donohue_286r - Harvard University

advertisement

Air Transportation Network Load

Balancing using Auction-Based Slot

Allocation

for Demand Management

George L. Donohue

Loan Le and C-H. Chen

Air Transportation Systems Engineering Laboratory

Dept. of Systems Engineering & Operations Research

George Mason University

Fairfax, VA

Harvard University

18 March, 2004

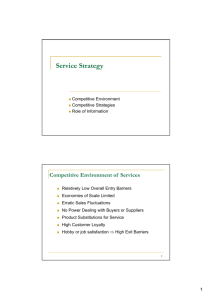

Outline

Necessity of Demand Management

History of US Demand Management

Auction model for airport arrival slots

auctioneer optimization model

airline optimization model

Atlanta airport case study

simulated scenarios

results and interpretation

Observations

Why Demand Management?

Over-scheduling causes delay and

potentially compromises safety

Number of Operations

TOTAL SCHEDULED OPERATIONS AND CURRENT

OPTIMUM RATE BOUNDARIES

60

50

40

30

20

10

0

7

8

9

10

11

12

Schedule

13

14

15

16

Facility Est.

17

18

19

20

Model Est.

Atlanta Airport - FAA Airport Capacity Benchmark 2001

21

Data Indicates Loss of Separation

Increases at High Capacity Fraction

Over-scheduling causes accident pre-cursor

events and potentially compromises safety

Hazard Reports 1988-2001

#reports

120

100

80

Near Midair Collision

Runway Incursion

Lost of Legal Separation

60

40

20

0

35

40

45

50

55

60

65

70

Percentage Capacity Used

Statistics at ATL, BWI, DCA and LGA airports (Haynie)

Observed WV Separation

Violations vs. Capacity Ratio

Number of < WVSS

Incidents Expected in

15 Minutes

Figure 6-5

Ratio of Incidents to Capacity Used

8

6

4

2

0

0

Haynie, GMU 2002

50

100

150

200

Percent of Capacity Used in 15 Minutes

BWI

LGA

Quadratic Model

Flight Banking at Fortress Hubs Creates

Inefficient Runway Utilization

Over-scheduling causes accident pre-cursor

events and potentially compromises safety

Under-scheduling wastes runway capacity

Number of Operations

TOTAL SCHEDULED OPERATIONS AND CURRENT

OPTIMUM RATE BOUNDARIES

60

50

40

30

20

10

0

7

8

9

10

11

12

Schedule

13

14

15

16

Facility Est.

17

18

19

20

21

Model Est.

Atlanta Airport - FAA Airport Capacity Benchmark 2001

Enplanement Capacity is More

Important than Operational Capacity

Small aircraft make inefficient use of runway

capacity

A TL

to ta l

ATL

total operations (OAG Summer

2000)

400

1

0 .9

0 .8

0 .7

350

300

seats/aircraft

250

0 .6

0 .5

200

0 .4

150

cumlativeshr

Cumulative

seat share

op

0 .3

100

0 .2

50

0 .1

0

0

0

00

.1

0

.2

0

.3

0

.4

0

.5

0

.6

0

.7

0

.8

.9

1

c u m u l a ti v

e

Cumulative

flight share

Cumulative Seat Share vs. Cumulative Flight Share and Aircraft Size

fl i g

Excess Market Concentration May Lead

to Inefficient Use of Scare Resources

HHI is a Metric used to Measure Market

Concentration

Hirschman-Herfindahl Index

(HHI) is standard measure of

market concentration

Department of Justice uses to

measure the competition within

a market place

HHI=(100*si)2 with si is

market share of airline i

Ranging between 100 (perfect

competitiveness) and 10000

(perfect monopoly)

In a market place with an index

over 1800, the market begins to

demonstrate a lack of

competition

HHI Index

6000

5000

4000

3000

HHI Index

2000

1000

0

ATL EWR LAS LAX LGA MSP ORD PHX SEA STL

Airport

History of US Demand

Management

LGA Airport Slot Control

High-DensityRule

Slot ownership

Deregulation

1968

- Limited #IFR slots

during specific time

periods

- Negotiation-based

allocation

1978

1985

AIR-21

Apr

2000

Exempted from

Use-it-orHDR certain

lose-it rule

flights to

based on

address

80% usage

competition

and small

market

access

Lottery

Jan

2001

End of HDR.

What’s next?

2007

Cap of the -Congestion

#exemption pricing?

slots

-Auction?

