Future Retail & Foodservice Opportunities

advertisement

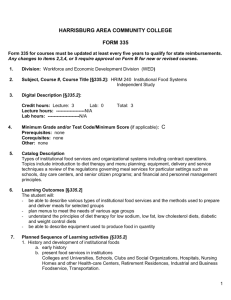

Future Retail & Foodservice Opportunities James Degen J. M. Degen & Company, Inc. www.Degenconsulting.com 805-434-2400 Words of Wisdom “So like Noah said--you’d better wake up you don’t want to get stuck in this zoo. Cause when he leaves the dock he ain’t waiting round for you. Be prepared to change some too.” Boz Scaggs--”Some Change” J. M. Degen & Company, Inc. Undercurrents Of Change Food At-Home Working women Time to prepare Declining skills Decline of “family meal” Expectations J. M. Degen & Company, Inc. Food Away-FromHome Labor cost Labor skill/availability Consistent quality Safety Menu differentiation Profitability Declining Food Expenditures U. S. Share of Income Spent On Food 12.00% 11.50% 11.00% 10.50% 10.00% 11.2% 10.2% 10.1% 9.50% 10.1% 10.1% 9.00% 1990 2000 2001 J. M. Degen & Company, Inc. 2002 2003 Shift In Consumer Food Expenditures To Foodservice Retail/Foodservice Sales Share 100% 80% 41% 50% 53% 55% 51% 47% 45% 60% 40% 59% 20% 0% 1980 1990 At Home 1995 Away From Home J. M. Degen & Company, Inc. 2003 Food Marketing and Consumption Have Changed Forever Demographics Wellness Culture Search For Value Value of Time Channel Blurring J. M. Degen & Company, Inc. Demographic Drill Down 78MM Boomers enter new life Stage--empty nest, retirement 73MM Gen Y’ers are becoming adults driving new culture cohort 61% of population growth by 2014 due to immigration 34% of U. S. households will be single person by 2010 J. M. Degen & Company, Inc. Wellness Culture Obesity and related heart health and diabetes concerns increasing--world-wide In 2004 33% of U. S. Adults on a diet 37% of health club memberships held by boomers 32% of Americans dieting for health reasons in 2001 71% of Americans believe that food & nutrition play a great role in maintaining overall health Increasing consumer interest in digestion/gut health Functional food category is estimated at $16+B Fresh = Healthy J. M. Degen & Company, Inc. Search For Value According to FMI, price is the leading reason for switching supermarkets (32%) Households most likely to participate in frequent shopper programs is $75K+ (35%) 39% of consumers shop at both WalMart Supercenters and traditional supermarkets. In the South it is 92% 82% of consumers participate in at least one frequent shopper program--93% of consumers over $100K in income J. M. Degen & Company, Inc. Value of Time Convenience culture continues with “time” the currency of 21st century 46% feel more stressed Vs 5 years ago 46% don’t have enough time in the day-53% of boomers 1/5 of all meals eaten in a car Food prepared away from home continues to grow Disappearance of traditional meal leads to more snack meals--4-6 meals/snacks per day J. M. Degen & Company, Inc. Channel Blurring Traditional retail food channels blurring into multiple retail channels offering food Traditional foodservice channels following similar patterns particularly snack meals Food becoming a traffic building tactic due to purchase frequency Value-priced food appeals to valueconscious consumers J. M. Degen & Company, Inc. Non-Traditional Channels Impact Retail Food Purchases Wal-Mart--U.S. food/beverage sales $67.6B (2003) Supercenters Sam’s Clubs Neighborhood Market Stores Membership Clubs Dollar Stores/Extreme Value Retailers Limited Assortment Stores Convenience Retailers Result: Supermarkets given up competing for center-store sales J. M. Degen & Company, Inc. Supermarket’s Decline In Relative Food Retailing Importance U. S. Food & Beverage Sales Share 2004 Grocery Stores 2.5% C-Stores 2.9% 2.8% Drug Stores 8.1% 6.7% Membership Clubs 2.4% Supercenters 7.7% 66.9% Discount Stores Spec. WholesaleRetailers All others J. M. Degen & Company, Inc. Retail Food Channel Growth Rates J. M. Degen & Company, Inc. Foodservice Is Defined By Chains Restaurants account for 63.6% of all foodservice industry retail sales. Top 100 chains account for 96.3% of all restaurant sales 96.3% of hamburger restaurant sales 91.3% of all family steak restaurant sales 83.4% of chicken restaurant sales 57.6% of other sandwich restaurant sales 50.7% of pizza restaurant sales J. M. Degen & Company, Inc. “The most frequently used culinary utensil is the window control of a car.”