Igor Bashmakov Three Laws of Sustainable Energy Transitions

advertisement

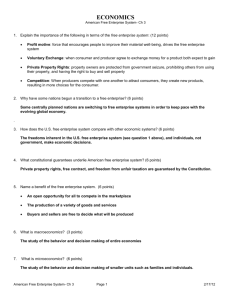

Igor Bashmakov Three Laws of Sustainable Energy Transitions November 25-26, 2007 Constants and variables of sustainable development • • • • • • • There are many dimensions of sustainable energy-economic development All disproportions finally impact sustainability of economic development both rates and costs of growth - through a depletion of resources needed to sustain development, including the resources of stable environment and climate The economy is a combination of poorly known but amazingly stable constants, as well as variables We put too much focus on variables, but: What is important for the sustainable development – is to keep critical energy-economic proportions within the very narrow ranges of their sustainable evolutions Another dimension of constants is the stability of the rates of change, which prevents from exceeding historical rates of change needed to mitigate climate change in the absence of specific policies Climate policies should not ignore constants of sustainable development The need to go beyond historical rates of changes towards stabilization of atmospheric concentrations of GHGs: energy intensity reduction The need to go beyond historical rates of changes towards stabilization of atmospheric concentrations of GHGs: carbon intensity reduction Geographic (North to South) shift of carbon dioxide emissions increases “downtown”. Patterns of energy transitions will determinate the heights of emission skyscrapers 3000 1600 1400 2500 1200 2000 1000 800 1500 600 400 1000 200 500 0 -200 1971-2000 Industry Transport Res. Build. Com. Build. Agriculture 2000-2030 Middle East and N. Africa Sub Saharan Africa Latin America Other Asia Centrally Planned Asia Former Soviet Union Central and E. Europe Western Europe -500 North America Middle East and N. Africa Sub Saharan Africa Latin America Other Asia Centrally Planned Asia Former Soviet Union Central and E. Europe Western Europe North America Pacific OECD Agriculture 0 Pacific OECD Industry Transport Re s. Build. Com. Build. -400 On the millennium-long time horizon, energy transitions are relatively slow But they have grown up to the level, where the scale of energy activities endangers the stability of the global climate More than just conventional wisdom is required to effectively address climate change at affordable mitigation and adaptation costs Social inertia and behavioral constants are poorly investigated. Present consumption and behavioral patterns are very deeply rooted in the past, a lot more deeply, than one may think People are still trying to obtain more personal freedom and build more privacy, which has become a synonym of prosperity. The concept of well-being for many years has been perceived as a concept of more-having On average, people spend the same 1-1.5 hours for daily travel, irrespective of the country and transportation mode Economics of happiness, sufficiency, values and consumption patterns, innovative life-styles may be very important for the transition from the present to the future. Hundreds of presently available scenarios of global energy system development until 2100 critically disagree on the scale and structure of future global energy systems and energy transition pathways Identifying regularities (or laws) of energy transitions allows it to balance conservatism (while transferring some past to the future) and unlimited imagination, which may tentatively shape the future using the backcasting approach Three laws of global and regional energy transitions • For long-term projections and for the identification of a potential for the future emergencies the following three laws of energy transitions are to be taken into account: The law of long-term energy costs to income stability • In the long run, energy costs to income ratios are relatively stable with only a very limited range of variations The law of growing energy quality • Growing overall productivity requires a better quality of energy services The law of growing energy efficiency • As energy quality improves against a relatively stable costs-toincome ratio, energy productivity grows, or energy intensity declines Every time, like a pendulum, the energy costs/GDP ratio driven by some economic gravitation gets back to the equilibrium, or sustainable dynamics zone 30% 20% 15% 10% USA OECD Energy costs to GDP ratio evolution in OECD and the USA 2006 2003 2000 1997 1994 1991 1988 1985 1982 1979 1976 1973 1970 1967 1964 1961 1958 1955 0% 1952 5% 1949 Energy costs/GDP ratio (%) 25% The law of