The Men Who Built America (summary)

advertisement

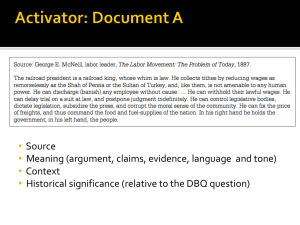

The Men Who Built America A new HISTORY series profiles the men whose imagination, daring, foresight-and some shenanigans--made the United States the economic power it is today. The Men Who Built America POSTED BY: Kim Gilmore September 04, 2012 3 All eyes were on the elephant as it ambled across the St. Louis Bridge. The longest arch bridge in the world at the time, it stretched gracefully across the Mississippi River. The pageantry that accompanied the completion of the spectacular structure was matched with an equal amount of anxiety. Careers and reputations, not to mention lives, were on the line through the construction process. Over budget and months past its deadline, the bridge was among the most massive American construction projects to date. When it officially opened in 1874, less than a decade after the end of the Civil War, the bridge was important both practically and symbolically. The success of such projects could show that the United States was back, and open for business. The man who provided the steel for the bridge, Andrew Carnegie, was a rising industrialist. His reputation seemed like it might rise or fall on the outcome of the project. With so many people skeptical of such a massive bridge, the “test elephant” was sent across to bring peace of mind to the American public that its structure was sound. The elephant survived the test—and so, too, did Carnegie. He would go on to become one of the nation’s foremost business tycoons, having transformed himself from a young Scottish immigrant to a corporate leader and philanthropist whose name still echoes prominently throughout American society today. At the end of the Civil War the nation was in tatters, both financially and psychologically. Both North and South had poured resources into the war effort, draining the economy, not to mention the optimistic spirit, of the nation. The assassination of President Abraham Lincoln in April 1865, just days after the end of the war, dealt another blow to the American psyche. The nation mourned too many of its sons, and now, its president. Given this state of affairs, some would have predicted a deep national decline would follow. How, then, in the course of just a few decades after the war, did the United States become one of the world’s leading economic and political superpowers? The Men Who Built America, a new series premiering on HISTORY in October, captures the astonishing growth of the United States in the wake of the Civil War, attributing this amazing industrial and national expansion to the prowess and grit of a handful of men: Vanderbilt, Carnegie, Rockefeller, Morgan, Frick, and Ford. Their names resonate throughout our society today, a testimony to the power and reach of the companies they built. Now, for the first time, viewers can see how exactly these men forged a nation from the ashes of Civil War, buoyed by their own determination to compete, take chances, and consolidate power. While their individual stories have been told many times over, this series explores the deep connections between these men, showing the behind-the-scenes deals and unexpected links that united— and, at times, divided—them in their thirst for success. The story starts in the immediate aftermath of the Civil War. Cornelius “Commodore” Vanderbilt, who already had amassed a fortune through his Shipping and transportation businesses by the mid-1840s, was determined to continue to grow his wealth and connect the nation through expansion of the Railroads. He had slowly been buying up small railroad systems in the 1860s. By 1870, he had consolidated the New York and Hudson River Railroads, creating one of the nation’s largest corporations. Vanderbilt’s control of the railroad industry was not without conflict. In fact, it was a powerful example of the ruthlessness of competition among American industrial leaders. Vanderbilt’s might was matched by oil tycoon John D. Rockefeller. Born in 1839, the much-younger Rockefeller had built an enormously successful oil business by the 1860s. As it became clear that their business interests were connected, Vanderbilt tried to play hardball with Rockefeller by charging steep prices to ship oil on his trains. Rockefeller famously took a trip to New York to see Vanderbilt in person. He boldly demanded that Vanderbilt keep rates reasonable or lose his valuable business, among other imperatives. The two struck a deal, paving the way for both companies to flourish. In 1870, Rockefeller formed what would become one of the nation’s most prosperous corporations, the Standard Oil Company. The intense competition to control the railroad industry took a bitter turn when Vanderbilt tried to buy up shares of the Erie Railway Company after a disagreement with the company’s treasurer, Daniel Drew. Vanderbilt was incensed to learn that two Erie board members, Jay Gould and James Fisk, had undercut his plans by issuing “watered stock.” The extra stock was forbidden by state laws that put limits on the amount of stock a company could issue. Vanderbilt sued, eventually winning this railroad war. But the incident was a portent of things to come. The drive to achieve dominance in American industry would be marked by wild competition and experimentation in a rapidly changing economy. The Men Who Built America shows the interlocking ties between the nation’s industries. While Vanderbilt and Rockefeller had focused on transportation and oil, Andrew Carnegie (below) set his sights on building American infrastructure through steel. A Scottish immigrant whose family had settled in Allegheny, Penn., in the 1840s, Carnegie landed under the wing of Tom Scott, the superintendent of the Pennsylvania Railroad Company. Carnegie rose rapidly through the ranks and started investing in companies ranging from the Keystone Bridge Company to the Union Iron Mills. Carnegie, like other American industrialists, had quickly learned how to grow capital through investment. By the early 1870s, Carnegie was focused on steel. Although he was not the first steel pioneer, Carnegie was the first to introduce the Bessemer steelmaking process on a large scale in the United States. This process was the critical building block in the mass production of steel, making it possible to create structures on a grand scale. Carnegie also introduced the open-hearth furnace into his mills in the 1890s, making it easier to melt mass amounts of steel. What Carnegie and other industrial leaders shared was an unceasing drive for success. Throughout the series, viewers hear from contemporary business leaders like Jack Welch, Donald Trump, Mark Cuban, Steve