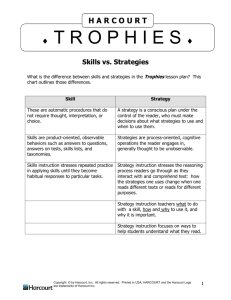

Securities Analysis, Section IV

Security Valuation

&

EIC Analysis

(Part 2)

Lecture Presentation Software

to accompany

Investment Analysis and

Portfolio Management

Sixth Edition

by

Frank K. Reilly & Keith C. Brown

Chapters 11,14,15, & 18

Top-Down Approach, Step Three

• Company and Stock Analysis

Copyright © 2000 by Harcourt, Inc. All rights reserved

Company Analysis and Stock Selection

• After analyzing the economy and stock markets

for several countries you have decided to invest

some portion of your portfolio in common stocks

• After analyzing various industries, you have

identified those industries that appear to offer

above-average risk-adjusted performance over

your investment horizon

• Which are the best companies?

• Are they overpriced?

Copyright © 2000 by Harcourt, Inc. All rights reserved

Company Analysis and Stock Selection

• Good companies are not necessarily good

investments

• Compare the intrinsic value of a stock to its

market value

• Stock of a great company may be overpriced

• Stock of a growth company may not be growth

stock

Copyright © 2000 by Harcourt, Inc. All rights reserved

Types of Companies and Stocks

•

•

•

•

Growth

Defensive

Cyclical

Speculative

Copyright © 2000 by Harcourt, Inc. All rights reserved

Growth Companies

• Growth companies have historically been

defined as companies that consistently

experience above-average increases in sales

and earnings

• Financial theorists define a growth company

as one with management and opportunities

that yield rates of return greater than the

firm’s required rate of return

Copyright © 2000 by Harcourt, Inc. All rights reserved

Growth Stocks

• Growth stocks are not necessarily shares in

growth companies

• A growth stock has a higher rate of return

than other stocks with similar risk

• Superior risk-adjusted rate of return occurs

because of market undervaluation compared

to other stocks

Copyright © 2000 by Harcourt, Inc. All rights reserved

Value versus Growth Investing

• Growth stocks will have positive

earnings surprises and above-average

risk adjusted rates of return because the

stocks are undervalued

• Value stocks appear to be undervalued

for reasons besides earnings growth

potential

• Value stocks usually have low P/E ratio

or low ratios of price to book value

Copyright © 2000 by Harcourt, Inc. All rights reserved

Value versus Growth Investing

• Buffett’s view:

– Growth is a key determinant of value for any

stock, so it is always a component of determining

whether or not a stock is undervalued

– Furthermore, so long as the market is undervaluing a stock, then he would categorize it as a

“value” stock

– Finally, he considers all investing to be “value”

investing

– Thus, he considers “value” vs. “growth” investing

to be a false dichotomy

Copyright © 2000 by Harcourt, Inc. All rights reserved

Defensive Companies and Stocks

• Defensive companies’ future earnings are

more likely to withstand an economic

downturn

• Low business risk

• Not excessive financial risk

• Stocks with low or negative systematic risk

Copyright © 2000 by Harcourt, Inc. All rights reserved

Cyclical Companies and Stocks

• Sales and earnings heavily influenced by

aggregate business activity

• Stocks with high betas

Copyright © 2000 by Harcourt, Inc. All rights reserved

Speculative Companies and Stocks

• Assets involve great risk

– e.g., biotechs, bankruptcies, etc.