Demand Management

Approaches

Administrative

negotiation-based IATA biannual conferences

Economic

weight-based landing fee: no incentive for large

aircraft – inefficient Enplanement capacity

time-based congestion pricing: not reveal the true

value of scarce resources

DoT supervised Market-based Auctions of

Arrival Metering-Fix Time Slots

Hybrid

Auction Model

Design Issues

Feasibility

package slot allocation for arrival and/or departure slots

politically acceptable prices

Optimality

efficiency: throughput (enplanement opportunity) and delay

regulatory standards: safety, flight priorities

equity:

stability in schedule

airlines’ need to leverage investments

airlines’ competitiveness : new-entrants vs. incumbents

Flexibility

primary market at strategic level

secondary market at tactical level

Design Approach

Objective:

Obtain Better Utilization of Nation’s Airport Network

Infrastructure – Network Load Balancing

Provide an Optimum Fleet Mix at Safe Arrival Capacity

Ensure Fair Market Access Opportunity

Increase Schedule Predictability - reduced queuing delays

Assumptions

Airlines will make optimum use of slots they license

Auction rules: Bidders are ranked using a linear combination of:

monetary offer (combination of A/C equipage credit and cash)

flight OD pair (e.g. international agreements, etc.)

throughput (aircraft size) ?

airline’s prior investment ?

on-time performance ?

Strategic Auction

Analytical Approach

Auction Model

Network Model

1

2

Bids

Schedules

Slots

Airlines

-Auctions only at

Capacitated Airports

-Auction Licenses

good for 5 to 10 years

5

3

Auctioneers

4

NAS

Analysis &

Feedback

Auction Model Process

Determine factor weights,

initial bids and increments

Simultaneous

bidding of

15-min intervals

More bids

than capacity

No

End auction process

Yes

Call for bids

Submit information

and bids

Sort the bids in

decreasing ranks

Local optimum

fleet mix order:

smalllarge

757heavy

Sequence flights

for each intervals

Auctioneer’s action

Airline’s action

Auctioneer Model

money

#seats

…

Bid vector Pj=

X= (x1

ARR

DEP

Package

Time window

1

…

i

i+1

…

96

P1

…

…

xj

Pj

…

Pj+1

xn)T

…

Weight vector

W = (w1 w2)T

1

1

Package

Time window

…

i

i+1

i+2

i+3

96

LP :

s.t.

P1

…

Pj

Pj+1

…

1 if Pj wins a round

0 otherwise

Pn

1

1

xj =

Pn

Rank of a bid vector : W·Pj

C = (WT·P1 … WT·Pj … WT·Pn)T

1

1

1

1

max

z = CTX

(ARR·X)i, (DEP·X)i lies within the Pareto frontier i

airlines’ combinatorial constraints

Atlanta’s VMC Auction Model

Capacity constraints for 15-min

bins:

100,100

arrival per hour

(ARR·X)i 25

(DEP·X)i 25

Let:

A=

ARR

,

DEP

b=

max

s.t.

ATL’s VMC capacity (April 2000)

25

25

departure per hour

z = C TX

AX b

airlines combinatorial constraints

Airline Bidding Model

Bidding is all about scheduling

Determine markets, legs, frequencies and departure

times

Fleet assignment :

(aircraft type,leg)

line-of-flying (LOF): sequence of legs to be flown by an aircraft in the

course of its day

B

2,4

1,3

1,5

F

2,6

A

E

3,7

4,8

D

C

Simple Flight Schedule Example

Bidding is all about scheduling

Determine markets, legs, frequencies and departure times

Fleet assignment :

(aircraft type,leg)

line-of-flying (LOF): sequence of legs to be flown by an aircraft in the

course of its day

Daily arrivals and departures at A of one LOF:

B

time

2,4

1,3

1,5

F

C

Package

ARR

2,6

A

Time window

1

…

i

i+1

…

96

E

3,7

4,8

D

DEP

…

Pj

Pj+1

1

1

P1

…

…

Pn

1

1

1

Package

Time window

…

i

i+1

i+2

i+3

96

P1

1

1

Pj

Pj+1

…

Pn

1

1

1

1

1

1

simple package bidding

1

Schedule Banking Constraints

Bidding is all about scheduling

Determine markets, legs, frequencies and departure times

Fleet assignment :

(aircraft type,leg)

line-of-flying (LOF): sequence of legs to be flown by an aircraft in the

course of its day

Daily arrivals and departures at A of one LOF:

B

time

2,4

1,3

1,5

F

C

Package

ARR

2,6

A

Time window

1

…

i

i+1

…

96

E

3,7

4,8

D

DEP

…

Pj

Pj+1

1

1

P1

…

…

Pn

1

1

1

Package

Time window

…

i

i+1

i+2

i+3

96

P1

1

1

Pj

Pj+1

…

Pn

1

1

1

1

1

1

complex package bidding

1

Assume the Airlines have a Near Optimal

Schedule and Try to Maintain in Auction

Airlines’ elasticity for changing schedule

15min

bids

withdrawn

15min

original scheduled

15-min interval

bids

withdrawn

Airlines bid reasonably and homogeneously by setting an

upper bid threshold proportional to #seats (revenue)

