impact study of value pricing on california state route 91

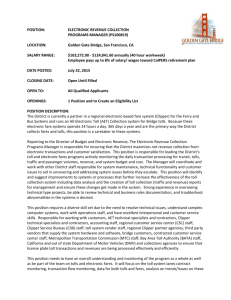

advertisement

A LOOK BACK: CALIFORNIA STATE ROUTE 91 Edward C. Sullivan, California Polytechnic State University, San Luis Obispo Facility Features • • • • • • • 4 lane toll road in median of 8 lane freeway 16 km. in length Express travel (no intermediate access) Heavy vehicles not permitted Electronic toll collection only (no cash) Time-dependent tolls, reflecting demand Originally constructed and operated by private company under franchise agreement with the State Project Location History of the SR 91 Express Lanes 1989 CA Legislature passes enabling legislation AB 680 Dec. 95 Lanes open; project cost $135 million (mixed equity& debt) Jan. 97 First general toll increase (about 10%) Sept. 97 Second general toll increase & schedule refinement Jan. 98 Tolls imposed on HOV-3+ users (@ 50% level) April. 98 Third general toll increase & schedule refinement Aug. 98 CPTC announces lanes reach financial "break even" Oct. 98 Eastern Toll Road opens in competition Jan. 99 Fourth general toll increase & schedule refinement Jan. 99 "West leg” of Eastern Toll Road opens Mar. 00 Fifth general toll increase Jan. 01 Sixth general toll increase Jan. 03 Franchise bought by OCTA for $207 million Aug. 03 Seventh general toll increase Typical PM Peak Operations Genesis – Calif. AB 680 (1989) • Goals of the legislation: – Attract “alternate funding sources” to meet state transportation needs – Gain private sector efficiencies in developing projects – Reduce congestion in crowded corridors – Provide alternate route selections – Provide private partners a “reasonable” profit Provisions of AB 680 • 4 demo projects w/ geographic distribution • Provides up to 35 year lease of right-of-way and airspace, which then reverts to the State (but may remain a toll road) • Projects become part of the state highway system • Must meet all applicable laws, environmental requirements, and be built to State standards • Any State services fully compensated; state powers (e.g. condemnation) made available • “Excess” tolls either go to the State or used to reduce project debt SR 91 Performance Summary The State Route 91 Impact Assessment Study • Objective: measure reactions to variable toll pricing and the other innovative features of the toll facility • Impacts tracked from mid-1994 through 1999 (one year after opening day) The State Route 91 Impact Study – Focus Areas • • • • • • • • Traffic counts, occupancy counts and speeds Effects on corridor bus, rail and park & ride Effects on accidents and significant incidents Traffic operations at entrances/exits Origin-destination (revealed preference) surveys Public opinion surveys Emissions modeling Calibration of choice models Findings – Tolls & Time Savings • Express lane use strongly reflects hourly travel time savings • Flattening of traffic peaks is weakly responsive to tolls – more responsive in the AM period • Commuters typically overestimate time saved by 5-30 minutes • Some users cite driving comfort & safety to justify paying tolls if time saving is minimal • About 18% do not pay their own tolls Findings – User Demographics • Income correlates positively with use frequency for all groups • Middle-income groups seem relatively most affected by toll increases • Being female strongly correlates with using the toll lanes • Middle age groups use toll lanes more than the youngest and oldest age categories • More education also correlates with toll lane use Lessons Learned About User Demographics • Results from CA Route 91 show a moderate income effect in travelers’ use of the toll lanes • Nevertheless many frequent users are low income, and many high income commuters are infrequent or non-users • Having said all this, the choice to use the optional toll lanes seems more related to current travel conditions and needs than to user demographics Findings – Ridesharing & Transit • Toll incentives were accompanied by long-term increase in 3+ ridesharing • HOV users have been more likely to use X-lanes • Flexible work schedules seem unrelated to X-lane use • No significant impacts on corridor transit use (public transit is about 1% of total corridor travel) Findings – Collision Experience • Accident rates in the corridor have generally varied with congestion – there appear to be no particular effects related to the special operating characteristics of the toll lanes Findings – Public Opinion • 91X lanes’ image suffered in 98-99 from disputes about ownership & congestion • Approval of variable