Wynn, and Russell Simmons. These modern-day corporate pioneers and philanthropists shed light on how their counterparts from an earlier era were able to achieve so much in a relatively short period of time. As Steve Wynn, chairman and CEO of Wynn Resorts, says, “These were very determined, high-strung focused men who had the capacity to be brutal competitors, swash-buckling entrepreneurs, and then turn around and be soft as butter, as generous as you can imagine anyone being.” Despite the efforts of men like Carnegie and Rockefeller to blaze ahead with little restraint, there were always factors that were out of their control. Their operations required the blood and sweat of countless workers who frequently refused to abide by the stark conditions of their workplaces. Just as corporations were growing, so were labor unions. Carnegie was confronted with the power of organized workers during the infamous strike at his Homestead Steel Works plant in 1892. He had recently consolidated his steel operations into the Carnegie Steel Company, appointing Henry Clay Frick as chairman. The striking workers were locked out of the Homestead plant after the company rebuffed their efforts to negotiate; they attempted to take control of the mill and prevent “scab” (non-union) workers from entering. In response, Frick hired hundreds of private detectives from the Pinkerton Detective Agency to forcibly re- open the plant. A violent clash ensued, leaving nine workers and seven detectives dead, and many more wounded. Eventually, the state militia had to be called in to quell the strike, as thousands of local citizens had arrived at the plant to support the workers. Carnegie Steel won out over the demands of the union, but the episode demonstrated the stark reality that corporations would not simply be able to will their workers into accepting unilaterally imposed wages and working conditions. Carnegie had placed his trust in Frick even after the Johnstown Flood of 1889. The catastrophic flood in the town of Johnstown, Penn., was the result of the failure of the South Fork Dam. More than 2,200 people were killed when the dam let loose an enormous surge of water through the area. Frick was considered to be partly responsible for the flood because of his role in having the dam modified to suit the needs of a private resort he and a group of speculators had built in the area. The flood was one of the worst disasters in American history, and it was the first time the American Red Cross, led by Clara Barton, oversaw a relief effort. The flood was deemed to be an “act of God,” and Frick and his colleagues were let off the hook, but the lawsuits against the resort owners by flood victims would help shape the future of state law from a purely fault-based system to one that focused on liability. In addition to challenges presented by workers, the American economy was also subject to instability in the midst of rapid expansion. One of the most severe depressions in U.S. history, known as the Panic of 1893, emerged as the result of unstable railroad financing and bank failures. A financier named John Pierpont (J.P.) Morgan, son of banker Junius Morgan, was ready to take his place on the national stage. J.P. Morgan helped restore the U.S. government’s gold reserves in exchange for a 30-year bond deal, helping alleviate the economic chaos unleashed by the 1893 depression. Morgan, of course, went on to become one of the titans of American banking and finance. One of the fascinating angles explored in The Men Who Built America is the cases in which American business titans chose unity over division, working together to expand their enterprises. In the aftermath of the Homestead Strike, Carnegie had put a young engineer who had been a plant superintendent in charge of repairing relationships between workers and managers at Homestead. Charles Schwab excelled at the position, and Carnegie promoted him to president of the Carnegie Steel Company in 1897 at the age of 35. Just a few years later, in 1901, Schwab and J.P. Morgan united to form the United States Steel Corporation, otherwise known as U.S. Steel. Morgan had diversified his investments, which included an increasing number of railroad companies. He also was a significant financial backer of Thomas Edison’s experiments with the light bulb. Though the public was skeptical of the safety of electricity, Morgan’s backing helped fund Edison’s efforts to make electric lights a mainstay in American households. Edison was an active promoter of the safety and utility of electricity. In 1884, he organized an “Electric Torch Light Procession” in which hundreds of his employees at the Edison Electric Lighting Company marched through New York City with light bulbs on their foreheads; the lights were connected by wires up the marchers’ shirtsleeves and powered by a horse-drawn generator. Morgan’s decision to back Edison ended up being a complicated gamble. Edison promoted the use of the direct current (DC) electric standard while Nikola Tesla and other engineers vowed that they had a better method in the alternating current (AC) standard. Edison fiercely challenged Tesla’s method, charging AC power was inefficient and unsafe. In 1903, Edison conducted an infamous and controversial experiment in which he electrocuted a circus elephant using AC power to prove that it was dangerous. Despite Edison’s fierce campaign, Tesla, together with George Westinghouse, won a bid to build the largest electric generator ever built in Niagara Falls, N.Y. Although he had miscalculated in his support for Edison, Morgan quickly cut him loose and went on to form General Electric, which adopted the AC standard. As the 19th century was drawing to a close, the captains of industry continued to grow and consolidate their companies. In the 1896 presidential election, they had heavily backed pro-business candidate William McKinley, hoping he would protect their interests. And although the Sherman Antitrust Act of 1890 established limits on corporate monopolies, it was not actively used against corporations in the years after it was passed. Things took a shocking turn, however, when McKinley was assassinated in September 1901 and Vice President Theodore Roosevelt was sworn into office. Roosevelt, who had placed curbs on corporate power while governor of New York, would go on to push for limitations on monopolies, gaining a reputation as a “trust buster.” Roosevelt’s clampdown powerfully culminated in the 1904 U.S. Supreme Court ruling in Northern Securities Co. v. United States. The Northern Securities Company, which had been formed by Rockefeller, Morgan, E.H. Harriman, James J. Hill, and others, was a railroad trust and holding company