Financial Accounting and Accounting Standards

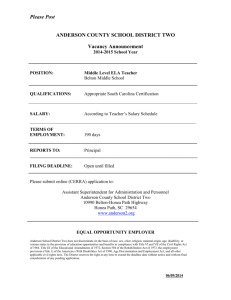

advertisement

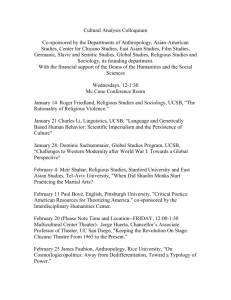

Financial Statements and the Annual Report Chapter 2 Slide 2-1 ECON 3A UCSB ANDERSON Objectives of Financial Reporting (a) PROVIDE USEFUL INFORMATION Financial reporting should provide information that is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions. The information should be comprehensible to those who have a reasonable understanding of business and economic activities and are willing to study the information with reasonable diligence.1 1Statement Slide 2-2 of Financial Accounting Concepts (SFAC) No. 1 LO 1 Describe the objectives of financial reporting. ECON 3A UCSB ANDERSON Objectives of Financial Reporting (b) REFLECT INFORMATION ON CASH FLOWS Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the sale, redemption, or maturity of securities or loans. Since investors' and creditors' cash flows are related to enterprise cash flows, financial reporting should provide information to help investors, creditors, and others assess the amounts, timing, and uncertainty of prospective net cash inflows to the related enterprise.1 1Statement Slide 2-3 of Financial Accounting Concepts (SFAC) No. 1 LO 1 Describe the objectives of financial reporting. ECON 3A UCSB ANDERSON Objectives of Financial Reporting (c) REFLECT THE FINANCIAL POSITION OF THE ENTITY Financial reporting should provide information about the economic resources of an enterprise, the claims to those resources (obligations of the enterprise to transfer resources to other entities and owners' equity), and the effects of transactions, events, and circumstances that change its resources and claims to those resources.1 1Statement Slide 2-4 of Financial Accounting Concepts (SFAC) No. 1 LO 1 Describe the objectives of financial reporting. ECON 3A UCSB ANDERSON ASSUMPTIONS PRINCIPLES CONSTRAINTS Economic entity Historical cost Cost-benefit Going concern Revenue recognition Materiality Monetary unit Matching Industry practice Periodicity Full disclosure Conservatism QUALITATIVE CHARACTERISTICS Relevance Reliability Comparability Conceptual Framework for Financial Reporting Slide 2-5 LO 2 Consistency ELEMENTS Assets, Liabilities, and Equity Investments by owners Distribution to owners Comprehensive income Revenues and Expenses Gains and Losses OBJECTIVES 1. Useful in investment and credit decisions 2. Useful in assessing future cash flows 3. About enterprise resources, claims to resources, and changes in them Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON ASSUMPTIONS PRINCIPLES CONSTRAINTS Economic entity Historical cost Cost-benefit Going concern Revenue recognition Materiality Monetary unit Matching Industry practice Periodicity Full disclosure Conservatism Relevance and Reliability QUALITATIVE CHARACTERISTICS Relevance Reliability Comparability Conceptual Framework for Financial Reporting Slide 2-6 LO 2 Consistency Capable of making a difference in a decision. • Verifiability • Representational faithfulness • Neutrality OBJECTIVES 1. Useful in investment and credit decisions 2. Useful in assessing future cash flows 3. About enterprise resources, claims to resources, and changes in them Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON FUNDAMENTALS OF GAAP Slide 2-7 Consistency/ Comparability: All companies for all periods account for things the same Monetary Unit: Only items which can be expressed in money are reflected Economic Entity: The entity can be separated. Time Period/ Periodicity: At least annually Historical Cost: Items are reported at their cost and depreciated if appropriate… but changes in value are excluded. Going Concern: Entity will continue in existence for the foreseeable future. This is why historical cost is acceptable… if there is no going concern, then