accounting - lsp4you.com

advertisement

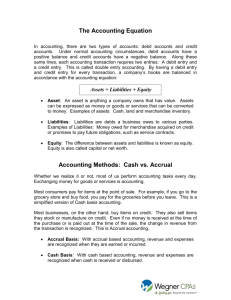

ACCOUNTING ACCOUNTING Accounting is the language of business. The affairs and the results of the business are communicated to others through accounting information, which has to be systematically recorded and presented. Accounting - Definition Accounting can be defined as the process of identifying, measuring, recording and communicating the economic events of an organization to the interested users of the information. Characteristics of Accounting Economic events Identification, measuring, recording and communication Organization Interested users of information Economic Events An economic event has been defined as ‘a happening of consequence’ to a business entity. Economic events are classified into • External types • Internal types. Economic Events Continue… An external event which involves the transfer or exchange of something of value between two or more entities. Economic Events Continue… Sale of goods to customers. • Payment of monthly rent to the landlord. Purchase of raw materials by an enterprise from some other business enterprise. Rendering of services to customers, etc. Economic Events Continue… An internal event is an economic event that occurs entirely within one enterprise. Eg : Supply of raw materials or equipment by the stores department to the manufacturing department. Identification It means determining what to record, i.e. to identify recordable events. It involves observing activities and selecting those events that are considered to be evidence of economic activity. Identification continue … The value of human resources, changes in managerial policies or changes in personnel are important but none of these items is recorded in financial accounts. However, when a company makes a cash sale or purchase, even if the item is small, it is recorded in the books of account. Measurement It means quantification, including estimates of business transactions into financial terms, i.e. rupees and paise. If an event cannot be quantified in monetary terms, it is not considered accounts. for recording in financial Recording Once the economic events are identified and measured in financial terms, they are recorded, i.e. a chronological diary of these measured events is kept in an orderly and systematic manner. Communication The economic events are identified, measured and recorded is communicated in some form to management and others for internal and external uses. The information is communicated through the preparation and distribution of accounting reports. The most common reports are in the form of financial statements (Balance Sheet and Profit and Loss Statement). Organization It can be a business entity or a nonbusiness entity, depending upon the profit or non-profit motive. Users of Accounting Information Different categories of users need different kinds of information for making decisions. These users can be divided into : •Internal Users; and •External Users. Internal Users These are the persons who manage the business, i.e. management at the top, middle, and lower levels. Their requirements of information are different because they make different types of decisions. Internal Users continue… The top level is more concerned with planning; the middle level is concerned equally with planning and control; and the lower level is concerned more with controlling operations. Information is supplied on different aspects, e.g. cash resources, sales estimates, results of operations, financial position, etc. External Users All persons other than internal users come in the group of external users. External users can be divided into two groups: those having direct interest; and those having indirect interest in a business organization. External Users continue… The main sources of information for external users are annual reports of business organizations, which state the financial position and performance and give the auditor’s report, director’s report and other information. External Users continue… Investors and creditors are the external users having direct interest. Tax authorities, regulatory agencies, customers, labour unions, trade associations, stock exchanges, investors, etc are indirectly interested in the company’s financial strength, its ability to meet short-term and long-term obligations, its future earning power, etc for making various decisions. ASSETS These are economic resources of an enterprise that can be usefully expressed in monetary terms. Assets are things of value used by the business in its operations. Fixed Assets Current Assets ASSETS continue… Fixed Assets are assets held on a longterm basis. e.g. Land, Building, Machinery, Plant, Furniture and Fixtures, etc. ASSETS continue… Current Assets are assets held on a short-term basis. e.g. Debtors, Bills receivable, Stock(Inventory), Cash and Bank balances, etc. LIABILITIES These are obligations or debts that the enterprise must pay in money or services at some time in the future. • Long-term liabilities • Short-term liabilities LIABILITIES continue.. Long-term liabilities are those that are usually payable after a period of one year. e.g. A term loan from a financial institution, debentures (bonds) issued by a company. LIABILITIES continue.. Short-term liabilities are obligations that are payable within a period of one year. e.g. Creditors, bills payable, overdraft from a bank for a short period. CAPITAL Investment by the owner for use in the firm is known as capital. Owner’s equity is the ownership claim on total assets. It is equal to total assets minus total liabilities. REVENUES These are the amounts the business earns by selling its products or providing services to customers. Other titles and sources of revenue common to many businesses are: sales, fees, commission, interest, dividends, royalties, rent received, etc. EXPENSES These are costs incurred by a business in the process of earning revenue. Generally, expenses