proving damages in a price-fixing case

advertisement

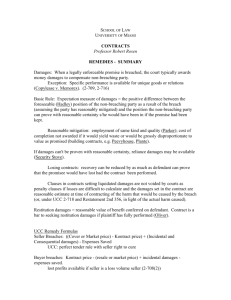

Proving and Disputing Damages at the Trial of an Antitrust Case Session Chair: James T. McKeown Moderator: Martha S. Samuelson Speakers: Joseph Goldberg Ragesh K. Tangri Richard T. Rapp Lara Dolnik 56th Antitrust Law Spring Meeting American Bar Association Washington, DC March 26, 2008 PROVING DAMAGES IN A PRICE-FIXING CASE A PRIMER Joseph Goldberg Freedman Boyd Hollander Goldberg & Ives, P.A. Albuquerque, New Mexico WHAT GETS US HERE “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” Adam Smith, The Wealth Of Nations at 144 DAMAGES = OVERCHARGE Usual measure of damages is the overcharge resulting from the price-fixing conspiracy: “[T]he difference between the price paid and the market or fair value,” that is competitive, price. Chattanooga Foundry & Pipeworks v. City of Atlanta, 203 U.S. 390, 396 (1906) RELAXED STANDARD OF PROOF FOR ANTITRUST DAMAGES “[T]he jury may not render a verdict based on speculation or guesswork. But the jury may make a just and reasonable estimate of the damage based on relevant data, and render its verdict accordingly. In such circumstances, ‘juries are allowed to act on probable and inferential as well as [upon] direct and positive proof. . . . Any other rule would enable the wrongdoer to profit by his wrongdoing at the expense of the victim.’” Bigelow v. RKO Radio Pictures, Inc,. 321 U.S. 251,264 (1946), quoting Story Parchment Company v. Patterson Parchment Paper Co., 282 U.S. 555, 564 (1931) “[S]ince the defendant created the need for damage estimation by violating the antitrust laws, it should bear the burden of uncertainty in proving the consequent damages.” II. A Areeda et al., Antitrust Law ¶ 392 (3rd Ed. 2007) CALCULATION OF PURCHASES AND ACTUAL PRICES PAID This is not necessarily a trivial task: Defendant’s transaction data or plaintiff’s purchase data Transaction data: consistency over time Price: off-invoice rebates and discounts Identification of relevant transactions: e.g., U.S. vs. Non-U.S ESTIMATION OF COMPETITIVE PRICES “Before or after” or “yardstick” approaches “Multiple regression also may be useful (1) in determining whether a particular effect is present; (2) in measuring the magnitude of a particular effect . . . .” Rubinfeld, Reference Guide on Multiple Regression at 181 Multiple regression analysis is “a methodology that is well established and reliable [for estimating damages].” City of Tuscaloosa v. Harcros Chemicals, 153 F.3d 548 11th Cir. 1998 MODEL SPECIFICATION ISSUES Make sure the model is well grounded in the facts of the case Data: reliability; completeness; aggregation; public vs firm-specific Dependent variable: usually price Independent variables: “Not all variables that might influence the dependent variable can be included if the analysis is to be successful; some cannot be measured, and others may make little difference.” Rubinfeld, Reference Guide on Multiple Regression at 188 Bias Robustness PRESENTATION AT TRIAL Establish expert’s credibility Summary of opinions Simplify statistical concepts Bring expert’s opinions back to the facts: “[A]necdotal reports can provide some information.” Kaye and Freedman, Reference Guide on Statistics at 90 Visualization: A picture is worth a thousand words Take the “sting” out of defendant’s criticisms SUMMARY OF ECONOMIC OPINIONS The structure of these markets, the conduct of the market participants and the performance of the market all strongly suggest that there was a manipulation of this market led by Hamanaka and supported by CLR, Global, Merrill Lynch, ______ and others from mid-1993 through mid-1996. The manipulation was successful in raising the price of copper cathode purchased by plaintiffs above competitive levels. My estimation of anticompetitive overcharges paid by plaintiffs because of the squeeze reaches a peak of 16 cents per pound in 1995-1996. COPPER PRICE -- OVERCHARGES Universities and Businesses Who Have Adopted Dr. McClave’s Textbooks International Sales Puerto Rico Canada England Brazil Mexico Australia Singapore Hong Kong Source: Prentice Hall Margin Increase from Competitive to Conspiracy