Budget & Performance Integration PowerPoint Presentation

advertisement

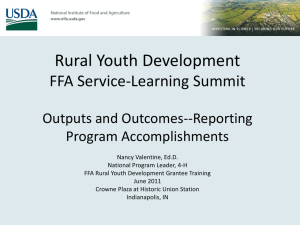

W orkshop on the President’s Management Agenda for SES Managers Budget and Perform ance Integration Justine Farr Rodriguez March 8, 2002 Transformation to PerformanceOriented Government • A transformation to performance-oriented government has begun and seems likely to be more deep-rooted than its predecessors. • Attention will focus on outputs produced and outcomes influenced throughout a cycle of assessing past results, developing policy, justifying and executing the budget, managing staff, acquisitions, IT, and financial reporting. What Works and Why? • Agencies will need more rigorous analysis of program effectiveness for FY 2004. • All kinds of documentation will be helpful in showing that a program works and that its managers understand why and how. • For programs that are less effective, the same kind of rigorous analysis must support proposals for reforms. Alignment: The Key to Green • Structural reforms to support budgeting and managing for results start by aligning “program activity” sub-accounts with an output or cluster of outputs. • Under a legislative proposal, appropriations to these accounts would cover the annual cost of resources to produce these outputs. • This would provide incentives for efficiency, integrate performance plans and budgets, and highlight effectiveness. Performance-Oriented Government • Nations are increasingly shifting to buying outputs, targeting outcomes, and performance budgeting. – – – – – – – – New Zealand Australia United Kingdom Canada Netherlands France OECD Malasia treasury.gov.nz budget.gov.au hm-treasury.gov.uk cga-canada.org minfin.nl minefi.gouv.fr oecd.org mir.com.my/lb Performance-Oriented Government • State and local governments have also been moving to performance budgeting. – – – – – – – – Texas Virginia Louisiana Missouri NASBO Sunnyvale, CA Indianapolis, IN Charlotte, NC library.unt.edu/govinfo dpb.state.va.us state.la.us/opb/pbb oa.state.mo.us/bp nasbo.org ci.sunnyvale.ca.us indygov.org charmeck.nc.us Performance-Oriented Government • The Federal Government has moved toward performance management for a decade. • Chief Financial Officers Act in 1990. • Government Performance and Results Act in 1993. • Federal Accounting Standards Advisory Board recommends matching cost with goods, services delivered to public, 1993. • Government Management Reform Act of 1994. • Federal Acquisition Streamlining Act of 1994. • Clinger-Cohen Act of 1996. • Agencies have financial, information, procurement, and human resources advisers linked in cross-agency councils. Performance-Oriented Government • So far, we have improved information about performance and better plans. • We also have information about cost, including some on the cost of programs. • Attention to this information is voluntary. • But if it is in the budget as performance with matched cost, it drives decisions and creates incentives for more effective and efficient government. Performance-Oriented Government In FY 2003, we started to use performance ratings in budget decision-making -- to allocate resources to support results. Within each sub-function or business line: – Support effective programs; – Reform less effective programs, or – Redirect resources to more effective uses. Effective programs influence outcomes! Performance-Oriented Government Performance orientation will be infused into every aspect of government: Budgeting -- focus on results, align structure Managing -- in the spotlight Staffing -- empower staff, reward results Acquisition -- competitive, performance-based IT -- integrated, timely, accessible Reporting -- results transparent to citizens What Works and Why? A full benefit-cost study is the “gold standard” of evaluation. It works! • Because its benefits exceed its cost -- and despite its high unit cost -- the Job Corps got funding for four more residential centers and upgrading to include education for high school diplomas. • The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) has proven itself cost-effective. Funding will cover all eligible applicants. • Funding for drug treatment was increased based on the decreased drug use, health costs, and criminal activity found by the latest evaluation. What Works and Why? An evidence-based logic model could help. • Document what has happened to an outcome from your agency performance plan. • Develop a logic model showing the outputs and environmental factors that could influence the outcome. • Look for evidence on the strength and nature of each relationship in research. • Examine recent patterns of agency outputs and external factors to see whether these relationships provide a reasonable explanation of changes in the outcome. What Works and Why? Benchmarking can provide some evidence of efficiency and perhaps effectiveness. • Identify similar operations elsewhere in government or in the private sector. • Compare these operations to analyze their relative cost and outputs. • Carefully analyze the similarities and differences. • Are there any ways in which these are not comparable operations? What are the implications of the differences? Performance-Oriented Budgeting Submissions that support results: • Involve planning, budgeting, and program staffs; • Ground the plan in previous results: – Document effectiveness! – Explain why less effective programs