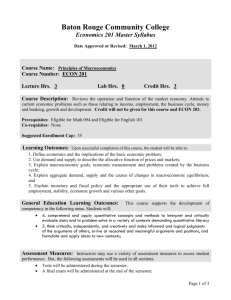

Economics - Bates College

advertisement

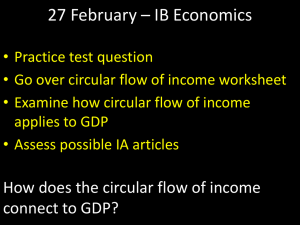

Principles Of Macroeconomics Today’s Outline Introduction Syllabus Points of Order Lecture one Introduction Dr Michael J. Oliver 10th year of teaching in UK and US Macroeconomic historian Currently have three books in print, another two due out this year. Syllabus The course is ‘electronic’. Lectures will be available for downloading AFTER the lecture. Emphasis is on YOUR contribution in class and outside. Points of Order Huge difference between school and college. Take a risk! I do not have all the answers. Lecture One Introduction to Economics A Definition of “Economics” Economics is the study of how individuals and societies choose to use the scarce resources that nature and previous generations have provided. Another Definition of “Economics” Economics is the study of how scarce resources are allocated among conflicting demands. Four Main Reasons to Study Economics... To learn a way of thinking To understand society To understand global affairs To be an informed voter 1. To Learn a Way of Thinking... Three Fundamental Concepts of Economic Thinking: • Opportunity Cost • Marginalism • Efficiency Opportunity Costs The opportunity cost of something is that which we give up when we make that choice or that decision. Opportunity costs imply that nearly all decisions involve trade-offs What do we mean by Opportunity Costs? “There’s no such thing as a free lunch!” Opportunity Cost Question… What is the opportunity cost of your attending college? Marginalism In weighing the costs and benefits of a decision, it is important to weigh only the costs and benefits that arise from the decision. (That is, the additional costs/benefits that are added as a result of that decision.) Efficient Markets An efficient market is one in which any and all profit opportunities are eliminated instantaneously. 2. To understand society... “The study of economics is an essential part of the study of society” 2. To understand society... Past and present economic decisions have an enormous effect on the character of life in a society! 3. To understand global affairs... Collapse of the Soviet Union The European Union NAFTA and GATT The Gulf War Starvation & Poverty in Africa 4. To be an informed voter... The number one issue on people’s minds in recent elections has been the economy. Clinton’s main focus during his presidency has been primarily on economic issues such as: deficit reduction, economic growth, international trade agreements and health-care reform The Scope of Economics MACROECONOMICS The branch of economics that examines economic behavior of the aggregates - income, employment, aggregate output, and so on. The Scope of Economics MICROECONOMICS The branch of economics that examines the functioning of individual industries and the behavior of individual decisionmaking units such as business firms and households. The Method of Economics Positive Economics An approach to economics that seeks to understand behavior and the operation of systems without making judgements. It describes what exists and how it works. The Method of Economics Normative Economics An approach to economics that analyzes outcomes of economic behavior, evaluates them as good or bad, and may prescribe courses of action. Normative economics will many times apply value judgements. Economic Theories & Models An economic theory is a statement or set of related statements about cause and effect, action and reaction. Economic Theories & Models An economic model is a formal statement of an economic theory. Usually a mathematical representation of a presumed relationship between two or more variables. Economic Theories & Models Inductive Reasoning is the process of observing regular patterns from raw data and drawing generalizations from them. Economic Theories & Models Ceteris Paribus is a device (i.e.an assumption) used to analyze the relationship between two variables while the values of other variables are held unchanged. It may be interpreted to mean “everything else equal or constant.” Economic Theories & Models - Cautions & Pitfalls The Post Hoc Fallacy Post hoc, ergo propter hoc, literally means “after this, therefore because of this.” It refers to a common error made in thinking about causation. If Event A happens before Event B, it is not necessarily true that A caused B. Economic Theories & Models - Cautions & Pitfalls - Correlation vs. Causation Two variables are correlated if one variable changes when the other variable changes. This does not mean that changes in one variable cause changes in the other. Economic Theories & Models - Cautions & Pitfalls The Fallacy of Composition The fallacy of composition implies that what is true for a part is necessarily true for the whole. Economic Theories & Models Empirical Economics is the collection and use of data to test economic theories. Economic Policy and the Criteria for Judging Economic Outcomes 1. 2. 3. 