• Can be viewed as a gamble

– Possible great gain

– Stock may be overpriced

Copyright © 2000 by Harcourt, Inc. All rights reserved

Economic, Industry, and Structural

Links to Company Analysis

• Company analysis is the final step in the topdown approach to investing

• Macroeconomic analysis identifies industries

expected to offer attractive returns in the

expected future environment

• Analysis of firms in selected industries

concentrates on a stock’s intrinsic value

based on growth and risk

Copyright © 2000 by Harcourt, Inc. All rights reserved

Economic and Industry Influences

• If trends are favorable for an industry, the

company analysis should focus on firms in that

industry that are positioned to benefit from the

economic trends

• Firms with sales or earnings particularly sensitive

to macroeconomic variables should also be

considered

• Research analysts need to be familiar with the

cash flow and risk of the firms

Copyright © 2000 by Harcourt, Inc. All rights reserved

Structural Influences

• Social trends, technology, political, and

regulatory influences can have significant

influence on firms

• Early stages in an industry’s life cycle see

changes in technology that followers may

imitate and benefit from

• Politics and regulatory events can create

opportunities even when economic

influences are weak

Copyright © 2000 by Harcourt, Inc. All rights reserved

Company Analysis

•

•

•

•

Industry competitive environment

SWOT analysis

Present value of cash flows

Relative valuation ratio techniques

Copyright © 2000 by Harcourt, Inc. All rights reserved

Firm Competitive Strategies

•

•

•

•

•

Current rivalry

Threat of new entrants

Potential substitutes

Bargaining power of suppliers

Bargaining power of buyers

Copyright © 2000 by Harcourt, Inc. All rights reserved

Firm Competitive Strategies

• Defensive or offensive

• Defensive strategy deflects competitive

forces in the industry

• Offensive competitive strategy affects

competitive force in the industry to

improve the firm’s relative position

• Porter suggests two major strategies: lowcost leadership and differentiation

Copyright © 2000 by Harcourt, Inc. All rights reserved

Low-Cost Strategy

• Seeks to be the low cost leader in its

industry

– Through economies of scale (in production or

marketing), better logistics, etc.

• Must still command prices near industry

average, so still must differentiate

• Discounting too much erodes superior

rates of return

Copyright © 2000 by Harcourt, Inc. All rights reserved

Differentiation Strategy

• Identify as unique in its industry in

an area that is important to buyers

• Above average rate of return only

comes if the price premium

exceeds the extra cost of being

unique

Copyright © 2000 by Harcourt, Inc. All rights reserved

Focusing a Strategy

• Select segments in the industry

• Tailor strategy to serve those specific

groups

• Determine which strategy a firm is

pursuing and its success

• Evaluate the firm’s competitive

strategy over time

Copyright © 2000 by Harcourt, Inc. All rights reserved

SWOT Analysis

• Examination of a firm’s:

– Strengths

– Weaknesses

– Opportunities

– Threats

Copyright © 2000 by Harcourt, Inc. All rights reserved

SWOT Analysis

• Examination of a firm’s:

– Strengths

– Weaknesses

– Opportunities

– Threats

INTERNAL ANALYSIS

Copyright © 2000 by Harcourt, Inc. All rights reserved

SWOT Analysis

• Examination of a firm’s:

– Strengths

– Weaknesses

– Opportunities

– Threats

EXTERNAL ANALYSIS

Copyright © 2000 by Harcourt, Inc. All rights reserved

Lynch’s Favorable Attributes

1. Firm’s product is not faddish

2. Company has competitive advantage over

rivals

3. Industry or product has potential for market

stability

4. Firm can benefit from cost reductions

5. Firm is buying back its own shares or

managers (insiders) are buying

Copyright © 2000 by Harcourt, Inc. All rights reserved

Lynch’s Categories of Companies

1. Slow growers

2. Stalwart

3. Fast growers

4. Cyclicals

5. Turnarounds

6. Asset plays

Copyright © 2000 by Harcourt, Inc. All rights reserved

Approaches to the

Valuation of Common Stock

Two general approaches have developed:

1. Discounted cash-flow valuation

•

Present value of some measure of cash flow, such

as dividends, operating cash flow, and free cash

flow

2. Relative valuation technique

•

Value estimated based on its price relative to

significant variables, such as earnings, cash flow,

book value, or sales

Copyright © 2000 by Harcourt, Inc. All rights reserved

Approaches to the

Valuation of Common Stock

These two approaches have some factors in

common

• Both are affected by:

–

–

–

–

Investor’s required rate of return

kV

Estimated growth rate of the variable used

gV

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation Approaches

and Specific Techniques

Approaches to Equity Valuation

Discounted Cash Flow

Techniques

Relative Valuation

Techniques

• Present Value of Dividends (DDM)

• Price/Earnings Ratio (PE)

•Present Value of Operating Cash Flow

•Price/Cash flow ratio (P/CF)

•Present Value of Free Cash Flow

•Price/Book Value Ratio (P/BV)

•Price/Sales Ratio (P/S)

Copyright © 2000 by Harcourt, Inc. All rights reserved

Why and When to Use the Discounted

Cash Flow Valuation Approach

• The measure of cash flow used

– Dividends

• Cost of equity as the discount rate

– Operating cash flow

• Weighted Average Cost of Capital (WACC)

