EVA - Strategy

advertisement

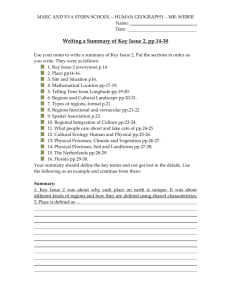

EVA & Strategy Stern Stewart, April 2000 ABC, Balanced Scorecard & EVA Stern Stewart, April 1999 TakeAway Points “In business circles,the term ‘strategic’ seems to be a synonym for negative present value” EVA & Strategy , Stern Stewart, April 2000 “New management techniques are based on economic theory rather than being tied to accounting frameworks …” • “Traditional financial measures confuse accounting anomalies with the underlying economics of of business” • “An accountant measures profit earned, while an economist looks at what could have been earned” EVA & Strategy , Stern Stewart, April 2000 ABC, BSC & EVA, Stern Stewart, April 1999 MVA Components • Invested capital – Level – Velocity • Current operations value (COV) – Discounted stream of returns (EVA) – Especially for mature businesses • Future growth value (FGV) – Internal / external – “In the money” or “out of” – Real Options EVA & Strategy , Stern Stewart, April 2000 Capital • Flexible vs. “rigid” (e.g. plants & equipment) • Tangible vs. intangible (brands, intellectual capital, organizational “software”, etc) • Equity vs. debt (which is self-disciplining) • Low cost vs. matched to needs EVA & Strategy , Stern Stewart, April 2000 EVA Objectives • Decentralize ownership & accountability • Develop strong “business literacy” …Get all employees speaking the same language • Confer economic discipline at all levels …Act like owners • Institutionalize a high performance culture EVA & Strategy , Stern Stewart, April 2000 EVA • Measuring profits after subtracting the expected return to shareholders (capital charge) • “Creating sustainable improvement in EVA is synonymous with increasing shareholder wealth” • “Switch from managing earnings to managing value” • A “management system”, not just a metric … ABC, BSC & EVA, Stern Stewart, April 1999 EVA: Integrated performance measurement, management, and reward system • Planning • Portfolio management • Decision-making: strategic, tactical • Total compensation EVA & Strategy , Stern Stewart, April 2000 Increasing EVA • Improve returns on existing capital Prices, margins, costs, volume • Grow profitability Increased sales, new products, new markets • Harvest underachieving parts Curtail investment, rationalize, divest, liquidate • Optimize cost of capital EVA & Strategy , Stern Stewart, April 2000 Value Creation Profiles High Prospects Superstars FGV % of MVA Benchwarmers Steady Veterans Low Negative EVA /Capital EVA & Strategy , Stern Stewart, April 2000 Positive Traditional Performance Metrics Traditional Performance Metrics • “Too blunt” (vs. sharp focus) • Numerous & complex … not aligned or integrated • Not systematically tied to value creation • Often, represent negotiated settlements prone to understate and underperform potential • Not easily “internalized” by employees • Key: balance accuracy & simplicity … get employees to think and act like owners EVA & Strategy , Stern Stewart, April 2000 Dysfunctional Behaviors Influenced by traditional accounting-based performance measures… • Rampant short-termism – EPS focus – End of month, quarter, year • Underpricing of capital – Overinvestment (especially mature businesses) – Misallocations (feed dogs, starve stars) – Underachievement (below WACC) • Excessive vertical integration – Versus outsourcing, partnerships, alliances • “Cooked” books – Acquisition accounting, accruals, transaction timing EVA & Strategy , Stern Stewart, April 2000 Stock Option Downsides • “Ownership” is beyond most employees sightlines • Often fail to provide clear and direct linkage between actions and results • Shared risk / return desired in bull markets, discouraging in bear markets EVA & Strategy , Stern Stewart, April 2000 Other Performance Management Methodologies Activity Based Costing (ABC) • As product and customer mix become more diverse, the assignment of overheads becomes grossly misleading, distorting the cost of individual products and services. • So, ABC is used to identify all activities, direct and indirect, and allocate the costs associated with these activities more precisely. • May (most) ABC systems only capture P&L costs. Should also be capturing the cost of capital (e.g. more inventory associated with a product is an economic cost). • ABC is most useful for operations with high indirect costs (overhead), complex transfer pricing issues, and shared processes or facilities. ABC, BSC & EVA, Stern Stewart, April 1999 Balanced Scorecard • Translates vision and strategy into objectives • Typically, 4 broad categories with 2 to 5 objectives each • Financial & non-financial objectives • Lagging (e.g. accounting P&L) and leading indictors (e.g. customer satisfaction) • Deployment and Alignment* … Deployment: consistent from top down (vertical) Alignment: consistent across functions (horizontal) • Issue: lacks a single focus of accountability ABC, BSC & EVA, Stern Stewart, April 1999 * Lecture Notes, K.E. Homa, 2001