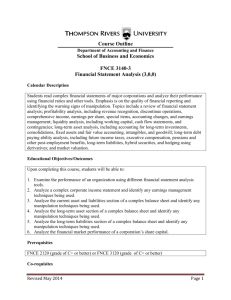

Now - Midwest Business Brokers and Intermediaries

SELLING A BUSINESS: HELPING YOUR

CLIENTS WITH THEIR BIGGEST DEAL

North Shore Council

Financial Planning Association of Illinois

Markus May, Esq.

Jeff Smiejek, CPA, CVA, CEPA

Tom Meyer

Alex Fridman

Enterprise Valu

e

Who is Purchasing?

• Outsider

• Insider

• Family Member

Outsider Sales – Pros and Cons

•

•

Price is higher, but higher taxes

No longer need to be involved long term in business – will have will training component

• Can will/gift the proceeds to children

• A way to distribute estate proportionately among children when business = major asset

• Lose the legacy

Insider Sales – Pros and Cons

• Buyer knows the business

• Maybe a lower price, but have a person who can run the business well

• Seller financing is more likely to be paid

• Less post-closing disputes

• Reward loyal employees

Family Member Sales –

Pros and Cons

• Good if want to leave a family legacy and all children treated equally

• Probably bad result if child has no experience

• Valuation is subjective: can leave more to the children with less estate or income taxes

• Issues if children are co-owners

• Issues if all children are not all owners

The Concept of Value

• Why valuations are performed and who performs them

• Effectively communicating an overview of the valuation process to your clients

The Concept of Value

• Oldest known appraisal —Genesis 23, Verse

15

• “The land is worth 400 shekels”

• Modern Valuation Theory —ARM 34—1920

• A result of the 18th Amendment (Prohibition)

• First attempt at valuing goodwill associated with breweries and distilleries

Value?

“Value…[is an] attitude of persons toward that thing in view of its estimated capacity to perform a service.”

“…certainly…property has no value unless there is a prospect that it can be exploited by human beings.”

James C. Bonbright

Financial Value

• “The value of any financial asset is the net present value of all future cash flows discounted at the appropriate rate of return.”

• Brealey & Meyers —Principles of Corporate Finance

Principal of Substitution

• A prudent buyer will pay no more for property than it would cost to acquire an equally desirable substitute with the same utility.

Valuation: Art or Science?

• Valuation applies both quantitative analysis and qualitative (subjective) analysis to derive an opinion of value

• Training, experience and common sense are key elements in a supportable opinion of value

Value to Whom?

$350

$300

$250

$200

$150

$100

$50

$0

$0

Actual Transactions from IBA Database

Price/Gross Revenues

$100 $200 $300 $400 $500

Annual Gross Revenues in Thousands of $

$600 $700

Range of Value

Transactions Upper 25% limit Lower 25% limit

$400

$350

$300

$250

$200

$150

$100

$50

$0

$0 $100 $200 $300 $400 $500

Annual Gross Revenues in Thousands of $

$600 $700 $800

Why Have a Valuation Performed?

• Tax purposes

• Estate Tax Form 706

•

•

Gift Tax Form 709

S-Election —net unrealized built-in gains

Why Have a Valuation Performed?

• Non-tax purposes

• Business sale/merger/acquisition

• Buy/sell agreements

• Obtaining financing

• Strategic planning and consulting

• Dissolution of marriage

• Dissident shareholder action

• Litigation support

• Damages/lost profits/business interruption

Who Performs Valuations?

• Business brokers/intermediaries and investment bankers

• CPAs

• Professors

• Financial analysts

• Professional business valuators

The Valuation Process

• Define the engagement and discuss expectations with the client

• Gather and review all necessary information that may impact the value of the subject company

• Analyze all information and make adjustments to “normalize” financial statements

• Apply valuation approaches and methods to estimate the value of the enterprise

• Consider application of premiums and discounts*

• Communicate the results

Types (Standards) of Value

• Market value

• Asset

• Financial

• Synergistic

• Fair market value

• Fair value

• Economic value

• Book value

• Owner value

• Collateral value

Identification of Value Drivers

• Value driver – n : an important factor that determines or causes an increase in value of a business, as viewed by investors

Source: Go Big Dictionary

• It is important to identify value drivers and their relationships to increasing cash flow, decreasing risk and increasing the growth of the business

• Value drivers are critical to the ongoing viability and success of a business!

Value Drivers - Operations

Customer list, repeat customers

Proprietary products: patents, copyrights

Large market share

Diversified: industry, products, customers, geographic locations

Value Drivers – Company Investment

Commitment to employees – training, benefits, etc.