– Free cash flow to equity

• Cost of equity

• Dependent on growth rates and discount

rate

Copyright © 2000 by Harcourt, Inc. All rights reserved

Why and When to Use the

Relative Valuation Techniques

• Provides information about how the market is

currently valuing stocks

– aggregate market

– alternative industries

– individual stocks within industries

• No guidance as to whether valuations are

appropriate; best used when:

– have comparable entities

– aggregate market is not at a valuation extreme

Copyright © 2000 by Harcourt, Inc. All rights reserved

Discounted Cash-Flow

Valuation Techniques

CFt

Vj

t

t 1 (1 k )

Where:

Vj = value of stock j

n = life of the asset

CFt = cash flow in period t

k = the discount rate that is equal to the investor’s required rate

of return for asset j, which is determined by the uncertainty

(risk) of the stock’s cash flows

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

The value of a share of common stock is the

present value of all future dividends

D3

D1

D2

D

Vj

...

2

3

(1 k ) (1 k ) (1 k )

(1 k )

Dt

t

(

1

k

)

t 1

Where:

Vj = value of common stock j

Dt = dividend during time period t

k = required rate of return on stock j

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

If the stock is not held for an infinite period, a

sale at the end of year 2 would imply:

SPj 2

D1

D2

Vj

2

(1 k ) (1 k )

(1 k ) 2

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

If the stock is not held for an infinite period, a

sale at the end of year 2 would imply:

SPj 2

D1

D2

Vj

2

(1 k ) (1 k )

(1 k ) 2

Selling price at the end of year two is the

value of all remaining dividend payments,

which is simply an extension of the original

equation

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

Stocks with no dividends are expected to start

paying dividends at some point else they

would not have any value!

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

Stocks with no dividends are expected to start

paying dividends at some point, say year

three...

D3

D1

D2

D

Vj

...

2

3

(1 k ) (1 k )

(1 k )

(1 k )

Where:

D1 = 0

D2 = 0

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

Infinite period model assumes a constant

growth rate for estimating future dividends

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Dividend Discount Model

(DDM)

Infinite period model assumes a constant

growth rate for estimating future dividends

D0 (1 g ) D0 (1 g )

D0 (1 g )

Vj

...

2

n

(

1

k

)

(

1

k

)

(

1

k

)

Where:

2

Vj = value of stock j

D0 = dividend payment in the current period

g = the constant growth rate of dividends

k = required rate of return on stock j

n = the number of periods, which we assume to be infinite

Copyright © 2000 by Harcourt, Inc. All rights reserved

n

The Dividend Discount Model

(DDM)

Infinite period model assumes a constant

growth rate for estimating future dividends

D0 (1 g ) D0 (1 g )

D0 (1 g )

Vj

...

2

(1 k )

(1 k )

(1 k ) n

D1

Vj

This can be reduced to:

kg

2

1. Estimate the required rate of return (k)

2. Estimate the dividend growth rate (g)

Copyright © 2000 by Harcourt, Inc. All rights reserved

n

Infinite Period DDM

and Growth Companies

Assumptions of DDM:

1. Dividends grow at a constant rate

2. The constant growth rate will continue for

an infinite period

3. The required rate of return (k) is greater

than the infinite growth rate (g)

Copyright © 2000 by Harcourt, Inc. All rights reserved

Infinite Period DDM

and Growth Companies

Growth companies have opportunities to earn

return on investments greater than their required

rates of return

To exploit these opportunities, these firms

generally retain a high percentage of earnings for

reinvestment, and their earnings grow faster than

those of a typical firm

This is inconsistent with the infinite period DDM

assumptions

Copyright © 2000 by Harcourt, Inc. All rights reserved

Infinite Period DDM

and Growth Companies

The infinite period DDM assumes constant

growth for an infinite period, but

abnormally high growth usually cannot be

maintained indefinitely

Risk and growth are not necessarily related

Temporary conditions of high growth cannot

be valued using the CGR-DDM

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation with Temporary

Supernormal Growth

Combine the models to evaluate the years of

supernormal growth and then use DDM to

compute the remaining years at a

sustainable rate

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation with Temporary

Supernormal Growth

Combine the models to evaluate the years of

supernormal growth and then use DDM to

compute the remaining years at a

sustainable rate

For example:

