Accounting Conventions

CHAPTER 14

ACCOUNTING CONVENTIONS

AND

POLICE

1 SOURCES OF ACCOUNTING CONCEPTS

AND CONVENTIONS

IAS 1 Presentation of financial statements :the overall considerations underlying financial statements, and the structure and content of financial statements.

The IASB’s Framework for the Preparation and

Presentation of Financial Statements.

Generally accepted accounting principles (GAAP)

2 THE NATURE AND PURPOSE OF

ACCOUNTING CONVENTIONS

Accounting Conventions :principles Or accepted practice which apply generally to transactions. They have an influence in determining:

---which assets and liabilities are recorded on a balances sheet

---how assets and liabilities are valued

---what income and expenditure is recorded in the income statements

---at what amount income and expenditure is recorded.

3 IAS1: PRESENTATION OF

FINANCIAL STATMENTS

IAS 1 states that the fundamental accounting concepts to be followed are:

---fair presentation

---going concern

----accruals

----consistency

Fair presentation

--Financial statements should be ‘fair presented’

--Compliance with IASs goes a long way towards achieving this.

--Additional disclosures, beyond those required by

IASs, should be made when necessary to achieve a fair presentation.

---In areas where no IAS exists, the financial statements should be presented in accordance with the stated accounting policies of the enterprise , in a manner which provides relevant, reliable, comparable and understandable information.

Going concern

--Going concern : assumption that an enterprise will continue in operational existence for the foreseeable future.

---Management must review the going concern status to confirm it is appropriate for the financial statements. They should consider all available information for the foreseeable future covering, but not limited to, twelve months from the reporting date.

Accruals (matching)

---Accruals (or matching ) basis of accounting: assets, liabilities, income and expenses are recognized when they occur and not when cash or its equivalent is received or paid

----Cost should be set off against the revenues they have contributed to.

Consistency

--Consistency : presentation and classification of items in the financial statements should be retained from one period to the next unless a significant change in the nature of the operations of the enterprise or a review of its financial statement presentation demonstrates that more relevant information is provided by presenting items in a different way, or a change is required by a new IAS.

Other matters dealt with in IAS 1

Selection and disclosure of accounting policies

---where there are no IASs, the policies should be selected and applied so that the financial statements are:

1 relevant to the decision-making needs of users

2 reliable: i.e. they

○ Represent faithfully the results and financial position

○ Reflect the substance rather than the form of transactions

○ Are neutral

○ Exercise prudence without impairing neutrality

○ Are complete.

---The accounting policies must be disclosed by note to the financial statements.

Materiality and aggregation

---Similar items should be aggregated together ,but information that is material should not be aggregated with other items

---Information is material if its non-disclosure could influence the economic decisions of users.

Offsetting

---Assets and liabilities should be offset unless this is allowed or required by an IAS

---Income and expense items should not be offset unless allowed or required by an IAS, or unless the amounts involved are not material.

Some other fundamental accounting concepts

These are not stated officially by the IASB but are generally recognized principles which underlie accounting and financial statements.

---Historical cost system: all values are based on the historical costs incurred.

---Stable monetary unit: diverse transactions are expressed in terns of a common unit of measurement, namely the monetary unit.

---Money measurement: accounts can only record items to which a monetary value can be attributed.

---Realization: a transaction should be recognized when the event from which the transaction stems has taken place and the receipt of cash from the transaction is reasonably certain.

---Business entity: financial accounting information relates only to the activities of the business entity and not to the activities of its owner or any other entity.

The entity is seen as being separate from its owners, whatever its legal status.

---Duality: every transaction has two effects. This underpins double entry and the balance sheet.

---Accounting period convention :the lifetime of the business is divided into arbitrary periods of a fixed length. usually one year. At the end of each arbitrary period, usually referred to as the accounting period, two financial statements are prepared:

The balance sheet , showing the position of the business as at the end of the accounting period

The income statement for the accounting period.

4 IASB’S FRAMEWORK FOR THE PREPARETION

AND PRESENTATION OF FINANCIAL

SATEMENTS

The framework sets out the concepts that underlie financial statements for external users.

It is designed to assist:

---The IASB in developing new standard and reviewing existing ones.

---In harmonizing accounting standards and procedures

---National standard-setting bodies in developing national standards

---Preparers of financial statements in applying IASs and in dealing with topics not yet covered by IASs

---Auditors in forming an opinion as to whether financial statements conform with IASs

---Users of financial statements in interpreting financial statements

---In providing those interested in the work of the IASB with information about its approach to the formulation of IASs

The framework deals with:

---The objective of financial statements

---The qualitative characteristics that determine the usualness of information in financial statements.

---The definition, recognition and measurement of the elements from which financial statements are constructed

---Concepts of capital and capital maintenance.

The users of financial statements are:

---Investors

---Employees

---Lenders

---Suppliers and other creditors

---Customers

---Governments and other agencies

---The public

The objective of financial statements : to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions.

The Framework identifies two underlying assumptions (these appear also in IAS 1)

---the accruals basis of accounting

---The going-concern basis

Qualitative characteristics : a set of attributes which together make the information in financial statements useful to users.