that controlled several of the major railways. The Supreme Court decision ruled the trust unfairly eliminated competition and the company was broken up. In the years after the Northern Securities case, dozens of other lawsuits were filed against big corporations, many of which resulted in the break-up of trusts and conglomerates. Still, corporations flourished, finding new markets in the 20th century as mass production and consumer spending continued to grow. Henry Ford’s experiments with mass production of cars and assembly line techniques resulted in the creation of the Model T in 1908. Within a few decades, the car was at the center of American culture, giving more and more people mobility. This mobility, in turn, helped stimulate demand for goods and services. In this way, the infrastructure jump-started by Carnegie, Rockefeller, Vanderbilt, and others paved the way for the consumer culture that would thrive in the 20th century. The Men Who Built America tells many little-known stories about the collaborations, rivalries, and late-night negotiations between these iconic American business leaders, many of whom also became the nation’s foremost philanthropists. Examining the lives and legacies of these leaders helps us better understand the world they inherited in the 19th century, and the one they left behind in the 20th. Kim Gilmore is a staff historian and director of corporate outreach for HISTORY®/A+E Networks. Henry Ford's Better Idea Maximizing efficiency was his real contribution to the American workplace. POSTED September 04, 2012 BY: Scott Parkhurst 2 Modern Americans know Henry Ford as the man behind Ford Motor Company, and most would probably credit him with the invention of the modern assembly line. Ford’s contribution to (and effect upon) American manufacturing in general is much more grand and goes beyond the mechanics of assembly. His vision, and the manner in which he approached achieving it, is truly his legacy. Like most new technologies, automobiles were initially built and sold as dalliances or even appliances for the wealthy. Today, we recognize how so-called early adopters pay more to be the first to have the latest high-tech gadgetry. Things weren’t so different 100 years ago when “horseless carriages” first appeared. However, Ford’s entire approach, from the company’s method of manufacture to the eventual reductions in the price of his products, was part of an overall effort to sell to the masses. Ford recognized that the ability to sell great quantities would multiply the profits they were capable of generating. His constant quest for manufacturing efficiency would also contribute directly to the bottom line, and this driven desire would rival his engineering acumen. One of the better-known examples of this does not even relate to the assembly-line process as we know it, but rather to Ford’s interest in the materials of which his vehicles were made. Naturally, Ford relied upon subcontractors to supply some of the components used in his new cars. As part of their contractual agreement, Ford specified the dimensions and even the type of wood to be used in the crates in which these parts were to be shipped. Once the crates arrived at the assembly plant, Ford forbade the use of crowbars to open them. Rather, he insisted they be carefully disassembled. In those early days of the automobile, wood was a common material used throughout the body, doors, and especially for the running boards. This was particularly evident in the legendary “Woody” station wagons produced from the 1920s through the early 1950s. The wood reclaimed from the shipping crates was reused for this purpose, and in many cases was already sized properly (per Ford’s contracted specifications). Not wanting to waste any wood, what few scrap pieces were left over were then further compressed into usable charcoal “briquettes.” There was a large enough quantity of charcoal being produced that Ford decided to create a business to market it, and thus the Ford Charcoal was born. Today, we know this enterprise as Kingsford Charcoal, named after a Ford relative of who brokered the site selection for Ford’s new charcoal manufacturing plant. That kind of progressive development in the name of efficiency wasn’t limited to what went out the door at the massive Ford Motor Company factories. The way in which raw materials were supplied to the plant also grew into more efficient and streamlined processes over the years. Rather than relying upon outside suppliers for steel to build his vehicles, Ford built his own foundries at which raw ore could be smelted and forged into various components. Furthermore, Ford eventually purchased the iron ore mines and the ships used to transport the raw materials to the factory. In this way, Ford could absolutely minimize prices and maximize quality, resulting in an unprecedented level of manufacturing excellence on a scale never before seen, worldwide. Interestingly, and importantly, Ford chose not to simply line his own pockets with the ever-growing profits of his visionary leadership. Rather, he invested heavily in the growth of his own company and his own workforce, while simultaneously lowering the prices on many of the vehicles being produced. In 1909, a new Model T Touring car (the most popular model) could be had for $850. This was reduced to $490 in 1914, and by 1925 the price had been slashed to $290. Making the cars more affordable had a positive impact on sales, resulting in a significant jump in the quantity of vehicles sold. With regard to the workforce, we must understand the challenges Ford was facing to fully comprehend the impact of his investment in this vital area. In the early part of the 20th century, a great percentage of the workforce consisted of unskilled immigrants. The typical solution was to break down assembly-line tasks into simple steps, and offer very low pay to several employees to accomplish each of them. The predictable result was that the workers would quickly grow bored of the mindless, repetitive tasks. Many workers would quit, and in 1913 it took the hiring of 963 employees for every 100 positions Ford needed to keep the assembly line working. Considering there were 13,600 employees in the plant at the time, the scope of the issue becomes apparent. Ford’s solution was multifaceted. A broad array of benefits was created, including incentive bonuses, a medical clinic, and athletic fields and playgrounds for the workers’ families. Still, the challenge of retention persisted, and Ford’s next step was a huge one. On Jan. 5, 1914, Ford announced all employees would receive a minimum of $5 pay for eight hours of work. This was more than double the previous $2.38 offered