With a 14 percent required rate of return, a

most recently paid dividend of $2.00 per

share, and dividend growth of:

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation with Temporary

Supernormal Growth

Year

1-3:

4-6:

7-9:

10 on:

Dividend

Growth Rate

25%

20%

15%

9%

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation with Temporary

Supernormal Growth

The value equation becomes

2.00(1.25) 2.00(1.25) 2 2.00(1.25) 3

Vi

2

1.14

1.14

1.14 3

2.00(1.25) 3 (1.20) 2.00(1.25) 3 (1.20) 2

4

1.14

1.14 5

2.00(1.25) 3 (1.20) 3 2.00(1.25) 3 (1.20) 3 (1.15)

6

1.14

1.14 7

2.00(1.25) 3 (1.20) 3 (1.15) 2 2.00(1.25) 3 (1.20) 3 (1.15) 3

8

1.14

1.14 9

2.00(1.25) 3 (1.20) 3 (1.15) 3 (1.09)

(.14 .09)

(1.14) 9

Copyright © 2000 by Harcourt, Inc. All rights reserved

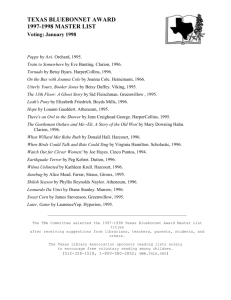

Computation of Value for Stock of Company

with Temporary Supernormal Growth

Year

Dividend

1

2

3

4

5

6

7

8

9

10

$

2.50

3.13

3.91

4.69

5.63

6.76

7.77

8.94

10.28

11.21

$ 224.20

Discount

Present

Growth

Factor

Value

Rate

0.8772

0.7695

0.6750

0.5921

0.5194

0.4556

0.3996

0.3506

0.3075

a

0.3075

$

$

$

$

$

$

$

$

$

b

2.193

2.408

2.639

2.777

2.924

3.080

3.105

3.134

3.161

25%

25%

25%

20%

20%

20%

15%

15%

15%

9%

$ 68.943

$ 94.365

a

Value of dividend stream for year 10 and all future dividends, that is

$11.21/(0.14 - 0.09) = $224.20

b

The discount factor is the ninth-year factor because the valuation of the

remaining stream is made at the end of Year 9 to reflect the dividend in

Year 10 and all future dividends.

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Operating Cash Flows

• 2nd DCF method

Derive the value of the total firm by

discounting the total operating cash flows

prior to the payment of interest to the debtholders

Then subtract the value of debt to arrive at an

estimate of the value of the equity

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Operating Cash Flows

n

OCFt

Vj

t

t 1 (1 WACC j )

Where:

Vj = value of firm j

n = number of periods; assumed to be infinite

OCFt = the firms operating cash flow in period t

WACC = firm j’s weighted average cost of capital

(OCF and WACC to be discussed in Chapter 20)

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Operating Cash Flows

Similar to DDM, this model can be used to

estimate an infinite period

Where growth has matured to a stable rate, the

adaptation is

Where:

OCF1

Vj

WACC j gOCF

OCF1=operating cash flow in period 1

gOCF = long-term constant growth of operating cash flow

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Operating Cash Flows

• Assuming several different rates of growth

for OCF, these estimates can be divided into

stages as with the supernormal dividend

growth model

• Estimate the rate of growth and the duration

of growth for each period

• This will be demonstrated later

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Free Cash Flows to Equity

• 3rd DCF method

• “Free” cash flows to equity are derived after

operating cash flows have been adjusted for

debt payments (interest and principle)

• The discount rate used is the firm’s cost of

equity (k) rather than WACC

Copyright © 2000 by Harcourt, Inc. All rights reserved

Follow the Cash

Free cash flow to equity defined

• Volume

• Pricing

• Expenses

• Leases

• Tax Provision

• Deferred Taxes

• Tax Shield

Sales

Operating

Margin

Cash

Earnings

Cash

Taxes

minus

• A/R

• Inventories

• A/P

• Net PP&E

•Operating

Leases

DWorking

Capital

Capital

Expenditures

Free Cash Flow

Cash available

for distribution to

all claimholders

Investment

Acquisitions/

Divestitures

Copyright © 2000 by Harcourt, Inc. All rights reserved

Present Value of

Free Cash Flows to Equity

FCFt

Vj

t

(

1

k

)

t

1

j

Where:

