Workers Classification Basics / Scholarship Payments

advertisement

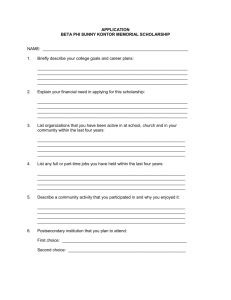

Generally, a scholarship is an amount paid for the benefit of a student, to aid the student in the pursuit of study at an educational institution. Scholarships and fellowships are payments to students for which no services are rendered or required. These awards are granted for the purpose of off-setting the cost of tuition, room and board, fees and/or other incidental expenses of attending the University. Scholarships are usually granted for some academic purpose (Recruitment), or for academic performance. There should be “no strings attached” to the award. A scholarship is more than a name. The IRS classifies scholarship/fellowship payments as Miscellaneous Income. No taxes are withheld from these payments, although the University does report the payments to the IRS(1098-T). If the scholarship/fellowship awards are not used by the student to offset the cost of qualified tuition and certain other expenses specified in the tax law then these moneys may need to be reported as income to the IRS by the student. A stipend is provided as a subsistence allowance for fellows to help defray living expenses during the research training experience. It is not provided as a condition of employment with either the Federal government or the sponsoring institution. The term stipend can sometimes be misused and is used often in situations where a department wants to pay funds to a student. The true intent and purpose of the payment must be determined. The purpose of the payment helps in determining which department would pay the student. If work or service is required to receive the award, this could be a compensation situation and would not constitute a scholarship payment. Research payments are usually considered as payment for work and would be Payroll. To be considered a scholarship payment: The student’s research should be independent, i.e. not assisting faculty with UCF research. The student must be receiving academic credit for the research. The student should be receiving compensation for research work hours separate from the scholarship. The purpose of the scholarship award cannot solely be the research. Unpaid Internships are always problematic because a scholarship payment can be deemed as payment for work. To be considered a scholarship payment: The student must be receiving academic credit for the internship. The student should be receiving compensation for work hours separate from the scholarship. The purpose of the scholarship award cannot solely be the internship. Federal crackdown on worker classification issues will yield $7 billion over 10 years Labor Department estimates 30% of employers misclassify employees Misclassification can deny workers’ basic rights and protections 2013 TIGTA Report – Estimated that employers save, on average, $3,710 per employee by misclassifying workers. $1,192,931 in taxes not properly reported in 1 year by an audit of 778 employers. Consolidated Appropriations Act of 2014 funded state unemployment offices to address misclassification of workers. Employee: Individual who performs services for you who is subject to your control regarding what will be done and how it will be done Independent contractor: An individual who performs services for you, but you control only the result of the work Scholarships: An amount paid to or allowed for the benefit of a student to aid such individual in pursuing their studies. Does not apply to any portion of any amount received which represents teaching, research or other services provided by the awardee. Types of control Behavioral control Financial control Relationship of the parties Type of instruction given Degree of instruction Evaluation systems Training provided by the business Key fact to consider: Whether the business retains the RIGHT to control the worker ▪ Regardless of whether the business actually exercises that right Significant investment Unreimbursed expenses Opportunity for profit or loss Services available to the market Method of payment Written contract Employee-type benefits Permanency of relationship Services provided a key activity of business Requirements for reports Payment of business or travel expenses Investments in facilities Work for multiple companies Control over discharge Level of instruction Degree of business integration Control of assistants Flexibility of schedule Need for on-site services Method of payment Provision of tools & materials Realization of profit or loss Availability to public Right to termination Amount of training Extent of personal services Continuity of relationships Demand for full-time work Sequences of work Good reasons Specialized expertise needed Non-integral undertakings Short-term projects Institution doesn’t have employees who do this job Bad reasons Payroll tax and benefit avoidance Circumvention of personnel rules and pay restrictions Quicker than going through HR It is what the worker wants It is the way we have always done it Contractors who worked for the university in the past 12 months Rehire former employee to perform similar duties Employees with a side business unrelated to their