liquidation basis may be appropriate. ECON 3A UCSB ANDERSON Qualitative Characteristics True or False? Relevance and reliability are the two primary qualities that make accounting information useful for decision making. True Slide 2-8 LO 2 Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON ASSUMPTIONS PRINCIPLES CONSTRAINTS Economic entity Historical cost Cost-benefit Going concern Revenue recognition Materiality Monetary unit Matching Industry practice Periodicity Full disclosure Conservatism Comparability and Consistency QUALITATIVE CHARACTERISTICS Relevance Reliability Comparability Conceptual Framework for Financial Reporting Slide 2-9 LO 2 Consistency ELEMENTS Assets, Liabilities, and Equity Investments by owners Distribution to owners Comprehensive income Revenues and Expenses Gains and Losses OBJECTIVES 1. Useful in investment and credit decisions 2. Useful in assessing future cash flows 3. About enterprise resources, claims to resources, and changes in them Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON Qualitative Characteristics True or False? Adherence to the concept of consistency requires that the same accounting principles be applied to similar transactions by all companies and for all periods? TRUE Slide 2-10 LO 2 Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON ASSUMPTIONS PRINCIPLES CONSTRAINTS Economic entity Historical cost Cost-benefit Going concern Revenue recognition Materiality Monetary unit Matching Industry practice Periodicity Full disclosure Conservatism QUALITATIVE CHARACTERISTICS Relevance Reliability Comparability Conceptual Framework for Financial Reporting Slide 2-11 LO 2 Consistency ELEMENTS Assets, Liabilities, and Equity Investments by owners Distribution to owners Comprehensive income Revenues and Expenses Gains and Losses OBJECTIVES 1. Useful in investment and credit decisions 2. Useful in assessing future cash flows 3. About enterprise resources, claims to resources, and changes in them Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON CPA Question, Nov. 94, FAR What is the underlying concept that supports the immediate recognition of a contingent loss? a. Substance over form. b. Consistency. c. Matching. d. Conservatism. Slide 2-12 LO 2 Describe the qualitative characteristics of accounting information. ECON 3A UCSB ANDERSON WHAT IS AN OPERATING CYCLE? The operating cycle is how long it takes a company to initiate, perform, and deliver their primary product or service. Take a wholesaler for instance. First they buy inventory, then they sell it on account, and ultimately they collect the cash owed from their customer. The period of time it takes to accomplish this is the “Operating Cycle”. Accounts Payable Inventory Cash Accounts receivable Slide 2-13 ECON 3A UCSB ANDERSON Balance Sheet Assets Assets are probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. Slide 2-14 LO 3 Explain the concept and purpose of a classified balance sheet. ECON 3A UCSB ANDERSON ASSETS, EXAMPLES AND MORE CASH PROCESS CULMINATES ACCOUNTS RECEIVABLE, ON BALANCE SHEET BY: SALES OFF THE BALANCE SHEET WHEN: COLLECTED, OR WRITTEN OFF INVENTORY, ON BALANCE SHEET BY: PURCHASES OFF THE BALANCE SHEET WHEN: SOLD- COGS FIXED ASSETS, ON BALANC SHEET BY: PURCHASES OFF THE BALANCE SHEET AS IT IS: DEPRECIATED- DEPRECIATION EXPENSE PREPAID EXPENSES, ON BALANCE SHEET BY: PAYMENT OFF THE BALANCE SHEET AS IT IS: CONSUMED- “BENEFIT IS REALIZED”- I.E INSURANCE EXPENSE Slide 2-15 ECON 3A UCSB ANDERSON Balance Sheet Current Assets Defined: An asset that is expected to be realized in cash or sold or consumed during the operating cycle or within one year if the cycle is shorter than one year. OR more commonly stated: An asset that is expected to be realized in cash or sold or consumed within one year or the operating cycle, whichever is longer. Slide 2-16 LO 3 Explain the concept