Vj = Value of the stock of firm j

n = number of periods assumed to be infinite

FCFt = the firm’s free cash flow in period t

Copyright © 2000 by Harcourt, Inc. All rights reserved

Relative Valuation Techniques

• Value can be determined by comparing to similar

stocks based on relative ratios

• Relevant variables include earnings, cash flow,

book value, and sales

• Multiply this variable by some “capitalization

factor”

• The most popular relative valuation technique is

based on price to earnings (the P/E approach)

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

• This values the stock based on expected

annual earnings

• The price earnings (P/E) ratio, or

Earnings Multiplier

Current Market Price

Expected Twelve - Month Earnings

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

The infinite-period dividend discount model

indicates the variables that should determine

the value of the P/E ratio

D1

Pi

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

The infinite-period dividend discount model

indicates the variables that should determine

the value of the P/E ratio

D1

Pi

kg

Dividing both sides by expected earnings

during the next 12 months (E1)

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

Thus, the P/E ratio is determined by

– 1. Expected dividend payout ratio

– 2. Required rate of return on the stock (k)

– 3. Expected growth rate of dividends (g)

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

As an example, assume:

–

–

–

–

Dividend payout = 50%

Required return = 12%

Expected growth = 8%

D/E = .50; k = .12; g=.08

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

As an example, assume:

–

–

–

–

Dividend payout = 50%

Required return = 12%

Expected growth = 8%

D/E = .50; k = .12; g=.08

.50

P/E

.12 - .08

.50/.04

12.5

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

A small change in either or both k or g can

have a large impact on the multiplier

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

A small change in either or both k or g can

have a large impact on the multiplier

D/E = .50; k=.13; g=.08

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

A small change in either or both k or g can

have a large impact on the multiplier

D/E = .50; k=.13; g=.08

P/E = .50/(.13-/.08) = .50/.05 = 10

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

A small change in either or both k or g can

have a large impact on the multiplier

D/E = .50; k=.13; g=.08

P/E = 10

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

A small change in either or both k or g can

have a large impact on the multiplier

D/E = .50; k=.13; g=.08

P/E = 10

D/E = .50; k=.12; g=.09

P/E = 16.7

D/E = .50; k=.11; g=.09

P/E = 25

Pi

D1 / E1

E1

kg

Copyright © 2000 by Harcourt, Inc. All rights reserved

Earnings Multiplier Model

small change in either or both k or g can

have a large impact on the multiplier

D/E = .50; k=.12; g=.09

P/E = 16.7

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation Using the

Earnings Multiplier Model

Given current earnings of $2.00 and growth of

9%

You would expect E1 to be $2.18

D/E = .50; k=.12; g=.09

P/E = 16.7

Copyright © 2000 by Harcourt, Inc. All rights reserved

Valuation Using the

Earnings Multiplier Model

Given current earnings of $2.00 and growth of

9%

You would expect E1 to be $2.18

D/E = .50; k=.12; g=.09

P/E = 16.7

V = 16.7 x $2.18 = $36.41

Compare this estimated value to market price

to decide if you should invest in it

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Cash Flow Ratio

•

•

•

•

2nd relative valuation approach

Companies can manipulate earnings

Cash-flow is less prone to manipulation

Cash-flow is important for fundamental

valuation and in credit analysis

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Cash Flow Ratio

• Companies can manipulate earnings

• Cash-flow is less prone to manipulation

• Cash-flow is important for fundamental

valuation and in credit analysis

Pt

P / CFi

CFt 1

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Cash Flow Ratio

• Companies can manipulate earnings

• Cash-flow is less prone to manipulation

• Cash-flow is important for fundamental

valuation and in credit analysis

Pt

P / CFi

CFt 1

Where:

P/CFj = the price/cash flow ratio for firm j

Pt = the price of the stock in period t

CFt+1 = expected cash low per share for firm j

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Book Value Ratio

• 3rd relative valuation approach

Widely used to measure bank values (most

bank assets are liquid (bonds and

commercial loans)

Fama and French study indicated inverse

relationship between P/BV ratios and excess

return for a cross section of stocks

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Book Value Ratio

Pt

P / BV j

BVt 1

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Book Value Ratio

Pt

P / BV j

BVt 1

Where:

P/BVj = the price/book value for firm j

Pt = the end of year stock price for firm j

BVt+1 = the estimated end of year book value

per share for firm j

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Book Value Ratio

• Be sure to match the price with either a

recent book value number, or estimate the

book value for the subsequent year

• Can derive an estimate based upon

historical growth rate for the series or use

the growth rate implied by the (ROE) X

(Ret. Rate) analysis

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Sales Ratio

• 4th relative valuation approach

• Strong, consistent growth rate is a

requirement of a growth company

• Sales is less subject to manipulation than

other financial data

• Popularized by Ken Fisher

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Sales Ratio

Pt

P

S St 1

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Sales Ratio

Where:

Pj

Sj

Pt

P

S St 1

price to sales ratio for firm j

Pt end of year stock price for firm j

St 1 annual sales per share for firm j during Year t

Copyright © 2000 by Harcourt, Inc. All rights reserved

The Price-Sales Ratio

Match the stock price with recent annual

sales, or future sales per share

This ratio varies dramatically by industry

Profit margins also vary by industry

Relative comparisons using P/S ratio should

be between firms in similar industries

Copyright © 2000 by Harcourt, Inc. All rights reserved

Estimating the Inputs: The Required Rate of

Return and The Expected Growth Rate of

Valuation Variables

Valuation procedure is the same for securities

around the world, but the required rate of

return (k) and expected growth rate of

earnings and other valuation variables (g)

such as book value, cash flow, and dividends

differ among countries

Copyright © 2000 by Harcourt, Inc. All rights reserved

Required Rate of Return (k)

• Required rate of return on equity (ke) affects

valuation, regardless of approach:

– kV , and vice versa

• This required rate of return will be used as the

discount rate and also affects relative-valuation

• Although ke is not directly used in the present

value of operating cash flow approach, it is

nonetheless a component of WACC

Copyright © 2000 by Harcourt, Inc. All rights reserved

Required Rate of Return (k)

• But, what is the proper approach for

deriving ke?

– CAPM?

– APT?

– Haugen’s ad hoc expected return factor model?

• Still an open question

– CAPM most widely used in practice

– Even then, questions can remain in terms of

how to apply the model

Copyright © 2000 by Harcourt, Inc. All rights reserved

Estimating Growth Rates

Three general approaches:

1. Reinvestment-rate approaches

–

Sustainable Growth Rate = RR X ROE

2. Historical estimates

–

–

Point estimates of growth rates

Regression-based estimates of growth rates

3. Back out growth rates from estimated size of

future market

–

Compare company to industry (Ch. 20) and industry

to economy as a whole (Ch. 19)

Copyright © 2000 by Harcourt, Inc. All rights reserved

Expected Growth Rate of Dividends

• Determined by

– the growth of earnings

– the proportion of earnings paid in dividends

• In the short run, dividends can grow at a different

rate than earnings due to changes in the payout

ratio

• Earnings growth is also affected by compounding

of earnings retention

g = (Retention Rate) x (Return on Equity)

= RR x ROE

Copyright © 2000 by Harcourt, Inc. All rights reserved

DuPont Breakdown of ROE

ROE

Net Income

Sales

Total Assets

Sales

Total Assets Common Equity

=

Profit

Margin

Total Asset

x Turnover

Financial

x Leverage

Copyright © 2000 by Harcourt, Inc. All rights reserved

Estimating Growth Based on History

•

•

•

Alternative to reinvestment rate approach

Historical growth rates of sales, earnings, cash

flow, and dividends

Two general techniques

1. arithmetic or geometric average of annual

percentage changes (point estimates)

2. linear or log-linear regression models

•

Both use time-series plot of data

Copyright © 2000 by Harcourt, Inc. All rights reserved

Checking Your Figures:

Three Alternative Measures of Value

(cf., Value Investing)

1. Value of Company’s Assets

–

–

–

Graham & Dodd net-net approach

Book Value of Assets – P/BV for valuation

Market value / replacement value of assets

2. Earnings Power Value

–

–

–

Value company’s current earnings, adjusted for seasonality /

cyclicality – DCF value assuming growth = 0 or = long-run

growth in economy

Greater than value of company’s underlying assets iff

company holds competitive advantage or benefits from

barriers to entry

Understanding value requires knowledge of industry

Copyright © 2000 by Harcourt, Inc. All rights reserved

Checking Your Figures:

Three Alternative Measures of Value

(cf., Value Investing)

3. What is Growth Worth?

–

Adds value only if growth occurs “within the franchise”