Periods 8% 7.76% 7.73% 6% 4% 2% 0% Margin Using Fiber PPI Margin Using MCI Source: PPI’s from U.S. Bureau of Labor Statistics and Prices from Defendants’ Transaction Databases Comparison of Overcharges Estimated by McClave's Regression Model To Overcharges Estimated by Defendants' Suggested Specifications 12% 10% 8% 6% 4% 2% Source: McClave’s Regression Model and Various Specifications Suggested by Defendants 14 D 13 D 12 D 11 D 10 D 9 D 8 D 7 D 6 D 5 D 4 D 3 D 2 D 1 D M cC la v e Es tim at e 0% Ten Guidelines for Thinking About Damages Defense Perspective by Ragesh K. Tangri American Bar Association Antitrust Section Spring Meeting Ten Guidelines for Thinking About Damages Defense Perspective 1. Select the right expert (and see whether your opponent has selected the wrong expert). 2. Insist on a budget from your expert, and track his or her progress against it. 3. Test your own models against your opponent’s numbers – avoid giving unintended gifts. 4. Beware the model which yields negative damages – that which looks too good to be true usually is. 5. “Trust but verify” your expert’s work, especially when it comes to citing case documents. 6. Simplify the trial presentation. 7. Press on disaggregation of damages – separate lawful vs. unlawful conduct, and what consequences flow from each. 8. Separate direct and indirect purchasers. 9. Separate some direct purchasers from others (if possible). 10. Separate domestic from foreign transactions – “follow the money” to the location where title passes. Ten Guidelines for Thinking About Damages Defense Perspective 1. Select the right expert (and see whether your opponent has selected the wrong expert). – – – – – Qualifications & experience Reference checks “Dings and dents” Human factors Find prior cross-exams Ten Guidelines for Thinking About Damages Defense Perspective 2. Insist on a budget from your expert, and track his or her progress against it. – – – Major cause of client heartburn Control size of team – require justification of each member Talk to references about team, not just testifier Ten Guidelines for Thinking About Damages Defense Perspective 3. Test your own models against your opponent’s numbers – avoid giving unintended gifts. – – Run your damages model with different assumed numbers Run non-damages models as damages models Ten Guidelines for Thinking About Damages Defense Perspective 4. Beware the model which yields negative damages – that which looks too good to be true usually is. – – – Why present a damages model at all? How small is too small? Correct your opponent’s mistakes as a way to sponsor a number (without sponsoring a number) Ten Guidelines for Thinking About Damages Defense Perspective 5. “Trust but verify” your expert’s work, especially when it comes to citing case documents. – – – Ensure accurate and fair citations of documents Ensure negative documents are discussed or accounted for Keep your factual cross-exam powder dry for trial Ten Guidelines for Thinking About Damages Defense Perspective 6. Simplify the trial presentation – – – Get your expert up and moving Keep the graphics simple (and admissible!) Keep the cross short, high level, interesting, simple, and gator-free Ten Guidelines for Thinking About Damages Defense Perspective 7. Press on disaggregation of damages – separate lawful vs. unlawful conduct, and what consequences flow from each. Ten Guidelines for Thinking About Damages Defense Perspective 8. Separate direct and indirect purchasers. Ten Guidelines for Thinking About Damages Defense Perspective 9. Separate some direct purchasers from others (if possible). Ten Guidelines for Thinking About Damages Defense Perspective 10. Separate domestic from foreign transactions – “follow the money” to the location where title passes What’s Wrong with Antitrust Damages Richard T. Rapp Special Consultant Proving and Disputing Damages at the Trial of an Antitrust Case 56th Antitrust Spring Meeting, American Bar Association Antitrust Section Washington, DC March 26, 2008 What’s Wrong with Antitrust Damages What’s right: Attention to how markets work “Framing”: Tactics and Ethics Stupid Damage Tricks are sometimes what’s wrong with