day job Photographer at holiday parties Pianist at a retirement function Interpreter on an urgent basis or crisis mode New hires Substitute teachers Graders Temporary help (workers who perform similar duties performed by employees) Workers who spend most of time in offices provided by university Hire contractors who will work for the university within the next 12 months Workers who receive continuing payments over several years Classification by function worker performs Teaching a course that earns credit ▪ Employee Teaching a course that does not earn credit ▪ Employee ▪ Unless individual meets criteria of holding oneself out as a contractor Providing services related to research ▪ Employee Substituting for a TA ▪ Employee Classification by function worker performs Serving as a proctor or grader ▪ Employee Receiving an honorarium ▪ Contingent on current status (i.e. if an employee, then treat as wages) Moonlighting ▪ Employee ▪ Unless individual meets criteria of holding oneself out as a contractor Officiating a sporting event ▪ Independent contractor Payment of FICA taxes for both worker & employer, & income tax withholdings Possible offset by certification from worker that attest to reporting taxable income & appropriately paying taxes Penalties for failure to withhold income taxes & file required tax forms & other filings Additional costs Administrative burden of filing amended W-2s; cost to employee for re-filing of their tax return Possible retroactive applications of benefits and possible penalties assessed by the state, such as: ▪ ▪ ▪ ▪ Retirement contribution Health insurance coverage Sick/vacation leave FAPLAN Contributions Instructors and substitutes Lawyers Schedule of classes & rooms provided Prescribed teaching hours Engaged to teach certain subjects Students assigned to class by college Required to give written exam Use college grading system Instructor may provide substitute ▪ Must have certain qualifications Employee or Independent Contractor? Employee Adjunct professor Taught online courses ▪ 4-12 courses per year ▪ Separate contract for each course Required to follow employment policies Paid fixed amount for each course Provided with syllabus Established own work hours Able to work from any location Course dates set by university Web interface provided by university Required to provide report including evaluation of student learning Employee or Independent Contractor? Employee Proctors Administer examinations Times & places of exams arranged by proctor Procedure for giving exam provided Required to submit tests with report at end of exam Paid by hour ▪ Guaranteed minimum of one hour Reimbursed for expenses May be discharged at any time Employee or Independent Contractor? Employee Biologist Grant money to support basic research project ▪ ▪ ▪ ▪ Salary for researcher Supplies and equipment Assistance Overhead for institution Extent of research determined by grantee Place and manner of performance determined by grantee Unused funds returned to grantor foundation Employee or Independent Contractor? Independent Contractor Research associate Conducted scientific research ▪ Type of research specified Subject to rules and regulations of the Bureau Entitled to the rights & privileges which accrue to members of its staff Provides report including results of research Employee or Independent Contractor? Employee Interns Lodged in university dorms & provided transportation Paid $3,000 Not a degree requirement Conducted research ▪ Assigned to work on particular project ▪ Worked with employee of grantor as a mentor Not given instruction on how to perform services Written report and presentation required Materials & supplies provided by grantor University carried worker’s compensation insurance Full-time for ten weeks Performed services under university name & did not perform services for others Employee or Independent Contractor? Employee Consultant Written agreement ▪ Manage the computerization of records ▪ Directed as to scope of duties & responsibilities ▪ Terminated by either party 6-8 hours per day ▪ 6 months Firm's location & home office Paid hourly Reported to director 2-3 times per week No benefits Furnished own computer & printer No training Held himself out to public Performed services under own business name Employee or Independent Contractor? Independent Contractor Retired employee Formerly account manager, project manager, operations manager, & director Advice on sales & engineering issues ▪ Two years Installation of new system Worked at Firm’s location ▪ Worked out of conference rooms Paid hourly Time off Set own hours Employee or Independent Contractor? Employee Off duty police officer Provided security for university football games Volunteered with respective police jurisdiction No instruction provided Hours established by university Meeting before duty began Equipment provided by worker’s respective jurisdiction Individual posts assigned by respective jurisdiction Written reports possible Paid hourly Employee or Independent Contractor? Employee Contacts: UCF Office of Student Financial Assistance Michael Bell 2-0090 UCF Tax – A division of Finance & Accounting Joel Levenson 2-0235 Meghan McCollum 2-1013