for a nine-hour shift, and was such a dramatic increase that it attracted workers from all over the nation. The tremendous response not only solved the retention issue, but profits increased as well. Between 1914 and 1916, the company’s profits doubled from $30 million to $60 million. The higher pay rate crossed another threshold, as workers could now afford the new Ford vehicles they manufactured, and many did. Henry Ford’s contributions to American manufacturing were great, but beyond the obvious mechanics of the mass production assembly line, his visionary approach to maximum efficiency in all areas was just as important. Through a constantly evolving process of improvement, Ford set new standards for manufacturing that still reverberate today. Scott Parkhurst, a freelance writer from Belle Plaine, Minn., specializes in automotive issues. Andrew Carnegie Scottish-born Andrew Carnegie (1835-1919) was an American industrialist who amassed a fortune in the steel industry then became a major philanthropist. Carnegie worked in a Pittsburgh cotton factory as a boy before rising to the position of division superintendent of the Pennsylvania Railroad in 1859. While working for the railroad, he invested in various ventures, including iron and oil companies, and made his first fortune by the time he was in his early 30s. In the early 1870s, he entered the steel business, and over the next two decades became a dominant force in the industry. In 1901, he sold the Carnegie Steel Company to banker John Pierpont Morgan for $480 million. Carnegie then devoted himself to philanthropy, eventually giving away more than $350 million. Contents Andrew Carnegie: Early Life and Career Andrew Carnegie: Steel Magnate Andrew Carnegie: Philanthropist Andrew Carnegie: Family and Final Years Andrew Carnegie: Early Life and Career Andrew Carnegie, whose life became a rags-to-riches story, was born into modest circumstances on November 25, 1835, in Dunfermline, Scotland, the second of two sons of Will, a handloom weaver, and Margaret, who did sewing work for local shoemakers. In 1848, the Carnegie family (who pronounced their name “carNEgie”) moved to America in search of better economic opportunities and settled in Allegheny City (now part of Pittsburgh), Pennsylvania. Andrew Carnegie, whose formal education ended when he left Scotland, where he had no more than a few years’ schooling, soon found employment as a bobbin boy at a cotton factory, earning $1.20 a week. Ambitious and hard-working, he went on to hold a series of jobs, including messenger in a telegraph office and secretary and telegraph operator for the superintendent of the Pittsburgh division of the Pennsylvania Railroad. In 1859, Carnegie succeeded his boss as railroad division superintendent. While in this position, he made profitable investments in a variety of businesses, including coal, iron and oil companies and a manufacturer of railroad sleeping cars. After leaving his post with the railroad in 1865, Carnegie continued his ascent in the business world. With the U.S. railroad industry then entering a period of rapid growth, he expanded his railroad-related investments and founded such ventures as an iron bridge building company and a telegraph firm, often using his connections to win insider contracts. By the time he was in his early 30s, Carnegie had become a very wealthy man. Andrew Carnegie: Steel Magnate In the early 1870s, Carnegie co-founded his first steel company, near Pittsburgh. Over the next few decades, he created a steel empire, maximizing profits and minimizing inefficiencies through ownership of factories, raw materials and transportation infrastructure involved in steel-making. In 1892, his primary holdings were consolidated to form Carnegie Steel Company. The steel magnate considered himself a champion of the working man; however, his reputation was marred by a violent labor strike in 1892 at his Homestead, Pennsylvania, steel mill. After union workers protested wage cuts, Carnegie Steel general manager Henry Clay Frick (1848-1919), who was determined to break the union, locked the workers out of the plant. Andrew Carnegie was on vacation in Scotland during the strike, but put his support in Frick, who called in some 300 Pinkerton armed guards to protect the plant. A bloody battle broke out between the striking workers and the Pinkertons, leaving at least 10 men dead. The state militia then was brought in to take control of the town, union leaders were arrested and Frick hired replacement workers for the plant. After five months, the strike ended with the union’s defeat. Additionally, the labor movement at Pittsburgh-area steel mills was crippled for the next four decades. In 1901, banker John Pierpont Morgan (1837-1913) purchased Carnegie Steel for some $480 million, making Andrew Carnegie one of the world’s richest men. That same year, Morgan merged Carnegie Steel with a group of other steel businesses to form U.S. Steel, the world’s first billion-dollar corporation Andrew Carnegie: Philanthropist After Carnegie sold his steel company, the diminutive titan, who stood 5’3”, retired from business and devoted himself full-time to philanthropy. In 1889, he had penned an essay, “The Gospel of Wealth,” in which he stated that the rich have “a moral obligation to distribute [their money] in ways that promote the welfare and happiness of the common man.” Carnegie also said that “The man who dies thus rich dies disgraced.” Carnegie eventually gave away some $350 million (the equivalent of billions in today’s dollars), which represented the bulk of his wealth. Among his philanthropic activities, he funded the establishment of more than 2,500 public libraries around the globe, donated more than 7,600 organs to churches worldwide and endowed organizations (many still in existence today) dedicated to research in science, education, world peace and other causes. Among his gifts was the $1.1 million required for the land and construction costs of Carnegie Hall, the legendary New York City concert venue that opened in 1891. Andrew Carnegie: Family and Final Years Carnegie’s mother, who was a major influence in his life, lived with him until her death in 1886. The following year, the 51-year-old industrial baron married Louise Whitfield (1857-1946), who was two decades his junior and the daughter of a New York City merchant. The couple had one child, Margaret (1897-1990). The Carnegies lived in a Manhattan mansion and spent summers in Scotland, where they owned Skibo Castle, set on some 28,000 acres. Carnegie died at age 83 on August 11, 1919, at Shadowbrook, his estate in Lenox, Massachusetts. He was buried at Sleepy Hollow Cemetery in North Tarrytown, New