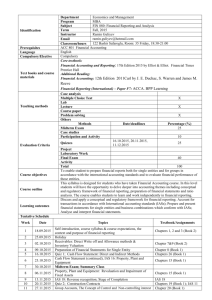

WHAT MAKESFINANCIALINFORMATIONUSEFUL ?

Threshold quality

Materiality 1

Information that is not material cannot be used

Relevance 2 more of one may mean less of the other Liability 4

WHAT MAKES INFORMATION WHAT MAKES INFORMATION

RELEVANT? RELIABLE?

Information that influences decisions information that is from error or bias

PREDICTIVE VALUE AND FAITHFUL COMPLETENESS 9

CONFIRMATORY VALUE 3 REPRESENTATION 5 NEUTRALITY 7

SUBSTANCE PRUDENCE 8

OVER FORM 6

WHAT QUALITIES MAKE THE PRESENTATION OF FINANCIAL

INFORMATION USEFUL?

COMPARABILITY 10 UNDERSTANDABILITY 13

CONSISTENCY 11 DISCLOSURES 12 USERS’ ABILITIES 14 e.g. accounting policies

and corresponding figures

WHAT LIMITS THE APPLICATION OF THE

QUALITATIVE CHARACTERISTICS?

BALANCE BETWEEN TIMENESS 16 BENEFIT AND

CHARACTERISTICS 15 COST 17

Materiality (1)

A threshold quality. If information could influence users’ decisions taken on the basis of financial statements, it is material.

Relevance (2)

A basis requirement. Financial information is relevant if it can assist users’ decision-making by helping them to evaluate past, present or future events or by confirming, or correcting, their existing evaluations.

Relevant information may have predictive value or confirmatory value(3): it may help users in assessing the future of the business or confirming past predictions.

Reliability(4)

A basic requirement. To be reliable, financial information must be free from bias and error. Some contingent items may by their nature be bound to be unreliable (see IAS 37).Subsidiary qualities that make information reliable are:

Faithful representation (5)

Information must faithful represent the effects of transactions and other events.

Substance over form(6)

Some transactions have a real nature (substance) that differs from their legal form. Whenever it is legally possible, the real substance prevails over the legal form.

Neutrality(7)

Judgments are made without bias in arriving at items in the financial statements.

Prudence (8)

The right degree of caution must be exercised in preparing financial statements and in estimating the outcome of uncertain events.

Completeness(9)

Information presented in financial statements should be complete, subject to the constraints of materiality and cost.

Presentation in financial statements:

---Comparability(10)

Financial statements should be comparable with the financial statements of other companies and with the financial statements of the same company for earlier periods.

To achieve comparability we need consistency(11) and disclosure of accounting policies(12 ).Accounting standards contribute to comparability by reducing the options available to enterprises in their treatment of transactions.

---Understandardablity(13)

Dependent upon users’ abilities(14).

The framework suggest that a reasonable knowledge of business and accounting has to be assumed here.

Limiting factors

Where there is conflict between characteristics, a balance between characteristics(15) needs to be achieved. Timeliness (16) is another limiting factor. Benefit and cost (17): the benefits from presenting the information should exceed the cost of providing it.

The elements of financial statements

An asset is a resource controlled by an enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise,

A liability is a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow from the enterprise of resource embodying economic benefits.

Equity is the residual interest in the assets of the enterprise after deducting all its liabilities.

5 IAS 18:REVENUE

IAS 18 defines when revenue from various sources may be recognized. Revenue and associated costs are recognized simultaneously in according with the matching concept.

It deals with revenue arising from three types of transaction or event.

---Sale of goods: should be recognized when all the following conditions have been satisfied:

◇ All the significant risks and rewards of ownership have been transferred to the buyer.

◇ The seller retains to effective control over the goods sold.

◇ The amount of revenue can be reliably measured.

◇ The benefits to be derived from the transaction are likely to flow to the enterprise.

◇ The costs incurred or to be incurred for the transaction can be reliably measured.

---Rendering of services : the sale usually takes place at a point of time whereas the provision of the service is likely to be spreads over a period of time. Revenue from services may be recognized according to the stage of completion of the transaction at the balance sheet date.

◇

The amount of the revenue must b measured reliably.

◇ The benefits from the transaction must be likely to flow to the enterprise.

◇ The stage of completion of the work must be measured reliably.

◇ The costs incurred or to be incurred for the transaction must be reliably measured.

When a partly completed service is in its early stages, or the outcome of the transaction cannot be reliably estimated, revenue should be recognized only up to amount of the costs concurred to date, and then only if it is probable that the enterprise will recover in revenue at least as much as the costs.

If it is probable that the costs of the transaction will not be recovered, no revenue is to be recognized.

---Interest, royalties and dividends: If the amount of revenue can be reliably measured and the receipt of the income is reasonably assured, these items should be recognized as follows:

---Interest: on a time proportion basis taking account of the yield on the asset,

---Royalties : on an accruals basis in accordance with the relevant agreement.

---Dividends : when the shareholder’s right to receive payment has been estimated.

Disclosure requirements of IAS 18:

---Accounting policies for revenue recognition, including the methods used to determine the stage of completion of transaction involving services.

---Amount of revenue recognized for each of the five categories (sale of goods, rending of service, interest, royalties and dividends), where material.

---The amount, if material, in each category arising from exchanges of goods or services.