Financial Statement Conceptual Framework Overview

advertisement

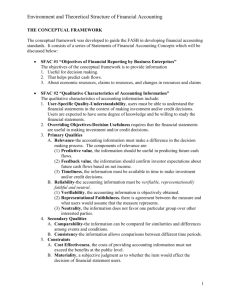

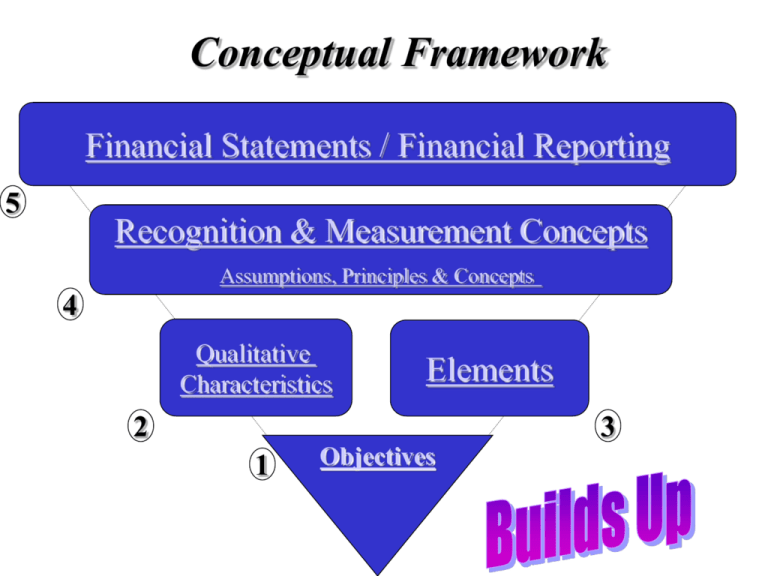

Conceptual Framework Financial Statements / Financial Reporting 5 Recognition & Measurement Concepts Assumptions, Principles & Concepts 4 Qualitative Characteristics Elements 2 3 1 Objectives Objectives of Financial Reporting by Business Enterprises: User Perspective Financial reporting should provide: (1) information useful in investment & credit decisions (2) information useful in assessing cash flow prospect (amount, timing & uncertainty), & (3) information about enterprise resources, claims to those resources, & changes therin. *** ... individuals who have a reasonable understanding of business & economic activities & are willing to study the information with reasonable diligence. SFAC 1 Qualitative Characteristics Primary Qualities: (1) Relevance (a) Predictive value, (b) Feedback value & (c) Timeliness (2) Reliability (a) Verifiability (b) Representational Faithfulness (c) Neutrality Secondary Qualities: (1) Comparability (across firms) (2) Consistency (over time) SFAC 2 Elements of Financial Statements • • • • Assets Liabilities Equity Investments by Owners • Distributions to Owners • Comprehensive Income • Revenue • Expenses • Gains • Losses SFAC 6 • Assumptions Recognition & Measurement Concepts – – – – Economic Entity Going Concern Monetary Unit Periodocity • Principles – – – – Historical Cost Revenue Recognition Matching Full disclosure • Constraints – – – – Cost-Benefits Materiality Industry Practice Conservatism Accounting Assumptions: Economic Entity: The business or economic entity exists separate & distinct from its owners, employees, suppliers & customers. This assumption defines accounting boundaries, but not legal boundaries. Going Concern: General purpose accounting reports are constructed under the assumption that the business enterprise will continue in business for the foreseeable future. The current relevance of the historical cost principle is based on the goingconcern assumption. Monetary Unit: Economic activity of an entity are measured and reported in the U.S. dollar. This assumes that the dollar has a reasonably constant value over time in terms of purchasing power. This assumption ignores inflation. Periodocity: Assumes that the economic life of a business can be divided into discrete time periods and that financial reports from each period are interpretable. Historical Cost Principle Acquisition cost is the most objective and verifiable basis upon which to account for assets and liabilities. That is, it is reliable. 5 methods to measure assets & liabilities: – – – – – Historical cost Current cost Current market value Net realizable (settlement) value Present (discounted) value Revenue Recognition Principle Recognize Revenue when: (a) realized or realizable & (b) earned…………………….on the date of sale exceptions: (a) during production ... if the production process is long … Ex: long-term construction contract (b) end of production … if selling price & amount is certain … ex: mining of certain minerals (c) receipt of cash … if the amount to be collected is uncertain Recognition Revenue…………when realized or realizable & earned Gains ……………when realized or realizable Expenses ….……when economic benefits are consumed in revenue-earning activities or when future economic benefits are reduced or eliminated Losses …………..when future economic benefits are reduced or eliminated SFAC 5 Matching Principle Expenses are matched to the revenue generated in that accounting period “let the expenses follow the revenues” Full Disclosure Principle Financial statements should include sufficient information to permit the knowledgeable reader to make an informed judgment about the financial condition of the enterprise. trade-offs: -sufficient detail to make a difference -presented in a condensed form for understandability & to avoid information overload Constraints: Cost-Benefit: The cost of providing the information should not exceed the benefits that can be derived from the information. Materiality: An item is material if its inclusion or omission would influence or change the judgment of a reasonable man. Materiality is based on relative size & importance. Industry Practice: The unique nature of some industries and business concerns sometimes (rarely) requires departure from basic theory. Conservatism: Never overstate assets or income. Financial Statements show: • Statement of Financial Position • Earnings • Comprehensive Earnings (earnings adjusted for the cumulative adjustment or other nonowner changes in equity foreign currency translation) • Cash Flows • Transactions with Owners A Hierarchy of Accounting Qualities Users of Accounting Information Decision Makers Pervasive Contraint Benefits > Costs Understandability User Specific Qualities Primary Qualities Primary Qualities Secondary Qualities Threshold for Recognition Decision Usefulness Relevance Predictive Feedback TimeValue Value liness Comparability Materiality Reliability Verifiability Neutral- Representational ity Faithfulness Consistency SFAC 2