Keep current with technology/equipment

Additional capacity for growth

Capital budgeting processes in place

Improve facility appearance

Value Drivers - Intangibles

A solid purpose and vision for business

Experienced, knowledgeable management

Work force is motivated, dependable

Key employees have employment/ non-compete agreements

Departing owner dispensable

Well-trained management team

Have Good Records

• The “Numbers” affect value

• Cash flow: Positive, growing, sustainable

• Generally Accepted Accounting Principles

• Accounting firm report

• Importance of credibility

Corporate Value Drivers

• Corporate Structure

• Corporate Formalities

• Issue Stock if not already issued

• Create By-Laws

• Minutes regarding Officers/Directors and Past Actions

• Operating Agreement or Buy/Sell Agreement

• Piercing the Corporate Veil

• Run the business to avoid personal liability

Contractual Value Drivers

• Contracts

• Vendors

• Customers

• Leases

• Terms and Conditions, etc.

Intellectual and Property Value Drivers

• Review Key Licenses

• Review Intellectual Property Ownership

Copyrights

Trademarks

Patents

Intellectual and Property Value Drivers

• Review Ownership of Property

• Works Made for Hire

• Computer Software

• Advertising

• Art Work

Common Approaches to Valuation

•

Market Approach

•

Income Approach

•

Asset Approach

Market Approaches

• Rule-of-thumb method

• Quick and dirty method based on industry averages

• Guideline publicly traded company method

• Based on similar and relevant comparable public companies

• Comparative or private transaction method

• Based on actual transactions of similar entities

Market Approach

• Apply a multiple to derive a value

• Price to earnings (P/E ratio)

•

•

Price to EBIT or EBITDA

Price to seller’s discretionary earnings (SDE)

• Price to gross revenues

• Price to book value

Market Example

Gross Revenues

Multiple X

450,000

2

$ 900,000

Earnings

Multiple X

220,000

4

$ 880,000

Income Approach

• Capitalization of earnings method

• Discounted earnings method

• Dividend pay-out method

• Excess earnings method

Variables That Affect the Discount or

Capitalization Rate

• Operating history

• Sensitivity to economic environment

• Management depth

• Capital structure

• History of distribution of earnings

• State of the industry

• Financial returns and ratios

• Intangible value

• Patents/trademarks etc.

• Trade secrets

• Processes, formulas etc.

• Location

Capitalized Earnings Method Example

V = __I__

R-G

I

R

= Earnings

= Business risks

$100,000

25%

G = Growth 5%

(R-G = Capitalization Rate)

Example: $100,000 = $500,000

25%-5%

Discounted Earnings Example

Future Periods

Earnings

Discount Factor

Present Value

1 2

200,000 230,000 270,000

3 Sum

700,000

0.86

0.75

0.67

172,000 172,500 180,900 525,400

Net Present Value

Plus: Terminal/Residual Value

Estimate of Total Business Value

525,400

500,000

1,025,400

Asset Approach

• Net asset value method

• Liquidation value method

Asset Approach

• Useful for

• Asset-intensive businesses

• Real estate holding companies

• Entities that hold mostly securities (or cash)

• Some contracting businesses that bid for work

Adjusted Asset Example

Book Value Adjustment

Assets:

Accounts Receivable 3,000 (400)

Fair Market Value

2,600

Fixed Assets

Less: Depreciation

Net Fixed Assets

Total Assets

3,000

(1,000)

2,000

5,000

(2,500)

1,000

(1,500)

(1,900)

500

-

500

3,100

Liabilities:

Current Liabilities

Long-Term Liabilities

Total Liabilities

Owner's Equity

Total Liab & Equity

150

200

350

4,650

5,000

0

0

0

150

200

350

(1,900)

(1,900)

2,750

3,100

Walking Buyer(s) Up To A Full

Valuation

M&A Advisor will do the “heavy lifting” to allow the Company to focus on running the business

M&A Advisor will emphasize the Company’s growth strategy and focus Buyer(s) on the appropriate financial metrics o Educate Buyer(s) to focus on run-rate or forward metrics to reflect current growth profile and business momentum o Adjust for potential non-recurring and one-time adjustments

Value from Well-

Managed Process

Validating the Business

Strategy

Perceived Value Today

Established and proven business today

Explaining the Story

Stable base business with attractive growth opportunity

Unique defensible market position

Significant investment in assets and employees

Proven management team with established track record

EBITDA adjustments

Top-line growth secured by sustainability of endmarket demand

EBITDA margin expansion from scalable operating platform and attractive new markets

Minimize potential buyer concerns

Organic and acquisition growth opportunities

Unique asset creating significant scarcity value

Validation of financial model will provide comfort that business can sustain growth and cash flow profile

Attractive financing markets

Buyer(s) actively seeking investments to deploy capital

Well run process will further drive value and minimize transaction risk

BREAK

15 Minutes

AUDIENCE

DISCUSSION

Preparing to Sell the Business

• Advise Client about the sale process and what to expect

• Time Frame: 3 months to 2 years between going to market and sitting down at the closing table

• The well prepared business sells faster

Sale Process

• Broker Agreement

• Market Business

• Confidentiality Agreement

• Letter of Intent

• Due Diligence

• Purchase Agreement

• Closing

Sale Process

AVOID SURPRISES!