long-term energy costs to income stability • Energy costs to income proportions are relatively stable over decades, if not over centuries, and very similar across regions and large countries • Sustainable variations of energy costs to GDP ratios are limited to 810% for the U.S. and 9-11% for the OECD. The range for energy costs for final consumers to gross output is even narrower: 4-5% for the U.S. and 4.5-5.5% for OECD • Energy costs to GDP ratio evolves with about 25-30 years’ cycle. Statistics allows for an assumption, that the upper threshold in the U.S. was exceeded around 1810, 1835, 1870, 1900, and 1920, 1949-1952, 1973-1985, and starting from 2005 • Every time, like a pendulum, the ratio driven by some economic gravitation gets back to the equilibrium, or sustainable dynamics zone • Stability of energy costs to income ratio results from the existence of energy affordability thresholds and behavioral constants Energy costs/GDP growth rates “wing” function: after energy costs exceed 10-11% of GDP, economic growth slows down • • • • • The approach used is based on the evaluation of limits to energy purchasing power Energy demand is more a function of energy to income ratio, than of income and price separately Energy demand functions have asymmetric elasticity Elasticity coefficients are drifting, as purchasing power thresholds are approached or exceeded Energy costs/GDP ratio for OECD are crossing the thresholds in 20072008 After that, the oil price may collapse late 2008 - early 2009 Energy demand to energy costs/GDP ratio --,-0,2 --0,5 -1,0 5% energy demand growth rate • 4% 3% 2% 1% 0% -1% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% -2% -3% -4% -5% energy costs/GDP Energy costs to income ratios are to be kept close to the thresholds to motivate energy efficiency improvements without slowing down economic growth • While the energy costs to income ratio is below the threshold, the economic growth is not affected But as soon as energy costs to income thresholds are exceeded: – economic activity slows down – energy productivity accelerates – as a result, both energy demand growth and energy prices escalation slows down until the ratio is back to the sustainable range • • This effect makes price elasticity asymmetric It is important to statistically monitor energy costs to GDP ratio as an important business cycle indicator 12% Energy costs to GDP ratio • y = 0,1771x + 0,0847 R2 = 0,0149 11% 10% 9% 8% 7% y = 0,136x + 0,0844 R2 = 0,0262 6% 5% y = -0,0144x + 0,0868 R2 = 0,0006 4% -1% 0% 1% 2% 3% GDP grow th rates 4% 5% 6% 7% energy productivity grow th rate energy consumption grow th rates 8% y = 1,3127x - 0,1505 R2 = 0,6993 y = -0,9995x + 0,1557 R2 = 0,9241 6% 4% y = -2,8445x + 0,3773 R2 = 0,8671 2% 0% -2% 8% 9% 10% 11% 12% 13% 14% 15% 16% -4% Energy costs to GDP ratio GDP growth rates energy consumption growth rates energy productivity growth rate The share of housing energy costs in personal income before tax for several countries and the EU stays in a very narrow range with amazingly universal 3-4% thresholds 10% 9% 8% 7% 6% 5% 4% 3% 2% 1% USA Japan China India EU 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 0% 1959 energy costs share in personal income before tax The ratio of housing energy costs to personal income varies in a very narrow sustainable range in many countries Consumption or collection rate price elasticity 120% Russia -0,2 “The Bashmakov wing”. Housing & municipal utility services affordability thresholds. When housing energy costs exceed 34% of income, energy consumption start declining. When it exceeds 7-8%, energy consumption declines below the sanitary level, and low-income families need assistance collection rate 100% -0,4 -1,0 80% 60% Threshold 1: consumption starts declining 40% 20% Threshold 2: consumption declines below the sanitary level 0% 0 2/1 4/2 6/3 8/4 10/5 12/6 14/7 communal and housing (numerator) and energy expenditures (denominator) as percentage of family income (%) 16/8 8% 5 7% 4,5 6% 4 3,5 4% 3 3% 2,5 2% 2 1% 1,5 0% -1% 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 Share in income 5% 1 -2% 0,5 -3% 0 Household energy costs GDP growth rates Sold houses/pop Sold houses per 1000 people When housing energy costs exceed the threshold, they bring along a mortgage crisis: less new homes are sold, and the economic growth slows down (USA – case) The ratio of transportation energy costs to personal income also varies in a very narrow range in many countries 9% The share of fuel transportation costs in personal income before tax in the USA and Japan 8% 7% 6% 5% 4% 3% 2% Motor vehicles and parts-USA