York. Industrial Revolution Starting in Britain in the 1700s, the Industrial Revolution was a change from an agrarian to an industrialized society. Did You Know? During the U.S. Civil War, Andrew Carnegie was drafted for the Army; however, rather than serve, he paid another man $850 to report for duty in his place, a common practice at the time. Cornelius Vanderbilt Shipping and railroad tycoon Cornelius Vanderbilt (1794-1877) was a self-made multimillionaire who became one of the wealthiest Americans of the 19th century. As a boy, he worked with his father, who operated a boat that ferried cargo between Staten Island, New York, where they lived, and Manhattan. After working as a steamship captain, Vanderbilt went into business for himself in the late 1820s, and eventually became one of the country’s largest steamship operators. In the process, the Commodore, as he was publicly nicknamed, gained a reputation for being fiercely competitive and ruthless. In the 1860s, he shifted his focus to the railroad industry, where he built another empire and helped make railroad transportation more efficient. When Vanderbilt died, he was worth more than $100 million Contents Cornelius Vanderbilt: Early Years Cornelius Vanderbilt: Steamships Cornelius Vanderbilt: Railroads Cornelius Vanderbilt: Final Years Cornelius Vanderbilt: Early Years A descendant of Dutch settlers who came to America in the mid-1600s, Cornelius Vanderbilt was born into humble circumstances on May 27, 1794, on Staten Island, New York. His parents were farmers and his father also made money by ferrying produce and merchandise between Staten Island and Manhattan in his two-masted sailing vessel, known as a periauger. As a boy, the younger Vanderbilt worked with his father on the water and attended school briefly. When Vanderbilt was a teen he transported cargo around the New York harbor in his own periauger. Eventually, he acquired a fleet of small boats and learned about ship design. In 1813, Vanderbilt married his cousin Sophia Johnson, and the couple eventually had 13 children. (A year after his first wife died in 1868, Vanderbilt married another female cousin, Frank Armstrong Crawford, who was more than four decades his junior.) Cornelius Vanderbilt: Steamships In 1817, Vanderbilt went to work as a ferry captain for a wealthy businessman who owned a commercial steamboat service that operated between New Jersey and New York. The job provided Vanderbilt the opportunity to learn about the burgeoning steamship industry. In the late 1820s, he went into business on his own, building steamships and operating ferry lines around the New York region. Shrewd and aggressive, he became a dominant force in the industry by engaging in fierce fare wars with his rivals. In some cases, his competitors paid him hefty sums not to compete with them. (Throughout his life, Vanderbilt’s ruthless approach to business would earn him numerous enemies.) In the 1840s, Vanderbilt constructed a large brick home for his family at 10 Washington Place, in Manhattan’s present-day Greenwich Village neighborhood. Despite his growing wealth, the city’s elite residents were slow to accept Vanderbilt, considering him rough and uncultured. In the early 1850s, during the California Gold Rush, a time before transcontinental railroads, Vanderbilt launched a steamship service that transported prospectors from New York to San Francisco via a route across Nicaragua. His route was faster than an established route across Panama, and much speedier than the other alternative, around Cape Horn at the southern tip of South America, which could take months. Vanderbilt’s new line was an instant success, earning more than $1 million (about $26 million in today’s money) a year. Cornelius Vanderbilt: Railroads In the 1860s, Vanderbilt shifted his focus from shipping to the railroad industry, which was entering a period of great expansion. He gained control of a number of railway lines operating between Chicago and New York and established an interregional railroad system. According to T.J. Styles, author of “The First Tycoon: The Epic Life of Cornelius Vanderbilt”: “This was a major transformation of the railroad network, which previously had been fragmented into numerous short railroads, each with its own procedures, timetables, and rolling stock. The creation of a coherent system spanning several states lowered costs, increased efficiency, and sped up travel and shipment times.” Vanderbilt was the driving force behind the construction of Manhattan’s Grand Central Depot, which opened in 1871. The station eventually was torn down and replaced by present-day Grand Central Terminal, which opened in 1913. Cornelius Vanderbilt: Final Years Unlike the Gilded Age titans who followed him, such as steel magnate Andrew Carnegie (1835-1919) and oil mogul John Rockefeller (1839-1937), Vanderbilt did not own grand homes or give away much of his vast wealth to charitable causes. In fact, the only substantial philanthropic donation he made was in 1873, toward the end of his life, when he gave $1 million to build and endow Vanderbilt University in Nashville, Tennessee. (In a nod to its founder’s nickname, the school’s athletic teams are called the Commodores.) The Vanderbilt mansions associated with the Gilded Age, including the Breakers in Newport, Rhode Island, and the Biltmore in Asheville, North Carolina, were built by Cornelius Vanderbilt’s descendants. (The 250-room Biltmore estate, constructed in the late 19th century by one of Vanderbilt’s grandsons, is the largest privately owned home in the United States today.) Vanderbilt died at age 82 on January 4, 1877, at his Manhattan home, and was buried in the Moravian Cemetery in New Dorp, Staten Island. He left the bulk of his fortune, estimated at more than $100 million, to his son William (1821-85). John D. Rockefeller John D. Rockefeller (1839-1937), founder of the Standard Oil Company, became one of the world’s wealthiest men and a major philanthropist. Born into modest circumstances in upstate New York, he entered the then-fledgling oil business in 1863 by investing in a Cleveland, Ohio, refinery. In 1870, he established Standard Oil, which by the early 1880s controlled some 90 percent of U.S. refineries and pipelines. Critics accused Rockefeller of engaging in unethical practices, such as predatory pricing and colluding with railroads to eliminate his competitors, in order to gain a monopoly in the industry. In 1911, the U.S. Supreme Court found Standard Oil in violation of anti-trust laws and ordered it to dissolve. During his life Rockefeller donated more than $500 million to various philanthropic causes Contents John D. Rockefeller: Early Years and Family John