and purpose of a classified balance sheet. ECON 3A UCSB ANDERSON Balance Sheet Liabilities Liabilities are probable future economic sacrifices obtained or controlled by a particular entity as a result of past transactions or events. Slide 2-17 LO 3 Explain the concept and purpose of a classified balance sheet. ECON 3A UCSB ANDERSON Balance Sheet Current Liabilities Defined: An obligation that will be satisfied within the next operating cycle or within one year, if the cycle is shorter than one year. OR more commonly stated: An obligation that will be satisfied within one year or the operating cycle, whichever is longer. Slide 2-18 LO 3 Explain the concept and purpose of a classified balance sheet. ECON 3A UCSB ANDERSON A Classified Balance Sheet Company Name Balance Sheet As of DATE Current assets Cash etc. Total current assets xxx xxx xxx Fixed assets Other long term assets Total assets Current liabilities Accounts payable etc. Total current liabilities xxx xxx xxx xxx Balances? Long-term debt, excluding current portion Equity Common stock APIC Retained earnings Total Liabilities & Equity Slide 2-19 ECON 3A UCSB ANDERSON A Multiple Step Income Statement Company Name Income Statement FOR THE PERIOD …. Slide 2-20 Revenue Cost of Revenue Gross Profit xxx xxx xxx Selling general & administrativ (SG&A) expense Depreciation expense Other operating expenses xxx xxx xxx Income before income tax provision Tax provision Income from continuing operations xxx xxx xxx Discontinued operations, net of tax Income before extraordinary items Extraordinary items, net of tax NET INCOME OR LOSS xxx xxx xxx XXX ECON 3A UCSB ANDERSON Analysis using a Classified Balance Sheet Liquidity = the ability of a company to pay its debts as they come due. A comparison of current assets and current liabilities is a starting point in evaluating the ability of a company to meet its obligations. Working Capital = Current Assets – Current Liabilities Company’s strive for a balance in managing its working capital – not too much or too little. $118,000 Current assets Slide 2-21 LO 4 – 59,900 Current liabilities = $58,100 Working capital Use a classified balance sheet to analyze a company’s financial position. ECON 3A UCSB ANDERSON Analysis using a Classified Balance Sheet The current ratio indicates the amount of current assets available at the balance sheet date relative to obligations coming due during that period. Current Ratio = Current Assets Current Liabilities 1.97 to 1 = $118,000 $59,900 Composition of current asset and current liabilities important. Slide 2-22 LO 4 Use a classified balance sheet to analyze a company’s financial position. ECON 3A UCSB ANDERSON Statement of Retained Earnings Exercise Landon Corporation was organized on January 2, 2002, with the investment of $100,000 by each of its two stockholders. Net income for its first year of business was $85,200. Net income increased during 2003 to $125,320 and to $145,480 during 2004. Landon paid $20,000 in dividends to each of the two stockholders in each of the three years. 2002 2003 2004 0 $ 45,200 $130,520 85,200 125,320 145,480 Less: Dividends (40,000) (40,000) (40,000) End. Retained earnings $45,200 $130,520 $236,000 Beg. Retained earnings Net income (loss) Slide 2-23 LO 7 $ Prepare and identify the components of the statement of retained earnings. ECON 3A UCSB ANDERSON Elements of the Annual Report BASIC- ALL AUDITED FINANCIAL STATEMENTS MUST INCLUDE: Financial statements Notes to financial statements Report of independent accountants PUBLIC COMPANIES ALSO MUST INCLUDE: Management’s assertions (SOX 403) Report of independent accountants on internal controls (SOX 404) Management discussion & analysis Summary of financial data Letter to stockholders http://www.starbucks.com/ Slide 2-24 ECON 3A UCSB ANDERSON DATSALLFORTHISCHAPTER Slide 2-25 ECON 3A UCSB ANDERSON