Trasportation-USA Transportation-Japan 8% 7% 6% 5% 4% 3% 2% 1% 2007 2005 2003 2001 1999 1997 1995 1993 1991 1987 1989 1985 1983 1981 1979 1977 1975 1973 1971 1969 1967 1965 1963 -1% 1961 0% 1959 When personal transportation energy costs exceed the 3% threshold, the share of income spent for the procurement of new cars comes down, slowing the rate of economic growth Share of energy costs for personal transportation in private incomes (before taxes) Gasoline and oil-USA 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 0% 1962 1% 1959 share in private incomes before tax 10% -2% Gasoline and oil Motor vehicles and parts - USA GDP growth rates Energy affordability limits approach allows for some more findings Limits of energy affordability for all energy end-users keep the sustainable lane for energy costs to income fluctuation very limited Mitigation response to carbon and energy tax policy may bring different results, depending on how far the energy costs to GDP or income ratio is from the threshold Carbon taxes should be flexible: the tax rates should be brought down when energy costs/GDP ratio is high to sustain economic growth; and they should go up if this ratio is low to keep the motivation “spring” compressed High oil prices cannot be sustained for a long time. They will collapse late 2008 – early 2009 Long-term scenarios with the energy costs/GDP ratio far beyond the 8-10% range are not sustainable and should be rejected Such approach shrinks the uncertainty range of future energyeconomy-climate system evolution Economy is an organic interaction of constants and variables • • • • • • Analysis of economic and behavioral constants deserves more attention, than it currently gets Some macroeconomic proportions are extremely stable, including the share of energy costs in the gross output Fluctuations of these proportions beyond very narrow limits of sustainable dynamics give birth to cycles in the economy (including Kondratiev’s long waves), which re-establish the economic equilibrium, but on a new technology basis When the share of energy costs grows, the rate of return drops, slowing down economic growth and shrinking sustainability zone for the economic dynamics ‘Learning-by-researching’ and ‘learning-by-doing’ speed up a lot in such situations, allowing for future acceleration of the economic growth rates In general, the ‘learning rates’ are higher, if innovations were introduced right after considerable energy costs increases. Technological progress is accompanied by improving energy quality/productivity The law of growing energy quality • The technology change leads to the substitution of lowquality production factors with the same production factors, only of a better quality • • • • • • The notion of high quality energy resource was evolving across times: fuel wood, coal, petroleum products, natural gas, compressed air, heat, chill, electricity, hydrogen From the economic standpoint, the quality of energy is mirrored by its contribution to the overall economic growth and to the total factor (not just energy alone) productivity They appear less expensive, when it comes to lifecycle costs of integrated energy service systems End-users switching from coal to petroleum products, gas, and electricity pay more for a unit of consumed energy, but not for a unit of purchased energy service When price for higher-quality energy source (electricity) goes up, it requires more lower-quality energy sources (coal, petroleum products) to substitute it, than visa versa If it were not for energy price volatility, the best way to compare the quality of energy carriers would be to use energy prices The law of growing energy productivity • • • Energy productivity improvement is a centurieslong trend of the civilization development All energy carriers, not only commercial ones, are to be considered Global long-term sustainable average annual rate of energy productivity growth is 1.0-1.5 percent USA - including biomass 2005 2000 1990 1980 1970 1960 1950 1940 1930 1920 1910 1900 1890 1880 1870 – more expensive, better quality energy services have to be accompanied with improved energy productivity 1850 – 1860 Staying within relatively stable long-term energy costs to income thresholds means, that GJ/1000$ 1980 • 90 80 70 60 50 40 30 20 10 0 USA - including biomass and animal power UK- only commercial energy • Average annual energy productivity growth rates decline, as time frame expands: • • • • • • Russia China Japan UK USA 1998-2005 – 5,0% 1971-2003 – 4.2% 1960-2004 – 1,9% 1960-2004 – 1,5% 1850-2004 – 1,0% Can we keep long-term energy productivity growth rates over 2.5%?