D. Rockefeller: Standard Oil John D. Rockefeller: Philanthropy and Final Years John D. Rockefeller: Early Years and Family John Davison Rockefeller, the son of a traveling salesman, was born on July 8, 1839, in Richford, New York. Industrious even as a boy, the future oil magnate earned money by raising turkeys, selling candy and doing jobs for neighbors. In 1853, the Rockefeller family moved to the Cleveland, Ohio, area, where John attended high school then briefly studied bookkeeping at a commercial college. In 1855, at age 16, he found work as an office clerk at a Cleveland commission firm that bought, sold and shipped grain, coal and other commodities. (He considered September 26, the day he started the position and entered the business world, so significant that as an adult he commemorated this “job day” with an annual celebration.) In 1859, Rockefeller and a partner established their own commission firm. That same year, America’s first oil well was drilled in Titusville, Pennsylvania. In 1863, Rockefeller and several partners entered the booming new oil industry by investing in a Cleveland refinery. In 1864, Rockefeller married Laura Celestia “Cettie” Spelman (1839-1915), an Ohio native whose father was a prosperous merchant, politician and abolitionist active in the Underground Railroad. (Laura Rockefeller became the namesake of Spelman College, the historically black women’s college in Atlanta, Georgia, that her husband helped finance.) The Rockefellers went on to have four daughters (three of whom survived to adulthood) and one son. John D. Rockefeller: Standard Oil In 1865, Rockefeller borrowed money to buy out some of his partners and take control of the refinery, which had become the largest in Cleveland. Over the next few years, he acquired new partners and expanded his business interests in the growing oil industry. At the time, kerosene, derived from petroleum and used in lamps, was becoming an economic staple. In 1870, Rockefeller formed the Standard Oil Company of Ohio, along with his younger brother William (1841-1922), Henry Flagler (1830-1913) and a group of other men. John Rockefeller was its president and largest shareholder. Standard Oil gained a monopoly in the oil industry by buying rival refineries and developing companies for distributing and marketing its products around the globe. In 1882, these various companies were combined into the Standard Oil Trust, which would control some 90 percent of the nation’s refineries and pipelines. In order to exploit economies of scale, Standard Oil did everything from build its own oil barrels to employ scientists to figure out new uses for petroleum by-products. Rockefeller’s enormous wealth and success made him a target of muckraking journalists, reform politicians and others who viewed him as a symbol of corporate greed and criticized the methods with which he’d built his empire. As The New York Times reported in 1937: “He was accused of crushing out competition, getting rich on rebates from railroads, bribing men to spy on competing companies, of making secret agreements, of coercing rivals to join the Standard Oil Company under threat of being forced out of business, building up enormous fortunes on the ruins of other men, and so on.” In 1890, the U.S. Congress passed the Sherman Antitrust Act, the first federal legislation prohibiting trusts and combinations that restrained trade. Two years later, the Ohio Supreme Court dissolved the Standard Oil Trust; however, the businesses within the trust soon became part of Standard Oil of New Jersey, which functioned as a holding company. In 1911, after years of litigation, the U.S. Supreme Court ruled Standard Oil of New Jersey was in violation of anti-trust laws and forced it to dismantle (it was broken up into more than 30 individual companies). John D. Rockefeller: Philanthropy and Final Years Rockefeller retired from day-to-day business operations of Standard Oil in the mid-1890s. Inspired in part by fellow Gilded Age tycoon Andrew Carnegie (1835-1919), who made a vast fortune in the steel industry then became a philanthropist and gave away the bulk of his money, Rockefeller donated more than half a billion dollars to various educational, religious and scientific causes. Among his activities, he funded the establishment of the University of Chicago and the Rockefeller Institute for Medical Research (now Rockefeller University). In his personal life, Rockefeller was devoutly religious, a temperance advocate and an avid golfer. His goal was to reach the age of 100; however, he died at 97 on May 23, 1937, at The Casements, his winter home in Ormond Beach, Florida. (Rockefeller owned multiple residences, including a home in New York City, an estate in Lakewood, New Jersey, and an estate called Kykuit, old Dutch for “lookout,” set on 3,000 acres near Tarrytown, New York.) He was buried at Lake View Cemetery in Cleveland. J.P. Morgan One of the most powerful bankers of his era, J.P. (John Pierpont) Morgan (1837-1913) financed railroads and helped organize U.S. Steel, General Electric and other major corporations. The Connecticut native followed his wealthy father into the banking business in the late 1850s, and in 1871 formed a partnership with Philadelphia banker Anthony Drexel. In 1895, their firm was reorganized as J.P. Morgan & Company, a predecessor of the modern-day financial giant JPMorgan Chase. Morgan used his influence to help stabilize American financial markets during several economic crises, including the panic of 1907. However, he faced criticism that he had too much power and was accused of manipulating the nation’s financial system for his own gain. The Gilded Age titan spent a significant portion of his wealth amassing a vast art collection Contents J.P. Morgan: Early Years and Family J.P. Morgan: Banking Titan J.P. Morgan: Congressional Investigation J.P. Morgan: Art Collection and Final Years J.P. Morgan: Early Years and Family John Pierpont Morgan was born into a distinguished New England family on April 17, 1837, in Hartford, Connecticut. One of his maternal relatives, James Pierpont (1659-1714), was a founder of Yale University; his paternal grandfather was a founder of the Aetna Insurance Company; and his father, Junius Spencer Morgan (1813-90), ran a successful Hartford dry-goods company before becoming a partner in a London-based merchant banking firm. After graduating from high school in Boston in 1854, Pierpont, as he was known, studied in Europe, where he learned French and German, then returned to New York in 1857 to begin his finance career. In 1861, Morgan married Amelia Sturges, the daughter of a wealthy New York businessman. Amelia Morgan died of tuberculosis four months