDARDS, SERVICE, SAFETY

COMMENCE STREET

AUDITS

STREETSCAPE

IMPROVEMENT WORKS

RETAILER STATUTE OF

BEHAVIOUR

THANK YOU

Ennis Office - 1 Barrack Street, Ennis, Co. Clare

Dublin Office – 32 Upper Baggot Street, Dublin 2

T: 353 (0) 65 6846927 | F: 353 (0) 65 6892451 | E: info@retailexcellence.ie | W: retailexcellence.ie