--Harry Balzer, NPD Customer Eating Place Traffic 2002 On-Premise 42% Off-Premise 58% J. M. Degen & Company, Inc. Retail & Foodservice Opportunities New retail and foodservice products are going to have to deliver against these changes in consumer definition, behavior and motivation J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Foodservice or food “prepared away from home” an opportunity for companies not already participating Members of Gen-Y eat out on average 24 times per month--almost once per day (Technomic) 51% of Gen-Y ate restaurant-prepared food growing up “sometimes” or “more often” compared with 12% of their baby-boom parents (Technomic) “These (Gen-Y) are consumers of bagged lettuce and (healthful)prepackaged meals” (FMI) “BATH restaurants (Better Alternative to Home), i.e., simple ethnic establishments” (Tim Zagat) J. M. Degen & Company, Inc. Rise of Culinology With most consumers growing up on eating out, food quality expectations and experiences are high The research chef has joined with the food scientist to create the culinary linkage between the supermarket, foodservice and food processing industries called Culinology Consumer and foodservice operator demand for nutritionally improved, convenient to prepare foods with acceptable sensory characteristics has created unique challenges for food scientists and research chefs. Prepared foods must replicate scratch-made quality in flavor, aroma and authenticity J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Food Movements Organic foods “Free range” meats/poultry Artisan foods Vegetarian Slow foods “Locally grown” Pedigreed/heirloom foods J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Next Big Food Wave--Pan-Asian Consumers seeking more variety and new tastes Bigger and more diverse than Latin Beyond food to the importation of culture Asian foods deliver against many consumer food demands Healthy Craftsmanship from complex recipes Exotic Fresh perceptions J. M. Degen & Company, Inc. Retail & Foodservice Opportunities The “G” word replaces the “C” word Low-carb trend (always a U.S. phenomenon) fades (Mintel) Other parts of the world look to low glycemic Reduces food intake decisions to a number Can be difficult to understand but can be simplified for consumers J. M. Degen & Company, Inc. International Food Labelling Program Registered trademark in Australia/USA/UK Foods must be GI tested by accredited laboratory Must meet nutritional criteria (eg saturated fat, salt) J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Recap Less money spent on food Price motivation to purchase on deal and at non-traditional channels Food prepared away from home including foodservice and “restaurant quality” prepared foods Diminishing consumer cooking skills and limited time to cook More snacking and smaller portions Foods that travel including dashboard dining and “Desk-fast” J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Recap (Continued) Weight control foods including the trend towards glycemic testing/labeling, nutrientdense foods, etc. Food as medication including Pharmafoods directed at heart health, quality of life improvement, pre/probiotics, etc. Shift from Western European cuisine to ethnic alternatives including Pan-Asian Rise of Culinology Demand for “fresh” ingredients that implies healthy J. M. Degen & Company, Inc. Retail & Foodservice Opportunities SUPER TRENDS Cleaner labels Fewer ingredients Recognized ingredients Natural and organic ingredients Nutritional label claims Natural label claims Big Flavor Higher consumer expectations Ethnic flavors including regional ethnic flavors, Latin, Asian New flavors and flavor combinations J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Meeting the challenges of clean labels and big flavor, naturally Multi-functional commodities Fewer processed food ingredients Nutritional and functional improvements Flavor enhancement capabilities Flavor contributions Multiple ingredient forms J. M. Degen & Company, Inc. Retail & Foodservice Opportunities Dried Plums Composition Fiber Sorbitol Malic Acid No Sucrose Low Glycemic Index Antioxidants J. M. Degen & Company, Inc. Benefit Fat replacement Sugar replacement Antimicrobial agent Flavor enhancement Preservation Natural color Extend shelf life Retail & Foodservice Opportunities Mushrooms Composition Low calories Glutamate Fat-free Sodium-free Sugar-free Selenium Low Carbohydrates J. M. Degen & Company, Inc. Benefits Consumer satiety Flavor enhancement Savory flavor Meat replacer/vegetar ian Increased value perceptions Retail & Foodservice Opportunities Almonds Composition High protein Low carbohydrates Glutamate Fiber Vitamin E Low in unsaturated fat J. M. Degen & Company, Inc. Benefits Consumer satiety Flavor enhancement Nutrient dense Crunchy texture Baked breading alternative Protein replacer Increased value perceptions Retail & Foodservice Opportunities Dried Plums, Mushrooms, Almonds demonstrate multi-functional ingredient benefits Fresh perceptions Replace artificial ingredients Add nutritional improvements Eliminate duplicated ingredients Increase and enhance flavor and texture characteristics Communicate favorable consumer perceptions J. M. Degen & Company, Inc. Final Words of Wisdom "As you discover changing times you must have the strength to endure. As you discover a changing world you can't be guessing, you must be for sure. In these ever changing times.” Earth, Wind & Fire J. M. Degen & Company, Inc. Future Retail & Foodservice Opportunities James Degen J. M. Degen & Company, Inc. www.Degenconsulting.com 805-434-2400