after the couple’s wedding. In 1865, Morgan married Frances Louisa Tracy (1842-1924), the daughter of a New York lawyer, and the pair eventually had four children. J.P. Morgan: Banking Titan In 1864, Morgan became a partner in the firm of Dabney, Morgan & Company, which served as the New York representative of Junius Morgan’s London banking firm, J.S. Morgan & Company. In 1871, the younger Morgan partnered with prominent Philadelphia banker Anthony Drexel (1826-93) to form Drexel, Morgan & Company. In 1895, two years after Anthony Drexel’s death, the business was renamed J.P. Morgan & Company. During the late 19th century, a period when the U.S. railroad industry experienced rapid overexpansion and heated competition (the nation’s first transcontinental rail line was completed in 1869), Morgan was heavily involved in reorganizing and consolidating a number of financially troubled railroads. In the process, he gained control of significant portions of these railroads’ stock and eventually controlled an estimated one-sixth of America’s rail lines. By the start of the 20th century, Morgan’s focus had shifted from railroads to other industries. In 1901, he bought the Carnegie Steel Company from Andrew Carnegie (1835-1919) for some $480 million then merged it with a group of other steel companies to create U.S. Steel, the world’s first billion-dollar corporation. Morgan also helped engineer the deals that established General Electric, International Harvester, American Telephone & Telegraph and other industrial giants. In 1902, he was instrumental in the formation of International Mercantile Marine (IMM), a conglomeration of transatlantic shipping companies. A decade later, the Titanic, owned by one of the IMM companies, White Star, sank on its maiden voyage after hitting an iceberg. Morgan, who attended the ship’s christening in 1911, was booked on the ill-fated April 1912 voyage but had to cancel. J.P. Morgan: Congressional Investigation During Morgan’s era, the United States had no central bank so he used his influence to help save the nation from disaster during several economic crises. In 1895, Morgan assisted in rescuing America’s gold standard when he headed a banking syndicate that loaned the federal government more than $60 million. In another instance, the financial panic of 1907, Morgan held a meeting of the country’s top financiers at his New York City home and convinced them to bail out various faltering financial institutions in order to stabilize the markets. Morgan initially was widely commended for leading Wall Street out of the 1907 financial crisis; however, in the ensuing years the portly banker with the handlebar mustache and gruff manner faced increasing criticism from muckraking journalists, progressive politicians and others that he had too much power and could manipulate the financial system for his own gain. In 1912, Morgan was called to testify before a congressional committee chaired by U.S. Representative Arsene Pujo (1861-1939) of Louisiana that was investigating the existence of a “money trust,” a small cabal of elite Wall Street financiers, including Morgan, who allegedly colluded to control American banking and industry. The Pujo Committee hearings helped bring about the creation of the Federal Reserve System in December 1913 and spurred passage of the Clayton Antitrust Act of 1914. J.P. Morgan: Art Collection and Final Years Morgan funneled a substantial portion of his wealth into his vast art collection. He began amassing the collection in earnest in the 1890s, and by the time of his death had spent an estimated $60 million on art (the equivalent of around $900 million in present-day dollars), according to the Morgan Library & Museum in New York City, which today houses his collection of rare manuscripts. In addition to art, Morgan owned a series of large yachts, all named Corsair. (During the Spanish-American War of 1898, the U.S. Navy conscripted the Corsair II for use as a gunboat.) The famous financier died at age 75 on March 31, 1913, in Rome, Italy. On April 14, the day of his funeral, the New York Stock Exchange closed in his honor until noon. He was buried in the Morgan family mausoleum at a Hartford cemetery. Did You Know? "Jingle Bells" was written by James L. Pierpont, the uncle of famed financier J.P. Morgan. The song, originally titled "The One Horse Open Sleigh," was actually written about Thanksgiving, and was considered a failure when first published in 1857 Henry Ford While working as an engineer for the Edison Illuminating Company in Detroit, Henry Ford (1863-1947) built his first gasoline-powered horseless carriage, the Quadricycle, in the shed behind his home. In 1903, he established the Ford Motor Company, and five years later the company rolled out the first Model T. In order to meet overwhelming demand for the revolutionary vehicle, Ford introduced revolutionary new mass-production methods, including large production plants, the use of standardized, interchangeable parts and, in 1913, the world's first moving assembly line for cars. Enormously influential in the industrial world, Ford was also outspoken in the political realm. Ford drew controversy for his pacifist stance during the early years of World War I and earned widespread criticism for his anti-Semitic views and writings. Contents Henry Ford: Early Life & Engineering Career Henry Ford: Birth of Ford Motor Company and the Model T Henry Ford: Production & Labor Innovations Henry Ford: Later Career & Controversial Views Henry Ford: Early Life & Engineering Career Born in 1863, Henry Ford was the first surviving son of William and Mary Ford, who owned a prosperous farm in Dearborn, Michigan. At 16, he left home for the nearby city of Detroit, where he found apprentice work as a machinist. He returned to Dearborn and work on the family farm after three years, but continued to operate and service steam engines and work occasional stints in Detroit factories. In 1888, he married Clara Bryant, who had grown up on a nearby farm. In the first several years of their marriage, Ford supported himself and his new wife by running a sawmill. In 1891, he returned with Clara to Detroit, where he was hired as an engineer for the Edison Illuminating Company. Rising quickly through the ranks, he was promoted to chief engineer two years later. Around the same time, Clara gave birth to the couple's only son, Edsel Bryant Ford. On call 24 hours a day for his job at Edison, Ford spent his irregular hours on his efforts to build a gasoline-powered horseless carriage, or automobile. In 1896, he completed what he called the "Quadricycle," which consisted of a light metal frame fitted with four bicycle wheels and powered by