are measured by the cost of assets consumed or services used during an accounting period. The usual titles of expenses are: depreciation, rent, wages, salaries, interest, costs of heat, light and water, telephone, etc. PURCHASES Purchases are total amount of goods procured by a business on credit and for cash, for use or sale. In a trading concern, purchases are made of merchandise for resale with or without processing. In a manufacturing concern, raw materials are purchased, processed further into finished goods and then sold. Purchases may be cash purchase or credit purchase. SALES Sales are total revenues from goods or services sold or provided to customers. Sales may be cash sales or credit sales. STOCK Stock (Inventory) is a measure of something on hand – goods, spares and other items – in a business. It is called stock on hand. STOCK: continue… In a trading concern, the stock on hand is the amount of goods which have not been sold on the date on which the balance sheet is prepared. This is also called closing stock. STOCK continue… In a manufacturing concern, closing stock comprises raw materials, semi-finished goods and finished goods on hand on the closing date. Similarly, opening stock is the amount of stock at the beginning of the accounting year. DEBTORS Debtors are persons and/or other entities who owe to an enterprise an amount for receiving goods and services on credit. The total amount standing against such persons and/or entities on the closing date, is shown in the Balance Sheet as Sundry Debtors on the asset side. CREDITORS Creditors are persons and/or other entities who have to be paid by an enterprise an amount for providing the enterprise goods and services on credit. The total amount standing to the favour of such persons and/or entities on the closing date, is shown in the Balance Sheet as Sundry Creditors on the liability side. ACCOUNTING PRINCIPLES Accounting principles can be subdivided into two categories: Accounting Concepts; and Accounting Conventions. ACCOUNTING PRINCIPLES Accounting Concepts Accounting Conventions The term ‘concept’ is used to connote accounting postulates, that is necessary assumptions and conditions upon which accounting is based. The term ‘convention’ is used to signify customs and traditions as a guide to the presentation of accounting statements. ACCOUNTING PRINCIPLES Accounting Concepts • Business Entity Concept • Money Measurement Concept • Cost Concept • Going Concern Concept • Dual Aspect Concept • Realization Concept • Accounting Period Concept ACCOUNTING PRINCIPLES Accounting Conventions • Convention of Consistency • Convention of Disclosure • Convention of Conservation ACCOUNTING PRINCIPLES Accounting Concepts The term ‘concept’ is used to connote accounting postulates, that is necessary assumptions and conditions upon which accounting is based. Business Entity Concept Business is treated as a separate entity or unit apart from its owner and others. All the transactions of the business are recorded in the books of business from the point of view of the business as an entity and even the owner is treated as a creditor to the extent of his/her capital. Money Measurement Concept In accounting, we record only those transactions which are expressed in terms of money. In other words, a fact which can not be expressed in monetary terms, is not recorded in the books of accounts. Cost Concept Transactions are entered in the books of accounts at the amount actually involved. Suppose a company purchases a car for Rs.1,50,000/- the real value of which is Rs.2,00,000/-, the purchase will be recorded as Rs.1,50,000/- and not any more. This is one of the most important concept and it prevents arbitrary values being put on transactions. Going Concern Concept It is persuaded that the business will exists for a long time and transactions are recorded from this point of view. Dual Aspect Concept Each transaction has two aspects, that is, the receiving benefit by one party and the giving benefit by the other. This principle is the core of accountancy. Dual Aspect Concept continue… For example, the proprietor of a business starts his business with Cash Rs.1,00,000/-, Machinery of Rs.50,000/- and Building of Rs.30,000/-, then this fact is recorded at two places. That is Assets account (Cash, Machinery & Building) and Capital accounts. The capital of the business is equal to the assets of the business. Dual Aspect Concept continue… Thus, the dual aspect can be expressed as under Capital + Liabilities = Assets or Capital = Assets – Liabilities Realization Concept Accounting is a historical record of transactions. It records what has happened. It does not anticipate events. This is of great important in preventing business firms from inflating their profits by recording sales and income that are likely to accrue. Accounting Period Concept Strictly speaking, the net income can be measured by comparing the assets of the business existing at the time of its liquidation. But as the life of the business is assumed to be infinite, the measurement of income according to the above concept is not possible. So a twelve month period is normally adopted for this purpose. This time interval is called accounting period. ACCOUNTING PRINCIPLES Accounting Conventions The term ‘convention’ is used to signify customs and traditions as a guide to the presentation of accounting statements. Convention of Consistency In order to enable the management to draw important conclusions regarding the working of the company over a few years, it is essential that accounting practices and methods remain unchanged from one accounting period to another. The comparison of one accounting period with that of another is possible only when the convention of consistency is followed. Convention of Disclosure This principle implies that accounts must be honestly prepared and all material information must be disclosed therein. The contents of Balance Sheet and Profit and Loss Account are