4. Efficiency Equity Growth Stability Economic Policy and the Criteria for Judging Economic Outcomes 1. Efficiency Efficiency in economics means allocative efficiency. An efficient economy is one that produces what people want at the least possible cost. Economic Policy and the Criteria for Judging Economic Outcomes 2. Equity Equity means fairness. Equity lies in the eye of the beholder…few people agree on what is fair and what is unfair. Economic Policy and the Criteria for Judging Economic Outcomes 3. Growth Economic Growth refers to the increase in total output of an economy. Economic Policy and the Criteria for Judging Economic Outcomes 4. Stability Economic Stability refers to a condition in which output is steady or growing with low inflation and full employment of resources. The Great Depression The Great Depression was a period of severe economic contraction and high unemployment that began in 1929 and continued throughout the 1930’s. Macroeconomic Concerns Aggregate Price Level Aggregate Output Total Employment Rest of the World Inflation and Prices Price level: a measure of the behavior of all prices in the economy Price level is a yardstick -- a tool for comparison of prices over time. Inflation: the rate of change in the price level Percentage change in GDP deflator, 1959 - 1994 12.0 Inflation Rate 10.0 8.0 6.0 4.0 2.0 0.0 1959 1963 1967 1971 1975 Year 1979 1983 1987 1991 Aggregate Output (GDP) Gross Domestic Product (GDP) is the dollar value of all final goods and services produced. Final good: a product which is ready to be used by consumers Business Cycle Periodic movements in output, prices, and employment Business cycles are not created equal. –Duration –Severity Business Cycle GDP rises and falls over short spans of time At any point in time, it may be above or below its long run trend These fluctuations define the business cycle Unemployment The unemployment rate refers to the percentage of people in the labor force who can’t find a job. Labor Force: people who are actively seeking or are currently holding a job Unemployment Rate, 1959 - 1994 10.0 Unemployment Rate 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1959 1963 1967 1971 1975 Year 1979 1983 1987 1991 Government Policies for Influencing the Macroeconomy Fiscal Policy: Government policies regarding taxes and expenditures Monetary Policy: The tools used by the Federal Reserve to control the money supply Supply-side Policies: policies that focus on aggregate supply and increasing production The Circular Flow Diagram The Players Households Firms Government Rest of the World The Circular Flow Diagram Households Consume (C) Save (S) Work (N) Pay taxes (T) The Circular Flow Diagram Firms Produce (GDP) Invest (I) Buy inputs (N) Pay taxes (T) The Circular Flow Diagram Government Buys goods (G) Borrows (B) Taxes (T) Issues money (M) The Circular Flow Diagram Rest of the World Exports (X) Imports (IM) The Circular Flow Diagram Firms Households The Circular Flow Diagram Purchases of Goods and Services Firms Households Wages, Interest, Dividends, and rent The Circular Flow Diagram Purchases of Goods and Services Taxes Government The Circular Flow Diagram Purchases of Goods and Services Taxes Wages, Interest, Transfer Payments Taxes Government The Circular Flow Diagram Purchases of Imports Purchases of Exports Rest of the World Three Market Arenas Goods and services market Labor market Money (financial) market Goods and Services Market Firms supply goods and services Goods and Services Market Household, Firms and Government purchase goods and services Labor Market Households supply labor Labor Market Firms and Government demand labor Financial Markets Households supply funds Financial Markets Households, Firms and Government demand funds Aggregate Demand Aggregate demand represents the total demand for goods and services in an economy. Aggregate Demand Curve Price Level P1 AD Y1 Aggregate Output Aggregate Supply Aggregate supply represents the total supply of goods and services in an economy. Aggregate Supply Curve Price Level AS P1 Y1 Aggregate Output Equilibrium Aggregate equilibrium is a level of prices and GDP such that the quantity of goods and services purchased equals the overall quantity of goods and services produced Equilibrium Price Level AS Equilibrium P* AD Y* Aggregate Output Parts of the Business Cycle Aggregate Output Peak Recession Expansion time Trough Percentage Deviation of GDP from Trend, 1960 - 1994 Percentage Deviation of GDP 7 6 5 4 3 2 1 0 -1 -2 -3 1960 1964 1968 1972 1976 Year 1980 1984 1988 1992 1994 Recession Growth rate of GDP falls Firms decrease production Unemployment rises GDP Unemployment Percentage Deviation of GDP from Trend, 1960 - 1994 Recessions Percentage Deviation of GDP 7 6 5 4 3 2 1 0 -1 -2 -3 1960 1964 1968 1972 1976 Year 1980 1984 1988 19921994 Expansion GDP growth rate rises Firms increase production Unemployment falls GDP Unemployment Percentage Deviation of GDP from Trend, 1960 - 1994 Expansions Percentage Deviation of GDP 7 6 5 4 3 2 1 0 -1 -2 -3 1960 1964 1968 1972 1976 Year 1980 1984 1988 19921994 Real GDP in the U.S., 1959 - 1994 5,500.0 5,000.0 4,500.0 Real GDP 4,000.0 3,500.0 3,000.0 2,500.0 2,000.0 1,500.0 1959 1963 1967 1971 1975 Year 1979 1983 1987 1991 1994 Real GDP in the U.S., 1959 - 1994 5,500.0 5,000.0 4,500.0 Real GDP 4,000.0 3,500.0 3,000.0 Trend Line 2,500.0 2,000.0 1,500.0 1959 1963 1967 1971 1975 Year 1979 1983 1987 1991 1994