tolls fell but overall approval of toll financing remains high • Toll payers express higher approval of variable tolls than non-payers • Approval declined for private operation • Approval of HOT lane concept is high SR 91 Benefit-Cost Summary Alt. 1 Express Lanes NPV ($million) Alt. 2 Dual-HOV Lanes NPV ($million) Travel Time Savings Inc. Cost of Emissions $605.90 -$3.54 $602.36 $336.70 -$2.03 $334.67 Incremental Initial Investment Operating Costs $32.80 $79.44 $112.24 $26.45 $4.80 $31.24 Benefit Cost Summary Benefits: Sum of Benefits Costs: Sum of Costs Net Present Worth $490 $303 Benefit-Cost Ratios Compared to Base Case 5.4 10.7 Compared to Alt. 2 3.3 Note: Net Present Values (NPV) are discounted to 1996 at a 3.1% discount rate. Benefits and costs are compared to the null alternative (construction of two unmanaged lanes, assumed to open in December, 1995). Comparisons include 10 years of costs and benefits (1996-2005). Seeds of De-Privatization • Traffic growth led to substantial renewed congestion • Some partners changed business strategy and wanted out • A 1999 buy-out offer from start-up non-profit (New-Trac) for $260 million was widely perceived as sweetheart deal contrary to public interest, with a major political outcry • A 1999 CPTC lawsuit against Caltrans stopped planned capacity improvements (Caltrans settled) • A 2000 Riverside County lawsuit against CPTC and Caltrans tried to void the franchise agreement • At least two unsuccessful legislative bills (AB 1091, AB 1346) sought to void the non-compete clause and have the public acquire the toll lanes by condemnation • In 2001, CPTC successfully refinanced $135 million in debt to pay loans from partners and cover remaining construction debt at 7.63% rather than 9% De-Privatization Arrives • In spring 2002, the CPTC and the Orange County Transportation Authority (OCTA) agreed to a sale of the 91 franchise for $207.5 million • In fall 2002, the governor signed AB 1010 which, among other things, authorizes the transfer • The sale became final in January, 2003 • CPTC metamorphosed into Cofiroute Global Mobility, which now operates SR 91 for OCTA Provisions of AB 1010 (2002) • Authorizes OCTA to buy the CPTC franchise • Calls for improving congestion by eliminating the noncompete clause • Calls for reduced SR 91 tolls and a minimum toll period • All projects become non-toll when franchises expire • No more new franchises after January 1, 2003 • OCTA prohibited from transferring its franchise without State approval • Creates an SR 91 advisory committee with strong local political control A Good Deal for All • CPTC receives $135 million to cover its (newly refinanced) debt plus $72 million for the original partners • OCTA can use a 30 year payback schedule of $13 million per year • An Ernst & Young study for OCTA predicts $40.5 revenue by 2010 with daily traffic to grow from 25,500 in 2001 to nearly 64,000 in 2030 • HOV-3+ again travel free (except during the worst of the afternoon peak, where the 50% toll is maintained) • In Nov., 2002, voters approved Measure A to provide nearly $1/2 billion in road improvements elsewhere in the 91 corridor, which would have been blocked by the noncompete clause In Retrospect • Despite de-privatization, the SR 91 project was a very successful project on many dimensions • It was an innovative model that helped establish in the U.S. an open mind toward market-based road pricing • It proved that public-private highway partnerships can be financially successful • The Achylles heal of this privatization project turned out to be the non-compete clause in the franchise agreement More Final Observations • Public-private infrastructure projects should be eligible for tax-exempt bonds, even with a forprofit private partner (OCTA debt will be about 5.5%, compared to CPTC’s 7.6%) • SR 91 showed the value in having the public partner obtain prior environmental clearance, on a reimbursement basis • Given the resource limitations of most public transportation authorities, the SR 91 non-compete clause was probably neither needed nor desirable The “Bottom Line” • CA Route 91 has demonstrated that innovative road pricing (premium service for a premium price) can be economically attractive, win public approval, and significantly influence travel behavior. • Increasing traveler options is a subtle yet powerful outcome from such value pricing projects. • “One size fits all” in road pricing has clearly failed. Increasing transportation choices through pricing has succeeded in CA and deserves careful consideration elsewhere.