No fleet mix change

Airline Agent Tries to

Maximize Profit

Objective function: Maximize revenue and ultimately maximize

profit

Maximise

Subject to:

(P B )

s

s

s

Bs M ys

( B0T ) s Bs M (1 ys )

To

bid or

not

Upper

bound

Lower

bound

to bid

for

forbids

bids

Bs Ps

' min( ( Ba,s )) ( BA,s )

Bs

( B0T ) s ys Ps ys

(W )5

( ( Ba,s )) ( BA,s )

' min

T

a

B

(

B

)

s

0

s

Bs M (1 y s )

(W ) 5

Airlines’ package bidding constraints

Variables:

{Bs}

{Ps}

M

ys

1

ys

0

Bo

Bs ’

T

set of monetary bids

airline expected profit by using a slot

big positive value

binary value

if airline bids for slot s

otherwise

airport threshold vector

airline threshold fraction

old bid for slot s in previous round

Network Model used to

Evaluate Auction Effectiveness

11-node network

DEN

SFO

LAX

PHX

MSP

ORD DTW LGA

BWI

IAD

DFW

ATL

Runway capacity determined by

Wake Vortex Separation Standards

(nmiles/seconds) (M. Hanson)

Trailing aircraft

Leading aircraft

Small

Large

B757

Heavy

Small

Large

B757

Heavy

2.5/80

4/164

5/201

6/239

2.5/68

2.5/73

4/115

5/148

2.5/66

2.5/66

4/102

5/136

2.5/64

2.5/64

4/101

4/104

and a scale factor to account for runway

dependency

departure separation

arrival separation

Simulation scenarios

Assumptions:

Aircraft can arrive within allocated slots with Required Time-ofArrival errors of 20 seconds (using Aircraft RTA Capabilities)

Auction items: Metering Fix Arrival Slots

No combinatorial package bidding

Bid values and minimum increments are relative to the value of initial

bid

Input:

Summer 2000 OAG schedule of arrivals to ATL (1160 flights)

Scenario 1 (Baseline):

OAG schedule

Scenario 2 (Simple auction):

Monetary Offer is the only determining factor

Auction-produced schedule

Traffic levels and estimated

queuing delays during VMC

Scheduled arrivals (#operations/quarter hour)

50

40

30

ATL reported

optimum rate

20

10

0

0

1

2

3

4

5

6

7

8

9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Estimated Average Runway Queuing Delay (min)

20

15

10

5

0

0

1

2

3

4

5

6

7

8

9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Time (15-min bins)

Original Schedule

Auctioned Schedule

45 min maximum schedule deviation allowed,

no flights are rerouted

Results : Flight Deviations

~70%

-60

-40

-20

0

20

40

min

15-min max allowed

30-min max allowed

45-min max allowed

Bell-shaped curves are consistent to the model assumption about airline

bidding behavior

Curves are skewed to the right due to optimum sequencing that shifts

aircraft toward the end of 15-min intervals

Results : Auction metrics

#Flights to be rerouted

100

80

Average cancelled

arrivals in summer 2000:

23

60

40

23

20

0

#Seats to be rerouted

8000

6000

4000

2000

50

0

#Rounds

110

40

100

90

30

80

70

2.5

Average Auction Revenue Per Flight

(x $Initial Bid)

20

10

2

1.5

0

1

10

15

30

45

Maximum schedule deviation allowed (min)

30

50

70

90

V1

110

130

#seats of rerouted flights

Observations on

Research to Date

Simple Auctions could Exclude small airlines

and/or small markets from Hub Airports

Simple Bidding Rules can Prevent this Problem

Number of flights to be rerouted is comparable to

the number of cancelled flights

Combinatorial Clock Auctions Offer a Promising

Market-Based approach to Demand Management

Auction Proceeds could be used as Incentives to

the Airports for Infrastructure Investments and to

the Airlines for Avionics Investments

Airlines Could bid with Avionics

Investment Promissory Notes

Increased Hub airport capacity is Dependent on

Aircraft being able to maintain Accurate TimeBased Separation (ROT and WV safety constraints)

Data Links, ADS-B, FMS-RTA and New Operational

Procedures will be required

Airlines could Bid with Script that constituted a

contract to equip their Aircraft with-in X years (i.e.