•

•

•

•

Potential problem - firm retains earnings, but reinvestment returns

are below the firm’s cost of capital (i.e., project NPV is negative)

Taking on more projects means that sales and earnings will grow,

but not by enough to cover additional costs of capital, so growth

will actually destroy value held by current shareholders

Key lesson = not all growth is “value-adding”

Only projects with positive NPV’s will create value, and projects

will only have positive NPV if they exploit or occur within the

firm’s realm of competitive advantage, i.e., within the firm’s

franchise

Copyright © 2000 by Harcourt, Inc. All rights reserved

Analysis of Growth Companies

• Generating rates of return greater than the firm’s

cost of capital is considered to be temporary

• Earnings higher than the required rate of return are

pure profits

• How long can they earn these excess profits?

• How long are they likely to earn these excess

profits?

• How long does the market expect them to earn

these excess profits?

• Is the stock properly valued?

Copyright © 2000 by Harcourt, Inc. All rights reserved

Measures of Value-Added

• The Franchise Factor

– Breaks P/E into two components

• P/E based on ongoing business (base P/E)

• Franchise P/E the market assigns to the expected value of

new and profitable business opportunities

Franchise P/E = Observed P/E - Base P/E

Incremental Franchise P/E = Franchise Factor X Growth Factor

Rk

G

rk

Copyright © 2000 by Harcourt, Inc. All rights reserved

Growth Duration

• Evaluate the high P/E ratio by relating P/E ratio to

the firm’s rate and duration of growth

• P/E is function of

– expected rate of growth of earnings per share

– stock’s required rate of return

– firm’s dividend-payout ratio

• Use the ratio of P/E’s, related to growth and

dividend rates, to infer the market’s implied

growth duration:

Copyright © 2000 by Harcourt, Inc. All rights reserved

Intra-Industry Analysis

• Directly compare two firms in the same industry

• An alternative use of T to determine a reasonable

P/E ratio

• Factors to consider

– A major difference in the risk involved

– Inaccurate growth estimates

– Stock with a low P/E relative to its growth rate

is undervalued

– Stock with high P/E and a low growth rate is

overvalued

Copyright © 2000 by Harcourt, Inc. All rights reserved

Growth Duration

T

(1 G g D g )

Pg (0)/E g (0)

(1 G D ) T

P

0

/

E

(0)

B

B

B

B

Pg (0)/E g (0)

1 G g Dg

T ln

ln

PB 0 / E B (0)

1 G B DB

P/E g

ln

P/E B

T

1 G g Dg

ln

1 G B DB

Copyright © 2000 by Harcourt, Inc. All rights reserved

Growth Duration

Alternatively, the equation can be rearranged to determine a

justified P/E ratio for a firm, given its expected dividend yield and

growth rate and the expected length of time over which the firm will

continue to experience above-average growth, relative to its

benchmark (B).

1 G g Dg

P/E g P/E B

1 G B DB

Copyright © 2000 by Harcourt, Inc. All rights reserved

T

Extensions on Growth Duration

• For more information and additional

extensions and applications in using marketbased information to infer the market’s

assumptions about the various factors that

drive a stock’s valuation, see:

– www.expectationsinvesting.com

Copyright © 2000 by Harcourt, Inc. All rights reserved

When to Sell

• Knowing when to sell is an even harder decision

than knowing when to buy

– Holding a stock too long may lead to lower returns than

expected

– If stocks decline right after purchase, is that a further

buying opportunity or an indication of incorrect analysis?

– Continuously monitor key assumptions

– Evaluate closely when market value approaches estimated

intrinsic value

– Know why you bought it and watch for that to change

– Always need a “sell discipline”

Copyright © 2000 by Harcourt, Inc. All rights reserved

Efficient Markets

• Opportunities are mostly among less well-known

companies

• To outperform the market you must find disparities

between stock values and market prices - and you must

be correct

• Concentrate on identifying what is wrong with the

market consensus and what earning surprises may exist

– Again, useful to examine the expectations that underlie the

current market price

– Are these realistic/optimistic/pessimistic?

Copyright © 2000 by Harcourt, Inc. All rights reserved

Next Up:

Final Topics

• Bond Portfolio Management

• Are the Markets Rational?

Copyright © 2000 by Harcourt, Inc. All rights reserved

Copyright © 2000 by Harcourt, Inc. All rights reserved