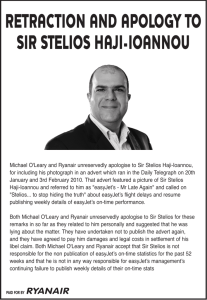

EasyJet - WordPress.com

advertisement

Low cost carriers in Europe The key success factors of Low Cost Carriers • Simple product: catering on demand for extra payment, planes with narrow seating (but bigger capacity) and one only single class, there is no seat assignment, ticketless travel • Positioning: aggressive marketing, use of secondary airports • Low operating costs: low wages, low air fees, low cost for maintenance, reduced employment, no air freight, no hub services, short cleaning times The easy way to succeed easyJet • Established in 1995, as a low cost airline • Its mission: “safe, good value, point-to-point air services” • biggest low cost airline in Europe flying more routes and planes than Ryanair (which until 2002 was number one). • By 2003 one of the most recognised brands in Europe. easyJet Background • Stelios – son of a greek shipping magnate (who built up on of the biggest maritime empires in the world) wanted to have a different business from his father because he felt too controlled. • The idea of easyJet came when he was on a Virgin Airways flight and found himself chatting with the person who was seated next to him. That person was an investor in Virgin and wanted Stelios to invest in the company. • Intrigued by the investment offer Stelios meet the founder of Virgin, (Richard Brandson) and this discussion impressed Stelios so much that instead of investing in Virgin he decided to set up his own airline. • With $7.5 milion borrowed from his father he started looking for sites to base his airline. He came across a tin shed near Luton Airport in London and found it the ideal location for his operations. • The Luton headquarters of easyJet were called easyLands! easyJet 1995 • March: incorpored as an European airline operator. • October: first flight booking were opened at the easyjet telephone booking center in EasyJet Land • November: Two inaugural flights flew from London to Glasgow and Edinburg. The inauguration of the services was supported by an advertising campaign that said “Making flying as affordable as a pair of jeans £29 one way” easyJet 1996-2002 • April 1996 – delivery of first wholly owned Boeing aircraft, first international operation between London and Amsterdam. • 1997 – official website easyJet.com to provide information about the airline. • November 2000 – the company was listed on the London Stock Exchange and easyJet starts to be funded: purchase of new 32 Boeing 737-700s which were to be delivered by 2004. • In 2002 Stelios retires from the post of easyJet’s chairman to pursue his other interests and the chairmanship was taken over by Sir Colin Chandler. • Initially easyJet had only two leased Boeing 737-200 aircraft • By 2002 the company had 64 jets and more 120 on order. It covered 105 routes to 38 destinations in Europe and employed over 3000 people and had a market value of £1.5 billion with a net income of $76.5 easyJet Operational mode • keep costs to a minimum to allow the airline to offer the lowest fares possible. • moving people from point a to point b in the best and cheapest possible way, stripping out all unnecessary costs. easyJet Successes thanks to 2 strategic imperatives: • Sweating the assets: - make sure planes were as full as possible and flying as much as possible • Sophisticated yield management system - which could set up an infinite number of fares for a given flight, based on the demand and supply position for that flight. The prices for the seats fluctuated depending on the demand for them at a particular time easyJet Operational policies: The airline followed a strategy of costs focused by adopting the following operational policies: -No Food On Flights – instead of serving food offer to passengers the choice of purchasing drinks or snacks from easyKiosk (an on-flight kiosk). Benefits – the passenger pays less for the ticket -Ticketingeliminate commissions payables to middlemen and encourage direct booking of tickets by passengers (internet or telephone) which made the tickets much cheaper. no ticket travel: passengers only needed a passport and the confirmation number easyJet Operational policies: (I) The airline followed a strategy of cost focus by adopting the following operational policies: - Pricing Policy – price of the tickets based on demand and supply of seats on a particular route at a particular time. prices dynamically determined by proprietary yield management software that constantly revised and recalculated prices according to demand and supply. e.g. if a person booked very early the ticket price would be low, as a number of seats would be available. As the seats got taken, the reduced supply would increase the price. flying with empty seats was a loss for the company (because same costs of flying whether full plane or not). If low demand for that flight – the ticket price would be lowered to encourage booking easyJet Operational policies: (II) The airline followed a strategy of cost focus by adopting the following operational policies: -The Fleet – standardization -flew only one type of plane: Boeing 737s to simplify the maintenance; -reduced training requirements for the pilots & cabin crew, as they had to only learn to operate a single type of plane. easyJet flew new planes. -more fuel efficient, cost less on maintenance than old ones (none of them were more than five years old) compared to Ryanair’s ones which were over 15 years old. easyJet Operational efficiencies: - Fly to main destination airports around Europe using smaller airports in the cities: less congested & lower price. - 10 trips per day against 6 of another airlines - The airline did not assign seat numbers - Short and medium haul point to point flights and not use strategic located airport (the hub) as a passenger exchange point for flights to and from outlying towns and cities. -Cutting unnecessary costs was a way of life at easyJet- easyJet marketing: - Estensive use of orange colour the crew wore orange clothes, planes were painted orange- Controversies about their marketing -using celebrities in their advertisments without permission- (e.g. In early 2003 the airline was involved in a controversy for using David Beckham in newspaper advertisements. When Beckham demanded that the airline pay £10.000 to a children’s charity for using his name in advertisements, the airline responded by saying that it would double the donation if Beckham paid £10.000 to the charity himself.) easyJet not always easy: • -even it had become a successful airline within a very short time, analysts wondered how long this model of success could sustain itself. • 1) the prices were around 60-70% percent higher than those of Ryanair. • 2) the earnings of easyjet were susceptible to price swings (as the airline did not hedge fuel costs) -this could be a major problem in case of fuel crisis• 3) the easyjet’s break-even load factor was 71% compared to competitor Ryanair’s 53%. However the major advantage easyJet -had was that it flew a newer fleet of planes compared to Ryanair. --fly to small airports within major cities despite to remote destinations far away from major cities (like Ryanair does). easyJet To provide an answer to the low-cost flights: Carries approximately 50% of the company’s german and European flights But even more… 2009 For the first time in its history Lufthansa created a new company called "Lufthansa Italia" with the aim of making Malpensa its fourth hub (after FRA, MUC and ZRH). Lufthansa is basing 6 A319s in MXP, already with direct flights from MXP to Paris and Barcelona, from next March to Bruxelles, Budapest , Bucarest, Madrid, Lisbon and London. 1990 - was the national airline carrier of the Federal Republic of Germany almost bankrupt (with a record loss of $350 milion) 2003 - privately owned & profitable aviation : profit of $718 milion Lufthansa’s goal - from an airline company to an aviation group (one of the founding members of STAR ALLIANCE which is the most competitive airline network in the world) For low cost - Lufthansa Regional Planes from other partners are operated via wet-leasing whereby Lufthansa leases the aircraft complete with crew and mantenance contracts. In this case the planes are integrated into Lufthansa’s scheduling (same flight numbers) and the company carriers the risk of the revenue only.