our damages. For example: – The wrong model – Ignoring exogenous realities – Near-zero-marginal cost prices Framing: Tactics and Ethics Amos Tversky and Daniel Kahneman, "The Framing of Decisions and the Psychology of Choice." Science 211: 453-458, 1981 – Explored heuristics and biases in reasoning— Distortions and violations of the rationality assumption – Framing— The framing of a decision affects the choice “Framing” a Decision Affects the Outcome Framing bias creates a strong incentive for plaintiffs to serve up inordinately high damage estimates and defendants inordinately low ones “Damages are $1 billion” “Their case was weak. Give them only $100 million” “Framing” a Decision Affects the Outcome Framing bias creates a strong incentive for plaintiffs to serve up inordinately high damage estimates and defendants inordinately low ones “Let’s punish the SOBs. Give them $30,000.” “Damages are $15,000” One Version of Price-fixing The more pricing voices in competition— the more prices will be driven down Cost Profit Price Cost Profit Price Price Profit Cost One Version of Price-fixing In this price-fixing conspiracy… Several independent pricing voices… become a single monopolist. One Version of Price-fixing Regression Analysis Can Be Used to Measure the Impact of Additional Competition on Price $140 $120 Regression line Unit Price Paid $100 $80 Estimated effect of a conspiracy involving only 3 vendors $60 $40 $20 $0 0 1 2 3 4 5 6 7 8 Equivalent Number of Equal-Sized Competitors 9 10 11 The Right and Wrong Model Damage Theory Doesn’t Fit the Alleged Bad Acts That model was suitable for bid rigging or a customer allocation scheme among salespeople It’s the wrong model for OPEC but that mistake is rare The OPEC model, in which the market supply curve is shifted by conspiracy, is wrong for bidrigging or customer allocation among salespeople who are not capable of restricting the market supply Ignoring Exogenous Realities The Simple Version: Concord Boat v. Brunswick Simple Cournot Model—outcome 50% but-for share, but competitors mishaps were ignored – Defective shifter – Muffed merger – Exit Complex Version: Under- vs. over-specified econometric models Near-Zero Marginal Cost Prices Used in the case of low-marginal cost goods and services “In a competitive market, P = MC” Wordplay: A pun on “competitive” – In perfect competition, P = MC; if it’s zero, nothing gets produced – With investment, in talent, branding, infrastructure, rivalrous behavior yields P > MC. The “competitive” price should be the “but-for price,” not the imaginary, Ec.100 wheat-market price. ABA Panel Discussion: Proving and Disputing Damages at the Trial of an Antitrust Case Laura Dolnik Dolnik Consulting LLC West Des Moines, IA What will my decision mean outside the courtroom? Will the cost of a large damages award be passed on to consumers (like me)? What will my decision do to consumer choices? How will my decision impact the number of jobs out there? Source: Gallup Source: Gallup Where does the money go? What will plaintiff(s) do with the money awarded? Will awarding damages make any real difference? Is awarding damages just helping someone “get rich quick”? How much do the lawyers get? Confidence in Institutions Top Five (Numbers shown are percentages) Source: Gallup Confidence in Institutions Bottom Five (Numbers shown are percentages) Source: Gallup Honesty/Ethics in Professions Top Five (Numbers shown are percentages) Source: Gallup Honesty/Ethics in Professions Low Ranked Professions (Numbers shown are percentages) Source: Gallup A Hypothetical Damages Problem Six private equity firms of various sizes are alleged to have fixed prices by consortium bidding, or by agreeing to sit out particular LBO auctions in return for tacit agreements to allocate auction participation Different private equity firms participated in the various LBOs at issue The 30 LBOs were of significantly different sizes; the premia over pre-LBO market values varied significantly Plaintiffs are former shareholders in 30 firms that were the subject of LBOs since 2004 and allege that the premia over public market values were depressed as a result of the alleged collusion