• Disclose, Disclose, Disclose

• Breach of Trust Kills Deals

• Better up Front than Later

• But not too Early

Letter of Intent / Term Sheet

• Initial Draft by Buyer Usually

• Sets the Terms of the Deal

• Get Attorney Involved in Negotiating

Deal Killer if Change Terms Later

Letter of Intent

• Should be Non-Binding Except Certain Items

• Takes Business off the Market

• Allows Due Diligence

Make sure you get what you think you are getting

Adjustments to Deal

Seller’s Due Diligence on the Buyer

Purchase Agreement

• Identify the Parties

• Identify What is Being Sold

Stock v. Assets

Accounts Receivable

Liabilities

Exclusions from Sale

Some Liabilities Follow

Purchase Price

• Payment Terms

• Seller Financing

• Security from Buyer

Security Agreement – pledging stock or assets

UCC Filing / Mortgage

Letter of Credit

• Earn Out

Purchase Price

• Working Capital

Cash + A/R + Inventory = Current Assets

A/P + Other Liabilities = Current Liabilities

Net Operating Assets (Assets – Liabilities)

• Pro Rations

Representations and Warranties

Organization and Good Standing

Enforceability; Authority; No

Conflict

Capitalization

Financial Statements

Books and Records

Sufficiency of Assets

Description of Owned Real

Property

Description of Leased Real

Property

Title to Assets; Encumbrances

Condition of Facilities

Accounts Receivable

Inventories

No Undisclosed Liabilities

Taxes

No Material Adverse Change

Employee Benefits

Compliance with Legal

Requirements; Governmental

Authorizations

Legal Proceedings; Orders

Contracts; No Defaults

Insurance

Environmental Matters

Employees

Labor Disputes; Compliance

Intellectual Property Assets

Relationships with Related

Persons

Brokers or Finders

Securities Law Matters

Solvency

Disclosure

Conditions to Closing

• Accurate Reps and Warranties

• Compliance with Agreement

• No Adverse Changes

• Buyer Financing

• Satisfactory Lease

• Key Customers/Employee Retention

• Satisfied with Due Diligence?

• Etc.

Indemnification

• Generally breach of Reps and Warranties / Agreement

• Add Deal Specific items – e.g. litigation

• Personal or Corporate?

• Set Off

• Baskets (deductible or tipping?)

• Dollar Limit

• Duration

General Provisions

DISPUTE

RESOLUTION

ETC.

WAIVER

VENUE

ASSIGNMENT

Ancillary Documents

• Employment Agreements

Seller/Owner

Key Employees

• Non-Compete

• Promissory Note/Security Agreement

• Escrow Agreement

• Bill of Sale and Assignment

Post Closing

• Training

• Working Capital Adjustments

• Taxes

• Investment of Income

• On the Beach….

Assembling the Deal Team

Financial Advisor

Business Valuator

Business Broker/

Intermediary

Begin Assembling a Deal Team

Deal

Attorney

Accountant

Conclusion

• Identify Client and Potential Purchaser

• Prepare Client for Sale by getting business operations and legal documents in place

• Assemble Good Advisors

• Prepare Client by informing about the sale process to avoid a disgruntled client

QUESTIONS ??

Alex Fridman

Alex Fridman is a Co-Founder of The Peakstone Group, a middle market investment banking and direct investing firm. Mr. Fridman has executed over

30 investment banking and principal transactions across numerous industries including general industrial, consumer and retail, distribution, healthcare and business services. Mr. Fridman previously held senior investment banking positions with Lehman Brothers and previously worked at Banc of America

Securities. He has his series 24, 79, 82 and 63 licenses and graduated from

Indiana University's Honors Business Program.

Alex Fridman

The Peakstone Group

150 N. Wacker Drive, Suite 2500

Chicago, IL 60606

(312) 346-7303 alex@peakstonegroup.com

Markus May, Esq.

Markus May is a client focused and service oriented business attorney at May

Law Firm Ltd. with knowledge in a broad range of industries. Mr. May has represented numerous clients with respect to M&A transactions and spoken to numerous professional and business organizations on the topic of helping to prepare a business for sale. Mr. May is a prior or current Chairman of the:

Securities & Business Law Section Council of the Illinois State Bar, Chicago

Bar Association (CBA) Business Law Committee, and CBA Mergers and

Acquisitions Committee and a member of the American Bar Association. He served six years on the MBBI board of directors.

Markus May

May Law Firm Ltd.

400 E. Diehl Rd. Suite 130

Naperville, IL 60563

630-864-1003 mmay@illinois-business-lawyer.com

www.illinois-business-lawyer.com