½ bid price)

Cash Bids could be used to replace PFC’s and go

directly to the Capacitated Airport’s Infrastructure

Investment Accounts

Future work

More airline and airport inputs

Experimental auction Participation

Include Efficiency Rules

Include combinatorial bidding

Include pricing

Conduct experimental auctions

Backup

Observed Runway Incursions

One formal simultaneous runway occupancy

When

Where

Leader\Exit_time

Trailer\Thr_time

5,Mar,2002

ATL 26L

Large\8:27:31

B757\8:27:17

-14 sec

Several “near” simultaneous runway occupancies

When

Where

Leader\Exit_time Trailer\Thr_time

5,Mar,2002

ATL 26L

Large\8:22:06

Large\8:22:06

5,Mar,2002

ATL 26L

Large\8:22:50

Large\8:22:50

5,Mar,2002

ATL 26L

Small\9:05:32

Large\9:05:30

5,Mar,2002

ATL 26L

Large\1:16:04

Large\1:16:04

6,Mar,2002

ATL 26L

Large\2:43:32

Heavy\2:43:32

6,Mar,2002

ATL 26L

B757\8:35:06

Large\8:35:06

Out of 364 valid data points

ATL and LGA Aircraft

Inter-arrival Times

LGA & ATL Arrival Histograms

14

LGA in VMC N=168

Aircraft / RW / Hr (20 Sec. Bins)

12

LGA in IMC N=124

10

ATL IN VMC N=114

ATL in VMC N=323

8

6

4

2

0

20

40

60

80

100

120

140

160

Inter-Arrival Time (Seconds)

180

200

LGA Arrival Histograms Normalized by Arrival Rate

Displaying Positive or Negative Deviation from WVSS

Adherence

10

8

6

4

2

0

140

100

60

20

-20

VFR 33.8 Arr/hr

IFR 34 Arr/Hr

VFR 30.9 Arr/Hr

VFR 27 Arr/Hr

-60

Aircraft / RW / Hr (20 Sec.

Bins)

Perfect WVSS Adherence = 0

Seconds Deviation per Aircraft From

Perfect WVSS Adherence Value

ATL Arrival Histograms RW 27 Normalized by Arrival Rate

Displaying Positive or Negative Deviation from WVSS Adherence

15

10

D1P1 31 Arr/Hr

D1P2 35 Arr/Hr

D2P1 34 Arr/Hr

5

Secs. Deviation per Aircraft From Perfect

WVSS Adherence Value

140

120

100

80

60

40

20

0

-20

-40

0

-60

Aircraft/RW/Hr (20 Sec.

Bins)

Perfect WVSS Adherence Value = 0

ATL Arrival Histograms RW 26 Normalized by Arrival Rate

Displaying Positive or Negative Deviation from WVSS Adherence

20

15

D1P1 36 Arr/Hr

D1P1 39 Arr/Hr

D2/P2 39 Arr/Hr

10

5

Seconds Deviation per Aircraft From Perfect

WVSS Adherence Value

140

120

100

80

60

40

20

0

-20

-40

0

-60

Arrivals for 1 Runway in 20

Second Bins

Perfect WVSS Adherence Value = 0

Perfect WVSS Adherence Value = 0

10

8

6

4

2

0

180

140

100

60

20

-20

VFR 33.8 Arr/Hr

IFR 34 Arr/Hr

VFR 30.9 Arr/Hr

VFR 27 Arr/Hr

IFR 18.7 Arr/Hr

-60

Arrivals for 1 Runway in 20

Second Bins

Aircraft Wake Vortex Separation

Violations : LGA & BWI

Seconds Deviation per Aircraft From Perfect

WVSS Adherence Value

FAA Barriers to Change

FAA has an Operational and Regulatory

Culture

Inclination to follow training that has

seemed to be Safe in the Past

FAR has NOT Changed to Provide

Operational Benefits from Introduction of

New Technology

Assumption that Aircraft Equipage would

be Benefits Driven did not account for

Lack of an ECONOMIC and/or SAFETY

Bootstrapping Requirement

FAA Investment Analysis Primarily

focus on Capacity and Delay

OMB requirement to have a B/C ratio > 1

leads to a modernization emphasis on

Decreasing Delay

In an Asynchronous Transportation

Network operating near it’s capacity

margin, Delay is Inevitable

Delay Costs Airlines Money and is an

Annoyance to Passengers BUT

is Usually Politically and Socially

Acceptable

Hypothesis: Most Major Changes to the

NAS have been due to Safety Concerns

1960’s Mandated Introduction of Radar Separation

1970’s Decrease in Oceanic Separation Standards

Required a Landmark Safety Analysis

1970’s Required A/C Transponder Equipage

1970’s Required A/C Ground Proximity Equipage

1990’s Required A/C TCAS Equipage

1990’s Required A/C Enhanced Ground Prox.

Equipage

1990’s TDWR & ITWS Introduction

1990’s Mandated Development of GPS/WAAS