a two-cylinder, four-horsepower gasoline engine. Henry Ford: Birth of Ford Motor Company and the Model T Determined to improve upon his prototype, Ford sold the Quadricycle in order to continue building other vehicles. He received backing from various investors over the next seven years, some of whom formed the Detroit Automobile Company (later the Henry Ford Company) in 1899. His partners, eager to put a passenger car on the market, grew frustrated with Ford's constant need to improve, and Ford left his namesake company in 1902. (After his departure, it was reorganized as the Cadillac Motor Car Company.) The following year, Ford established the Ford Motor Company. A month after the Ford Motor Company was established, the first Ford car—the two-cylinder, eight-horsepower Model A—was assembled at a plant on Mack Avenue in Detroit. At the time, only a few cars were assembled per day, and groups of two or three workers built them by hand from parts that were ordered from other companies. Ford was dedicated to the production of an efficient and reliable automobile that would be affordable for everyone; the result was the Model T, which made its debut in October 1908. Henry Ford: Production & Labor Innovations The "Tin Lizzie," as the Model T was known, was an immediate success, and Ford soon had more orders than the company could satisfy. As a result, he put into practice techniques of mass production that would revolutionize American industry, including the use of large production plants; standardized, interchangeable parts; and the moving assembly line. Mass production significantly cut down on the time required to produce an automobile, which allowed costs to stay low. In 1914, Ford also increased the daily wage for an eight-hour day for his workers to $5 (up from $2.34 for nine hours), setting a standard for the industry. Even as production went up, demand for the Tin Lizzie remained high, and by 1918, half of all cars in America were Model Ts. In 1919, Ford named his son Edsel as president of Ford Motor Company, but he retained full control of the company's operations. After a court battle with his stockholders, led by brothers Horace and John Dodge, Henry Ford bought out all minority stockholders by 1920. In 1927, Ford moved production to a massive industrial complex he had built along the banks of the River Rouge in Dearborn, Michigan. The plant included a glass factory, steel mill, assembly line and all other necessary components of automotive production. That same year, Ford ceased production of the Model T, and introduced the new Model A, which featured better horsepower and brakes, among other improvements. By that time, the company had produced some 15 million Model Ts, and Ford Motor Company was the largest automotive manufacturer in the world. Ford opened plants and operations throughout the world. Henry Ford: Later Career & Controversial Views The Model A proved to be a relative disappointment, and was outsold by both Chevrolet (made by General Motors) and Plymouth (made by Chrysler); it was discontinued in 1931. In 1932, Ford introduced the first V-8 engine, but by 1936 the company had dropped to number three in sales in the automotive industry. Despite his progressive policies regarding the minimum wage, Ford waged a long battle against unionization of labor, refusing to come to terms with the United Automobile Workers (UAW) even after his competitors did so. In 1937, Ford security staff clashed with UAW organizers in the so-called "Battle of the Overpass," at the Rouge plant, after which the National Labor Relations Board ordered Ford to stop interfering with union organization. Ford Motor Company signed its first contract with UAW in 1941, but not before Henry Ford considered shutting down the company to avoid it. Ford's political views earned him widespread criticism over the years, beginning with his campaign against U.S. involvement in World War I. He made a failed bid for a U.S. Senate seat in 1918, narrowly losing in a campaign marked by personal attacks from his opponent. In the Dearborn Independent, a local newspaper he bought in 1918, Ford published a number of anti-Semitic writings that were collected and published as a four volume set called The International Jew. Though he later renounced the writings and sold the paper, he expressed admiration for Adolf Hitler and Germany, and in 1938 accepted the Grand Cross of the German Eagle, the Nazi regime's highest medal for a foreigner. Edsel Ford died in 1943, and Henry Ford returned to the presidency of Ford Motor Company briefly before handing it over to his grandson, Henry Ford II, in 1945. He died two years later at his Dearborn home, at the age of 83. Did You Know? The mass production techniques Henry Ford championed eventually allowed Ford Motor Company to turn out one Model T every 24 seconds Recommended Articles under Cornelius Vanderbilt Andrew Carnegie Scottish-born Andrew Carnegie (1835-1919) was an American industrialist who amassed a fortune in the steel industry then became a major philanthropist. Transcontinental Railroad In 1869 the Central Pacific and Union Pacific Railroads were joined at Promontory, Utah, completing the transcontinental railroad. Industrial Revolution Starting in Britain in the 1700s, the Industrial Revolution was a change from an agrarian to an industrialized society Recommended Articles under Andrew Carnegie J.P. Morgan J.P. Morgan (1837-1913) was a powerful American banker who financed railroads and helped organize U.S. Steel and other major corporations. Cornelius Vanderbilt Shipping and railroad tycoon Cornelius Vanderbilt (1794-1877) was one of the wealthiest Americans of the 19th century. Industrial Revolution Starting in Britain in the 1700s, the Industrial Revolution was a change from an agrarian to an industrialized society Recommended Articles under John D. Rockefeller Henry Ford Engineer, automaker and industrialist Henry Ford introduced the first affordable passenger automobile, the Model T, and pioneered assembly-line production. Recommended Articles under J.P. Morgan John D. Rockefeller John D. Rockefeller (1839-1937), founder of the Standard Oil Company, became one of the world's wealthiest men and a major philanthropist. Thomas Alva Edison Thomas Edison (1847-1931), one of the most famous and prolific inventors in history, was responsible for some of the most important inventions of the modern age. Recommended Articles under Henry Ford Model T The Model T is one of the best selling cars in history, and was the first car that was affordable for the majority of Americans.

![men_who_built_america[1]](http://s2.studylib.net/store/data/005219845_1-7979604da89ac700f7913bb56611cc41-300x300.png)