prescribed by law. These are designed to make disclosure of all material facts compulsory. Convention of Conservation Financial statements are always drawn up on rather a conservative basis. That is, showing a position better than what it is, not permitted. It is also not proper to show a position worse than what it is. In other words, secret reserves are not permitted. FUNCTIONS OF ACCOUNTING • Keeping systematic records • Protecting properties of the business • Communicating the results • Meeting legal requirements Keeping systematic records The first function of accounting is to keep a systematic record of financial transactions, to post them to the ledger accounts and ultimately prepare final statements. Protecting properties of the business The second important function is to protect the property of the business. The system accounting is designed in such a way that it protects its assets from an unjustified and unwarranted use. Meeting legal requirements The fourth accounting and is the to last meet function the of legal requirements under the Companies Act, Income Tax Act, Sales Tax Act and so on. THE ACCOUNTING CYCLE Recording transactions in subsidiary books. Classifying data by posting from subsidiary books to the accounts. Closing the books and preparation of final accounts. SYSTEMS OF ACCOUNING • Cash System • Single Entry System • Double Entry System Cash System This system takes into account only cash receipts and payments on the assumption that there are no credit transactions. Even if there are any, they will not be recorded. This system may be suitable for charitable institutions like schools, colleges, social clubs, etc. Single Entry System As the name itself implies, it deals with only one aspect of transaction. This system recognizes cash and personal items of the transactions and it ignores the impersonal items. So it is incomplete, inaccurate and unscientific. Double Entry System This is the most scientific system that recognizes both the aspects of each transaction and also records each aspect. This system takes into account every business transaction in its double aspect, i.e., receiving benefit by one party and giving the like benefit by another. So it records the two-fold aspect of every business transaction. Double Entry System continue… Example: When ‘A’ purchases a car, he receives the benefit in the form of a car and gives the benefit in the form of money. Similarly, the car seller receives the benefit in the form of money and gives the benefit in the form of a car. Double Entry System continue… Definition The process by which the dual aspects of business transactions are recorded is known as the double entry book-keeping. It is a complete book-keeping in the sense that it records all the two aspects, debit and credit in each business transaction, in equal value. CLASSIFICATION OF ACCOUNTS Every business deal with other “Person”, possesses “Assets”, pay “Expenses” and receive “Income”. So from the above, we can see every business has to keep • An account for each person • An account for each asset and • An account for each expense or income. CLASSIFICATION OF ACCOUNTS • Accounts in the names of persons are known as “Personal Accounts” • Accounts in the names of assets are known as “Real Accounts” • Accounts in respect of expenses and incomes are known as “Nominal Accounts” CLASSIFICATION OF ACCOUNTS ACCOUNTS PERSONAL ACCOUNTS IMPERSONAL ACCOUNTS REAL ACCOUNTS NOMINAL ACCOUNTS PERSONAL ACCOUNTS Accounts in the name of persons are known as personal accounts. Eg: Babu A/C, Babu & Co. A/C, Outstanding Salaries A/C, etc. REAL ACCOUNTS These are accounts of assets or properties. Assets may be tangible or intangible. Real accounts are impersonal which are tangible or intangible in nature. Eg:- Cash a/c, Building a/c, etc are Real Accounts related to things which we can feel, see and touch. Goodwill a/c, Patent a/c, etc Real Accounts which are of intangible in nature. NOMINAL ACCOUNTS These accounts are impersonal, but invisible and intangible. Nominal accounts are related to those things which we can feel, but can not see and touch. All “expenses and losses” and all “incomes and gains” fall in this category. Eg:- Salaries A/C, Rent A/C, Wages A/C, Interest Received A/C, Commission Received A/C, Discount A/C, etc. DEBIT AND CREDIT Each accounts have two sides – the left side and the right side. In accounting, the left side of an account is called the “Debit Side” and the right side of an account is called the “Credit Side”. The entries made on the left side of an account is called a “Debit Entry” and the entries made on the right side of an account is called a “Credit Entry”. RULES FOR DEBIT AND CREDIT Personal Account Debit the Receiver Credit the Giver Debit what comes in Real Accounts Nominal Accounts Credit what goes out Debit all Expenses and Losses Credit all Incomes and Gains Steps for finding the debit and credit aspects of a particular transaction • Find out the two accounts involved in the transaction. • Check whether it belongs to Personal, Real or Nominal account. • Apply the debit and credit rules for the two accounts. Exercise • Purchased a Building for Rs.20,000/-. • Paid Cash Rs.1,000/- to Satheesh. • Paid Salary Rs.1000/-. • Received Commission Rs.250/-. • Sold goods for Cash Rs.3500/-. Subsidiary Books • General Journal • Special Journals • Purchase Book • Sales Book • Purchase Return Book • Sales Return Book • Bills Receivable Book • Bills Payable Book • Cash Book • Petty Cash Book Journal Journal is the prime or original book of entry which all transactions are recorded in the form entries. Journalising is an act of recording entering transactions in a Journal in the order date. Date Particulars LF Debit Amount Credit Amount in of or of Journal Entry Jan 1, 1981 Prakash Started a business Rs. 15,000/Date Particulars 1981 Jan 1 Cash a/c Dr. To Prakash’s Capital a/c (Being cash invetsed to business) LF Debit Amount Credit Amount 15,000 15,000