Evaluation of Working Wheels, Seattle

advertisement

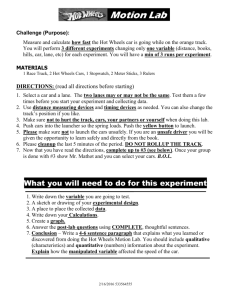

WORKING WHEELS EVALUATION Low Income Car Ownership Meeting December 5, 2005 Susan Crane, Port Jobs, Seattle, Washington www.portjobs.org One applicant’s story… “I 2 am a single mom with two boys, one is 5 and the other is 14. I’m attending pre-apprenticeship training full-time during the day, and work part-time as a waitress at night. I do not have a car and this makes everyday extremely difficult for myself and my children. The daycare that my youngest son is in charges $5 every minute you are late. The bus was late one day by 15 minutes, and I had to pay $75 extra. Also, I want to apply for the Ironworker’s apprenticeship – but one of the job requirements is that I have reliable transportation, because I will be working on jobsites all around King County. Time is running out for me.” -Beth, a Working Wheels applicant The Working Wheels Program Working Wheels opened in 2002 and has sold more than 225 cars to low income individuals and families. The cars: reconditioned used cars, with low miles and regular maintenance, mostly donated from public fleets. A typical car has an average sales price of $1,730, an average market retail value of $3,300, and has 51,000 miles. The loans: low interest auto loans and banking services from a local bank (7% interest rate, 3-year terms, no prepayment penalties or origination fees). The support and training services: additional 3 services include financial education, credit repair, insurance assistance, and employment assistance. 4 The Working Wheels Car Lot Who are the partners? Fremont Public Association Port Jobs Created Working Wheels. Provides technical assistance, fundraising help, and website / database development. Starting program evaluation Operates Working Wheels. FPA’s certified auto mechanics recondition cars before sale. Provides financial education classes and credit repair services to applicants. City of Seattle Donates 50 fleet vehicles per year. King County Donates up to 50 fleet vehicles per year and provides financial support. Sound Community Bank Provides low-interest auto loans and banking services to clients. Port of Seattle Donates up to 10 vehicles per year and provides free car storage space. Pacific Associates Provides financial mentoring and employment services to car owners. Federal Home Loan Bank of Seattle Referral agencies Social service agencies refer participants to the program. Self-referred individuals may apply on their own too. Provides loan guarantees for Working Wheels loans. Funders WA StateWorkFirst, Seattle Foundation, Allen Foundation Brokered relationships with financial have provided financial support. institutions during start-up. Wells Fargo Bank The Working Wheels Evaluation Client Outcomes: A comprehensive evaluation articulating how owning a car affects participants’ lives and employment situations. Explores three primary questions: How does owning a car affect an individual’s employment situation. Is she working more hours and earning more money? How does a car owner’s family benefit from the car? Does access to a low-interest bank loan affect a car owner’s credit standing and his use of bank services? Methodology: 6 Qualitative telephone interviews with 51 WW car owners Quantitative employment/earnings data from WA State ESD for all car owners, with comparison group analysis Demographic and loan data on all car owners Evaluation Key Findings 7 Improved Employment Opportunities Improved employment opportunities: (see slide on next page) Increase hours worked – an average 32% increase in weekly hours Increase flexibility in jobs and shifts Increased education and training opportunities • Increased earnings:* – 81% of car owners experienced wage gains over the 15 month period. – Median hourly wage increased from $11.25 one quarter before car purchase to $12.34 three quarters after, an increase of 10%. – Median wage gain was 10% higher than the comparison group • Decreased dependence on public assistance: – 60% decrease in car owners who receive TANF cash assistance; – Majority of those who left TANF cite an increase in income as the reason. *Source: Washington State Employment Security Department employment records 8 Impact of WW Car on Employment Outcomes "Do you feel that owning a WW car has helped create a change in…" 100% Percentage of Respondents 20% 25% 25% 23% 22% 18% 75% 50% 98% 80% 75% 75% 77% 78% 100% 82% No 25% Yes 0% 9 Increased Increased Change in Increase in Increased More Easier Increased job Income Hours shifts able range of jobs ability to stable commute opportunities to work able to participate in work trainings employment * Source: Survey responses from 51 interviewed WW car owners Benefits to the family It’s easier to get kids where they need to be: Nine out of ten parent respondents report transporting their children to daycare, school, extracurricular activities, and doctor’s appointments is easier now that they have cars. Children can participate in new activities: 83% of parent respondents report that their children can participate in new activities, such as joining the school debate team, taking Tae Kwan Do classes, and going to the park. Families are spending more time together: 76% of parent respondents report having a car has increased the time or improved the quality of time they spend with their children. 10 *Source: Interviews with 51 Working Wheels car owners Access to Credit and Financial Services Low default rates: Only 2.5% of WW car owners have defaulted on their loans. Car owners are saving money! 53% of respondents report being able to save more money since owning their cars. 39% of respondents report opening a savings account for the first time since owning their cars. Decreased use of high-cost financial services: Respondents report an increase in their use of checking and savings accounts, and a decrease in their use of predatory services such as Payday loans. *Source: Aggregate loan information from Sound Community Bank; interviews with 51 Working Wheels car owners 11 A mom’s story… “The car has helped so much with my kids. We are on medical coupons, so the kids are restricted to the one dentist who takes coupons in our area. It takes 3 buses to get there, and this is impossible to manage during my working day. And of course that dentist doesn’t offer night appointments. The kids hadn’t been able to go to the dentist in about two years. Now that I have a WW car, I can take them.” -Sally, a WW car owner, April 2005. 12 Summary of findings WW car owners are earning more money and improving their employment situations. WW car owners are experiencing benefits that affect their entire families, from taking children to daycare to shopping at discount stores. WW car owners are saving money, increasing their use of traditional banking services, and decreasing their use of predatory lenders. 14 In her own words… “I can’t begin to tell you how much this program has saved my life. Without this car, I wouldn’t have a job. My supervisor told me I had two months to find reliable transportation, or he would let me go. Thank goodness I found Working Wheels. Even today, I am really just two paychecks away from living on the street. Having a reliable car is essential to keeping my job and keeping my life together. This car has been the greatest one-time gift of my life.” -Margaret, a WW car owner, April 2005. 15 Working Wheels opens doors… “Because of my WW car loan experience, I decided to apply for a home improvement loan – and good gracious I was approved! I’ve owned my home on Beacon Hill for 30 years, but haven’t been able to afford necessary home improvements. My old knees have seen better days, and I can hardly manage to climb the stairs to my bedroom every night. With my new home improvement loan, I’m going to have a bedroom put in downstairs, so I don’t have to experience pain everyday. I am so grateful that I have this opportunity.” 16 - Betsy Jones, a 65 year old WW car owner