were selected for reform; how they will succeed. • Integrate past, future performance with resources in streamlined presentation. Performance-Oriented Budgeting Preparing a performance budget: • For each outcome, which outputs with which characteristics have the most effect? • What is the full cost of producing these outputs? • Could efficiency be improved? • With different resource levels, how would production or performance targets change? Outputs Are the Link Between Inputs and Outcomes Outputs Inputs Outcomes Financing sources Net impacts – Outputs or clusters of related outputs can be aligned with staff offices and budget accounts. – Outputs and other factors can be related to outcomes using analytical equations. Performance-Oriented Infrastructure Two steps are necessary to strengthen budget structure: • Improve alignment of budget accounts and the program activities within accounts and staff units with responsibility for achieving specific results. – This can be done agency by agency. • Charge these accounts consistently with the full annual cost of the resources used. – This requires government-wide legislation. Alignment: The Key to Green Alignment of the program activities within accounts and staff units with responsibility for producing an output or related cluster of outputs toward the same outcome is the key to green in integration, and other initiatives. – This puts authority and funding for the full cost of programs in the hands of line managers and gives them flexibility in resource use to achieve better results. – It facilitates integration of budgetary, performance, and accounting information for a program or bureau on small, standard systems for everyday management. Alignment for Integration with Plans • Start with a good strategic plan with a few agency strategic goals. • For each goal, identify outcomes the agency is committed to influence. • Identify all of the program activities that contribute to influencing each outcome. • Develop an integrated plan and budget structured around these goals, outcomes. • Include summaries of bureau operations. Alignment for Achieving Results • Align program budget accounts with bureaus to provide organizational accountability over time. – Within bureaus, consider separate accounts for mandatory vs. discretionary, – Or for programs with very different purposes. • When bureau outputs and outputs from other bureaus contribute to the same agency outcome, develop a formal coordinating mechanism. – Managers of program activities should practice continual informal coordination. Charge Resources to the Place Where They Are Used All resources are financed in the budget, but not consistently where they are used. – Some are financed centrally by the agency or Treasury, or cross-subsidized by other programs. Budgeting and managing would be easier if: – Resources were funded where used; – Salaries, grants, transfers, credit subsidies, and other costs were charged to programs; – Pairs of accounts were used to charge the annual cost of retiree benefits, cleanup, and capital use to programs. Separate Program from Support Accounts Program Accounts: • Departmental Oversight • Inspectors General • Programs that provide services, goods, transfers, grants, credit, regulation to benefit the public Support Accounts: • Support Revolving Funds of all kinds • Retiree Benefit Funds • Hazardous Substance Cleanup Funds • Capital Acquisition Funds Intra-governmental Support Revolving Funds • Franchise funds • Working capital funds • Fee-funded subaccounts All required to be self-supporting at full cost • Private contractors Competition by performance-based contracts Budgeting and Accounting: Key Timing Differences Accrual before budget: • Retiree Benefits • Hazardous Waste Clean-up Budget before accrual: • Capital Acquisition • Inventory Acquisition Grants, transfers, credit, salaries, and most other outlays have similar budgetary and accrual timing. Accruing Cost of Retiree Benefits and Clean-up • Employee Pensions: Full accruing cost of CSRS Accruing cost of small systems • Retiree Health Benefits: Accruing retiree health benefits • Hazardous Substance Clean-up from Federal operations Capital Acquisition Funds • CAFs would be budget accounts -- usually one per agency. • They would be financing accounts only. • Programs would request assets for use in their operations subject to a capital planning process with review by the agency head. • Up-front BA would be borrowing authority; an annual capital usage charge paid to the CAF could only be used for the user’s share of the “mortgage” payment to Treasury. Budgeting and Managing for Results • Legislation to support this initiative: – Full Funding of Federal Retiree Costs Act , Title II of Managerial Flexibility Act of 2001. – The Budgetary Cost and Performance Integration Act of 2002. • Other resources: – OMB RMOs; Justine_F._Rodriguez@omb.eop.gov – Agency web sites; US CFO Council – GAO especially Results-Oriented Agency Budget Practices, January 2002 Benefits for Management • Staff, authority, resources, flexibility on the front line serving citizens -- with rewards. • Routine ability to seek performance-based support services within government and from private providers at best value. • Good capital programming; annual user charges. • Integrated IT for timely, accurate feedback on costs and performance and e-Gov for delivery. • Transparent reporting of achievements.